In the last blog of The Fun Accountant’s bank reconciliation series, I am going to recap the previous four previous articles/videos and then I am going to tie it all together with an another bank reconciliation example in this final fifth bank reconciliation tutorial for advanced Sage Accounting users.

We are going to celebrate completing the bank reconciliation series by showing off the skills gained and the final example of what you can achieve with the practical knowledge given in the series. Hopefully you can do bank reconciliations comfortably in your own working environment after following The Fun Accountant’s bank reconciliation series.

You will find that performing a bank reconciliation using accounting software programs is much easier to do than answering a theoretical accounting questions asked by accounting training modules.

Partly because the accounting software assists with this process and partly because bank transactions are executed faster and these transactions are imported directly into your accounting system, giving less opportunities for errors and deviations from the banks statement. I prefer to rather focus on practical examples for accounting functions in the real-world in stead of giving theoretical teachings.

The principles of bank reconciliations are very simple and remain unchained after many, many years. Be careful not to fall into the trap of confusion and complexities that many people portray this subject to be.

Let’s recap from my previous articles about the subject of bank reconciliations.

1. Define bank reconciliations one more time.

I want to simplify the function of bank reconciliations again.

A bank reconciliation is where you take your bank statement balance at a point in time and compare it to the bank balance in your accounting records to see if they agree. Then if they do not agree, you have to either fix the error or note the reasons for any differences-aka-reconciliation.

Fortunately accounting software programs prepare the ideal templates for you so that a bank statement report can be generated with ease noting any differences. And doing it while you finish the bank transactions allocations. So it is really not a big deal.

You have learned why bank reconciliations are important.

2. Bank reconciliations for beginners – Bank Reconciliations Part 1.

You have learned how to do a bank reconciliation as a beginner and mostly seen how your bank reconciliation function will be completed when you import bank transactions unless there are any differences. In this article I am going to touch on one of the most common errors resulting in a bank reconciliation difference and also explain how to solve it.

3. A full manual bank reconciliation – Bank Reconciliations Part 2.

Going back to basics, I have dedicated an article/video to perform a full manual bank reconciliation, which is rarely necessary and mostly for students who are studying accounting. But I had to perform this manual bank reconciliation myself for a client showing that these instances actually do occur. You can view this video as a theoretical exercise and example for when you get stuck and if you can successfully pull-off a manual bank reconciliation I do not foresee that you will ever struggle with performing any type of bank reconciliation.

Of course the accounting softwares’ bank reconciliation layouts differ and it may take some time to get use to a specific accounting software’s nuances, but the principle remains the same and for me having worked on various accounting software programs, Sage Accounting’s bank reconciliation is the easiest and quickest to perform but that is my personal preference.

4. The quickest and easiest full digital bank reconciliation – Bank Reconciliatioins Part 3.

Much similar to the manual bank reconciliation is the full digital bank reconciliation. We dived deep into the subject of bank reconciliations as I showed all the steps to pull-off a transaction-by-transaction comparison of the cashbook with the bank statement. Following this example will give you a comprehensive framework in case you get stuck doing a bank reconciliation and also give you a good comparison of Sage Accounting’s bank reconciliations with other software on the market.

5. Bank processing and reconciliations – Bank Reconciliations Part 4.

In the fourth bank reconciliation article/video we went from start to finish with the banking function in Sage Accounting. I showed you my preferred method of capturing bank transactions manually with only a few transactions on a bank statement and then completed the process with a bank reconciliation as the icing on the cake.

6. Bank reconciliations on Sage Accounting for advanced users – Bank Reconciliations Part 5.

In this grand finale article/video lets see how an advanced user easily and quickly performs bank reconciliations in Sage Accounting.

The quick bank reconciliation process.

I am logged in to Sage at the banking transactions area.

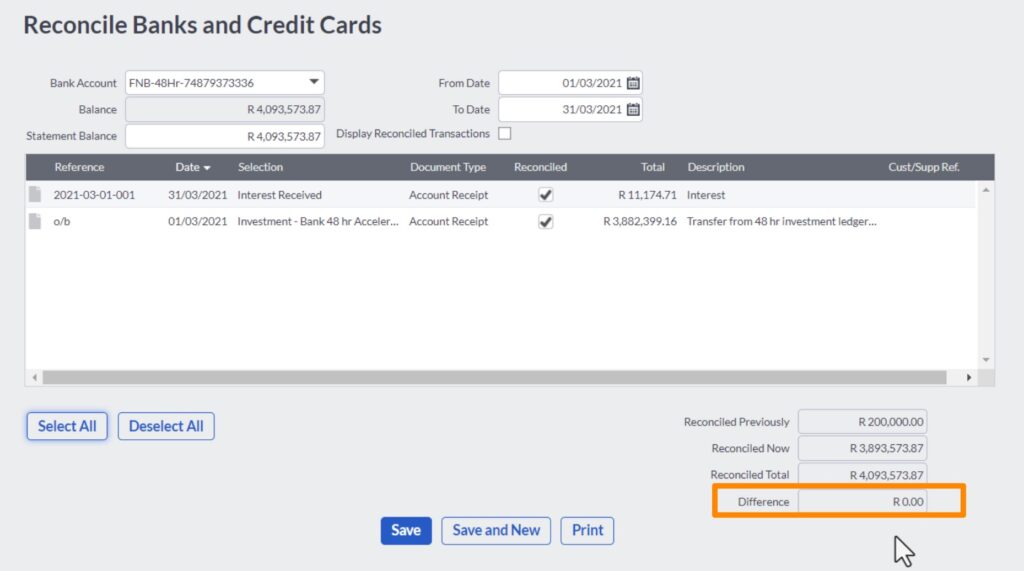

> Go to “Reconcile Banks and Credit Cards” from the top navigation menu bar.

> Select the appropriate bank account from the list of bank accounts in your books.

> The bank reconciliation starting date is already filled in in the “To Date” field. If you are happy with it, leave it as is.

> Then I choose the bank reconciliation date in the “To Date” field.

> The “Balance” field is already populated from your Cashbook.

> Enter the bank statement balance in the “Statement Balance” field.

> Select all the unreconciled transactions and after doing that, the “Difference” between your Bank Statement and the Accounting balance should be zero.

> Click on “Print” to save a bank reconciliation report. You must keep the bank reconciliation report as evidence that the bank balance in your accounting records is accurate, valid and complete.

> Lastly, “Save” the bank reconciliation.

And that is it. This is an example of how quickly your bank reconciliation function can be performed.

The most common Bank Reconciliation error.

Let’s troubleshoot one of the most common bank reconciliation errors that you are likely going to encounter as a business owner or bookkeeper.

Following the exact same steps as laid out above, everything should be fine because the Accounting Balance and the Bank Statement’s balance agree but after ticking the unreconciled transaction, there is still a large difference in the bank statement reconciliation. What now..?

Prior periods’ transactions have not been marked off as reconciled.

If this happens then you know that there are transactions prior to this reconciliation period that have not been marked off as reconciled.

The solution is very simple: You have to select a prior period start date, which will then display all the transactions that have not been reconciled yet in prior periods.

All that you have to do is to select them as reconciled and then the bank reconciliation difference should be “NIL”.

We’ve covered every aspect of Bank Reconciliations in the series.

I think by now… after all five bank reconciliation articles and videos we have drained every single drop from the subject of bank reconciliations and you should be good to go.