Understanding what a payroll cycle is and why it is important in Sage Business Cloud Accounting is crucial, as it represents the first step in setting up payroll for organisations of all sizes.

I am going to give you the essence of payroll cycles, illustrating their full capabilities and provide an in-depth demonstration of setting up payroll cycles in Sage Business Cloud Payroll.

This exploration includes everything from facilitating diverse payment timeframes—such as weekly, bi-weekly, or monthly cycles—to enabling precise cost tracking and reporting. This is achieved by segmenting cycles by department or branch, thus tailoring your payroll process to meet the specific needs of your organisation if you have more than one branch or department.

Furthermore to see the theory in practice, I invite you to watch my YouTube video where I attempt to answer a common question among small business owners: What is a payroll cycle, and why does it matter in Sage Business Cloud Payroll? This video aims to provide an in-depth understanding and practical demonstration of payroll cycles’ impact and importance.

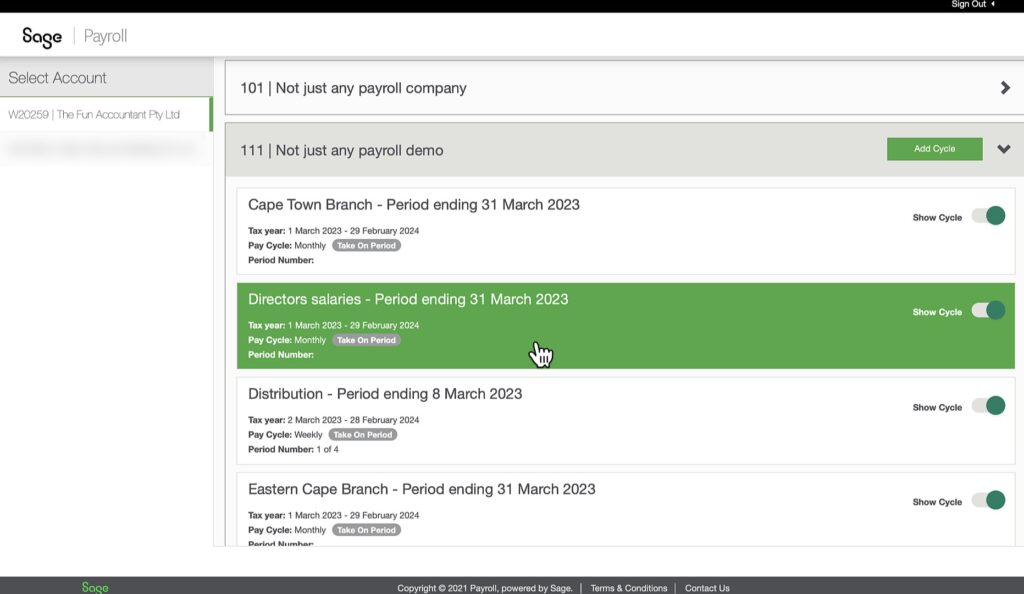

Additionally, for confidentiality purposes, you have the option to create separate exclusive cycles, such as one for Directors’ salaries and restrict access to this cycle to specific designated people.

Stick around if you’re interested in learning more about payroll cycles and why they matter in Sage Business Cloud Payroll.

Setting up a new company in Sage Business Cloud Payroll.

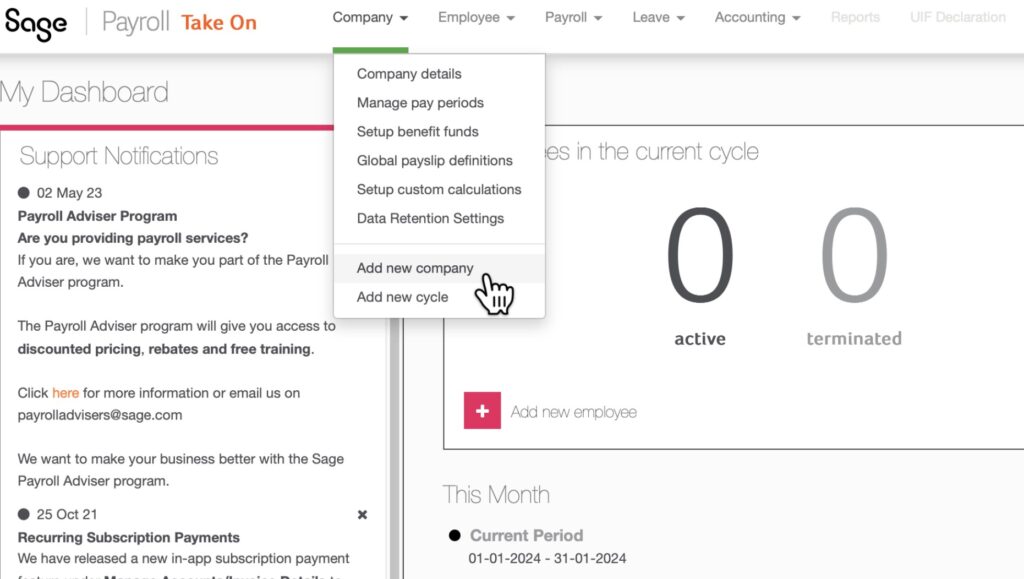

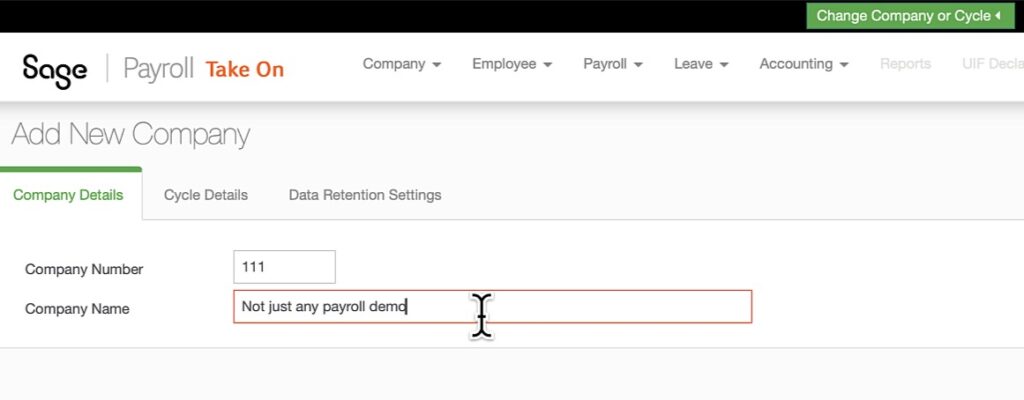

To begin, you’ll need to log in using your email address and password. For the purposes of this demonstration, assuming you already have a company registered for payroll, you’ll need to add a new company. This is done by:

- selecting ‘Company’ from the top navigation bar and

- then navigating to ‘Add new company’.

In the subsequent screen, you’re required to assign a company number. This number can be anything of your choosing and is not set in stone; you have the freedom to change it later. However, it’s important to note that having a company number is mandatory in Sage Payroll.

After assigning the company number, enter your company name. For this demonstration, I’ve chosen “Not Just Any Payroll Demo” as the name.

Then, click ‘Next’ to proceed.

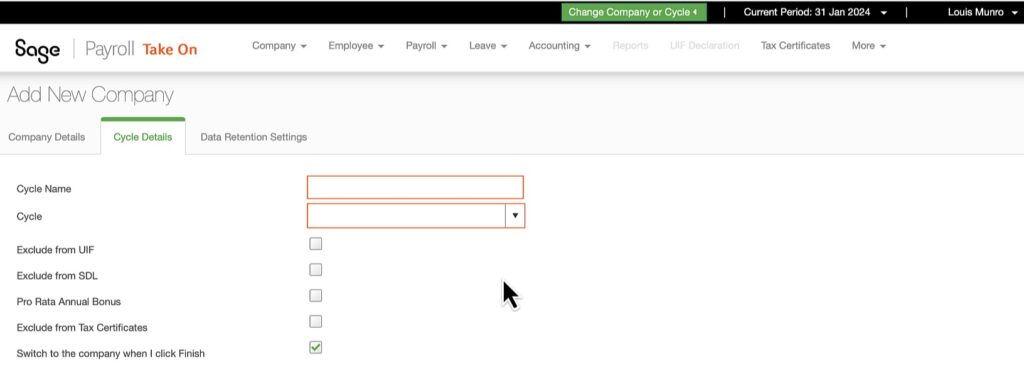

Following this step, you will be directed to the next section, which focuses on “Cycle Details.”

Adding details for the first monthly cycle.

Let’s begin with the most commonly utilized payroll cycle by employers across South Africa: the monthly cycle. This is because the majority of employees receive their pay on a monthly basis.

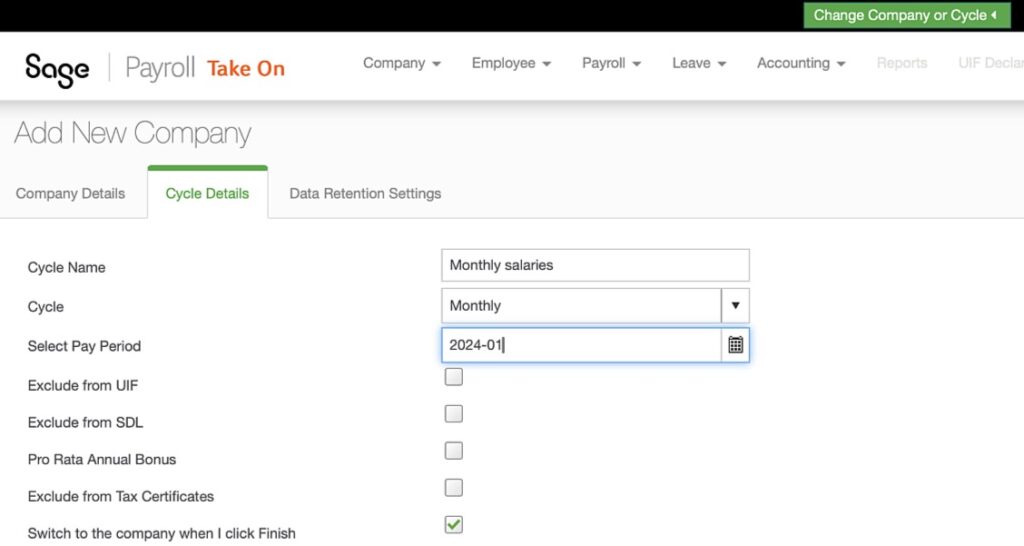

When you reach the “Cycle details field” select the cycle, choose ‘Monthly’.

Next comes an important step in the ‘Select Pay Period’ field. Exercise caution here: upon clicking on the calendar, it will automatically bring you to the current month.

It’s important to notice that you cannot select a future pay period that falls into the next financial year. For instance, March 2024 isn’t available if you are in the February 2023 month.

Be aware that you cannot process any payrolls in the months prior to the period that you have selected.

Most employers will not have exclusions for UIF, SDL and tax if that is the case you can click on next to take you to the Data Retention Setting screen, where you determine for how long Sage must keep your data. For most employers the average length to keep information is five years.

After clicking ‘Finish’, the company cycle is successfully saved, and you are automatically directed to the company details section. However, this article will specifically focus on payroll cycles, so we will not cover completing the company details section.

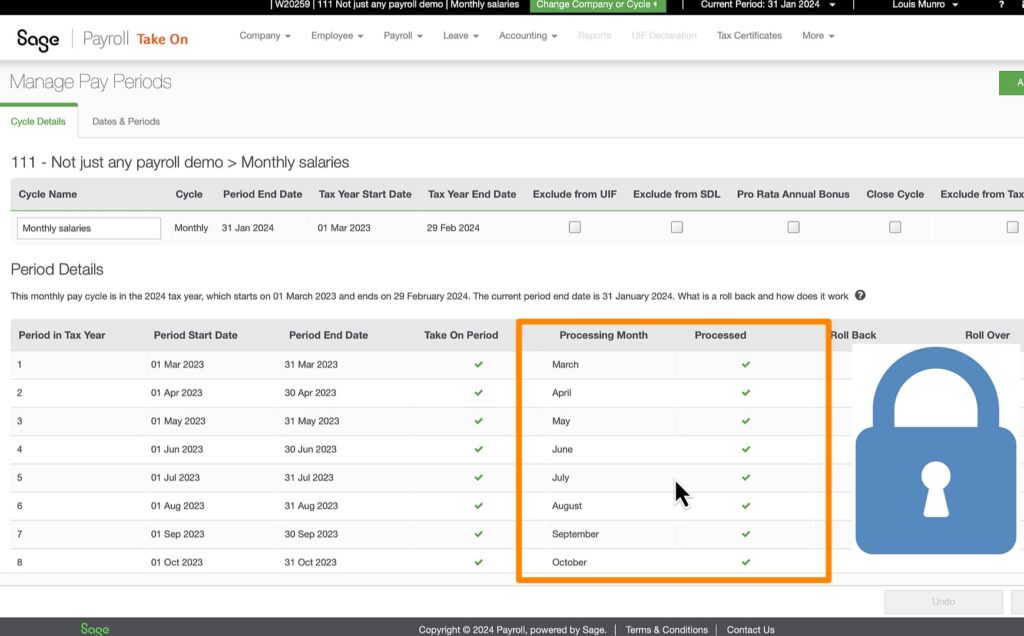

Understanding locked pay periods in the payroll software.

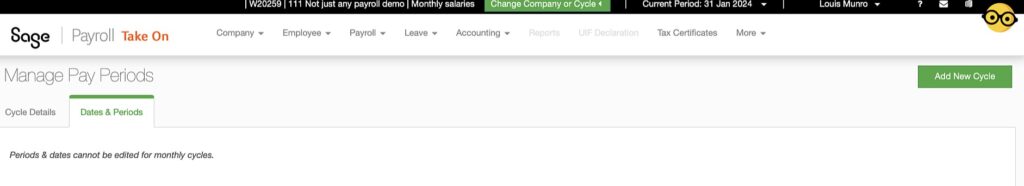

When setting up payroll cycles in Sage Business Cloud Payroll, understanding the concept of locked pay periods and their implications is crucial.

For instance, when setting up your first payroll in Sage Business Cloud Payroll, if you choose January as the starting month, all previous payroll periods leading up to December will be locked and become inaccessible for processing past payroll data. Upon navigating to the ‘Manage Pay Periods’ section under the company settings, you will observe that each month up until December is marked with a processed tick, signifying that those periods are locked.

So, what’s the problem? This restriction prevents you from entering historical payroll data for earlier periods on a month-by-month basis. Such a limitation can pose significant challenges during the migration process from an old payroll system to Sage Business Cloud Payroll.

When you’re catching up on past payroll data by rolling forward each period up to your current month—known as the ‘Take on’ period—with Sage Business Cloud Payroll, you won’t face any charges. Fees apply only for processing going forward. This cost-effective feature facilitates a smooth transition and setup.

This feature allows for a cost-effective transition and setup. Armed with this understanding of pay periods, you’re well-prepared to accurately bring your previous payroll information into Sage Business Cloud Payroll without additional costs. Ready to streamline your payroll process and leverage these benefits?

🌟 Start your journey with Sage Business Cloud Payroll today and simplify your payroll management:

Setting up monthly payroll cycles for different departments.

In scenarios where your company encompasses multiple departments and you require distinct payroll reports for each, Sage Business Cloud Payroll offers a solution by allowing the setup of separate payroll cycles for different departments through the cycle function.

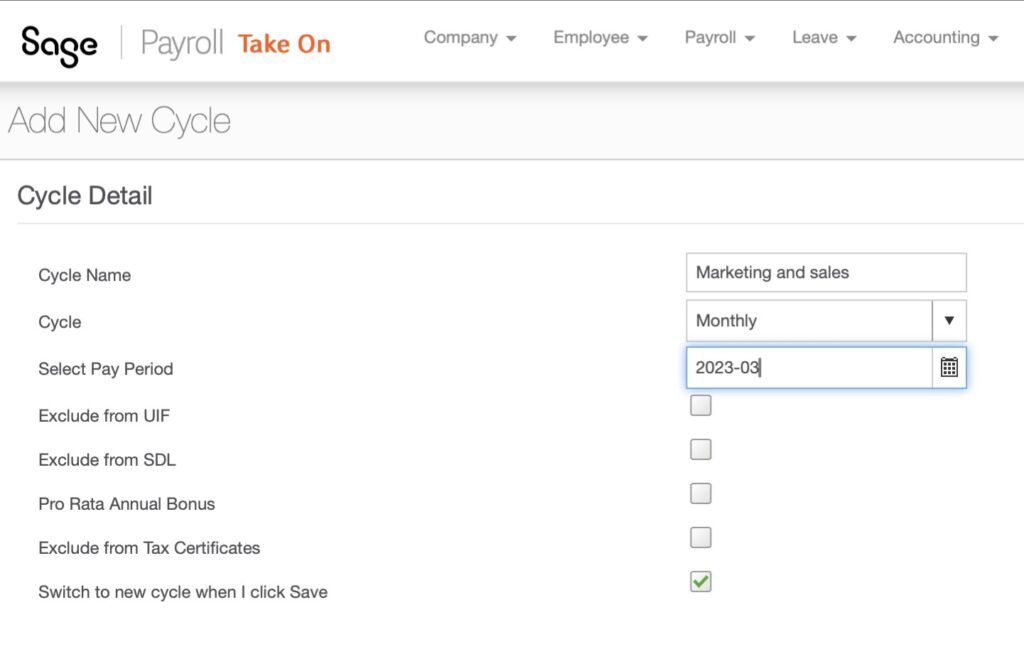

Adding a new cycle to your company is straightforward: simply click on the green “Add new Cycle” button.

Let’s create a cycle specifically for the marketing and sales department, intending to process their payroll on a monthly basis.

To synchronize with the fiscal calendar, I’ll adjust the Pay period date to start at the beginning of the financial year, March 2023. This adjustment is crucial for updating the payroll from March in the ‘Take on’ period as explained earlier.

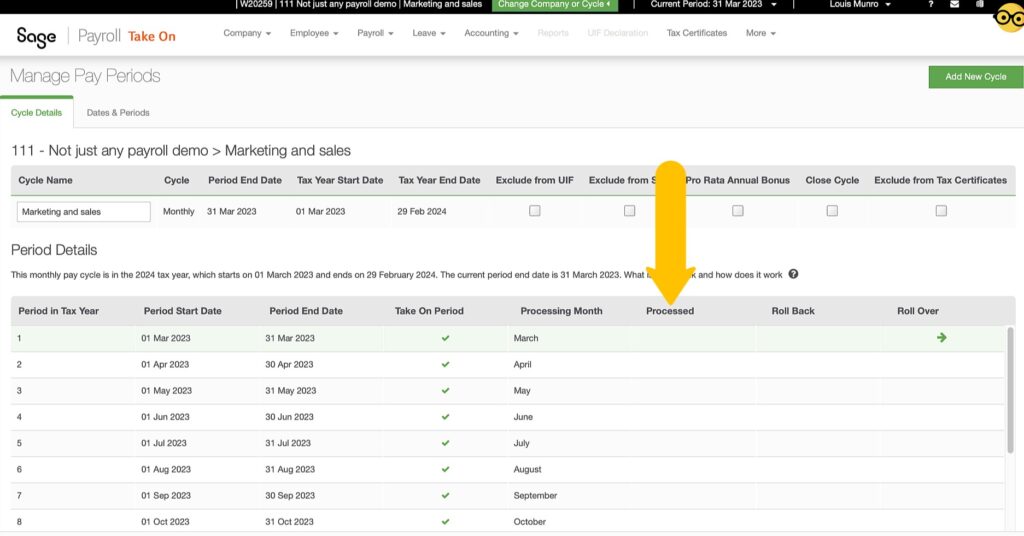

After saving the new cycle, the ‘Manage Pay Periods’ screen will indicate that payroll processing can commence from March 2023—the start of the tax year.

As a result, all months within the year are now open for processing, allowing for a systematic update of your payroll system month by month for that department.

Expanding Sage Payroll’s Flexibility with Biweekly Pay Cycles.

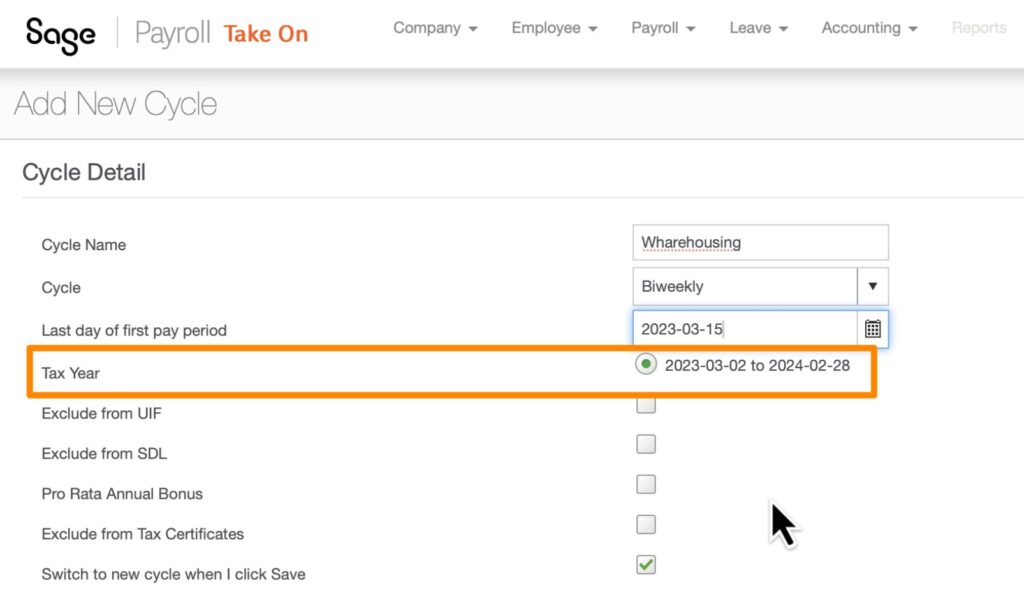

To further demonstrate the versatility of Sage Payroll, let’s consider adding a new payroll cycle for the warehousing department. However, this time, instead of monthly payments, employees in this department will receive their salaries biweekly.

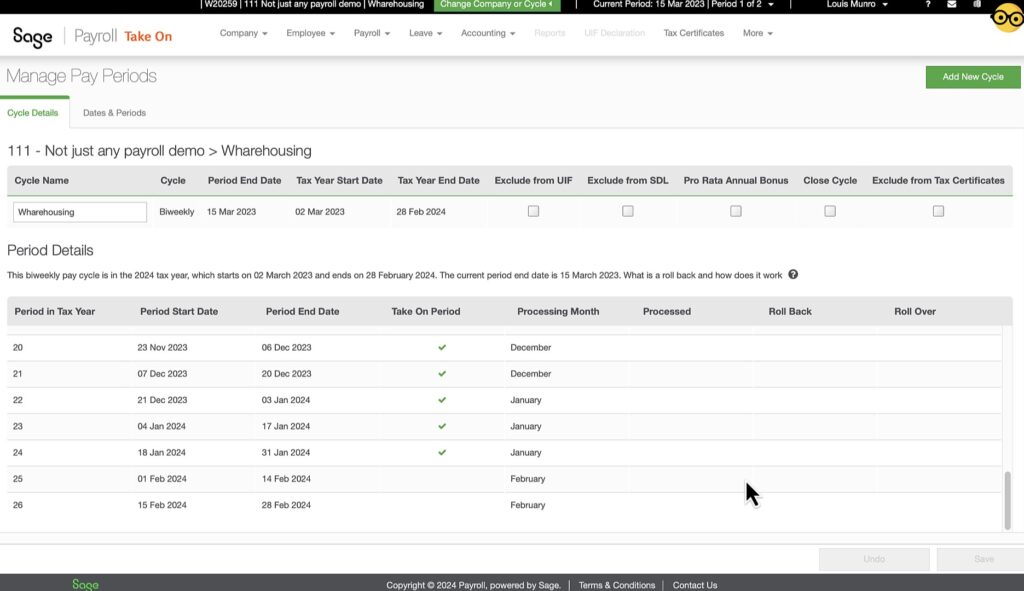

The setup of pay periods is crucial: the cycle begins on the selected start date and concludes every two weeks for salary disbursements. It’s important to note that once a pay date is selected, it becomes permanent for the duration of that cycle’s existence. Thus, choosing your start days with caution is essential, as you’ll commit to those biweekly periods for the entire cycle.

Understanding Tax Year Delineation in Payroll Cycles

A crucial aspect of setting up payroll cycles in Sage Payroll is understanding how the tax year is delineated within each cycle, significantly affecting employees tax certificates. Unlike common expectations, the tax year for a cycle is determined by its start date—it could, for instance, begin on the 2nd of March, marking the cycle’s tax year commencement rather than aligning with the traditional first day of the financial year.

Moreover, the end of a payroll cycle may not coincide with the financial year’s closure. For example, in a biweekly cycle setup, the final, or 26th, cycle of the year could conclude on a day that differs from the last day of February, diverging from the conventional financial year ending. This variance underscores the importance of carefully planning cycle dates to align with your payroll and tax reporting requirements in employee tax documents.

The Permanence of Payroll Cycle Dates.

A critical aspect of setting up payroll cycles, especially for those choosing a biweekly schedule, is the permanence of the cycle dates once selected. This rigidity implies that if a cycle is set to occur every second Friday, for instance, this schedule is fixed for the entirety of the cycle’s existence. Consequently, the selected dates will recur every two weeks as planned, without any possibility for alteration.”

The inflexibility of these dates highlights the necessity of careful consideration and strategic planning before finalizing your payroll cycle setup. Any mistakes or oversights in selecting these dates can lead to long-term scheduling challenges, underscoring the need to choose dates that align well with your organization’s operational needs and payroll management objectives.

Given these considerations, it’s evident why many organizations prefer monthly payroll cycles that conclude on the last day of each month. Monthly payrolls are easier to manage, require less work, and result in cost savings, making monthly cycles a more efficient choice for organizations aiming to optimize their payroll operations.

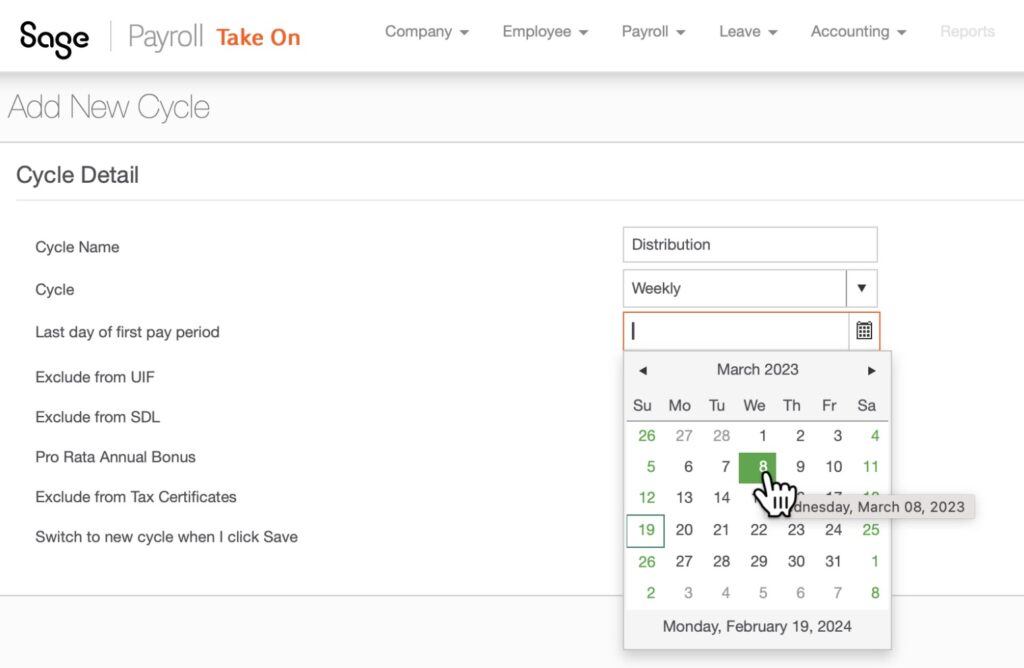

Implementing a Weekly payroll cycle.

In South Africa, many businesses still accommodate weekly payroll cycles. Though it may seem counterproductive due to the economic realities forcing some employees to live paycheck to paycheck, this necessitates employers to offer weekly payrolls. Despite being costly and less efficient—increasing workload fourfold—it’s a practice aligned with the immediate financial needs of the workforce.

In response to this ‘reality,’ I’m introducing a new payroll cycle tailored for weekly wages. This cycle is specifically designed to ensure that employees are paid weekly, matching their anticipated payment schedule.

Weekly cycles operate with a pay period recurring every week. An essential aspect of setting up weekly cycles is selecting the first pay period’s final day. For example, by choosing Wednesday, the 8th of March 2023, as the pay period’s last day, the cycle officially starts on Thursday, the 2nd of March 2024. Such precise scheduling is vital for ensuring the payroll cycle harmonizes with the organization’s operational flow.

Similar to the biweekly setups, once the pay periods for weekly cycles are chosen, they become fixed and cannot be altered. Considering your weekly payroll scheduling is essential to ensure the payroll cycle not only meets the organization’s workflow but also aligns with the expectations of the labor force.

Furthermore, you’re given the flexibility to determine both the start and the end of this cycle’s financial year, which may differ from the official tax year.

Once this crucial decision is made, you can move forward. It’s important to bear in mind, though, that after you finalize your choice by clicking ‘save,’ the dates of the cycle are locked in and cannot be altered.

After the cycle has been created, it’s important to review the pay periods to ensure there are 52 weekly cycles, each consistently ending on the same day of the week.

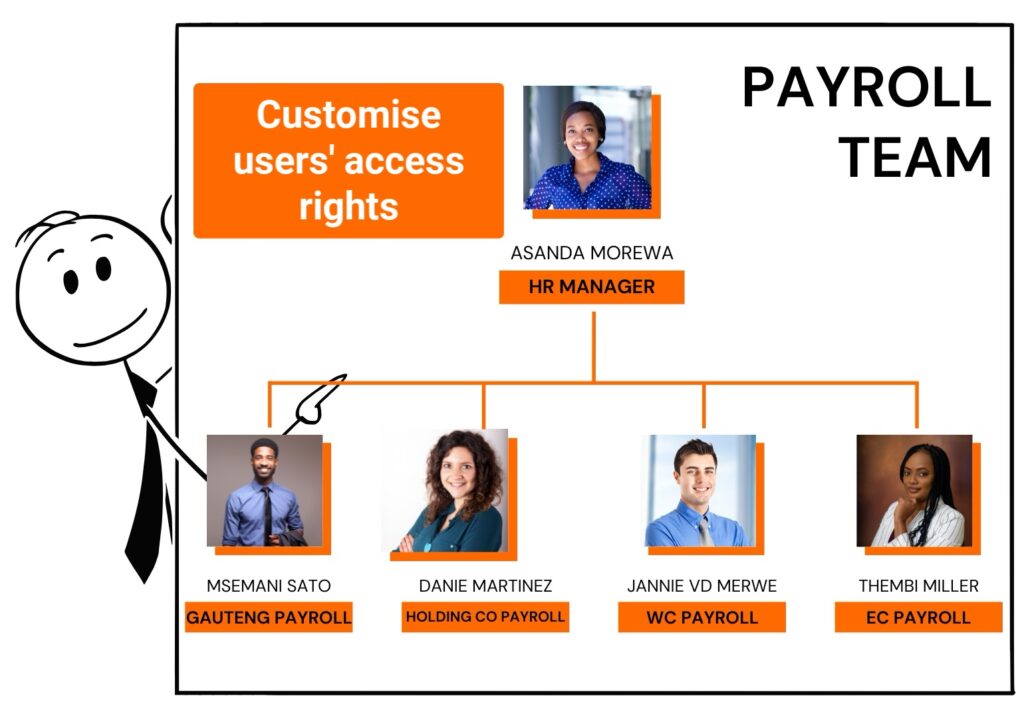

Creating payroll cycles for various branches or business units.

Now, let’s explore additional functionalities. For those companies operating with multiple branches, the payroll system offers a solution that enables each branch to handle and report on its payroll independently.

Sage Business Cloud Payroll offers the capability to manage separate payroll cycles for different branches of your business. Consequently, you can establish individual payroll cycles for each branch, each with separate access, thereby streamlining payroll management across your organization.

You can grant distinct access rights to various individuals within these cycles, thereby enhancing branch-specific reporting, control, and management in large organizations. This feature enables the creation of multiple user profiles without incurring additional costs, allowing you full control over which users have access to specific cycles.

Need to manage payroll for multiple branches and administrators at no extra cost? Discover Sage Business Cloud Payroll. Start with a free trial through the link in the video description.

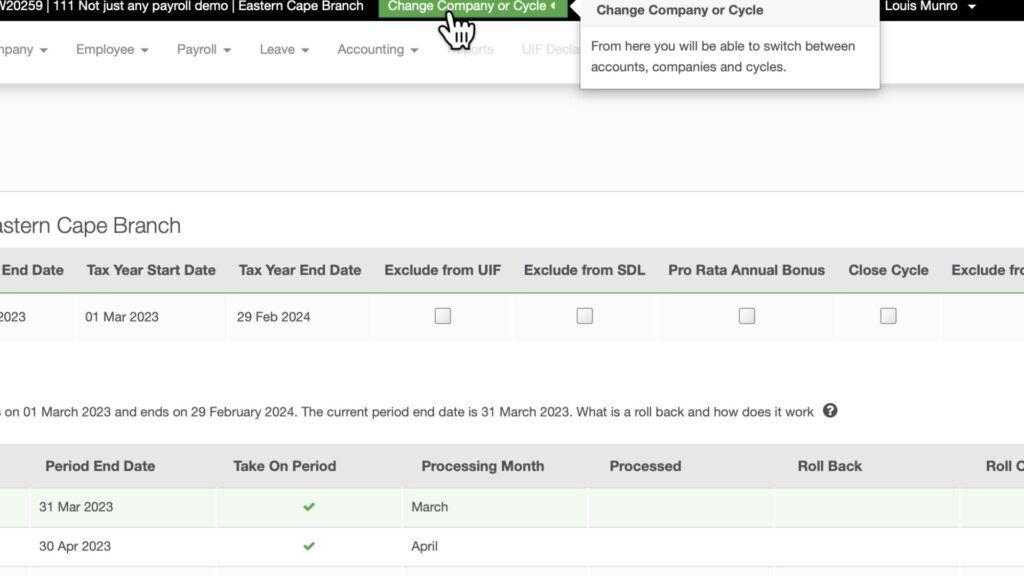

Switching between payroll cycles with ease.

To switch between cycles within your company, simply use the green button labeled ‘Change Company or Cycle’ located at the top. This functionality enables seamless navigation between different cycles, facilitating efficient payroll management across various departments or branches.

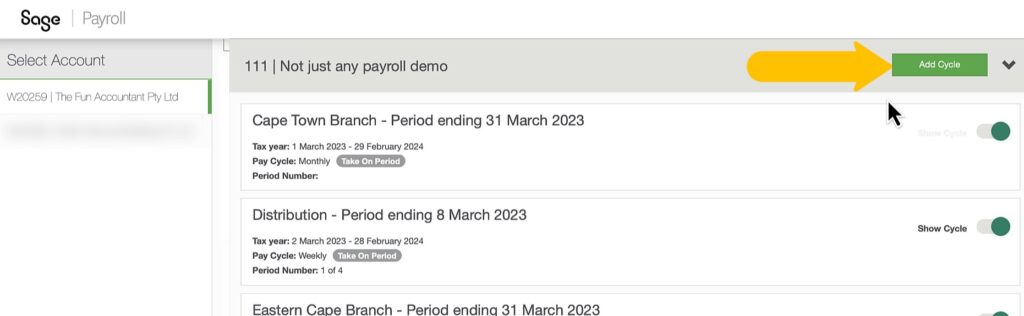

Adding a new payroll cycle with restricted access from the payroll cycle screen.

From the cycle screen, adding a new cycle within Sage Payroll is straightforward. Next to your company name, you’ll find the ‘Add Cycle’ button. Simply click on it, and you’ll be taken to the familiar screen where we’ve been setting up cycles throughout.

Beyond the ease of adding cycles, Sage Payroll offers robust options for managing access to these cycles, an essential feature for maintaining confidentiality within your organization.

This functionality allows you to restrict access to certain cycles, ensuring that sensitive information, such as director’s salaries or specific departmental financials, remains secure and visible only to authorized personnel.

Whether you’re adding a cycle for a new branch or creating one for a specific group of employees, the ability to control access rights plays a critical role in safeguarding your payroll data’s integrity and confidentiality.

Recap of payroll cycles in Sage Business Cloud Payroll.

Today, we’ve explored the invaluable feature of setting up payroll cycles in Sage Business Cloud Payroll, emphasizing that it’s the first step in establishing a payroll for an organization. We’ve covered cycles in detail, from different pay period timeframes to seamlessly managing multiple branches.

Sage Business Cloud Payroll offers a comprehensive solution tailored to meet the diverse needs of organisations, ensuring smooth and efficient payroll operations.

Head to the Sage Business Cloud Payroll pricing and features page via the link above for a deeper understanding of its value proposition.