Are you a business owner? Want to learn more about accounting? or new on Sage Accounting? Well then this post is for you: What follows is an introduction to Sage bank reconciliations for beginners.

In my previous articles I’ve shown the various ways of getting bank transactions into the sage accounting system and then we looked at how to deal with the categorisation and allocation of bank receipts and bank payments.

Our next and final step concerning bank transactions in our books is to ensure its accuracy by performing bank reconciliations.

I am going to introduce a simple and easy way of doing bank reconciliations with Sage Accounting. Reinforcing why Sage is so highly regarded, because the Sage Accounting version I am using, makes bank reconciliations a breeze. Removing technicalities and accounting jargon. Are you ready for this, okay let’s go!

What is a bank reconciliation?

In layman’s terms a bank reconciliation is the process of comparing data on cash books with the corresponding data on the bank statements.

According to Sage the purpose of a bank reconciliation is to make sure the transactions entered in Accounting match the transactions on your bank statement. This makes sure that your bank balance is correct.

Why must your bank balance be correct?

Your bank balance must be correct, because for most businesses the bank is where the money flow is gathered and monitored and accountants want to account for every cent.

If the recording of your bank transactions are 100% accurate then the reports generated are reliable and you have achieved a major advancement in the management of that business.

Are bank reconciliations really necessary with data transfers?

When you made the payment or received the money, the bank transaction details have been recorded and the work of generating transaction records has already been performed by the bank.

It is a waste of time to manually write-up books or recapture any bank transaction on an accounting system from the bank statements, because the data file already exists and it is with the bank.

We merely have to take this data that belongs to us and transfer it to us. We can do the transfer by importing data either automatically with direct bank feeds or bulk imports of bank transactions that potentially only takes a couple of minutes.

Here is where bank reconciliations come to play, because glitches can still happen with data transfers via the internet. Sometimes transactions are duplicated, sometimes it is corrupted. Data transfers are not perfect but it is still reliable and fast. You only have to deal with the few exceptions to the rule.

Performing a small and simple bank reconciliation of a real business bank account.

A bank reconciliation for me these days is a fast check where I confirm the bank’s data for validity, accuracy and completeness.

Let’s start for beginners with a basic, small bank reconciliation of a Netcash account containing only a few transactions but it’s an example of a real bank account of a real business.

1. Orientation.

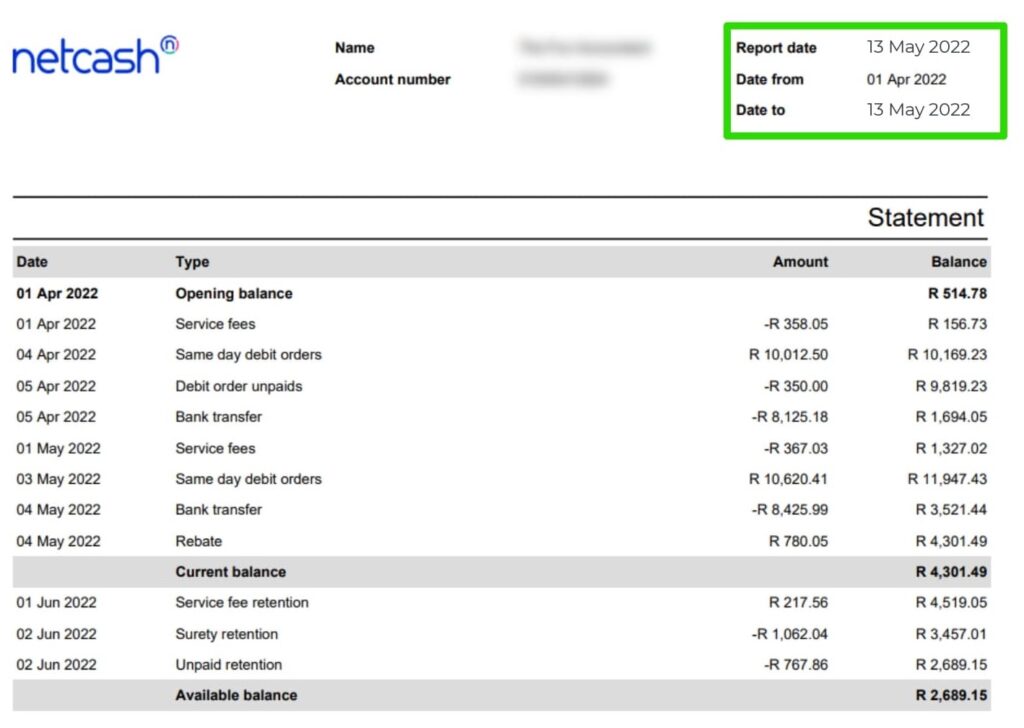

To orientate yourself and determine the dates that you want to reconcile to, open your bank statement like I have done here with this Netcash statement.

Have a look at the dates most bank reconciliations are performed for the last day of the month but if you think about it, it does not have to be only for month ends. The reason is that if your bank reconciles at mid month it means that the previous month’s end must be in balance.

In this case I am going to perform a bank reconciliation on the 13the of May as most of the transactions happen at the beginning of the month and I would like to send statements to customers that reflect those transactions. For that I need to be sure of the accuracy of the bank balance for the date of the statements which is the 13th of May.

2. Make a note of the bank balance per bank statement.

The next step is to make a note of the bank balance because you are going to need it later. Don’t’ worry it will become clear soon. I am going to copy the balance amount of R4301.49.

3. Access the bank reconciliation function in Sage.

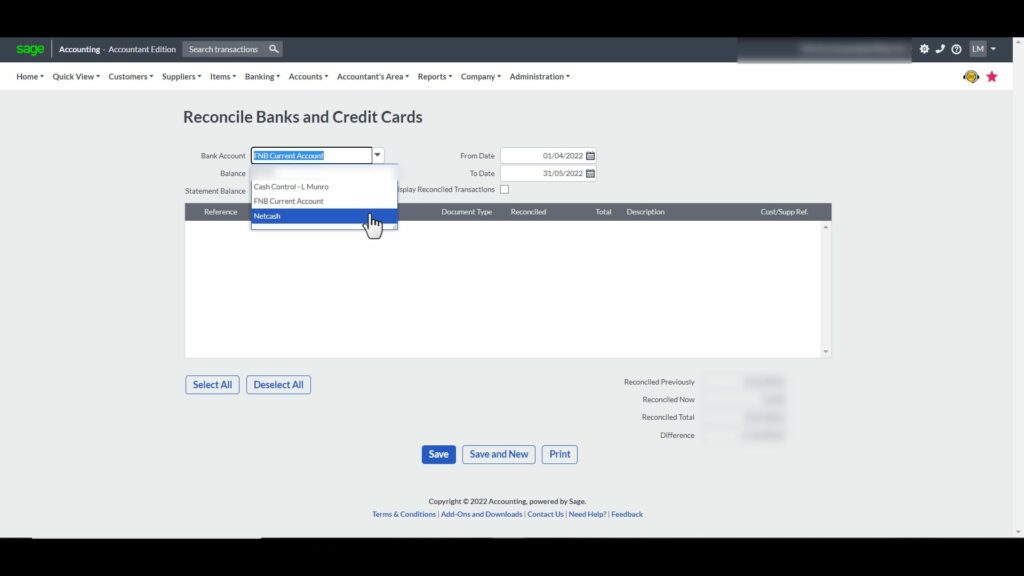

I am logged in at the Sage Workspace and I access the bank reconciliation function by selecting the Reconcile bank Statement widget that will take me directly to where I need to be.

4. Select the specific bank account from your list of bank accounts.

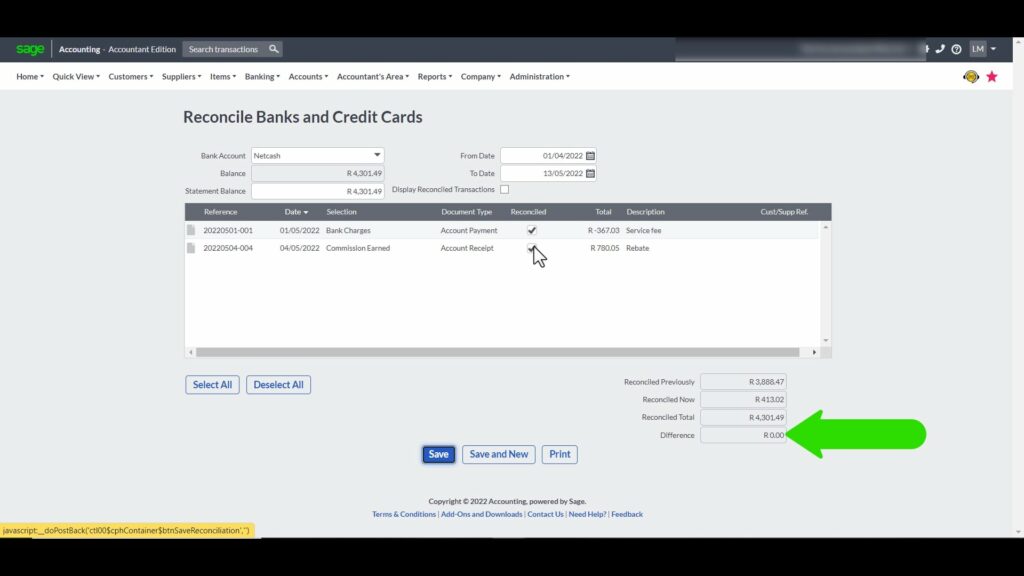

At the Reconcile banks and Credit Cards screen in the Bank Account field I am going to navigate to the netcash bank account.

The Balance under the bank Account name is the balance of the bank according to my Sage books for the “To Date”.

5. Select the bank reconciliation date.

My first step is to select the correct date of the bank reconciliation. In my example, my reconciliation balance-date is from the 1st of April to the 13th of May, which I select in the from-and-to-date fields.

Be aware that Sage requests to save each change that you make during the reconciliation process.

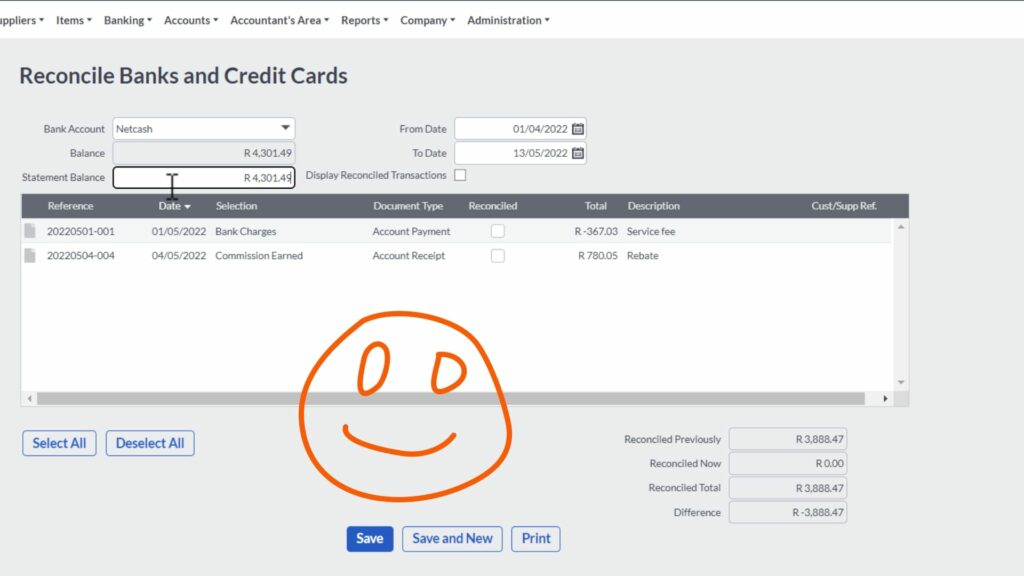

6. Enter or copy the bank statement balance

As a refresher I am quickly going back to the bank statement and copy the balance from the bank statement to the field next to the Statement Balance.

Already I am happy because the computer balance agrees to the bank statement balance.

But, there is a but unfortunately. If you look at the bottom of the reconciliation totals you will see that there is a difference.

7. Sort-out the difference by reconciling bank transactions

In the middle of the screen in the transactions grid two transactions are reflected. These are the transactions that were imported to the Sage Accounting banking section, but not yet marked as agreed with the bank statement. I know that my difference is immaterial, because I have already seen that the bank balance and statement balance above agree. When I mark these transactions as reconciled then the difference at the bottom is zero and I have successfully completed a bank reconciliation.

8. Keep a copy of the bank reconciliation.

Before you Save your work. First print the reconciliation because if you click on save, Sage will direct you away from this screen without the option to print your reconciliation.

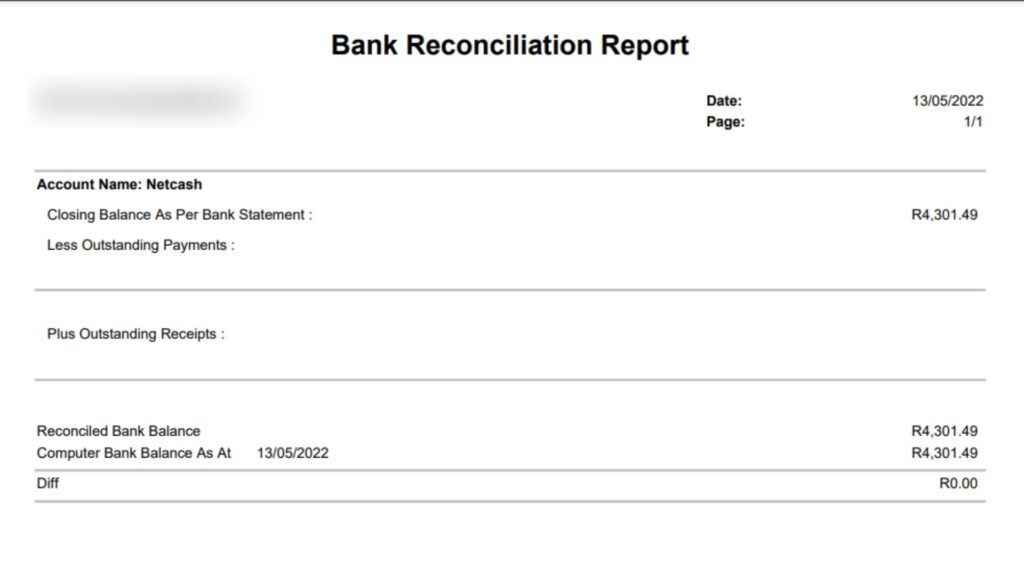

View the bank reconciliation report.

Now let’s view the Sage Accounting bank Reconciliation Report. The report is beautifully laid out.

Containing the following:

- Bank Account Name,

- Closing balance per bank statement,

- Less outstanding payment. This is relevant where cheque payments are made and only reflected in the bank after a number of days. With a live accounting system I do not encounter this often. I still find it with credit card transactions that takes longer to clear.

- Add outstanding receipts where a receipt is being captured in your accounting records but only cleared by the bank later.

- Making the sum of the above 3 gives you the reconciled bank balance which is compared to the

- Computer Bank balance at the date of the reconciliation.

- The difference must always be zero, otherwise there is an error.

Save and keep the bank reconciliation report.

It is important to save this report in a monthly management pack for the following reasons:

- As proof that the function was performed correctly,

- As proof that the accounting records in reports can be trusted,

- As proof for internal management overseeing work,

- As proof for external auditors like Revenue Tax Services etc.

Save the bank reconciliation on Sage

The reconciliation process is completed by saving it.

Bonus: Dashboard graphs

When you are directed back to the Dashboard screen note the Banking Widget that gives a graphical presentation of the bank balance movement.

For a business owner this is a helpful feature to make an immediate mental connection with the cash flow and bank balances of the business.

Well this was the start of our banking reconciliations journey.

Join me in future videos and posts where I am going to troubleshoot obstacles and hiccups that I encounter with various bank reconciliations. I am going to show you how to deal with them so that you can learn from my experience and have a good reference to come back to in case you get stuck with your bank reconciliations.