To know what to do, and to understand how bank reconciliations work, we have to start at the beginning and for me the beginning is to be able to do an old-school, manual bank reconciliation. Don’t fear going manual, I am going to show you exactly what to do. I am going to give you all the steps needed so that bank reconciliations never, ever will be a problem for you.

I have a confession to make…I often go back to a manual bank reconciliation as my fail save when all the quick reviews of my business’ banking fails me to resolve incorrect bank balances. The skill of being able to do a manual bank reconciliation is the foundation to be able to generate accurate business reports that can be trusted.

No choice but the manual route…

There are circumstances where you simply have no choice but to go the manual route with bank reconciliations for instance:

- There is a difference in your bank reconciliation that you are unable to resolve with the normal digital solutions.

2. The magnitude of transactions are large and you have to deal with hundreds or even thousands of transactions and you reconcile the bank on a daily basis.

3. Bank errors are rare but they do happen sometimes during imports and can throw you off your game completely, the resolve is to go back to a manual bank reconciliation.

4. In your business there may be many similar transactions with the similar amounts occurring every day. If you lose track, the best is to go manual.

5 An accounting software program like Sage Accounting identifies duplicate transactions and the system then asks you whether they should be kept or deleted. A manual reconciliation assists during this process.

6. Some people work better with printed transactions and are not familiar yet with digital bank reconciliations.

- If all else fails go manual as a last resort. This has worked for me on many occasions in the past.

What is a bank reconciliation?

A bank reconciliation is the process of comparing business bank transactions entered to the corresponding bank statement’s transactions.

What is the purpose of a bank reconciliation?

According to Sage the purpose of a bank reconciliation is to make sure the transactions entered in Accounting match the transactions on your bank statement. This will ensure that your bank balance in your books is correct.

Why must your bank balance be correct?

Why must your bank balance be correct, because for most businesses the bank is where the money flow is:

- gathered,

- measured and

- monitored

and it should be 100% accurate. If inaccurate reports are being used to make business decisions, it can have devastating consequences for that business and its stakeholders.

Sum-up bank reconciliations

To sum up the function of bank reconciliations in one word it will be “trust”. Meaning the bank balance and its transactions can be trusted as accurate, valid and complete.

What do you need to perform a bank reconciliation?

You need:

- The bank statement for the period that you want to reconcile,

- The bank transaction report or also known as a Cash Book for the same period as the bank statement.

- Then the curveball, the previous period’s bank reconciliation.

Why we need the previous period’s bank reconciliation?

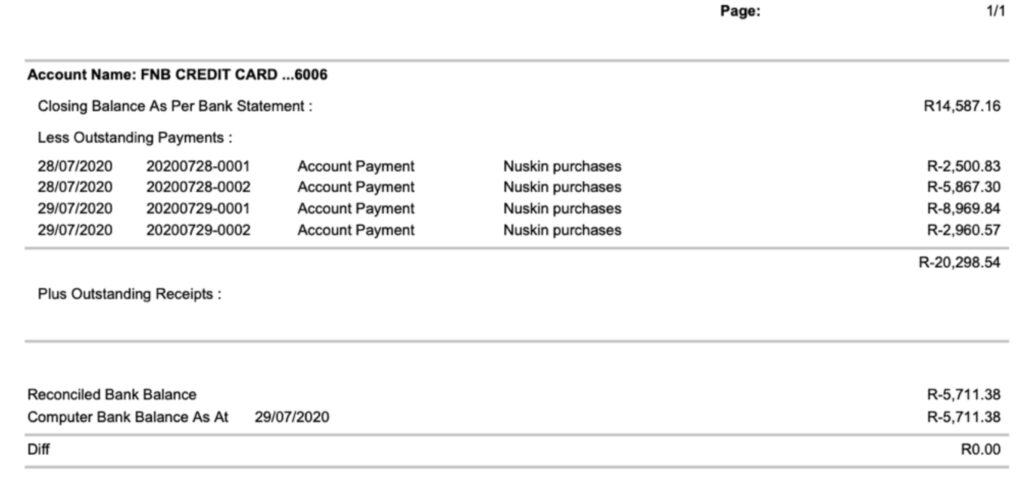

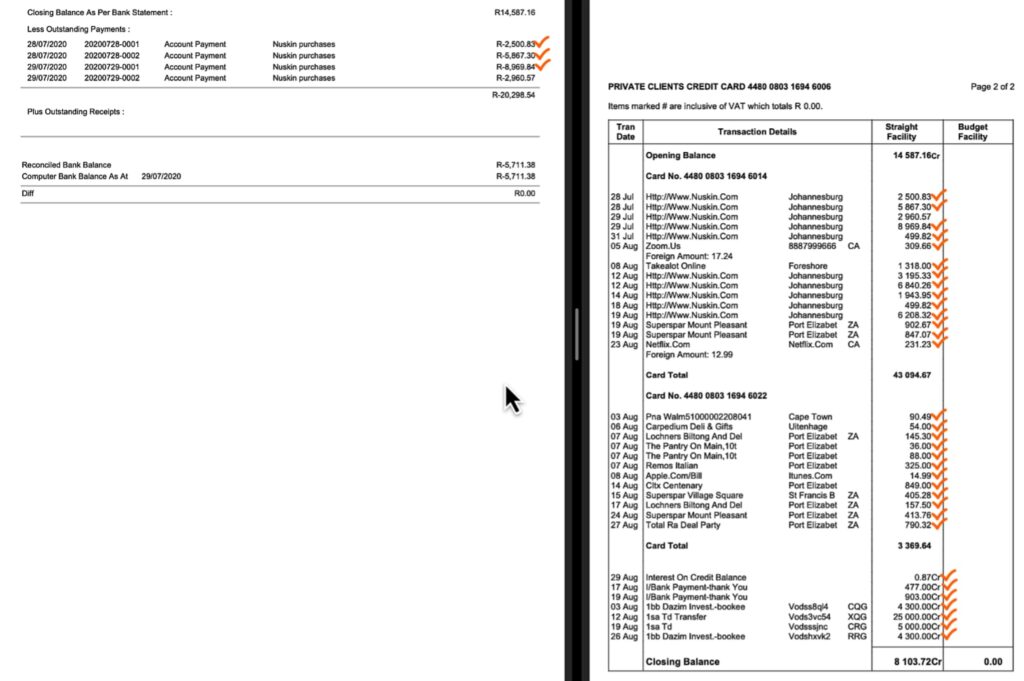

If you look at my opening bank balance per my accounting records you will see that the:

balance is an overdraft amount of R5,711.38 indicated by the negative sign,

while my bank statement amount is positive R14,587.16.

The difference between the two amounts is R20,298.54.

Going back to the previous bank reconciliation you see that the balance per bank statement was R14,587.16 but there were payments made of R20,298.54 in total in the accounting books that did not reflect yet in the bank statement on the 29 July 2020.

So if you deduct the R20,298.54 from the statement balance the net amount of minus R5,711.38 is the reconciled balance agreeing with the accounting record’s bank balance.

I have learned from my previous period’s bank reconciliation that:

Those outstanding payments are likely going to appear in the next period bank statement which is going to affect the bank statement balance BUT it will not affect the books bank balance as it was already processed and taken into account. We will simply delete them off our list of Outstanding payments.

Why do I expect that to happen?

We live in a fast moving digital world where transactions are literally executed within seconds. Of course there are exceptions to the rule especially when it comes to cross-border transactions where transactions take longer to clear through the bank mostly due to government regulations.

The message here is…

The message here is to look out for and take ALL the reconciling transactions into account when performing a bank reconciliation.

The first item needed: The Sage bank transactions report

These are the steps to find the sage bank transaction report to download or print:

- Go to the top navigation menu bar on Banking >

- Scroll down to Reports and then >

- Select the Banks and Credit Cards Transactions on the right side of the menu>

- Specify the date range by selecting Custom Dates and then enter the Starting Date as well as the End date of the report.

- In the bank account field select the specific bank account that you want a report from.

- Do not complete the category fields for this example and

- Leave the status on both active and inactive.

- Include all types of transactions.

- Lastly click on View Report.

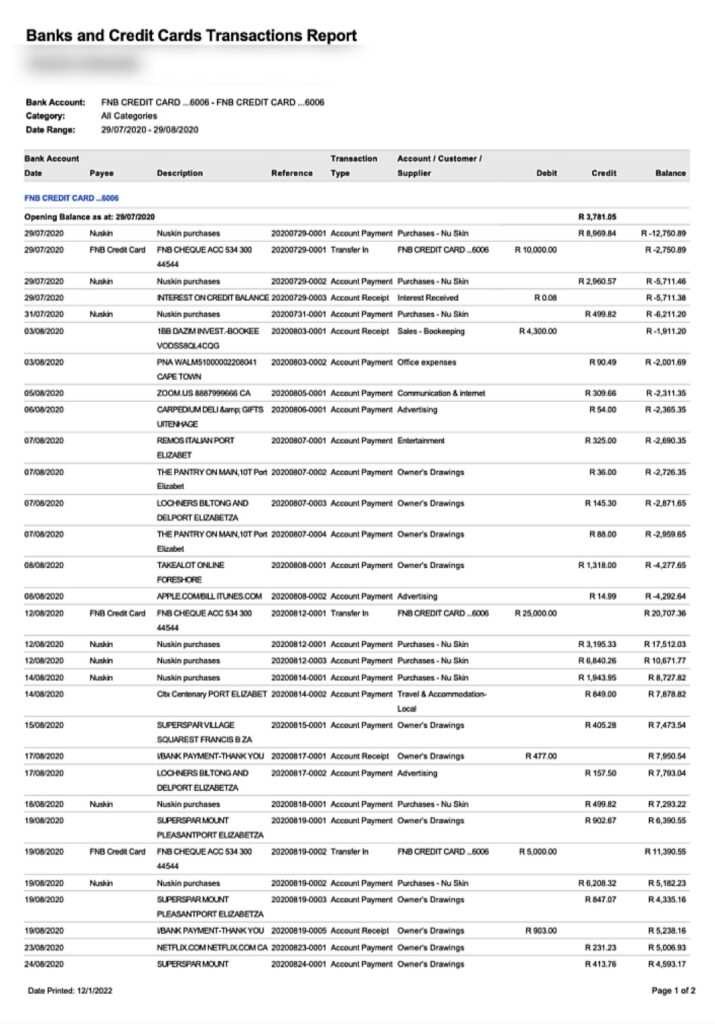

What you see here is the bank transactions captured or imported in the accounting records.

To assist with the reconciling process we are going to export this report in PDF format.

And this is how the report looks like in PDF format.

Second Item needed: The Bank Statement

Get your bank statement ready because you are going to compare all the transactions from the cash book to the bank statement.

Third Item needed: The Previous Period’s Bank Reconciliation

Below is the previous period’s bank reconciliation as an example for what you may need.

We now have all the information needed to perform a manual bank reconciliation.

The bank reconciliation process.

Our next step is to compare each bank transaction amount from our cash book one-by-one with the bank statement’s amount to spot any differences.

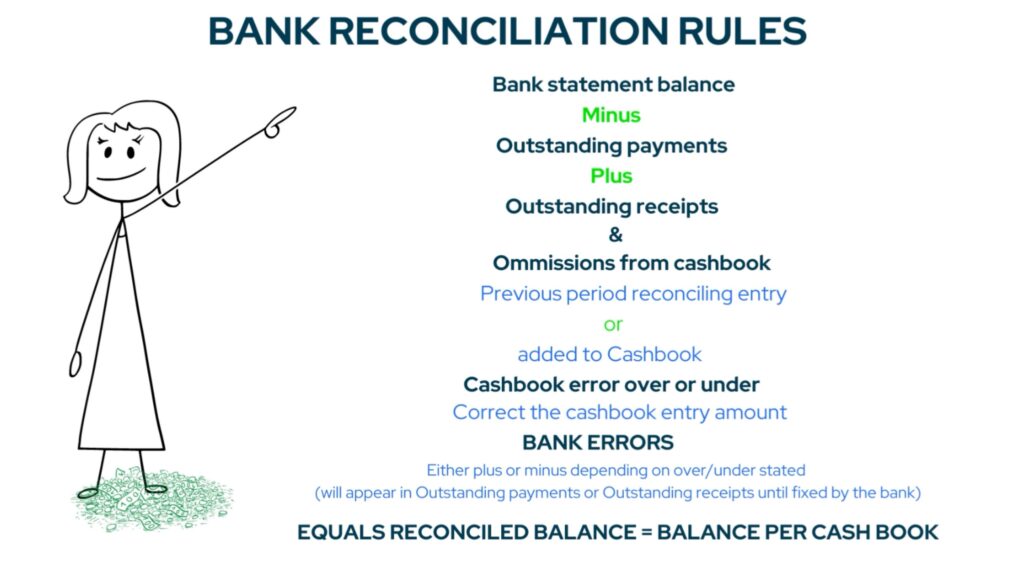

Rules to follow:

If an amount appears on your cash book and not on the bank statements:–> it is an outstanding payment or an outstanding receipt.

- Outstanding payments must be deducted from the bank statement balance

- and outstanding receipts must be added to your bank statement balance

for the two bank balances to reconcile.

If an amount appears on your bank statement but not on your cash book –>

- have a look at the previous bank reconciliation and

- if it doesn’t appear there, it is an omission from your books that has to be –> added to your cash book.

If an amount is incorrect and it is your error –> you need to correct the amount and redo the reconciliation. It is highly unlikely for the bank to make transaction errors.

To understand exactly what I have just said follow me in this practical example.

Practical Example – follow the video below on YouTube to see each transaction that are being compared and cleared.

The Cash Book is displayed next to the bank statement and we start by comparing transactions. My first transaction for the period is the R499.82 cents and I mark it off on both reports because it agrees.

Next is a receipt of R4300 which can be found at the bottom of the bank statement.

The third transaction is for R90.49 which appears to be correct.

I am now going to tick off each transaction that agrees on both reports.

Once I have compared all the transactions we will look and consider the differences.

Putting it all together.

I’ve completed marking off all the transactions in my cashbook and as you can see there were no errors.

I actually expected it and the reason why I expected it, is because I imported these bank transactions from the bank leaving very little chance of making any typing or input other errors.

Again emphasising the point of getting your books onto a cloud accounting system like Sage because it reduces time consuming manual inputs, increases accuracy and delivers quick results.

Reconciling items.

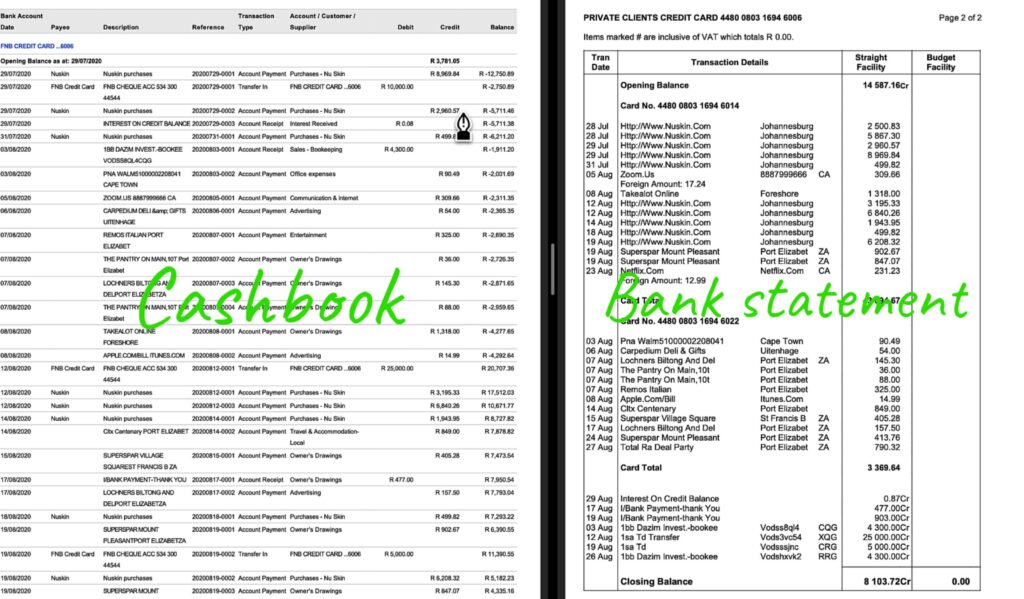

There are however differences as the transactions that appear at the top of the bank statement are not reflected in my cashbook, but hang on, look at the dates of those transactions…They come from a previous period. This tells me that I must look at the previous period’s bank reconciliation which is now displayed on the screen next to the bank statement.

Indeed, under the Outstanding Payments is an amount of R2,500.83 which agrees with the amount on the bank statement and I can mark it off. Also the next outstanding payment of R5,867.30 and R8,969.84 and lastly R2,960.57.

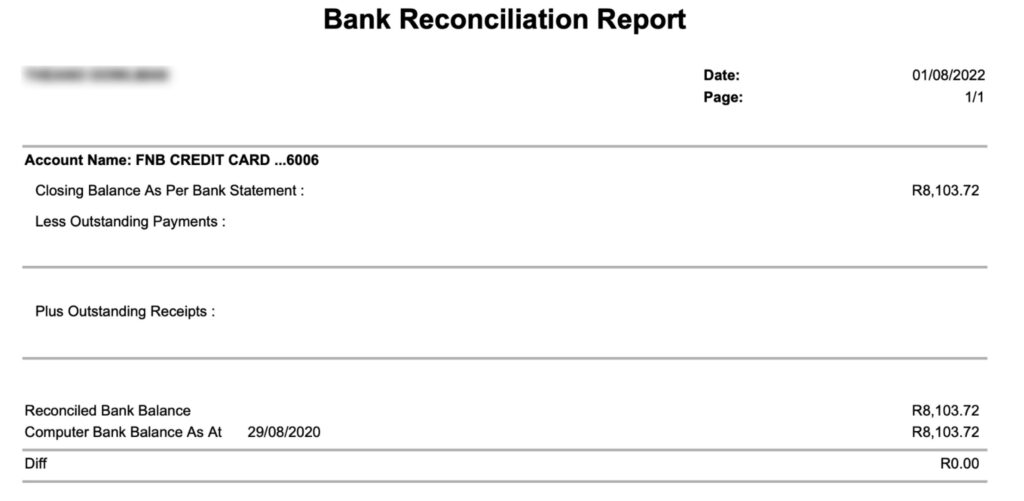

I want you to now only focus on the bank statement and you will see that we have ticked off all the transactions on the bank statement. The bank statement balance is R8,103.72.

We have done exactly the same with our cashbook and the balance is also R8,103.72. Our accounting bank balance reconciles to the bank statement and there are no outstanding payments or receipts.

The last step – Generating a bank reconciliation report

In your last step, knowing what you know, you can finish off the bank reconciliation in Sage and generate a beautiful bank reconciliation report that you can be proud of.

- At the top navigation menu bar head over to Banking >

- Move down to transactions move your cursor to the right to “Reconcile Banks and Credit Cards” and click on it.

- Select the bank account,

- Enter the period start and end date >

- At the “Statement balance”, type in the bank balance per bank statement, and you can see that it agrees with the accounting balance, leaving a zero difference amount.

- To save this bank reconciliation statement click on the Print button … and there displayed is a beautiful bank reconciliation report.