Let’s see folks, if it is possible to perform a quick and easy full digital bank reconciliation on Sage Accounting.

You can follow along with me and compare my bank reconciliation methods to yours. As well as to: use this video as a comparison to measure Sage Accounting’s bank reconciliations with other accounting software available.

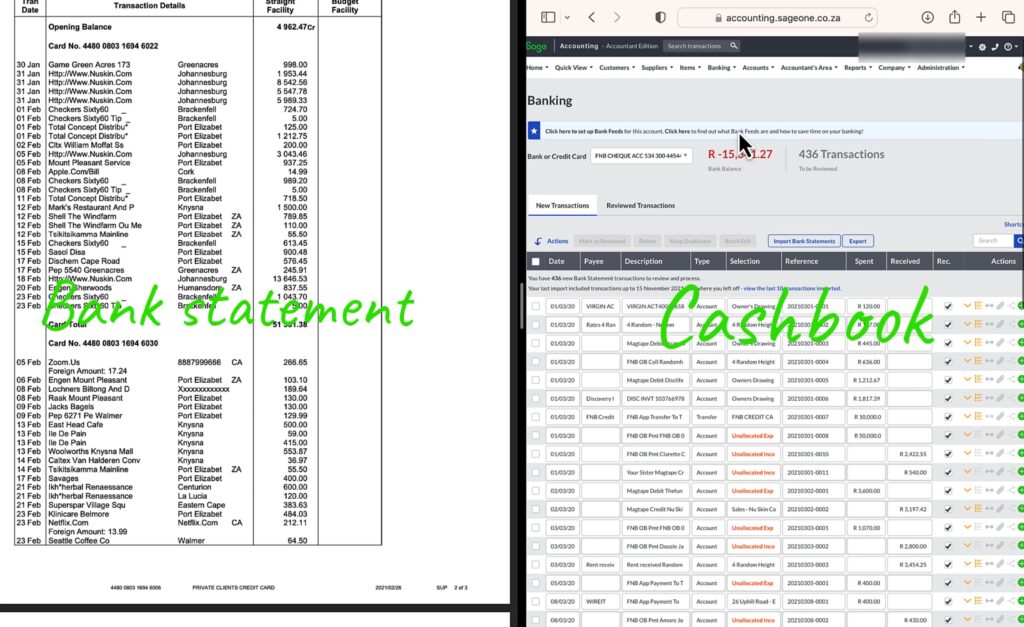

Bankstatement vs Cash book.

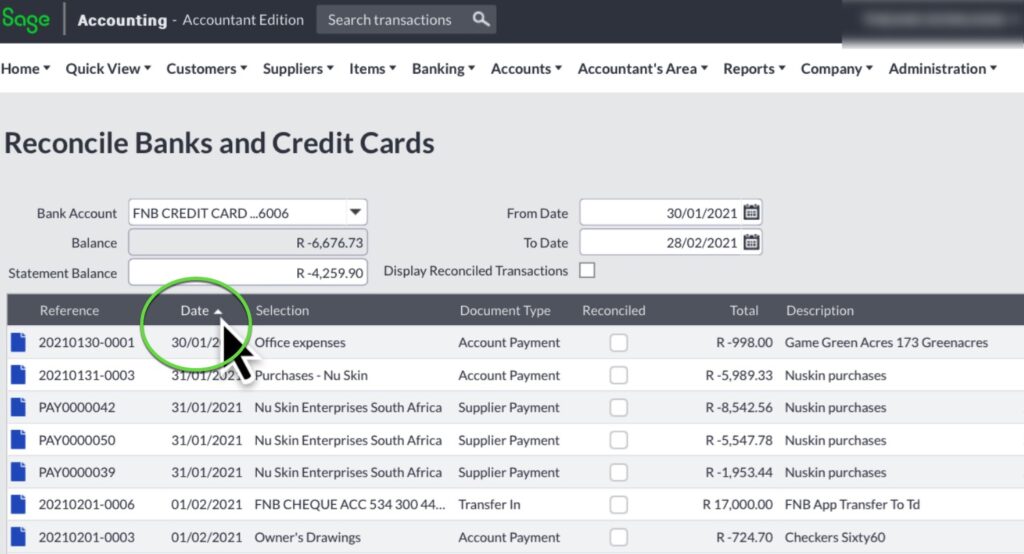

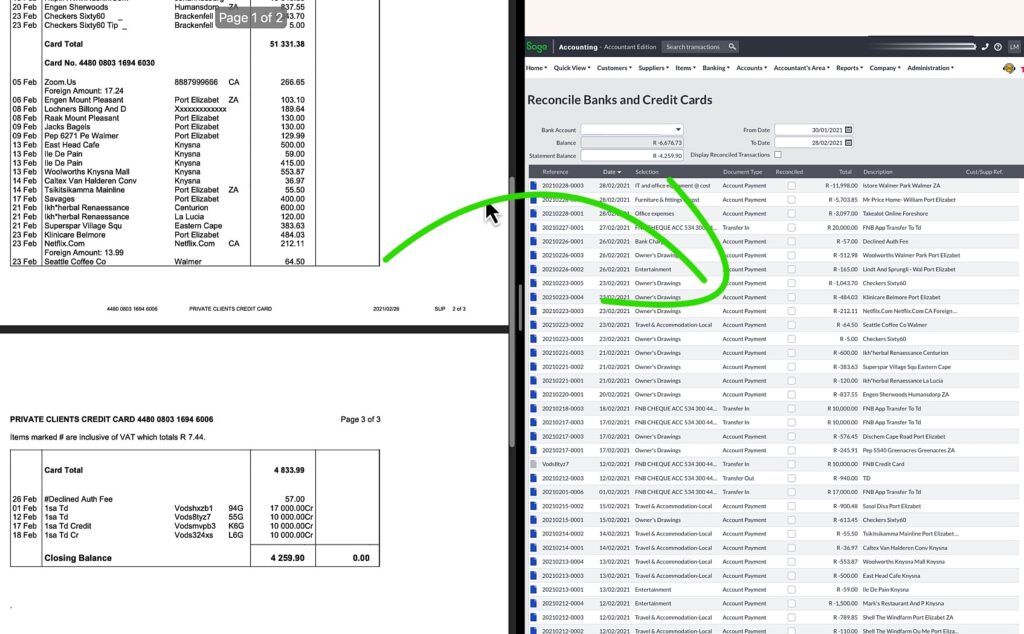

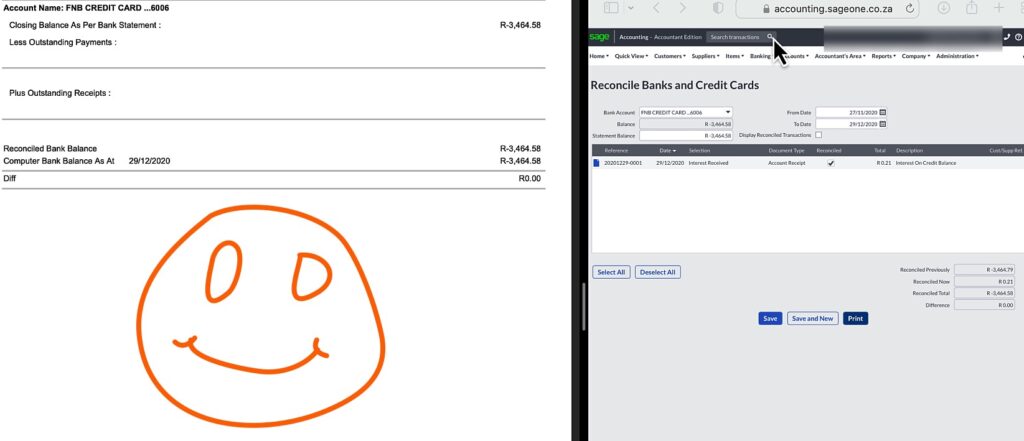

Displayed on the screen are the bank statement on the left hand side and Sage Business Accounting on the right.

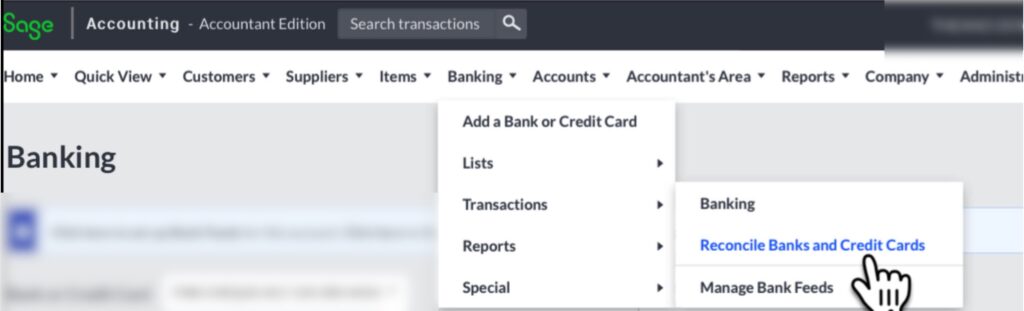

Navigate to Sage Bank Reconciliation.

In Sage Accounting if you are in the cashbook you can navigate to the bank reconciliations from the top navigation menu bar by moving my cursor to:

- Banking

- Transactions and to the right

- Reconcile Banks and credit Cards, click on it.

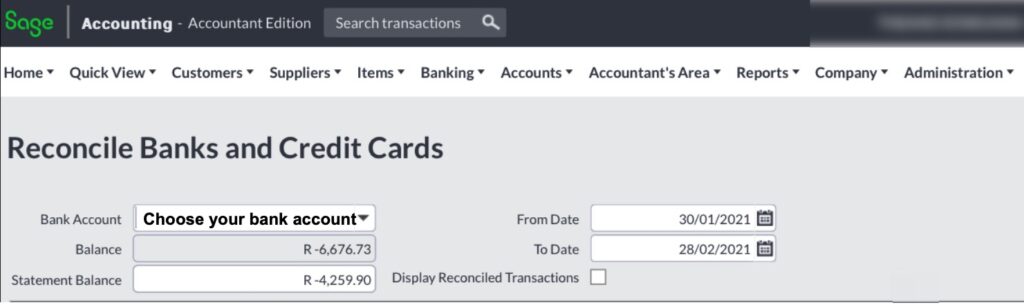

In the bank Account field you select the specific bank account that you want to reconcile.

Fields that needs completion for a bank reconciliation in Sage Banking.

Starting date.

In the From Date field type in the starting date and you will notice this message always coming up when changing any field within the Sage bank reconciliation area stating that “you will lose any unsaved changes. Do you want to continue?”, click on yes.

End date.

Enter the last day of the reconciliation in the To Date field.

Bank statement balance.

Enter the bank statement balance on the date of the bank reconciliation.

All the bank reconciliation fields summarised.

Once this is all the done:

- Selecting the relevant bank account,

- Starting date,

- End date and

- Statement balance

The fun can begin by correlating the amount from the bank statement to the accounting entries in the cash book.

Sort the cashbook by date.

The first step is to sort the bank transactions by date which will make it much easier for you to find the corresponding bank transaction amount on the bank statement.

Use the bank statement as base.

Using the bank statement as a base to track the same transaction in the cash book will give the reconciliation order, preventing you from getting confused and speeding up the process.

Mark the bank statement amount as well as the cash book amount as reconciled by ticking it off on the checkbox under the Reconciled column next to the amount in Sage Accounting. Once the transaction is ticked off it means that the transaction agrees with the bank statement.

Follow the process off selecting an amount from the bank statement and then finding it in the cashbook until all the bank statement transactions have been traced to the cashbook.

An important tip for when performing a bank reconciliation.

I only focus on the amounts of the two bank transactions and don’t pay any attention to other aspects of a transaction during the bank reconciliation process.

I consider the categorization, payee, date, references, taxes and other bank field entries during the bank payment and bank receipt allocation process and NOT when I am performing a bank reconciliation. I will only cross reference these other fields when I have transactions of the same amount and need more information to identify which transaction it is.

By focusing that way, placing each task in its own separate little execution box and doing one thing at a time, helps me to be organised, following a system which will save time and money.

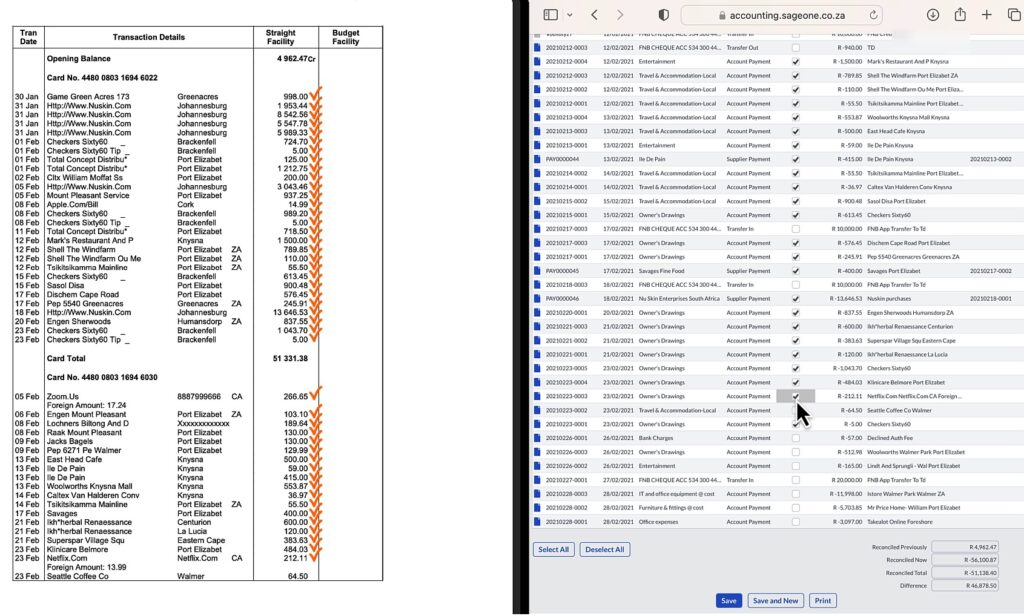

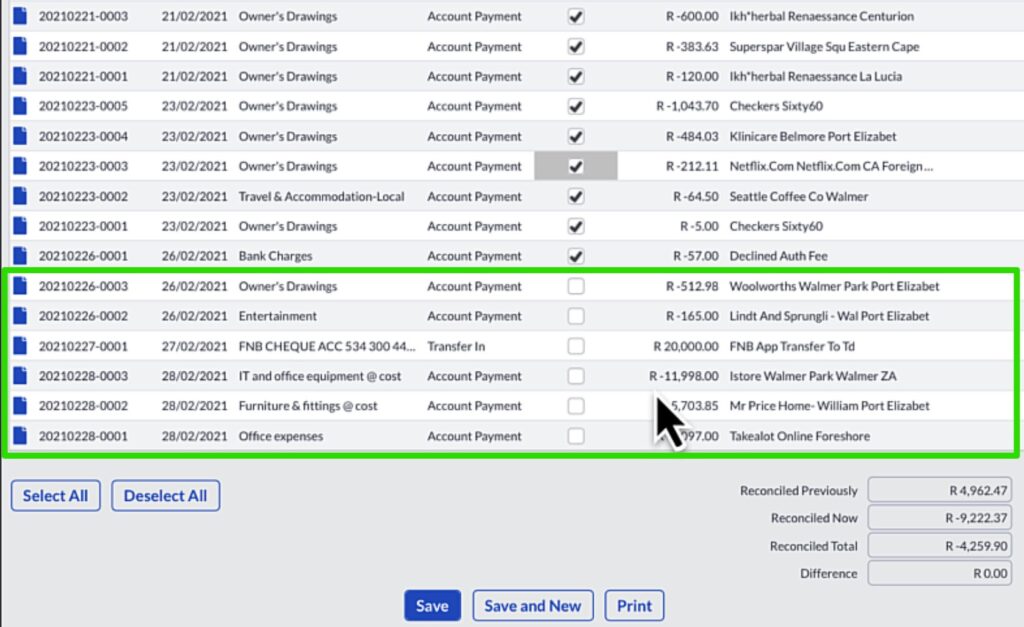

Reconciling items.

Once you have marked off all the transactions from the bank statement but in the cashbook there are transactions recorded in the period that did not yet go through the bank.

These transactions are called reconciling items that will be reflected as outstanding on the bank reconciliation. They will hopefully appear on future bank statements and do not have to be captured again. They will only be removed from the outstanding items list on the bank reconciliation.

The bank reconciliation totals.

At the bottom of the report the totals of the transactions are collated and the reconciled total agrees with the bank statement balance indicating that you have successfully completed the bank reconciliation.

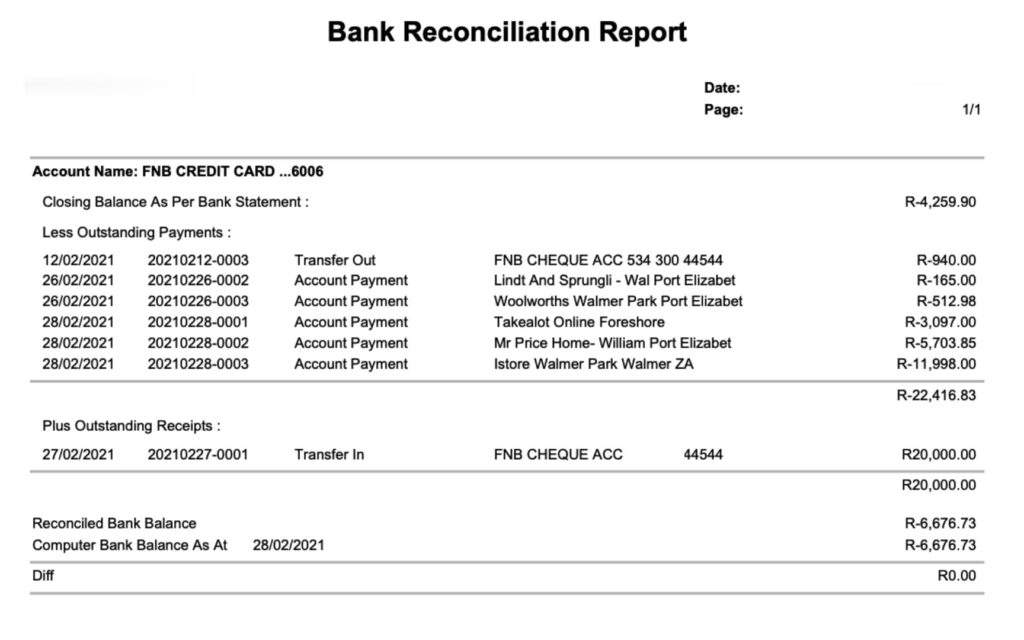

The bank reconciliation report.

The final bank reconciliation report starts with:

- the bank statement balance

- less the outstanding payments and

- adding the outstanding receipts which were the items that were not matched to the bank statement and not ticked off on the cashbook.

- Equals the reconciled balance which must agree with the computer bank balance from your books.

We are happy because there are no differences.

The final step is to save the bank reconciliation.

Lapses of concentration the biggest culprit.

I have seen from experience that If you do not get the bank reconciliation right, it is mostly due to a small lapse of concentration. These mistakes happen often with many people.

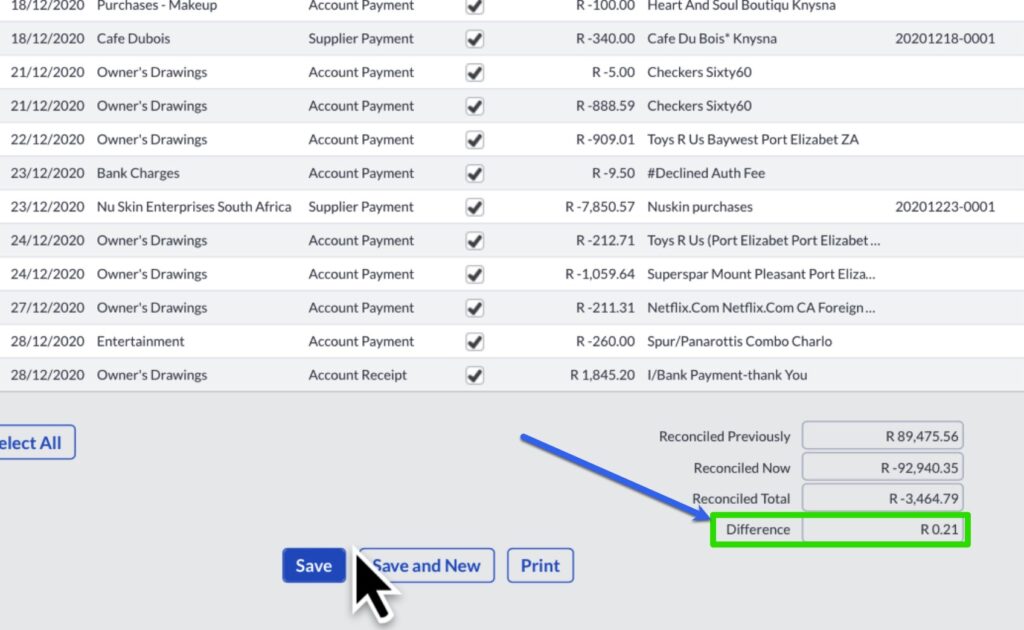

In this real life example my bank reconciliation was out. I am going to reveal how I discovered the problem and then the steps taken to correct it. Maybe as I reveal troubleshooting the errors you will learn something from this.

Everything went well until…

During the bank reconciliation process everything went really well, right up to the end where there was a small difference of 21 cents.

Any difference after marking off all the cashbook transactions comes as a shock. My advice to you is to stay calm because in most cases it is due to a small error in oversight.

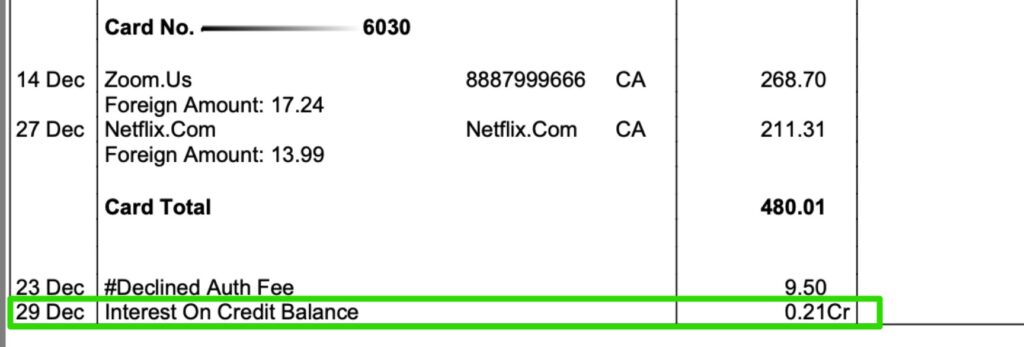

Scroll through the bank statement.

My first step is to scroll quickly through the bank statement, getting an overview looking to find transactions for this amount. Narrow down your search and focus on the periods near the start and end date of the bank reconciliation.

Doing this I found the exact amount on the bank statement a transaction on the 29th of December – Interest on Credit balance for 21 Cents.

I remember that I set the end date of the bank reconciliation at 28 of December 2020. Therefore the 21 cents transaction occurring on the 29th was excluded from my bank reconciliation and the reason for the difference.

Save the work you have done so far.

I am saving the work that I have done this far, because a lot of time and energy went into this up to this point.

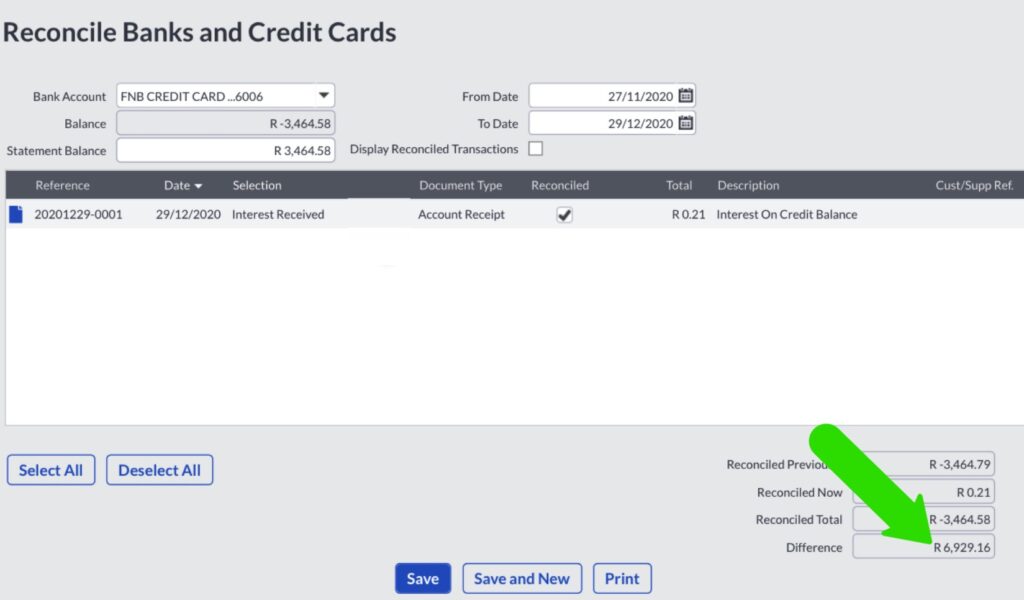

Fixing the end date of the bank reconciliation.

In order to change the beginning date of the reconciliation.

Select the correct bank account and most importantly change the end date of the reconciliation to the 29th of December and also enter the bank statement’s closing balance.

The transaction should be marked as reconciled but…

The transaction should be marked as reconciled on the cash book but there is still a big difference.

Firstly stay calm…

I’ve entered the bank statement balance as a positive amount but it should be a negative balance as the credit card statement from this bank shows money due to the bank as a positive instead of a negative. Any person can make this assumption and it is nothing serious. All that needs to be done is to correct it quickly.

The bank statement report.

Now that I have fixed this, you can see that there is no difference anymore as revealed by bank statement report.

Conclusion.

Well this was my version of a quick and easy bank reconciliation. I have showed you all the details and steps taken along the way.

For me Sage Accounting provides the best experience for bank processing and reconciliations.

If there is still anything that is unclear you can watch the video on YouTube. You will also find other useful information and free training videos on The Fun Accountant’s YouTube channel.