Let’s understand how to correctly set up retirement funds, known as “benefit funds”, in Sage Business Cloud Payroll. It is a straightforward process that follows on from adding a Company and the Payroll Cycles Setup and must be done FIRST before adding your employees to the payroll software.

It involves doing it in two steps:

First, you’ll need to set up the benefit funds within the system. This involves configuring the specific details of the retirement funds you want to offer to your employees.

Once that’s complete, the next step is to link these benefits to the employees’ payslips. This ensures that the retirement contributions are automatically calculated and included in each payroll run.

Understand Retirement Funds in Payroll with the Video tutorial

To improve your knowledge with a visual presentation check out the YouTube video link below. ???

Preparing to Set Up Benefit Funds (Retirement Funds)

Thorough preparation is key when setting up benefit funds in Sage Payroll. It’s crucial to have all the necessary information at hand. This will guarantee that all calculations will be accurate once processing begins. This attention to detail will save time and prevent errors in the long run.

Expert Tip! —->>>Before you begin:

- Make sure you have the correct fund details,

- understand which types of earnings contribute towards the benefit fund, and

- know the percentage of earnings that will be calculated for contributions, as specified by the fund’s rules.

Effects of Incorrect Setup

If there are any mistakes in the initial setup and you’ve already processed payroll transactions to any benefit fund, you’ll face the cumbersome task of rolling back to your first processing month to make corrections. This highlights just how crucial a correct initial setup is to avoid complex issues later on.

Getting it right from the start ensures a smooth payroll process. By carefully preparing and double-checking all details before processing, you can avoid the hassle and complexity of fixing errors down the line. A little extra effort upfront can save a lot of time and frustration later.

A payroll’s perspective on Benefit Funds in South Africa

Benefit funds in South Africa play a crucial role in helping employees save for retirement and provide coverage against risks such as disability, as well as support for the employees’ families in case of the member’s death. These funds are regulated by the South African government to ensure proper management and protection.

Employers typically deduct contributions for these funds from employees’ salaries and often make matching contributions as well.

When you click on: ‘Setup Benefit Funds’ under the ‘Company Setup’, you will reach the ‘Manage Benefit Fund’ screen. Here, you can set up two types of benefit funds: Pension Funds and Provident Funds.

Types of Benefit Funds

Pension Funds

Pension funds gives you the ability that when you retire, you can take up to one-third of your total savings in the fund as a lump sum. The rest is paid out as a monthly income or annuity. A pension fund helps ensure you have a steady income throughout your retirement.

Provident Funds

Provident funds were initially designed to give you all your savings as a lump sum when you retire. Providing more flexibility with your money but not guaranteeing a monthly income later on. However, recent changes in the law are making provident funds more like pension funds. In the future, if you’re part of a provident fund, you’ll also need to use two-thirds of your retirement fund to buy an annuity, providing you with a monthly income, just like with a pension fund.

What About Retirement Annuity Funds (RAFs)?

Retirement Annuity Funds, or RAFs, aren’t included in the list of benefit funds set up by employers because they are personal retirement savings plans. They’re set up and contributed to by individuals, not by employers. While employers can choose to contribute to RAFs on behalf of their employees, it’s not mandatory, and the individual still maintains control over the fund.

Later in this article, we’ll explain how to set up these contributions as a tax-saving benefit that reduces the monthly PAYE dues for your employees.

By understanding these various types of funds and their regulations, employers can better manage employee benefits and ensure compliance with South African laws.

Setting Up a Pension Fund in Sage Business Cloud Payroll

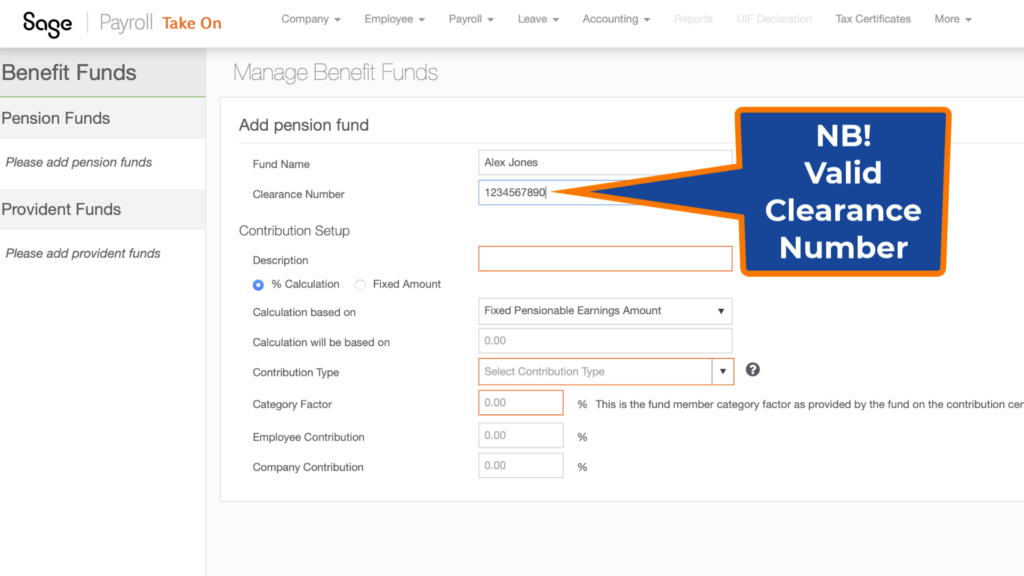

Adding a Pension Fund. You’ll need the following information:

- the fund name and,

- very importantly, the Clearance Number provided by the fund. Please note, you MUST obtain a valid clearance number; without it, the setup will not work, and you’ll encounter validation errors from SARS if the number is incorrect.

- Next, a fund description and,

- decide whether the contribution will be based on a percentage or a fixed amount.

- Your fund’s rules will clearly indicate whether it’s a Defined Contribution, Defined Benefit, or Hybrid fund.

- The employee contribution and,

- the employer’s contribution.

During the payroll run, you’ll see exactly how these contributions reflect on the payroll and the employee’s payslip. Finally, save these settings.

Setting Up a Provident Fund in Sage Business Cloud Payrol

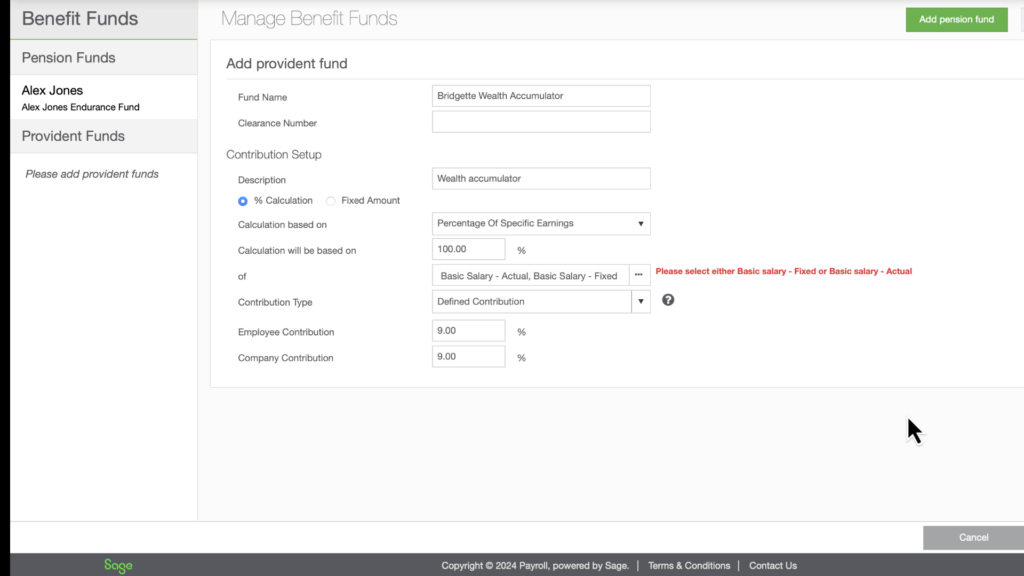

Let’s add a Provident Fund, a common component in many payroll setups. Begin by:

- Enter the fund’s name

- and its description.

- the Fund Clearance Number, which is crucial for setting up your company benefit fund.

- decide whether the contribution will be based on a percentage or a fixed amount. Since the percentage calculation is already selected, specify the percentage to be applied to an earnings type. It’s important to choose one salary type—either Basic or Fixed—as the system doesn’t allow for both.

- Press OK.

- The contribution type for this fund is a Defined Contribution.

- Set the employee contribution and the employer’s contribution.

- Now, I’m ready to save.

And there you have it—an example of how to set up a Provident Fund in Sage Business Cloud Payroll.

Key Takeaways for Setting Up Benefit Funds in payroll

The biggest takeaway from this section is the importance of adding your benefit funds before you add your employees in the setup process.

Ensure you have all necessary correspondence with the fund on hand, including details like the fund’s name and clearance number.

Also, be clear about the type of fund—whether it’s a Defined Contribution or another type—and other aspects like the base amount for contribution calculations and the percentage contributions from both employer and employee.

Linking Benefit Funds to Employees

Now that we’ve added the benefit funds, the next step is to link these funds to specific employees for their payslip runs. This is a one-time process; once linked, the benefits will automatically be included in each payroll run going forward. This streamlines the payroll process, ensuring that contributions are consistently and accurately applied to each employee’s payslip.

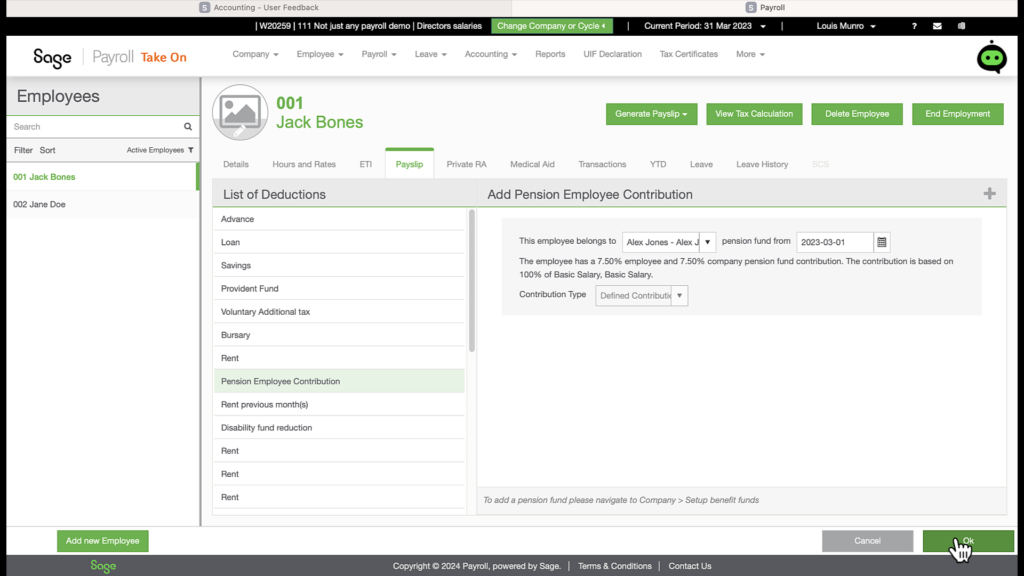

Setting Up Pension Funds on the Employee Payroll Screen

The rest of the payroll setup takes place on the Employee Payroll screen.

As the employer, you need to know three key things:

- The amount the employee contributes to the fund each month.

- The start date of these contributions.

- The fund’s clearance number.

Start by expanding the list of deductions and locate ‘Pension Employee Contribution.’ Remember when we added the pension fund earlier? The specific fund now appears on our list for selection.

As soon as you select it, the details of contributions for both the employee and employer are displayed, including the base earnings and the percentage of those earnings that will be contributed. Then, choose the date from when the pension fund contributions will start, and press ‘OK’ to save the settings.

You’ll notice that the pension fund has an effect on the employee’s tax because pension fund contributions are an allowable deduction from tax.

Setting Up Provident Fund Deductions

Many hourly-paid employees have provident funds set up for them, so let’s go through how to add this to the payroll setup.

- Click on the plus sign to open up more payslip-specific deductions.

- Select ‘Provident Fund’ from the list of deductions.

- Choose the fund that the employee belongs to, which we set up earlier, and

- select the date from when the fund becomes applicable to the employee.

- Details of the fund, including employee and employer contributions, the portion of earnings it is based on, and the percentage contribution, are displayed. These details were previously established when we added the fund in the benefit fund setup.

- Once you press ‘OK,’ the provident fund contributions will be calculated during each payroll run for this employee until the arrangement is terminated. This ensures that all contributions are accurately and consistently applied to the employee’s payslip.

Setting Up a Private Retirement Annuity (RA)

Next, let’s set up a Private Retirement Annuity (RAF), further familiarising you with the payroll setup. Click on the plus sign at the right-hand side of the screen to add the retirement annuity. You’ll also need to enter the clearance number of the fund, which should be provided by the employee. Once all the details are correctly filled in, press ‘Save.’

This ensures that the employee’s contributions are accurately recorded and that the person receives the appropriate tax benefits for their retirement savings.

Reviewing Retirement Funding Reports

To ensure everything is set up correctly and to provide transparency, let’s explore the retirement funding reports by printing a year-to-date detail report per employee for all three types of retirement plans.

This report will show a detailed breakdown of contributions for each retirement plan, allowing you to verify that all contributions are being handled correctly and providing a comprehensive view of the retirement savings for each employee.

Final Thoughts

Setting up and managing retirement funds in Sage Business Cloud Payroll might seem complex at first, but with the right approach, it becomes a straightforward process. By understanding the types of benefit funds, accurately setting them up, and linking them to employee payslips, you ensure that your payroll runs smoothly and compliantly.

Remember, thorough preparation is key. Ensure you have all the necessary details, such as fund names and clearance numbers, and understand the contribution calculations before starting. This will save you from potential errors and complex corrections later on.

By following these steps and using the tools available in Sage Business Cloud Payroll, you can efficiently manage retirement funds, provide valuable benefits to your employees, and maintain compliance with South African regulations. For a detailed walkthrough, be sure to check out our YouTube video where Louis provides expert tips and actionable insights.

Happy payroll processing!

Ready to simplify your payroll setup and ensure compliance with South African retirement fund regulations? Sign up for a 30-day free trial of Sage Business Cloud Payroll and experience seamless setup for retirement funds and more. Click the link below to get started and transform your payroll process today! ??????