For most entrepreneurs, their bank account is the most important aspect to manage. In many respects, the bank balance is the biggest indicator or barometer of business success.

Why is it important to check your banking online?

Valuations of businesses and the measurement of wealth is a science of its own. It requires the consideration of assets tangible and intangible, liabilities, profits, and risk. When we think about wealth whether it is our own or someone else’s, we think about how much money is in the bank account. Our measurements of wealth whether a true indicator or not are based on our bank balance. With our bank balances comes a lot of emotions, positive and negative emotions. Our bank balances can determine our state of being.

All transactions that happen in business or life flows through the bank account and no business can escape this. Maybe the saying should not have only been “death and taxes” but “bank, death and taxes”.

Can I check my bank account online without accessing it?

With Cloud Accounting software you are able to check your bank account online without having to access your bank account. This is done by automatic bank feeds. The benefit of automatic bank feeds is that you only have to set up your bank account information once in your accounting software. From your Cloud Accounting, your bank account transactions can automatically flow to your business’ books. This enables you to have instant up-to-date information on your bank account from a single source, your cloud accounting.

The capturing of the Bank or in accounting terms the Cashbook has always been central to the recording transactions in order to measure business flow.

We’ve come a long way in the evolution of business economics. From copy and writing the bank transactions in physical books to automatically bank feeds where bank transactions are recorded and categorised for your business as and when it happens with very little or no human involvement.

How reliable are bank feeds?

Irrespective of the advancement made with bank feeds with great assistance by systems like Yodlee, bank feeds are not yet always stable and consistent. I have found lags and errors with uploading of bank transactions through bank feeds. These errors resulted in the duplication or omission of transactions. It takes much longer to search for errors and fix it than to simply do it correctly the first time. Therefore I have avoided using automatic bank feeds that are an integral part of Sage Cloud Accounting and other cloud accounting packages like Xero and QuickBooks.

Until banks and SAAS suppliers can find a permanent workable solution for bank feeds we have to use a solution that is better, cheaper and more cost-effective than manually entering of bank transactions. This function of manual capturing is called data capturing and with the available technology, data capturing is a waste of resources and money. Data capturing is highly labour intensive and expensive. It is marked by errors and the potential of creating and concealing fraudulent activities.

If bank feeds are not a 100% workable solution yet, what is?

The workable solution is to import your bank account transactions from your internet bank profile into your accounting software. The import of bank transactions is after automated bank feeds the most time saving and accurate way of getting your bank transactions into your accounting software.

What happens during a bank import to your accounting books?

Bank imports is a two-step process.

- Firstly, a data range of transactions is exported from your internet banking and downloaded to your preferred storage place.

- Secondly, the exported download file is extracted and uploaded to your accounting.

An import of bank transactions automatically completes all the necessary fields required for your accounting for a specified date range from your bank statement.

These fields extracted from the bank statement are the following:

- Transaction date

- Payee

- Description that appeared

- Reference is given by Cloud Accounting software

- The amount under the “spent” or “received” columns

It is interesting to note that bank imports have been available for a long time and is still available for desktop accounting software as well as Cloud Accounting software for small and large businesses.

The major banks provide various options whereby bank transactions can be downloaded for further reworking. The download formats differ from bank to bank but most banks cater to the popular download file formats.

Which popular download formats are available?

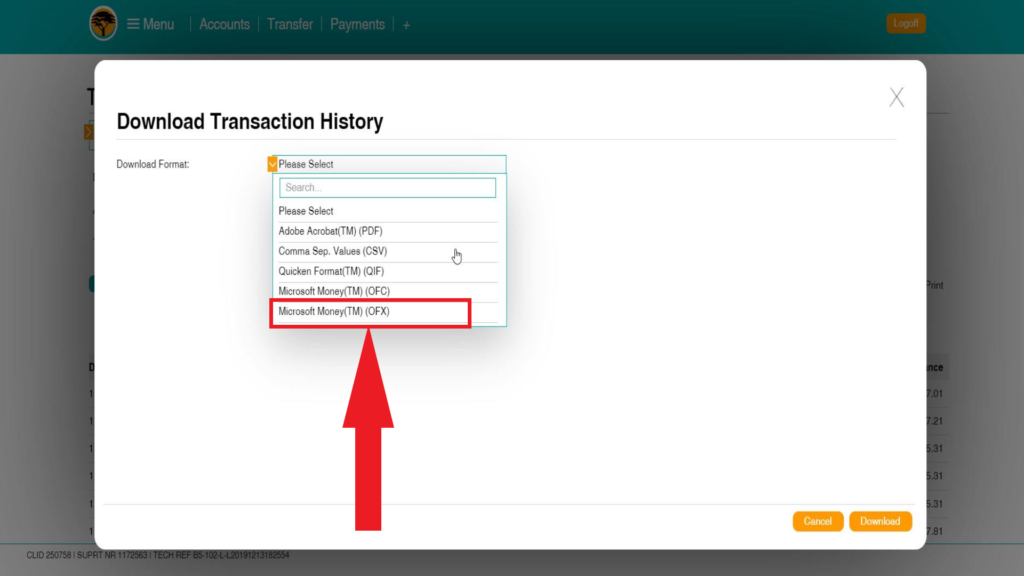

- Adobe Acrobat (TM) – PDF

- Comma Sep. Values – CSV

- Quicken Format (TM) – QIF

- Microsoft Money (TM) – OFC

- Microsoft Money (TM) – OFX

Which bank file download format is the best to use with Sage Cloud Accounting and why?

In my opinion, the best download format to use is Microsoft money known with the abbreviation of OFX. After an OFX download has been performed and you are at the stage of importing the OFX file, no further manipulation of the data is required. The fact that I have to delete and reorder certain columns in a CSV file before I can upload it into Sage Business Cloud Accounting removes some of the value of importing. If this manipulation of data is not done correctly you can end up with errors in your Cloud Accounting which is time-consuming to find and correct. It defeats the objective of the importation of your bank. An OFX import circumvents the need for data manipulation and is a simple, effective way to do a bank import. I have not experienced any errors in OFX import.

What are the steps to do an OFX bank export?

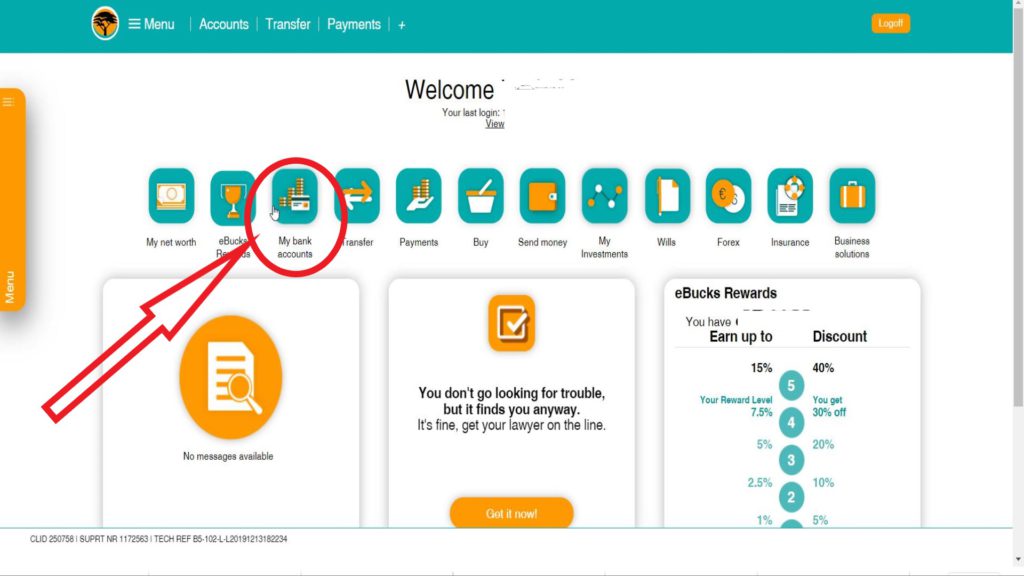

I am using First National Bank which is a major bank in South Africa as an example of how to perform this process.

- Login to your banking profile and select the bank account you want to export

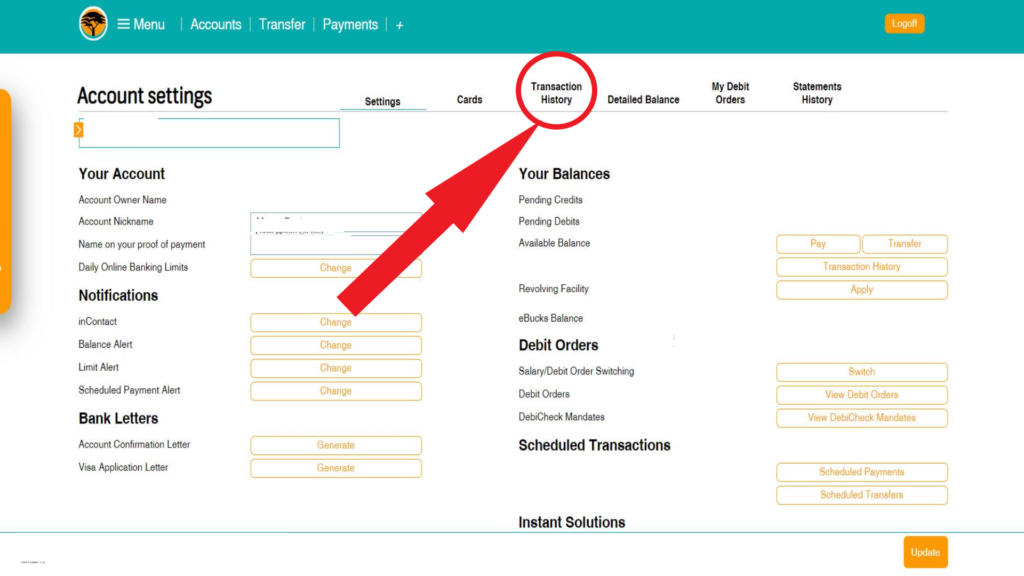

- Go to your transactions history.

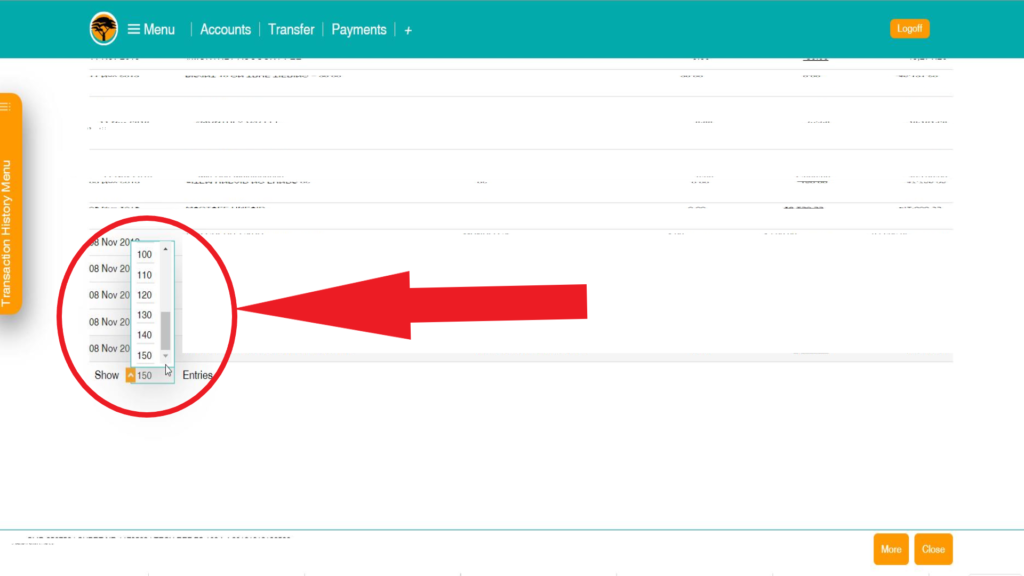

- Select the date range quantity limit of transactions you would like to export. I suggest that you select the maximum.

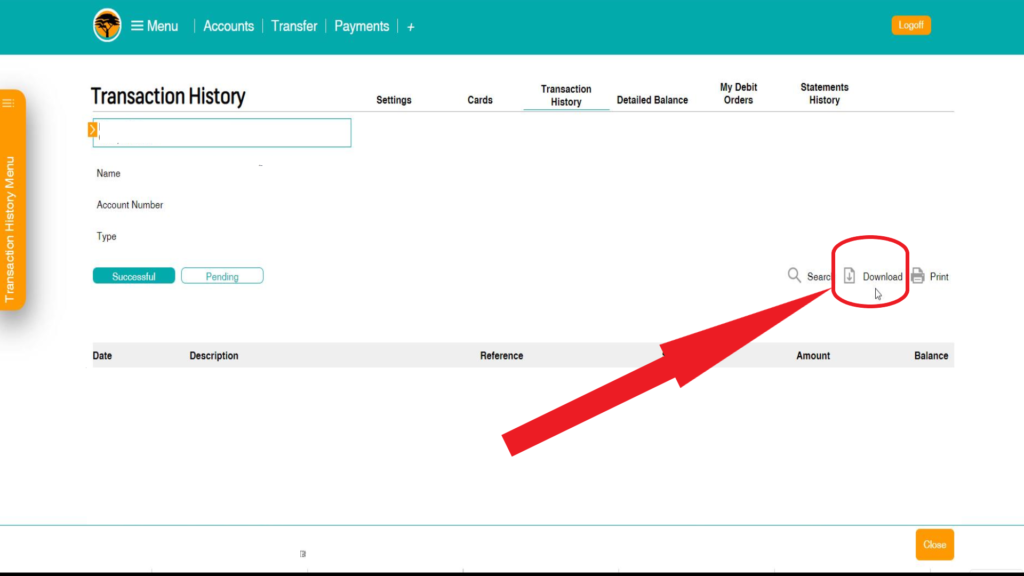

- Click on download

- Select the OFX download option.

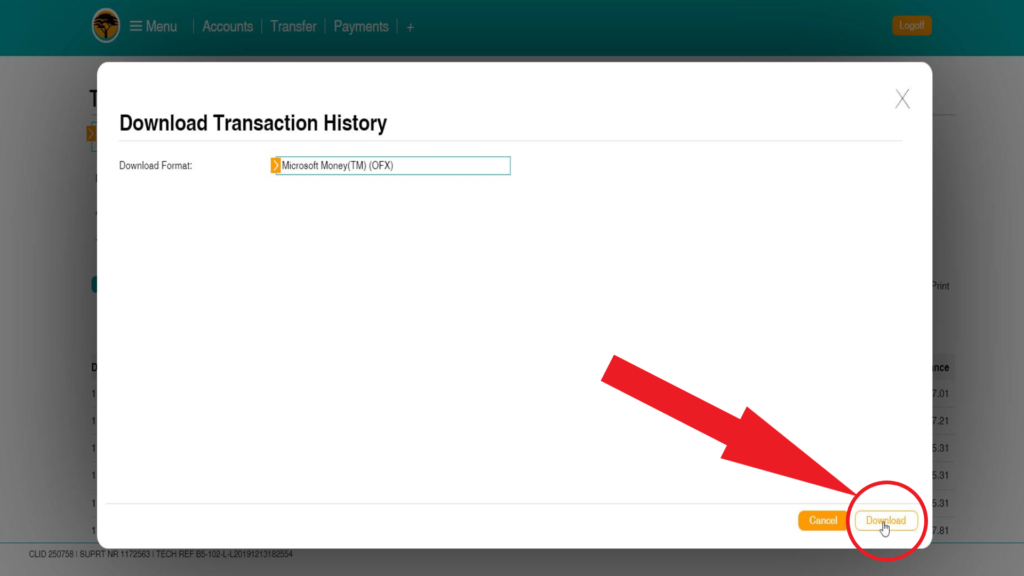

- Click on download.

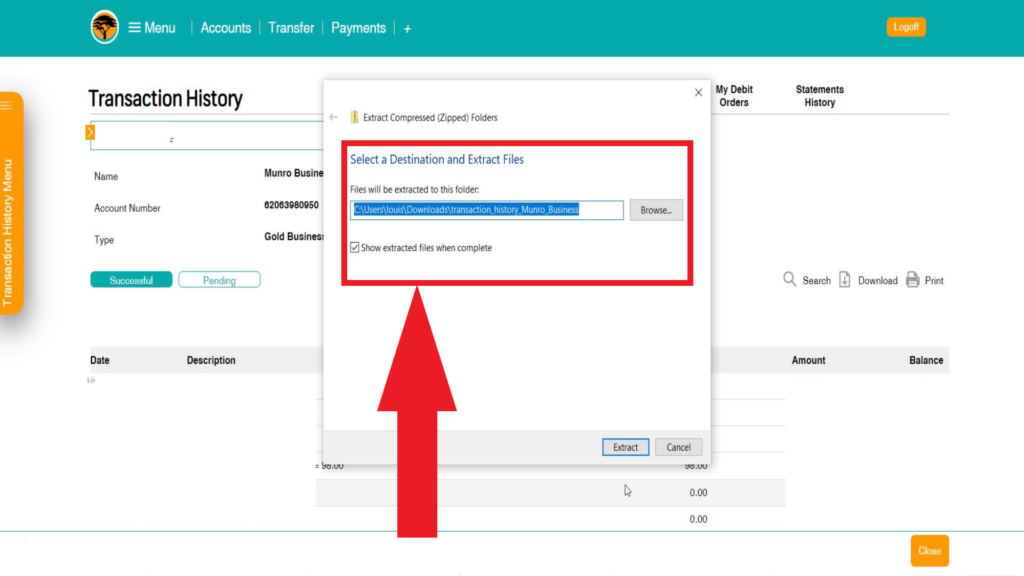

- Decide where to temporarily keep the download file by choosing the download path and extract the zipped file.

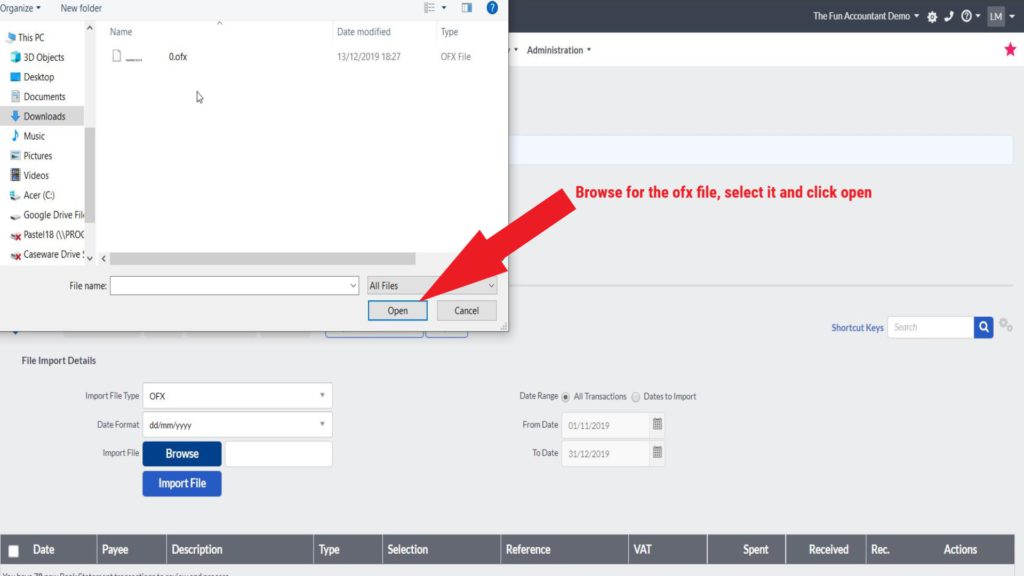

Certain banks compress the download file to reduce its size. This file needs to be extracted before it can be imported into your Cloud Accounting. If you are unsure about how to import this file into your accounting, you can have it available in this format to send it to your bookkeeper.

What are the steps to perform an OFX bank import to Sage Business Cloud Accounting?

-

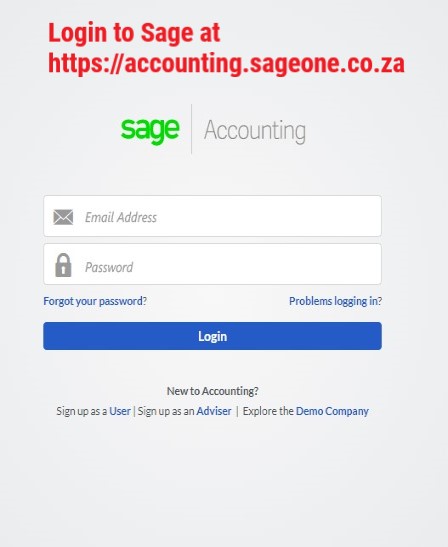

Login to Sage Business Cloud Accounting.

-

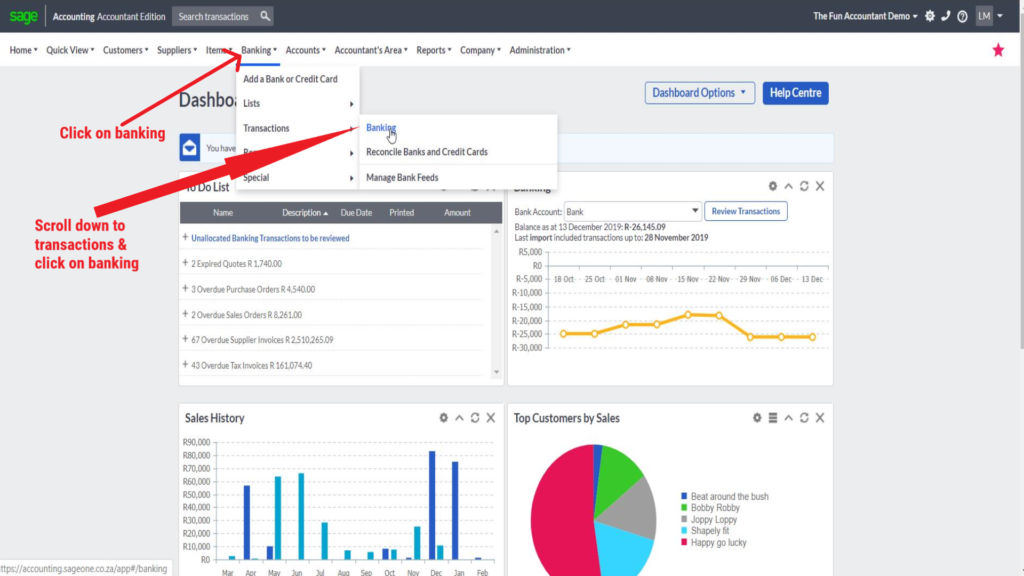

Select “banking” from the top navigation menu.

-

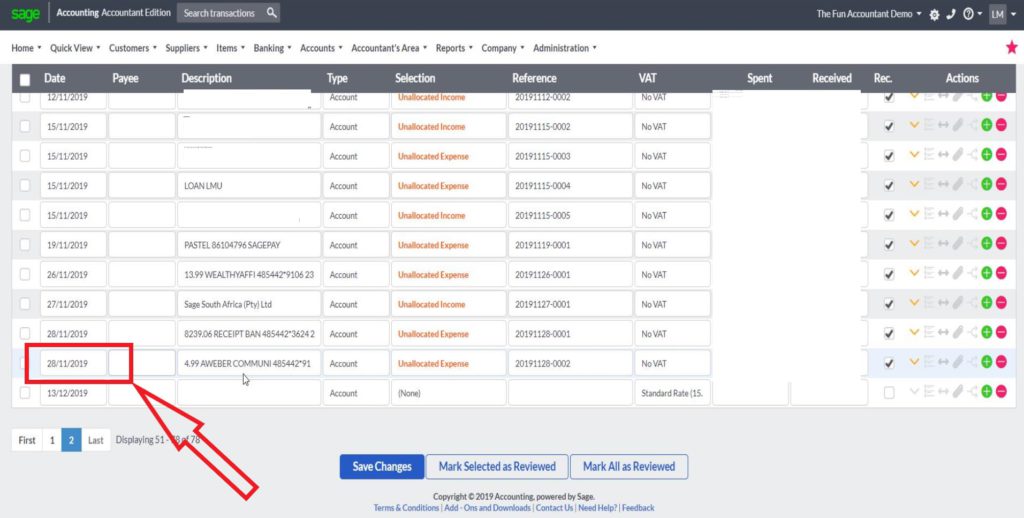

Select reviewed transactions and make a note of the last date that transactions were previously processed.

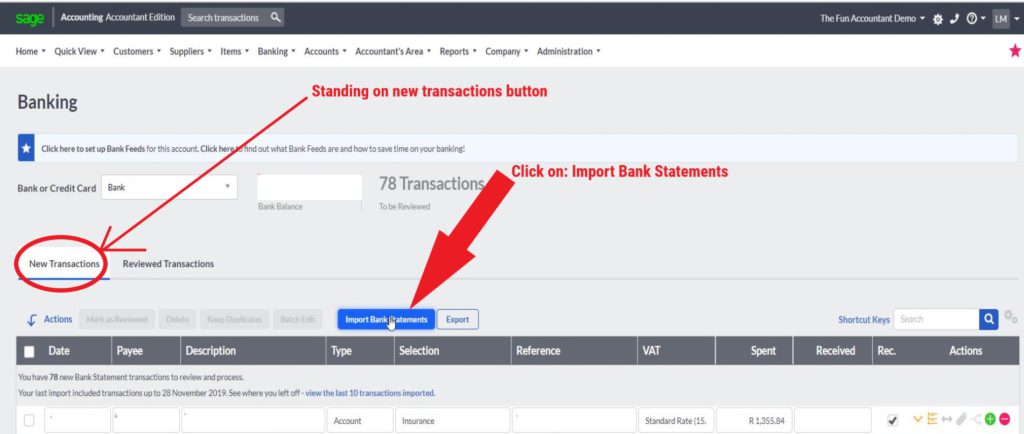

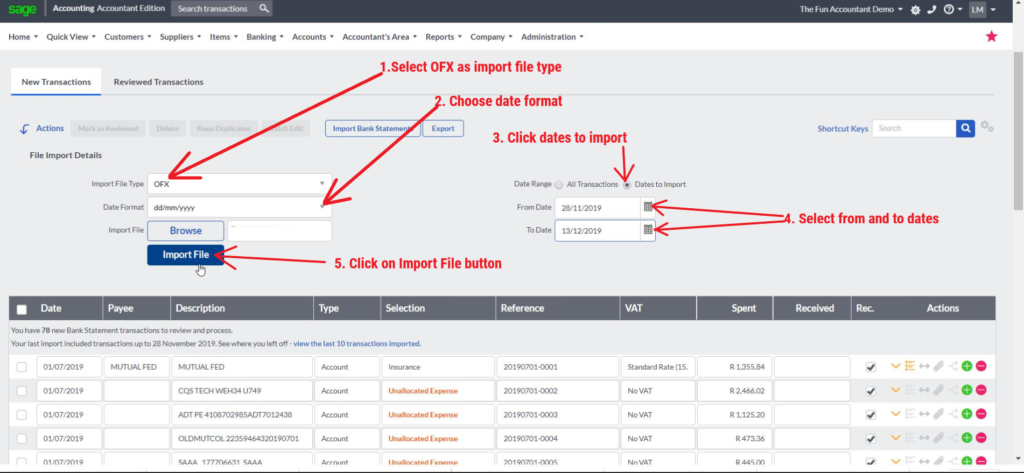

- Select new transactions and click on Import Bank Statement.

- Choose the import download type as OFX. Then browse for the OFX file, select it and click on open.

- Select the Import File Type, Date Format, Import start and end dates and then click on import file.

-

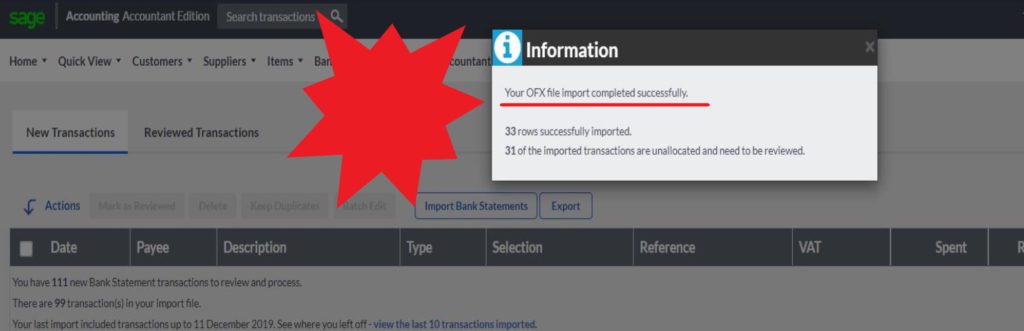

Import completed

What happens after the bank import?

The bank transactions are now in the system and can be categorised. Receipts can be recorded as an income (general ledger account) or as a customer receipt. Payments can be categorised to an expense (general ledger account) or as a supplier payment.

Depending on the Cloud Accounting software that you use, further actions can be performed on a particular transaction line for example

- Creating rules for future automation of future allocating transactions;

- Split a transaction for more than one allocation;

- Assigning transaction to a project;

- Tracking of transaction or further analysis codes;

- Expanding the transaction description;

- Adding files or supporting documents to a transaction;

- Choose Taxes codes depending on your geographic location and regulations.

A person is actually not required to do any more typing once you have done an import of your bank. You only have to make certain selections. It’s at this point where errors are eliminated and where time and money are saved.

Final thoughts

In this article, I reveal that you can check your bank account online from your Sage Business Cloud Accounting when you are using “bank feeds”

In the case where bank feeds are not working well, I show the best way to export bank transactions in the OFX format. These bank transactions can be imported directly into Sage Cloud Accounting and I show how to import OFX banking file.