In this supplementary blog post, to our video we delve deeper into the process of performing Tax Identification Number (TIN) verification for employees. Understanding and ensuring the accuracy of tax identification numbers is vital for employers, especially during the EMP501 employer reconciliation in South Africa. Let’s explore the importance of accurate tax identification numbers and the methods of verification.

The Importance of Accurate and Valid Tax Identification Numbers

During the EMP501 reconciliation, employers must verify tax identification numbers and ensure the accuracy of payroll information, including:

- employees’ earnings,

- withheld taxes, and

- statutory contributions such as unemployment insurance and

- skills development levies.

This article and accompanying video have been created with employers in mind, providing a quick solution for tax identification number verification during the EMP501 reconciliation process.

Understanding Tax Identification Numbers

In South Africa, an individual’s tax identification number is known as the South African Revenue Service (SARS) “Tax Reference Number”. It is a unique number assigned to each taxpayer and plays a crucial role in fulfilling tax obligations and engaging in financial and legal activities, such as property transactions and interactions with government agencies.

Why Tax Identification Number Verification Matters

Having a valid tax identification number is essential for individuals starting a new job, as employers require this information to deduct and submit the correct amount of income tax to SARS.

Individuals without a tax number may face difficulties in securing employment or receiving their salary in compliance with tax regulations. However, it’s important to note that many people, particularly manual labor workers, don’t have tax identification numbers, placing the burden of verification on South African employers.

The Negative Implications of Inaccurate or Invalid Tax Numbers

Employers must ensure the accuracy and validity of tax reference numbers for their employees. Inaccurate tax numbers can have severe implications, including non-compliance with tax regulations, incorrect withholding amounts, financial discrepancies, penalties, fines, and further scrutiny during SARS audits. Moreover, employees may face difficulties in filing tax returns, receiving accurate tax deductions, and accessing entitled tax benefits, which can lead to dissatisfaction and strained relationships between employees and employers.

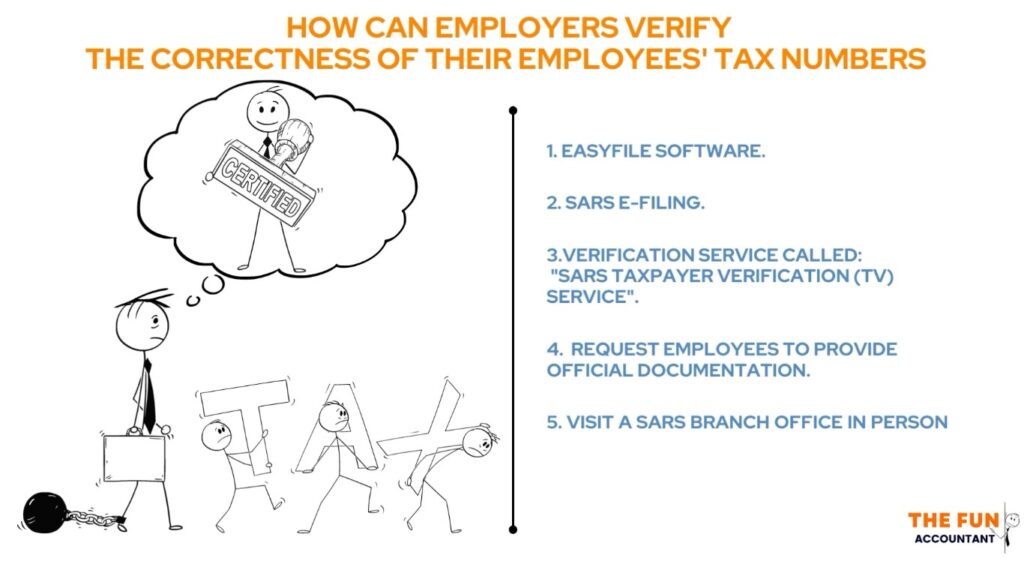

The Different Methods of Tax Number Verification

Employers in South Africa can verify the accuracy of their employees’ tax numbers through various methods.

- The recommended approach is using the Easyfile software program provided by SARS.

- Employers can also utilize the “Employer Workbench” section, where they can view and verify the tax numbers associated with their employees’ profiles on the SARS eFiling System,

- SARS provides a verification service called “SARS Taxpayer Verification (TV) Service,” which allows employers to verify the tax numbers of individuals.

- Employers can request employees to provide official documentation that includes their tax reference numbers, such as their IT34 assessment, the (ITR12) certificate or their tax clearance certificates.

- Employers may visit a SARS branch office in person to verify the tax numbers of their employees, which is in my opinion the worst option available and only advisable when the Employer has a specific concern that require direct interaction with SARS officials.

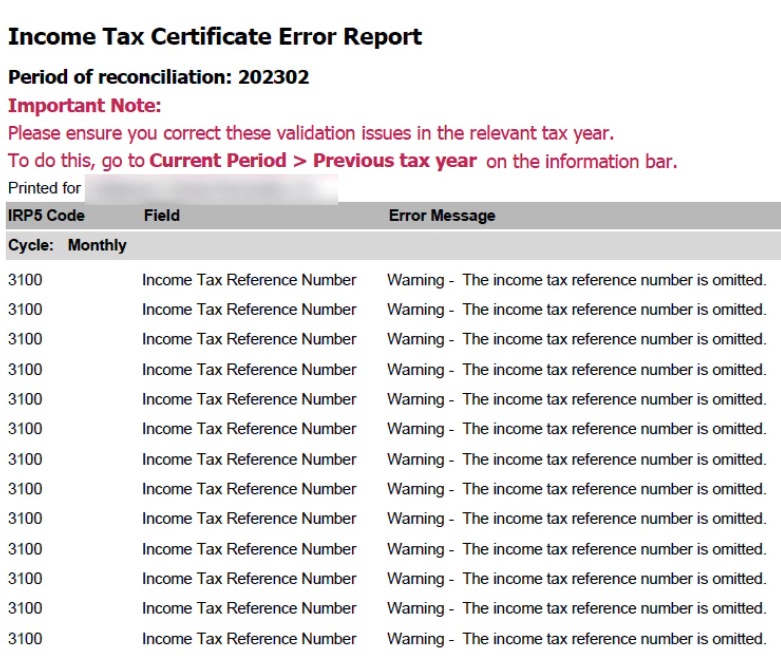

The “Income Tax Certificate Error” in the Sage Cloud Payroll software program

Sage Cloud Payroll provides employers with a report during the EMP501 process of any errors pertaining to a period of reconciliation.

Employers that are presented with the “Income Tax Certificate Error” will encounter problems for the year-end submission because without a tax identification number it will be impossible to link the tax paid for this employee to the employee’s tax return.

We can solve this issue hassle free for the employer by using the function provided by Easyfile.

Step-by-Step Guide on How to Verify Tax Identification Numbers using Easyfile

To streamline the tax identification number verification process, we recommend using the Easyfile software program. Here are the steps:

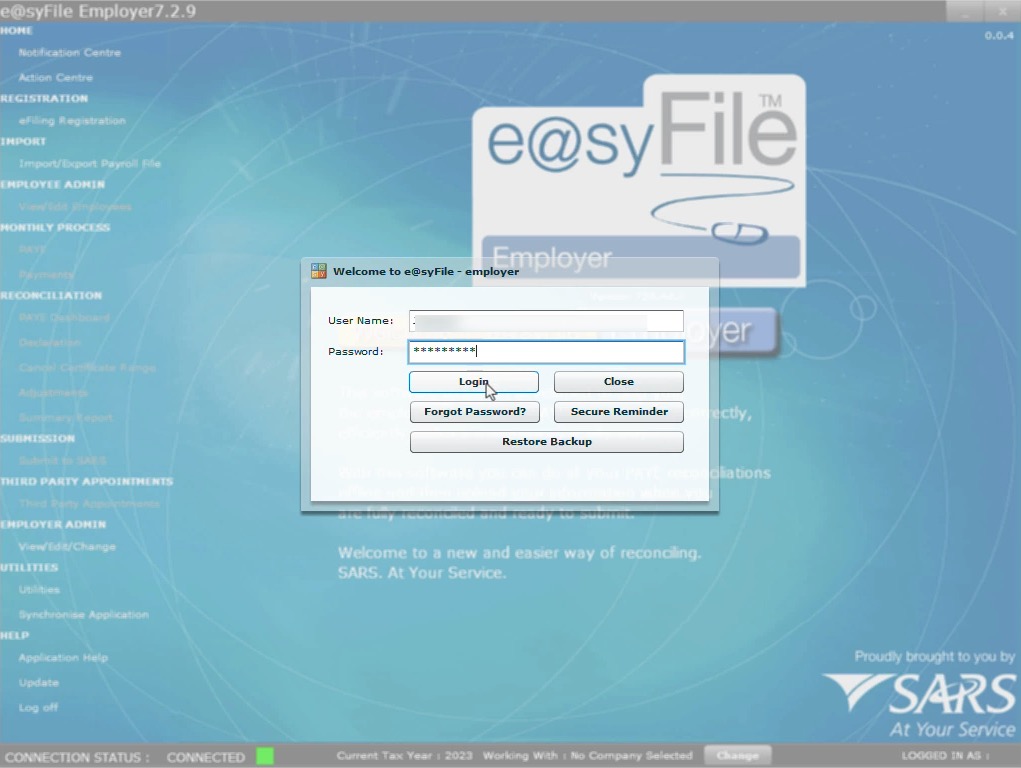

- Log into Easyfile.

- Select the reconciliation period at the tax year button.

- Find the employee you are looking for from the list of employees.

- Click on the “View” button next to the employee’s name.

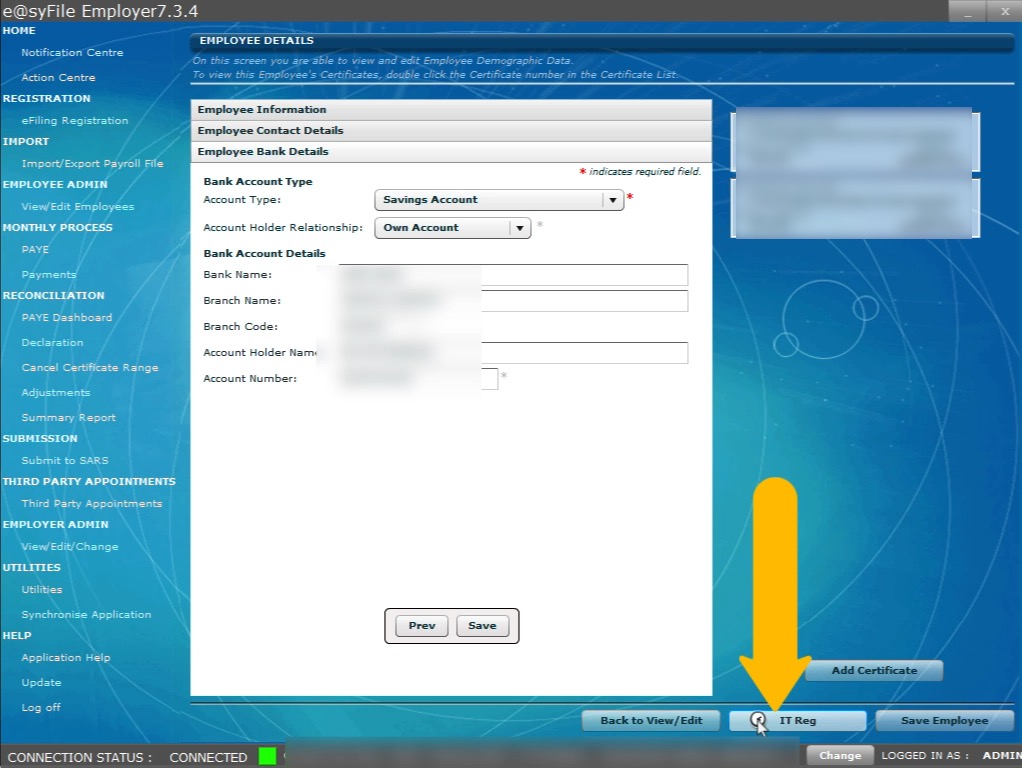

- You are now on the Employee Information page at the bottom of the page select the “IT Reg” button. .

- You will be directed to the “Employee Contact Details” page. Click on the “IT Reg” button again.

- You will be taken to the “Employee Bank Details”. For the third time you will click on “IT Reg.”

- Now, the SARS eFiling login menu will appear. Enter the employer’s username credentials and SARS eFiling password. Click on Login.

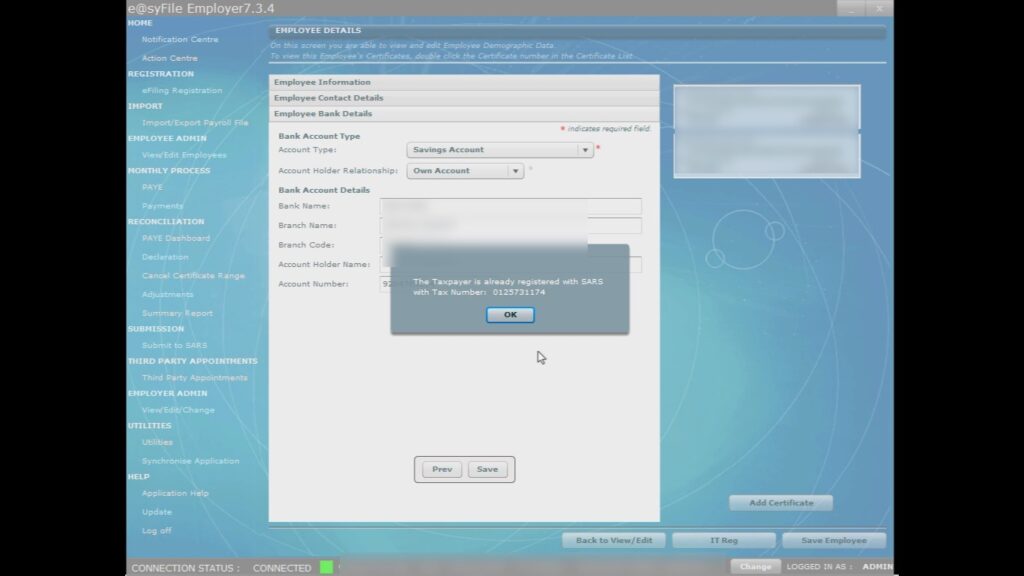

- You will receive a message about the tax identification number of the employee. Copy the tax number and press OK.

- Click on the “Previous” button to return to the Employee Information page, where you will see the tax number automatically filled in the Income Tax Reference field.

- Finally, click on “Save Employee.”

How to Prevent Future Errors

To prevent tax validation errors in the future, we recommend updating the tax identification numbers in Sage Cloud Payroll. Follow these steps:

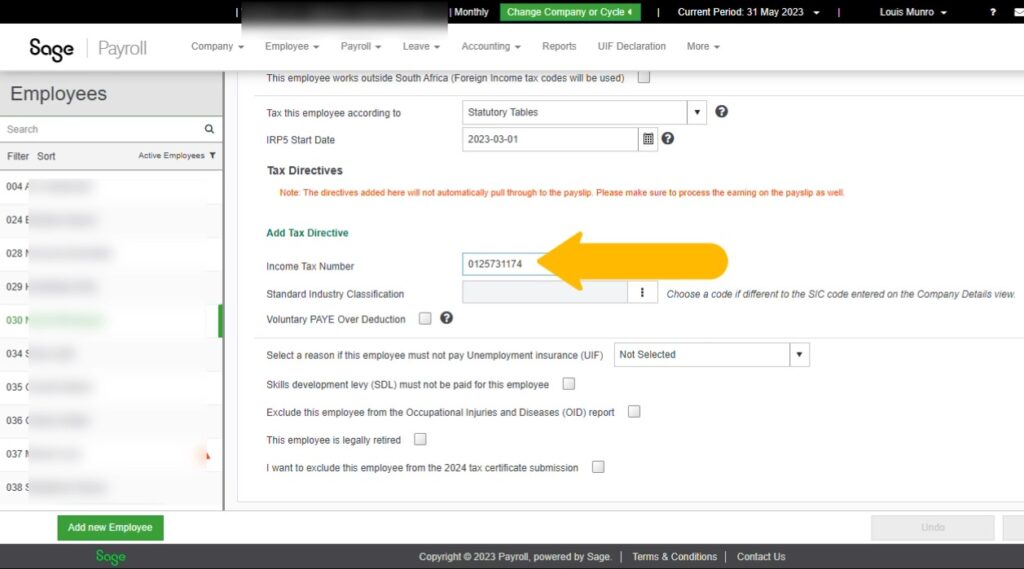

- Open Sage Cloud Payroll and navigate to the Employee Details section.

- Locate the employee for whom you verified the tax identification number using Easyfile.

- In the Income Tax Number field, paste the tax number copied from Easyfile.

- Save the changes to update the employee’s entry of the tax identification number.

What’s in It for Me? The Benefits of Easyfile Tax Identification Verification

By following these steps and ensuring the accuracy of tax identification numbers, employers can prevent tax validation error reports, maintain accurate records, avoid discrepancies, and ensure smooth compliance with tax regulations. Accurate verification saves time, minimizes errors, and provides reliable data for businesses.

In Conclusion

Accurate and valid tax identification numbers are crucial for employers in South Africa. The EMP501 reconciliation process, along with tax identification number verification, is essential for accurate payroll records and compliance with tax regulations. By using Easyfile and updating tax identification numbers in Sage Cloud Payroll employers can streamline the verification process and enjoy the benefits of accurate reporting.

FAQs – Tax Identification Number Verification

As we explore the process of tax identification number verification, we understand that there may be common questions related to this topic. Here are three frequently asked questions and their answers:

How do I check my tax identification number (TIN)?

To check your tax identification number, follow these steps:

- Log in to the SARS eFiling System.

- Navigate to the “Profile” section.

- Under the “Tax Practitioner” tab, click on “Registered Taxpayer Details.”

- Here, you will find your tax identification number listed.

What is my South African TIN number?

Your South African tax identification number, also known as the South African Revenue Service (SARS) Tax Reference number, is a unique number assigned to you as a taxpayer. It is essential for fulfilling your tax obligations, engaging in financial and legal activities, and ensuring compliance with tax regulations. You can find your South African TIN number on official documents such as your IT34 assessment, the (ITR12) certificate, or your tax clearance certificates.

I need my tax number. How can I obtain it?

If you need your tax number, you have several options to obtain it:

- If you are employed, your employer requires your tax number to deduct and submit the correct amount of income tax from your salary. You can find your tax number on your payslip or by contacting your employer’s human resources or payroll department.

- If you are a business owner, you can retrieve your tax number from your registration documents or contact the South African Revenue Service (SARS) directly for assistance.

- Individuals who do not have a tax number yet can apply for one by completing the necessary forms and submitting them to SARS. Visit the SARS website or a SARS branch office for more information on the application process.

Please note that these FAQs are specific to tax identification number verification in South Africa. If you have additional questions or concerns, we recommend contacting the South African Revenue Service (SARS) directly for further assistance.

Watch our Video Guide on Tax Identification Number Verification

Looking for more in-depth guidance on tax identification number verification? Check out our accompanying YouTube video where I provide a comprehensive explanation and practical demonstration of the process. In the video, I delve further into the steps, share valuable insights, and address common concerns. Click on the link below to watch the video and enhance your understanding of tax identification number verification.