What is the shortest route from point A to point B? Most people will say a straight line. What are the shortest route and the bookkeeping steps before generating monthly reports? I will reveal the steps that I take and a checklist that I follow before generating monthly reports.

It cannot be emphasized enough that you also need the right tools in terms of accounting software. It definitely helps your cause if you are armed with the best cloud accounting software. With the application of automation add-ons, generating accurate monthly reports is not a hard goal to achieve. The best cloud accounting software has comprehensive reporting sections.

Monthly reports are the end result of bookkeeping.

Wikipedia defines bookkeeping as: “the recording of financial transactions and is part of the process of accounting in business. Transactions include purchases, sales, receipts, and payments by an individual person or an organization/corporation. Any process for recording financial transactions is a bookkeeping process. Bookkeeping refers mainly to the record-keeping aspects of financial accounting, and involves preparing source documents for all transactions, operations, and other events of a business.”

Monthly reporting can consist of a wide variety of reports. These reports are focused on reporting on the financial performance of the business as well as it’s financial position. That information is needed for making decisions about the day-to-day operations of the business.

The end result of the bookkeeping process is reporting which can cover various periods. Monthly reports are the most popular for the management of an organization. Monthly reports’ popularity could be due to the fact that sufficient time has elapsed to provide enough information to draw conclusions from. Another useful aspect is that months can be compared against each other in order to form a picture of trends and the health of the business. Monthly reports provide a good indication of the direction the business is heading to.

Monthly reports are not a process like bookkeeping. It is rather the end result of bookkeeping and consists of a list of reports that are required by the management of the business. Once all the bookkeeping steps up to the end of the month is completed, monthly reports can be generated. The type and the layout of monthly reports are dependent on the accounting software being used.

Requirements for monthly reports

There are three requirements that monthly reports must comply with:

- Validity – The transactions must be correct and true. Inherently it means that the transactions recorded actually occurred.

- Complete – All the transactions have been recorded and nothing is omitted from the business records including the revenue, expenses, liabilities and the assets.

- Accuracy – The transactions recorded are accurate in terms of date, quantity, quality, description and amount. Accuracy also refers to transactions that conform to the chosen accounting standard and policy in terms of its classification, value and presentation.

The 7 bookkeeping steps

In order to fulfill the requirements of monthly reports, certain bookkeeping steps must be completed. These steps are also used as a checklist to ensure that all the processes have been followed and completed.

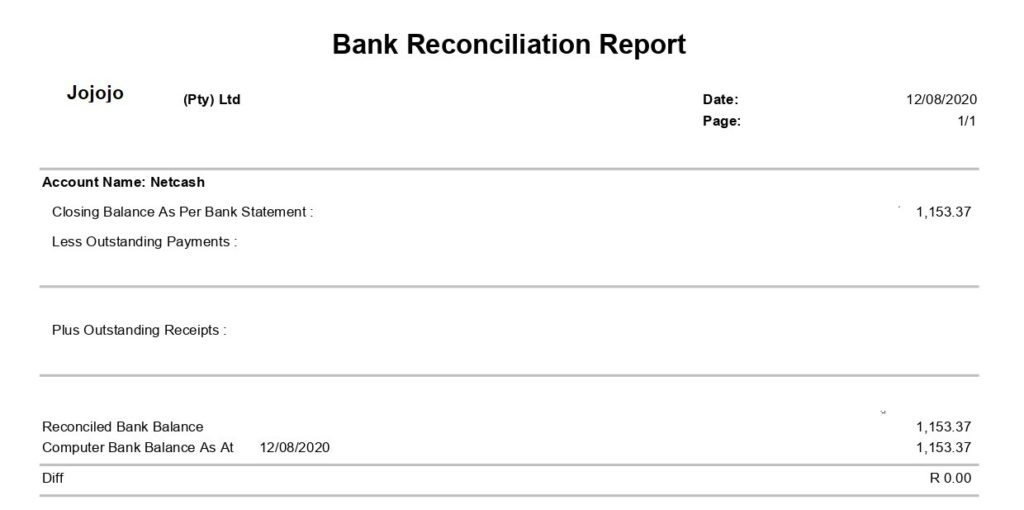

1.Bank and cash

Inspect your list of bank accounts and ensure that all the bank accounts are reconciled and agreed to the physical bank statement.

For cash-on-hand accounts, check that all the cash accounts are counted on the last day of the month and that the physical amount on hand agrees to the balance stated in your business books.

2. Sales and customers

Ensure that there are no outstanding quotes, sales orders and delivery notes. Check that all the sales invoices have been raised. Review the customer balances at month-end and investigate credit balances which may indicate that certain sales invoices have been omitted. Raise questions about amounts that are long overdue to you (customer balances older than 30 days.)

Once you are satisfied with the customer age analysis send out the customer statements. With cloud accounting software a statement run can be performed where the statements are emailed to all the customers with balances due.

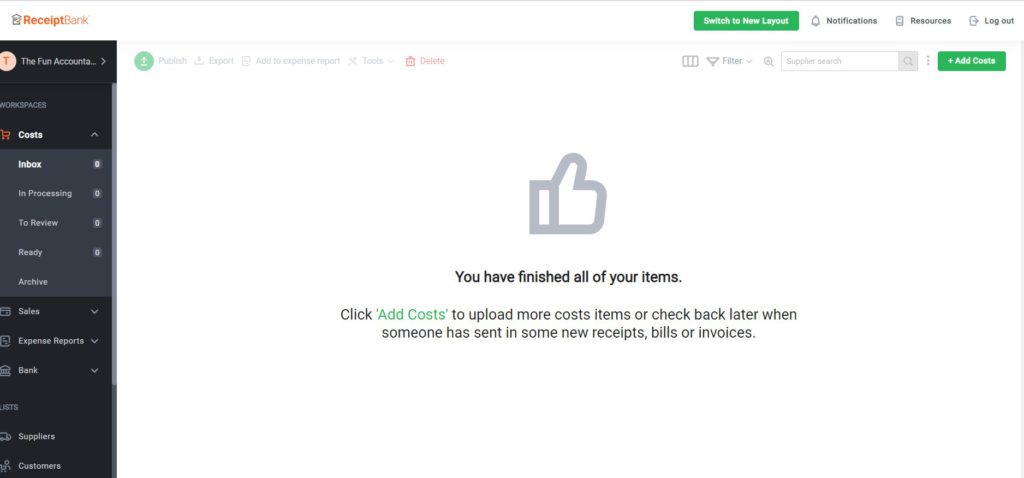

3.Purchases and suppliers.

In case you apply automated bookkeeping with a tool like Receipt bank, ensure that the inbox is cleared first, before doing anything else.

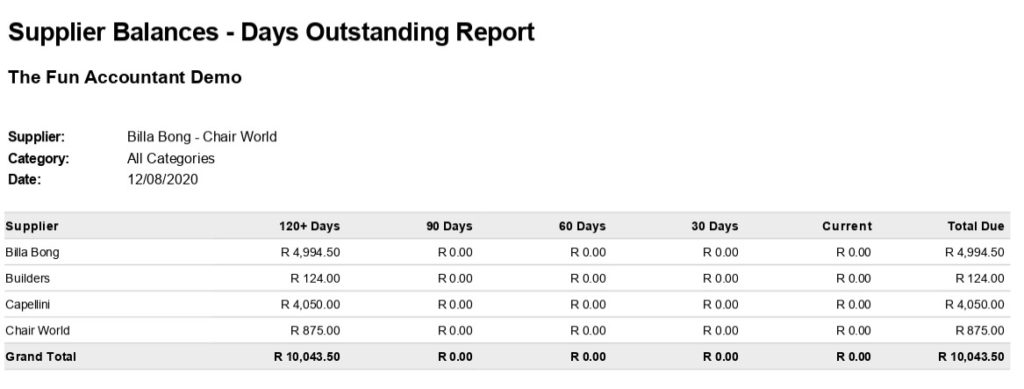

Inspect the purchase orders and goods received notes for completeness and ensure that all the supplier bills have been recorded. Review the supplier balances at month-end (supplier age analysis) and investigate all debit balances (negatives). These may indicate that not all the bills have been recorded. Raise questions about bills outstanding that are long overdue and haven’t been paid yet.

Once you are satisfied with the supplier age analysis. You can pay the bills that are due. In the case that you have implemented automation, you can create and send a payment batch to an automated payment system which will create all the payments simultaneously. An example of such a payment system would be Netcash.

4. Payroll

Many people think that payroll software is similar to accounting software. The two are worlds apart. The payroll results in transactions that are payable like salaries, tax and other statutory deductions. These are deducted made from employees’ salaries. It has become the responsibility of employers to pay the statutory deductions to the authorities.

Payroll deductions and contributions are a burden that the governments have placed that burden onto businesses. The best way to deal with this is to use a cloud payroll system. These systems create a database of employees’ information and then apply the parameters that have been set for each employee. These are applied with a payroll run that normally happens on a monthly basis. Weekly and bi-weekly payroll runs are also commonly used in business.

It is possible to create automated payments to employees where the net pay from the payroll reports are integrated and sent to a payment system. All the employees are paid simultaneously. Netcash is a good example of a salary payment system that integrates with your payroll.

The recording of payroll payments and liabilities in the accounting records of the business is a bookkeeping function.

The recording of payroll transactions must be completed up to the current month before monthly reports can be generated.

5. Inventory

Normally businesses will ensure that the stock quantities are checked and agreed to the quantities in the accounting system at least on a monthly basis. A stocktake is then being performed. Businesses that run proper stocktake procedures will ensure that the quality and expiry dates of their products are also checked. The damaged and obsolete stock needs to be written off.

Businesses that follow best practices run live and perpetual stock systems. This means that the stock quantity and value is accurately reflected in the books at any given point in time.

Inventory management can become a complex area. Most cloud accounting systems provide a reasonably good basic inventory system. In cases where more functions are required for example barcoding, you should consider add-ons to your cloud accounting system. There are numerous add ons to choose from.

The inventory value must be correctly and accurately reflected before monthly reports can be generated.

6. Fixed assets

In many cases, there is more work required when dealing with fixed assets. The additions to fixed assets need to be recorded in a fixed asset register. Then depreciation needs to be calculated and the depreciation entry passed in the accounting records of the company. It is advisable to keep the invoices for additions to fixed assets separately as it may be required as evidence for auditing, insurance and fixed asset register purposes.

7. Liabilities

Mortgage bonds and various types of loans payable are classified under liabilities. For a loan to be accurate, the capital balance outstanding on the last day of the month must be reflected in the books. This means that the interest of the loan must be calculated according to the agreed terms and recorded in the books.

Conclusion

You are good to go and you can proceed with monthly reports now that the 7 bookkeeping steps are completed.