Small businesses can obtain online access to money management software that was recently only reserved for large corporations. These online solutions have opened a whole new door for cash flow management of small businesses.

Netcash is a leader in online money management with its range of services on a single platform that provides money collection and payment solutions to businesses. In this Netcash review, I’ll take a closer look at Netcash to provide the reader with information that may assist with the decision of whether Netcash may be a suitable solution to improve the money management of your business.

What is Netcash?

Netcash is a payments facilitator to businesses and organizations. Netcash provides secure payment solutions that are Cloud-based and was previously known as Sage Pay and historically part of the Sage Group.

Why did Sage Pay change their name to Netcash?

In recently received emails from Sage Pay they informed all users that Sage Pay has changed its name to Netcash.

On the 2nd of December 2019 this mail was followed by another stating that Netcash is finally here!

This announcement brings a welcome relief to end speculations about what will emerge from Sage Pay and how this will be affecting all the users of Sage Pay. In a letter from Charles Pittaway, the Managing Director of Sage Pay ZA dated 19 July 2019, he stated that he and Sven Woxholt have completed the buy-out of Sage Pay ZA. In this letter Charles said that Sage Pay payments and banking partnership through Sage Business Cloud Payments and banking Cloud platform has been a unique concept of Sage that have been working well, but that the Cloud Payment platforms require its own innovation that will work better as a standalone payment specialist.

Everything became crystal clear to me when the Sage FTSE 100 company revealed on the 10th of September 2019 that they are looking to offload Sage pay. https://www.business-live.co.uk/technology/sage-reveals-plans-sell-payment-16893504

Their strategy of selling their Sage Pay payment gateway was already completed in South Africa in July 2019. Sage is repositioning their business to be more focused on cloud-based accounting services.

What type of payments does Netcash performs

1. Debit Orders

A complete money collection service for collecting recurring payments from Customers for monthly subscriptions, premiums or invoices.

2. Salary Payments

Integrate to Sage Payroll whereby businesses can pay salaries by submitting a payroll batch to Netcash. From Netcash the payroll batch can be inspected, amended if necessary and authorised for payment online to all South African Bank accounts. All employees are paid simultaneously to verified bank accounts.

3. Creditor Payments

A convenient, risk free way of paying bills with Netcash that integrates with numerous Accounting, ERP and billing software. The important aspect of segregation of duties is accomplished by adding multi-layers of access for authorisation of transactions.

4. Pay Now Invoice

Positive cash flow management starts with offering your Clients more than one way to pay your invoices. When your Customers receive your online invoice a “click to pay” button is included in the footer of your invoice. As your Customers click on this button they are presented with 6 different ways to pay you. These options include well known brands such as Materpass, Visa checkout, credit card, bank EFT, instant EFT and paying at certain retail stores.

5. Pay Now SMS Email

You can automate your payment requests by sending an SMS or Email to all of the unpaid debit orders. When your Customer clicks on the notification they are presented with the 6 different ways to pay you.

This function is also available when you are mobile and you need immediate payment. From your smart device you can login to Netcash and send an immediate payment request to your Client.

6. Pay Now Gateway

Collecting online payments with the Netcash payment gateway ensures that your online shopping carts do not stay empty because your Customers feel unsure or unsafe when checking out their purchases.

Netcash is integrated with various online shopping cart plugins like Woocommerce and CS.Chart. The Netcash Pay Now Gateway offers 3D security and PCI compliance for the prevention of fraud and chargebacks.

What are the Pros and Cons of Netcash?

Pros of Netcash:

- Netcash, previously known as Sage Pay, has been around for a very long time and has built a reputation of being a secure, reliable payment and collection option. You know what you get when signing on with Netcash.

- When you sign on, Netcash assigns a dedicated account manager to partners that can speed-up resolving any issues you might encounter. These account managers offer a brilliant problem-solving attitude with a human touch.

- Support can be received telephonically or by Email. You have access to the general support team or your dedicated account manager. Support is only available from Mondays to Thursdays 08h00 – 19h00 and Fridays 08h00 – 17h00. These hours can be lacking for businesses that may encounter online problems after hours. The reason why it is stated as one of the pros is because of the good quality support that one gets when you end up needing support.

- Netcash is more cost-effective than most competitors and banks offering these services.

- The reports available from Netcash is vast, fast and can be tailored to your needs. Various risk reports reduce the risk of paying the incorrect account. Credit status checks, bank verifications and access to multiple credit bureaus add to reduce the risk to your business and support good business practices.

- A strong feature of Netcash is its ability to integrate with popular accounting and payroll packages. This integration helps you to be more accurate when paying suppliers and employees. It further reduces time when allocated receipts as customers’ pay now invoices are matched to the amounts received.

- Batches are created from your payroll and accounting package and these batches can be reviewed and authorised by different people from the ones generating the batches. If you desire a strong control environment this can be achieved with Netcash’s multi-layer of authorisation.

- Netcash transactions can be linked to accounting packages for bank feeds. As an alternative Netcash transactions can also be imported to your accounting.

- The high level of integration that is achieved by Netcash through payroll and supplier accounts that sync to Netcash results in a lot of time that is saved and improve your business efficiency.

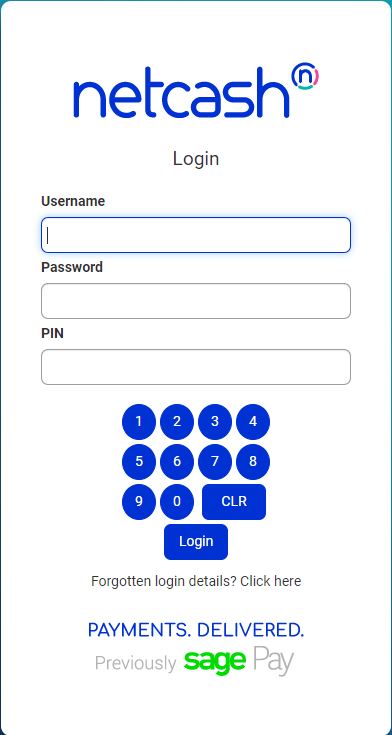

- Netcash is a secure platform that offers extra security with different levels of access, One-Time-Pins or 2-factor authentication when performing payments. On the other hand Customers that pay you via one of the 6 payment methods also experience a safe and secure way of transacting with your business. This security provides confidence in your brand and general business processes.

- Account validation that is offered by Netcash is a strong feature that ensures you pay the intended party. In a world overwhelmed with fraud the validation step is an easy and necessary feature provided by Netcash.

- Earn interest on a positive balance in your Netcash account. The interest earned at a rate of 3% p.a. at the moment is a contributing factor to continuous improve your cash flow, even when it is standing still.

Cons of Netcash:

- Support us only provided during office hours. There are no live chats available which is a feature that we got accustomed to being provided by popular brands. Being able to be helped quickly and efficiently any time of the day becomes more and more important especially for small businesses and start-up Entrepreneurs that work after hours.

- To open an account takes a LOT of PAPERWORK. I understand the problem of legality being a headache for many businesses, but Netcash could have maybe found smarter solutions to get accounts opened easier and faster.

- Only available for businesses and there are limited functions available. I was thinking that Netcash could spread its wings wider and increase its Customer base by giving access to individuals. This could drive the costs down for everybody if there are more users of the product.

- There are very limited training and online resources available on Netcash and definitely an area that Netcash needs to work on if they would like to expand their business.

- Netcash’s business revolves around South Africa and there are complications when you run a multi-currency, international or only a fully online business. Overseas payment gateways are easier to set up and deal with receiving funds from all over the globe.

- Netcash requires personal surety when opening an account for collections. This is a bold move by Netcahs but understandable in today’s world of fraud prevention. A possible solution could have been an insurance option because signing personal surety is always a risky thing to do.

Netcash review – a great local collection and online payment gateway

Businesses need to be creative to secure positive cash flow. Netcash provides that creativity by offering Customers 6 different ways to pay your account. This alone will not ensure cash in the bank but is an important step towards it.

Netcash’s collection facility is state of the art, reliable, less expensive than most bank products and is a necessity for businesses and organisations that require regular premiums or recurring funds from its Client base.

Netcash is a secure online platform that can be managed from anywhere. The added benefit of SMS or Email pay-now payments helps those businesses that are mobile. It only takes a few seconds to think about your business and how you can use it.

Netcash seamlessly integrates with Cloud Accounting software like Sage Business Cloud Accounting and Sage Online Payroll. This reduces the headache of administration and paperwork.

Netcash delivers a strong product offering and is certainly one of the best in South Africa in its field but it is lacking where an international solution is required.

Want to learn how to import from a Netcash bank account into Sage Business Cloud Accounting. Have a look at this video on how to import from Netcash bank account into Sage Cloud Accounting.

Final thoughts

Netcash provides a secure online money management system with a personalised touch to it. No additional software is required with Netcash. Netcash presents various methods to give your customers more and easier options to pay you and thereby your cashflow can improve. The magnitude of paperwork that needs to be completed is worth the time and effort to open a Netcash account and apply its solutions in your business.

Interested in getting Netcash for your business or wanting to learn more.