In this blog post, I will be sharing how to add an account in Sage Cloud Accounting without exiting the banking screen.

If you are using Sage Cloud Accounting and are allocating transactions the chances are that you would have to add a new account category to your list of accounts. It can be a very challenging and time-consuming process to exit your transaction screen and add an account category to your list of accounts.

Sage has come up with a few solutions to help you deal with this. I want to show you a quick method of adding an account in Sage Cloud Accounting without leaving the current transaction screen. This can help a Sage user to save time and be more productive.

What is an Account Category

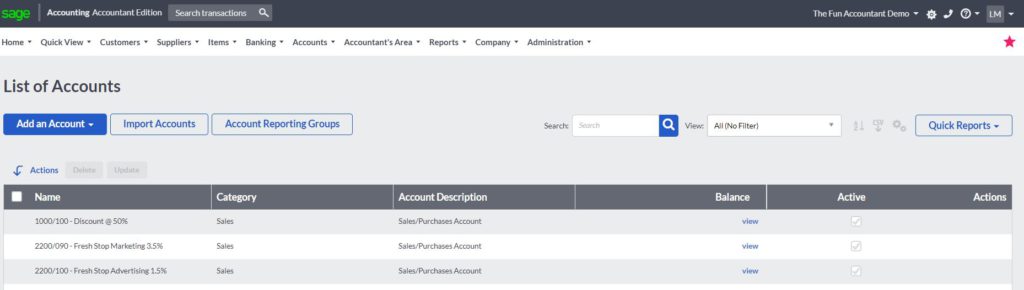

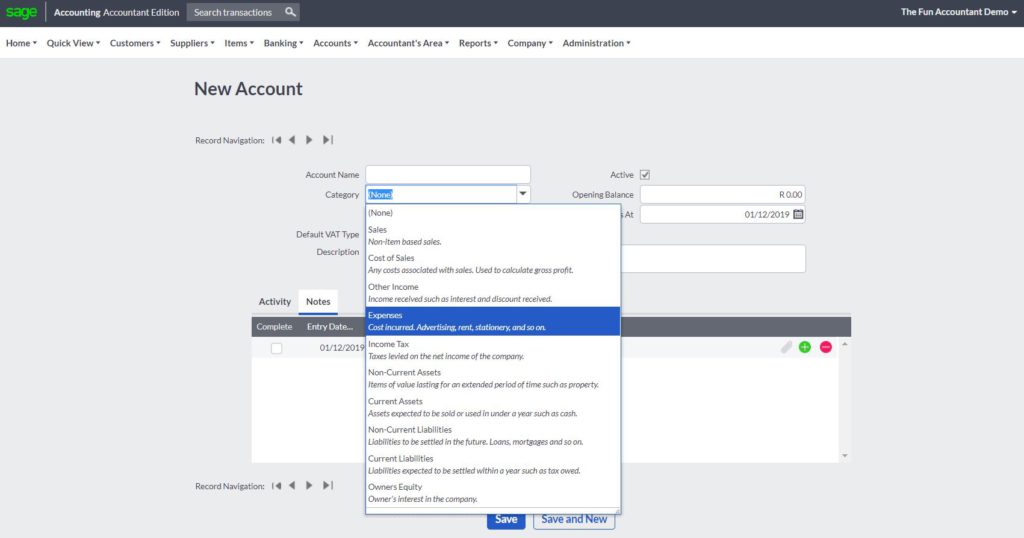

Sage has created 10 account categories to which an account can be mapped or linked to. The different accounts are grouped together under an account category. This grouping is important when I need to see the results of my business when drawing reports, for example, a Profit and Loss report.

The 10 Sage Cloud Accounting Categories

- Sales – The account that I created should form part of my sales income. I can have more than one account linked to sales depending on my business’ income streams. For example payroll work, bookkeeping work, tax work and consulting work.

- Cost of sales – The cost associated with generating sales. It can be direct expenses and a portion of indirect expenses required to generate an income.

- Other income – This is income generated by my business which is not directly linked to my core business activity. For example, renting a portion of the building that I don’t need to a third party. These are positives and add additional income to my business.

- Expenses – All businesses have other expenses that are needed but these are not directly related to generating sales. It is also referred to as overhead expenses or indirect expenses. Examples of such expenses are advertising, telephone, office space rent, bank charges, and accounting fees.

- Income Tax – This category would differ from country to country. This is the tax expense that is being levied by the government on the net profit of the business. This expense is normally determined after the year-end. This expense category should not be confused with Sales Tax or Value Added Tax depending on your country’s specific rules. Please ask assistance from your Accountant if you are unsure of how this expense must be dealt with.

- Non-current assets – Sage defines it as “Items of value lasting for an extended period of time such as property. It can also be items bought that create an income over a period of more than 1 year, such as machinery for which an account will be opened separately and linked to Non-current assets.

- Current assets – These are accounts from which you expect to get an income from within a period of 1 year such as stock owned, customer outstanding accounts. It also refers to assets that add to the value of the business and that can quickly be converted for the business, for example, a positive bank balance and a short term deposit account.

- Non-Current Liabilities – Accounts that are linked to this category refers to accounts where there is an outflow of your funds over a long term (more than 1 year) such as a mortgage bond, long term leases over vehicles or machinery.

- Current liabilities – These are accounts associated with an outflow of your funds within the next 12 months. It is short term amounts owed like creditors, a bank overdraft and tax payable. Liabilities reduce the value of your business.

- Owners Equity – The value of the business at any specific point of time is expressed as owner’s equity. Likely accounts linked to owner’s equity will be share capital and accumulated profits. The total assets less the total liabilities will agree to this amount.

Adding a new account without leaving the banking screen.

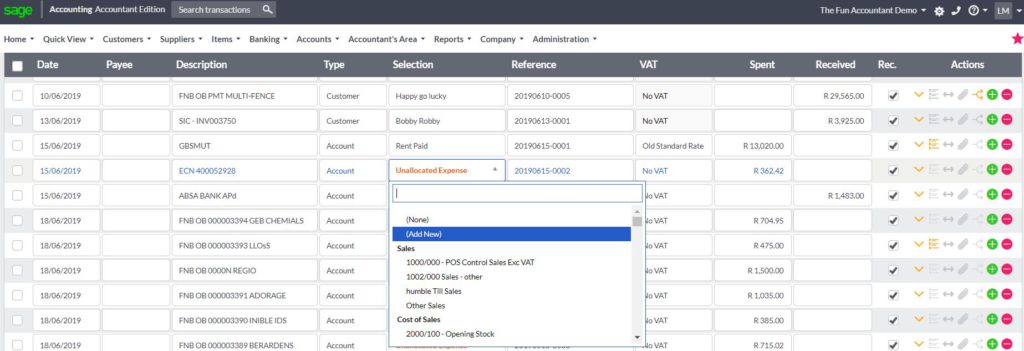

I am processing a transaction and found when categorising the expense that I don’t have this particular expense. I don’t have to leave the screen, all I have to do is go to the account lists and add a new account to complete the processing.

I can go directly to the top of my expense drop-down list. Select add new. Then I can create a new account by giving it a description and select the category to which the account belongs as described above. This account will automatically be selected to complete this transaction.

Want to see how I add an account in Sage Cloud Accounting watch this video on how to add an account in Sage Cloud Accounting

There are many time-saving actions you can take within Sage Cloud Accounting. I will be sharing many more tips.

If you have any tips to save time in your business, whether it is accounting related or not, please feel free to share it in the comment section.