Cloud Accounting is synonymous with the fourth industrial revolution.

Cloud Accounting revolutionised the bookkeeping function for businesses and accountants. 25% of businesses already use cloud solutions. Most recent research data reveals that 60% to 70% of businesses will consider cloud accounting in the next two years. According to Intuit 78% of small businesses will shift to the cloud by 2020.

In an article written by The Fun Accountant and published by Sage: The Fun Accountant proposes the reason why this major shift is happening, is because Cloud Accounting makes business sense.

Read the full article here ====>>> https://www.sageone.co.za/the-fun-accountant/

We will take a closer look at exactly what is Cloud Accounting and how can accountants and business owners equip themselves to make the right decision when jumping into the cloud.

What is Cloud Accounting?

Intuit Quickbooks defines Cloud Accounting:

“Cloud Accounting is the use of accounting software where both the software and the data is stored online”

Webopedia defines Cloud Accounting:

“Cloud computing accounting software is accounting software that is hosted on remote servers. It provides accounting capabilities to businesses in a fashion similar to the SaaS (Software as a Service) business model. Data is sent into “the cloud,” where it is processed and returned to the user. All application functions are performed off-site, not on the user’s desktop.”

Cloud Accounting provides the user access to the processing of his data on a public or semi-public space where the data is transmitted and shared through the network cloud.

How is Cloud Accounting provided?

Accounts are stored on a server that belongs to the service provider or cloud services subsidiary. The servers are accessed via the internet through the service provider’s online interface.

There are BIG roleplayers in the industry that provides the Cloud Accounting solutions to their clients through their secure platform and hosting.

The following are the most well-known service providers of Cloud Accounting:

- Sage Business Cloud Accounting

- Xero

- Quickbooks Online

- Freshbooks

- Zoho Books

- Accounting Seed

- SlickAccount

- Tipalti

- Invoicely

- FreeAgent

What are the benefits of Cloud Accounting?

1. Affordability

The cloud can be provided at an affordable price due to the fact that the cost of storage are shared by many different parties. Affordability enables small businesses to access to powerful business functions for their businesses.

2. Access from anywhere

The servers are accessed through the internet in the same way as a secure website or online banking. This provides greater flexibility to the users and easier access from home, office, coffee-shop to perform the necessary functions. This means that the business’ accountant can also access their client’s books and provide the necessary guidance or perform certain entries and to extract data for compiling reports.

3. Access from any device

With the traditional desktop-accounting-software, you have to install the accounting software physically on each computer. Cloud Accounting gives you the ability to jump between workstations, laptops, notebooks or mobile phones as long as you have an internet connection without the complexities of installing the software manually.

4. Safe and secure

The cloud accounting service providers make security their highest priority. It makes sense as this is their livelihood and a crack in the system will destroy their reputation and business. Cloud accounting is provided in a highly secure environment with many back ups and fail-safes in place that only big businesses can afford.

Service providers like Sage Business Online Accounting use 256-bit encryption to encrypt data stream of files.

Techopedia described 256-bit encryption as the most secure encryption methods.

Many users regard cloud accounting as being more secure and less costly than relying on onsite back-up and self-implemented security.

5. Seeming less processing without interruptions

We live in a time where internet applications run for 24/7, uninterrupted. This has become the norm and cloud accounting is no exception to the norm. With traditional desktop software, the likelihood of losing data through damages of the computer or server is large. Depending on the damage, your data might be corrupted and completely inaccessible.

Cloud Accounting service providers like Sage display warning messages at the top-bar when the service will be down for a short period due to maintenance. In all cases, these happen very early mornings outside of normal business hours.

6. Automation of manual entries

The benefit of automation of entries gives large scale advantages to the business. This saves time for bookkeeper and businesses and also ensures more accuracy. The opportunity to make errors are far less with the automation of transaction entries.

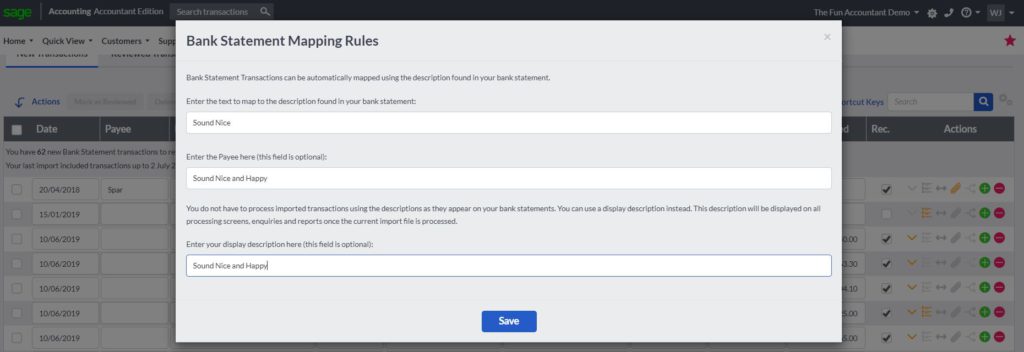

An example of automation is the Bank Statement Mapping Rule of Sage whereby transactions are recorded based on the description of the bank statement. When the same description is found by your Sage Cloud Accounting it is automatically recorded to the category set-up with the Mapping Rule. This works for customer, supplier or general ledger transactions.

7. Access to live-data

The benefit of accessing live-data as transactions are recorded “on-the-go” as part of the business operation. Business owners can make better decisions with relevant, accurate and up-to-date information.

8. The benefit of integration

Cloud accounting seamlessly integrates with other software and applications. This increases the business’s ability to expand its processes through

Cloud accounting seamlessly integrates with other software and applications. This increases the business’s ability to expand its processes through

access to many more applications. These applications are solution-driven and perform a very specific function for that business at a fraction of the cost that self-written programs would do.

An example of integration is ReceiptBank that applies artificial intelligence and optical character recognition to scanned document images, smartphone photos and emailed invoices that are imported as transaction data into accounting ledgers.

9. Environmental friendly

The digital economy really supports the green economy with the ability to go paperless. Less paper printing with online storing of documentation and the ability to access large quantities of documents. The cost of physically storing documents is also removed from the business.

10. Better business better performance with cloud accounting

Cloud accounting can handle a large number of transactions. If the business grows and the quantity of transactions increases it is easily handled by your Cloud Accounting software. It doesn’t cost you more, therefore, the cost per transaction reduces.

Adding more users is simple. The business functions can be separated between more users and the business can grow without being restricted by its data handling abilities.

Cloud Accounting supports mobile use which is the future of business.

How do you buy Cloud Accounting?

Cloud accounting is subscriber-based and not product base. This means that it is bought by the business as SAAS (Software as a Service). Subscriber-base drives the price down as the hosting and network cost are distributed among more users.

When should you adopt Cloud Accounting?

Cloud accounting improves the overall ability of your business. It is less cheap than using manual labour, less problematic than desktop applications and it is affordable. Small start-ups across all industries can use cloud accounting. The likelihood is already there that some-or-other computerised process is being used with the less desirable outcome than cloud accounting.

My advice: Move to cloud accounting before your competition does.

Sign up to a 30-day free trial: