In this blog, I am going to cover how to process a bank account and then finish the function with a bank reconciliation in Sage Accounting. I am going to use my own experience as an example for you to follow with me as I reveal my method of bank processing and reconciliations in Sage Accounting.

How do you deal with processing 24 months’ bank statements?

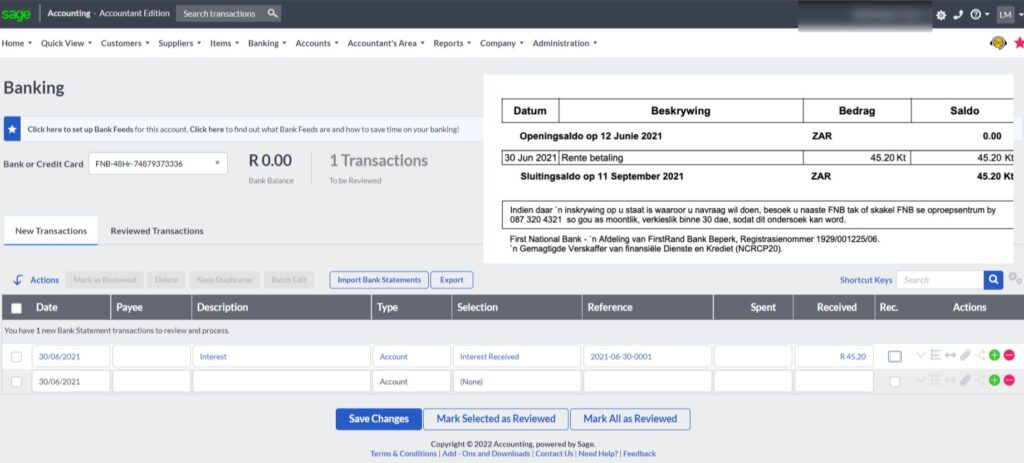

I am doing the books for a client when I am met with this bank statement, and also 23 more months of similar type of bank statements of this savings account. This business bank account only has one transaction per month, of interest received.

Although it appears fairly simple to deal with this I am left with a choice:

- I could import these 24 months’ bank statements into Sage Accounting or

- I could capture them.

as I need to catch up on 2 years of accounting entries.

It seems like a simple no-brainer choice, but what would you do if there is only one transaction per month per bank statement and you have 24 of these?

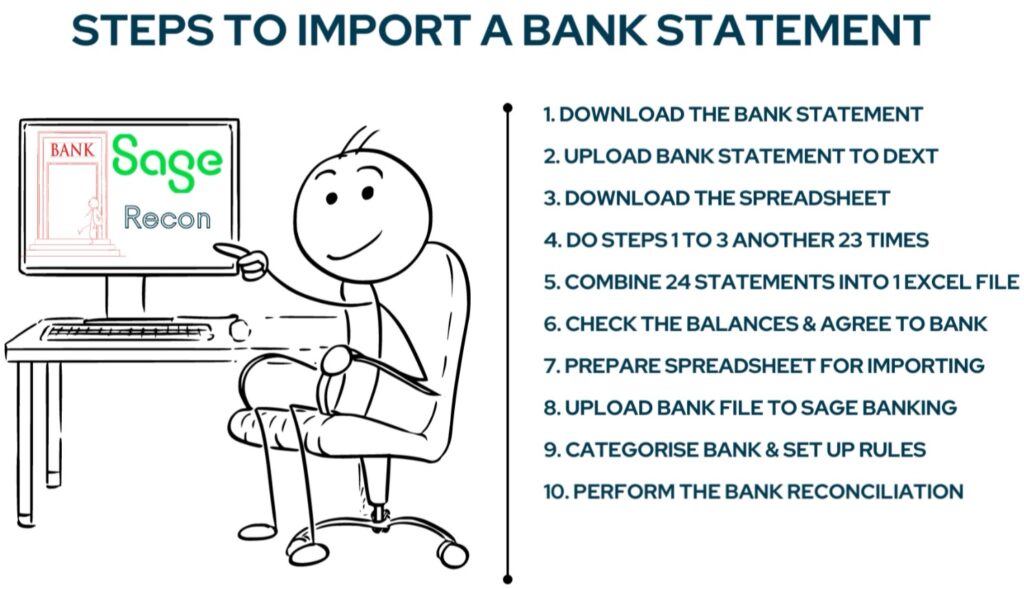

The bank import route.

If you decide to import the bank statement the steps taken would be something like this:

- Download the bank statement.

- Upload it to Dext where it is converted to an excel spreadsheet.

- Download the spreadsheet and do the previous 3 steps 23 times.

- Then combine the 24 statements into one excel file.

- Check the balances and ensure that it agrees with the bank statement.

- Amend and adjust the excel spreadsheet to prepare it for the CSV import into Sage accounting.

- Upload the CSV file to Sage Banking and troubleshoot any errors that may occur during the import process.

- Then categorise the bank transactions.

- Set up a rule for the automatic processing of the other 23 transactions.

- Lastly perform the bank reconciliation on Sage Accounting.

Processing the bank as an alternative.

Alternatively you can take the bank statement and process each monthly transaction manually on Sage Accounting.

Hopefully you will recognise that there are situations where the importing of bank transactions which I am so in favour of will actually take longer than to simply capture the bank transactions manually from the bank statement.

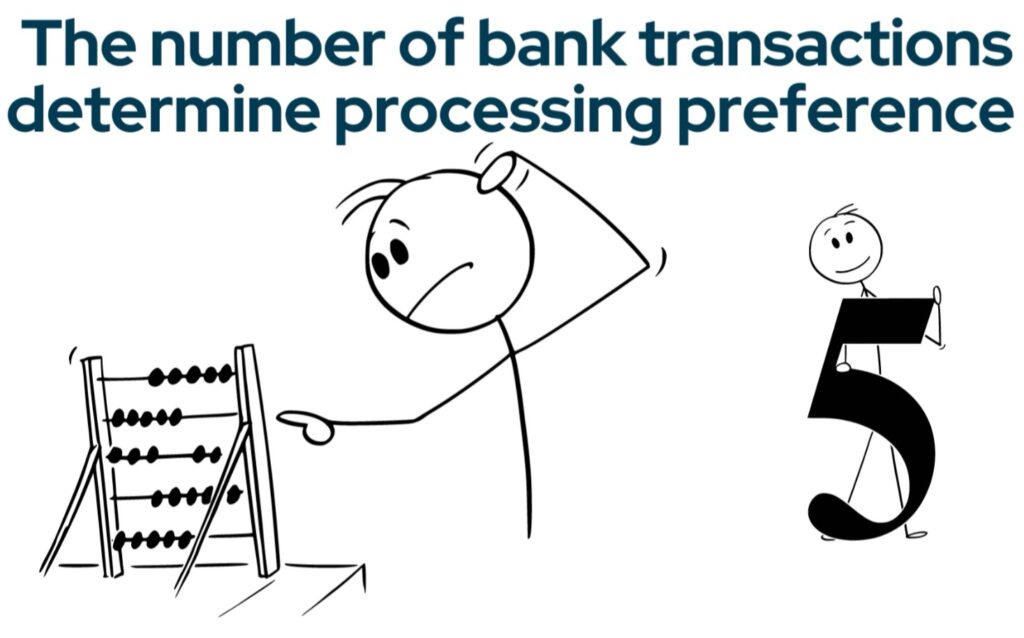

When to pivot.

There is a certain pivot point where the number of bank transactions determines your processing preference. You can actually choose to rather manually capture the bank transactions instead of importing them.

I have no set rule for this but in general for me the tipping point is 5 transactions. If there are more than 5 transactions on a bank statement I prefer to import rather than capture simply, because it will be quicker and easier to do.

My example becomes your tutorial.

This bank statement having only one transaction per month, meets my preference for manually capturing. I am going to give you the steps to process this bank transaction quickly, manually on Sage Accounting.

The bank balance must be reconciled and I am going to show you how I do this bank reconciliation from my processing result.

In Sage Accounting check if the bank transactions was not already captured.

To enhance efficiency and accuracy double-check that the transaction was not already captured. This

Navigate to Sage Banking.

I am logged in to Sage accounting’s Workspace from here you go to the bank transactions processing from the top navigation menu by clicking on:

- Banking,

- Down to transactions which will reveal the menu on the right

- Choose Banking

- Select the relevant bank account

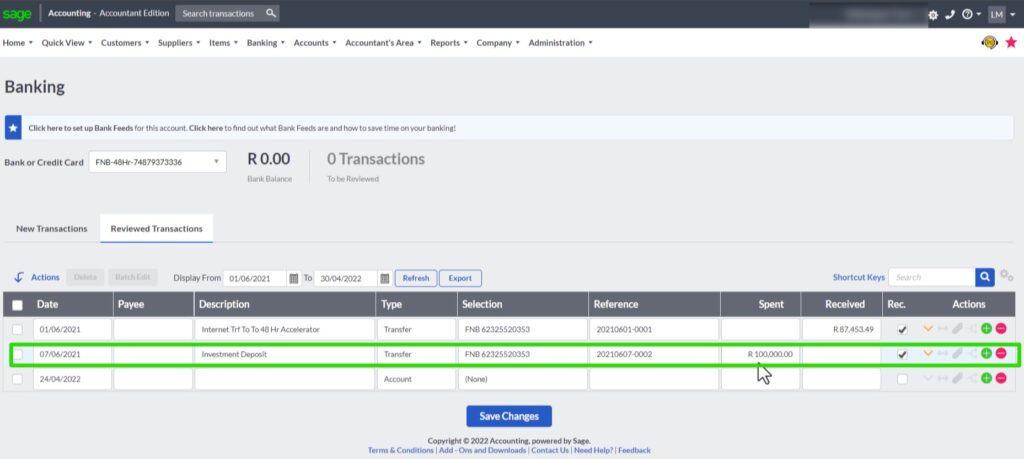

Reviewed banking transactions.

I would like to see if this transaction was not already captured in the accounting system and to view captured transactions you select the reviewed transactions button.

Enter the —>>>starting date in the Display from field and the end date in the To field to display the bank transactions already captured and reviewed. You will notice I have stated the To date field even beyond the bank statement period as the 30th of April 2022 to make 100% sure that there were no transactions captured.

—>>>Click on the Refresh button to execute our selections. The last transaction captured was on the 7th of June 2021. It is safe to start capturing the bank transaction that is on the bank statement starting on the 12 June 2021.

Capturing bank transactions.

To start capturing we are going back to the New transactions screen. Although it is possible to capture transactions in the reviewed transactions as well. I shall rather keep to the laid out steps in Sage for clarity purposes.

The banking grid layout is similar to a spreadsheet. It consists of column headings at the top and rows beneath it where transactions can be entered or filled during the import process.

All that you need to do is to complete each field from the bank statement provided.

The bank statement is also displayed on the screen while we process the transaction to make it easy for you to follow along with me.

- In the first field on the left under the “Date” column you enter the transaction date as it appears on the bank statement.

- You can skip the “Payee” field because it is bank interest from the bank we are processing the transaction from.

- Enter the “Description” of the transaction in my case interest.

- Under the “Type” column leave the entry field as Account which is the default selection in this Sage for allocating the transaction to a general ledger account because bank interest received is not a customer, supplier, transfer or tax transaction type.

- In the “Selection” field you select the appropriate category income general ledger account from the dropdown list of accounts.

- The next field requires a unique “Reference” for this transaction. I normally enter the transaction date and the number count of the transaction for that day.

- You will fill in the amount received from the bank statement under the “Received” column.

- The “REC” field is the abbreviation for reconciled, you can tick the box now because the transaction agrees with the bank statement, but I am going to leave this step for later when I perform the bank reconciliation.

- I am not going to fill in anything under the rest of the “Actions fields” because this is not a complex customer or supplier transaction or a transaction that needs to be split. If you would like more information about these action fields, watch my video about Bank Processing of Customer Receipts.

- Also note that this business is not registered for Value Added Tax and therefore the “Tax Type” option is not available in the Banking processing.

- I have completed all the necessary fields and will save my work before I proceed to perform the bank reconciliation.

The bank reconciliation process in Sage Accounting.

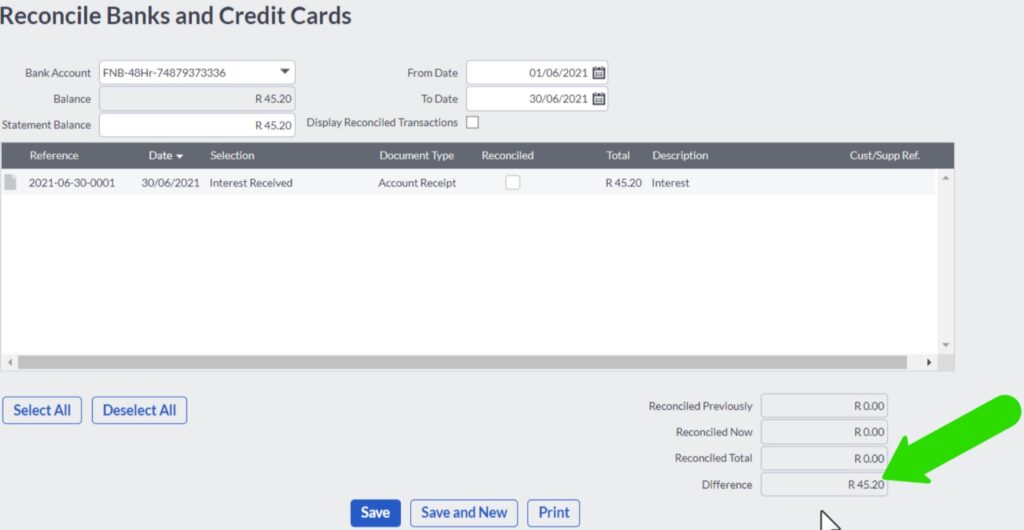

You can find the Reconcile Banks and Credit Cards link also at the top navigation menu bar under Banking.

The bank reconciliation fields.

In the Bank Account field select the appropriate bank account from the drop down list.

The Balance field below it is completed automatically and it is the accounting bank balance.

In the From Date field enter the starting date of the bank reconciliation. As well as the end date of the reconciliation in the To Date field.

Obtain the bank statement balance and enter the balance from the bank statement in the Statement Balance field.

At the bottom there is a Difference amount because the transaction that I have entered has not been reconciled yet.

Reconciling transactions

The unreconciled transaction is displayed in the centre area of the reconciliation screen and you reconcile it by ticking the checkbox under the Reconciled column.

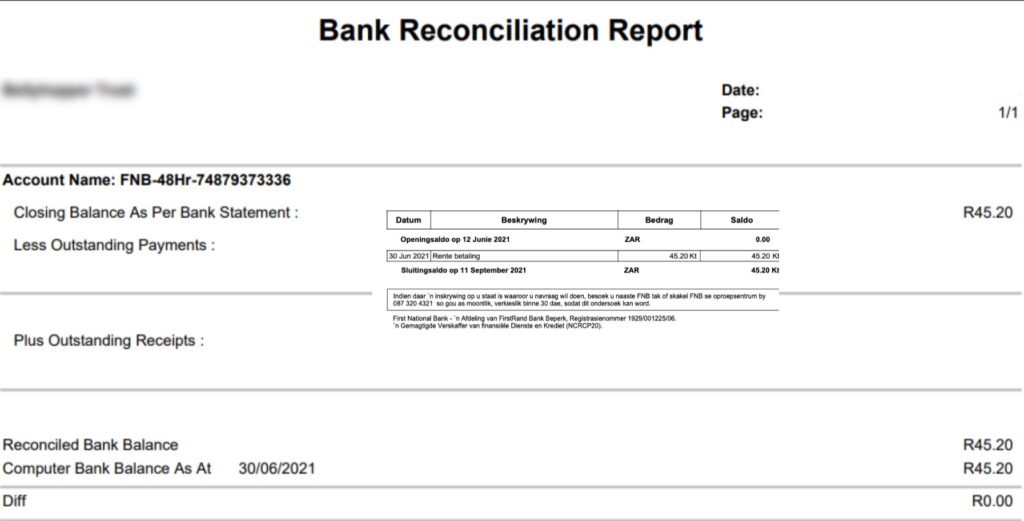

Click on the print button to save a bank reconciliation report on your computer.

The bank reconciliation report.

When you open the Bank Reconciliation Report it displays everything needed as proof that the three balances agree with each other and they are the:

- Closing Bank Statement balance.

- The reconciled bank balance originating from what I just did.

- And the Computer Bank balance is the balance per my accounting records.

And of course the Difference should be zero.

Going back to the Reconcile Banks and Credit Cards function, I always end it off by saving my work.

Conclusion

Now you have seen how to manually enter a bank transaction in Sage Accounting and also how to reconcile the bank account.

I hope it is clear to see how easy it is to use Sage Accounting’s banking function when you only have a few transactions per month. If you are able to do this process and bank reconciliation yourself as a business owner, your books will be accurate, valid and complete and you can save money on accounting fees. I have provided a link in the description below if you want to try out Sage Accounting for free for 30-days, no obligation.