In this article, I’m going to walk you through how to submit and pay payroll taxes online using Sage Business Cloud Payroll. Yes, payroll taxes—a topic that makes most people want to fall asleep, but stick with me!

To give perspective – submitting and paying payroll taxes is actually just one piece of the payroll puzzle.

It’s something you tackle towards the end of the payroll run.

I’m going to show you how to handle payroll taxes. Specifically, we’ll look at:

- Payroll tax calculations

- Generating payroll reports for tax, UIF, and SDL amounts

- Submitting the EMP201 return to SARS on eFiling

- Paying the payroll taxes

- Performing the UIF declaration

For an enhance experience follow along the video on Youtube ????

Payroll Series Overview

To really get how payroll taxes fit into the whole payroll management process, it helps to refer back to my previous posts and videos in the payroll series. Each step we’ve covered so far has led us to this crucial moment—tackling payroll taxes and UIF.

Let’s quickly recap those steps to put everything into context, so you’re ready to take on the taxman!

New Payroll Setup: We added a new employer / company. ? Start your payroll

Payroll Cycles: We set up payroll cycles.? What is payroll cycles and why is it important

Retirement Funds: We added retirement funds to the payroll and linked them to employees in the setup phase. ? Understand Retirement Funds in Payroll

Employee Setup: We added employees and dealt with validation errors. ? How to add Employees in Sage payroll

Running Payroll: We did mock examples of earnings and deductions for both salaried employees and hourly wage earners. ? Payroll run

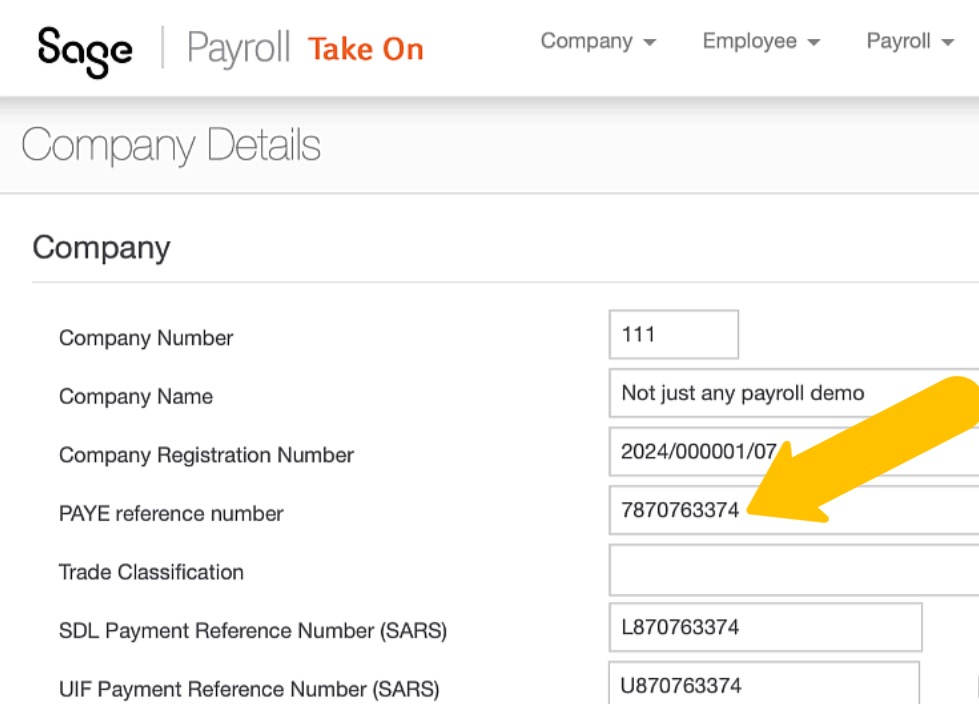

Important Details

It is important to remember that payroll taxes were first addressed when the PAYE reference number—SARS employer registration number—was added. Once this number was entered, the SDL and UIF numbers were automatically populated.

The UIF registration number, which is distinct from the SARS UIF collection number, was also included. Additionally, the contact details for SARS and UIF were filled in.

Key Point when thinking about Payroll Taxes

The payroll run itself—and the employee taxes—are actually pretty simple. The real effort is in the setup, making sure each employee’s earnings and deductions for a specific period are accurate and complete.

Once that’s sorted, handling the employee taxes becomes much more straightforward.

Using Sage Business Cloud Payroll Reports

The reports most commonly used by payroll administrators in Sage Business Cloud Payroll are under the ‘Financial’ tab.

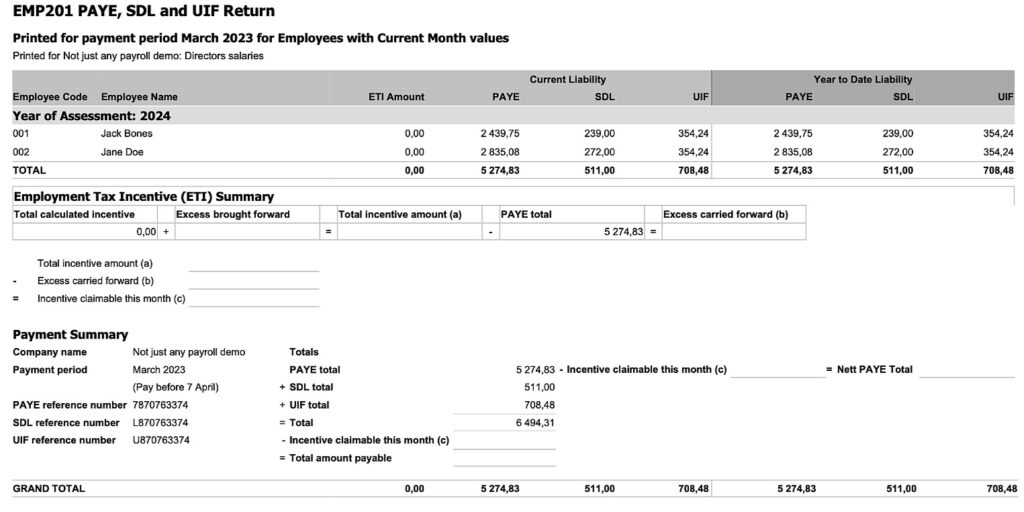

Here, we’ll find the EMP201 report, which is needed to process payroll taxes. Select the submission period. For a quick report, leave the settings as they are to print employees with current month values.

Select ‘Preview’ and the EMP201 report for submitting PAYE, SDL, and UIF is displayed. I would advise you to save this report, and store it in your favourite storage place where you can easily retrieve it again.

Once saved, open the report to view it in PDF format.

The comprehensive EMP201 report will show:

- the current amounts due,

- each employee’s contribution to the total amounts,

- and finally, the Payment Summary. This summary is the most important part, as it highlights the totals that need to be entered on eFiling and submitted to SARS.

Online Submitting of Payroll Taxes on SARS eFiling

Now, let’s walk through the steps to enter this information online into SARS eFiling and correctly report and pay your payroll taxes.

Open and activate the EMP201 return

First we’re going to activate the EMP201 return for the month.

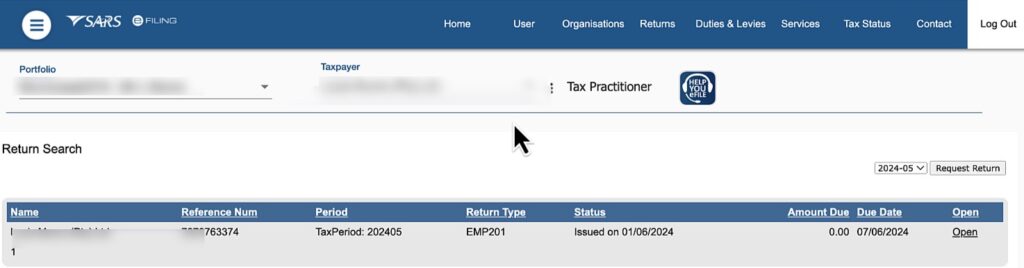

- First, head over to the SARS eFiling website and log in with your username and password.

- In the left sidebar menu, select ‘Return Issued…’ then ‘Employees Tax’.

- At the top, you’ll see the reporting date—click ‘Request Return’ to access the return for that period.

- If you’re claiming ETI, click ‘OK’. If not select ‘Cancel’. This will still generate an EMP201 return for the organisation.

Accessing and Completing the EMP201 Return

A return summary will appear, displaying the organisation’s:

- Name,

- PAYE reference number,

- tax period,

- return type,

- return status,

- amount due,

- due date, and

- an ‘Open’ link.

Click ‘Open’ to access the EMP201 return.

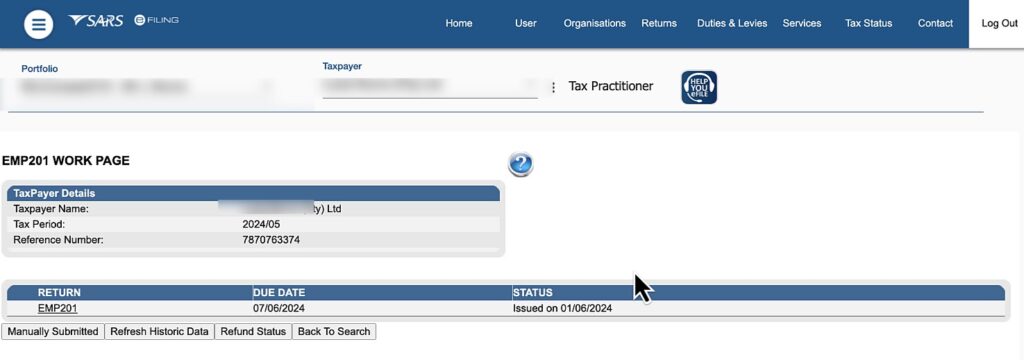

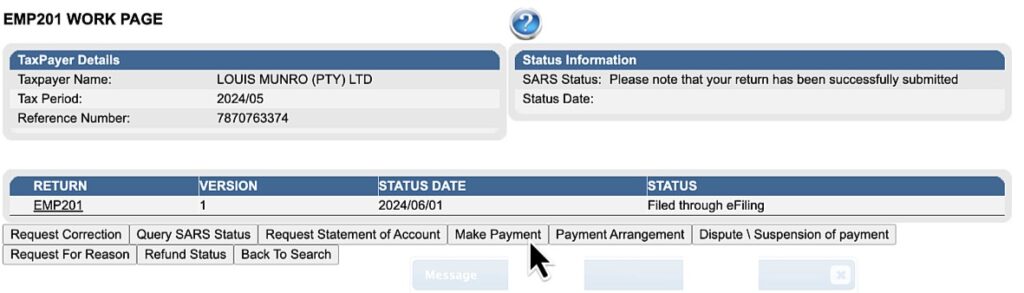

This will bring up the EMP201 Work page.

From there, click ‘EMP201’ again to open the Monthly Employer Return, where we’ll input the necessary information. The employer details should already be pre-populated, but it’s mandatory to fill in the contact details.

Once you have filled in the contacts details the next step is to refer back to the EMP201 report generated in Sage Business Cloud Payroll to enter the financial details.

Extracting Payroll Data from the Sage EMP201 Report and enter it on SARS efiling

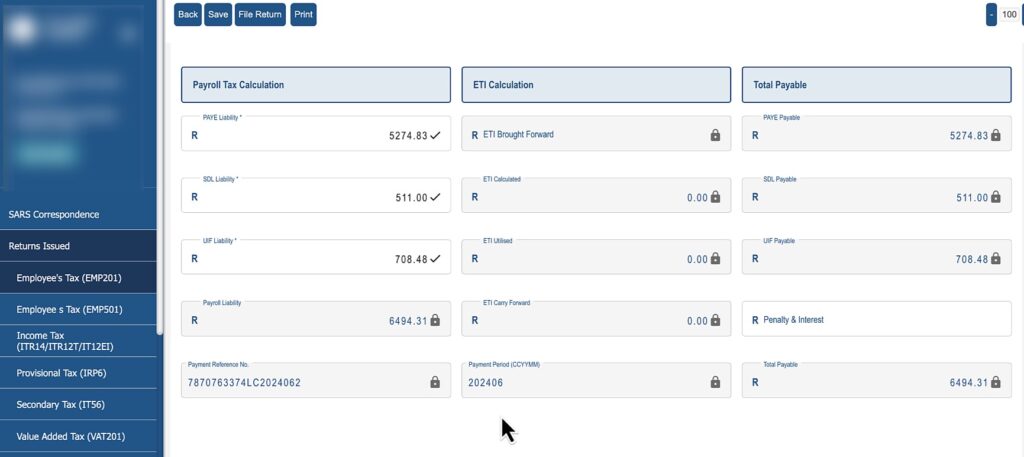

The EMP201 return fields to complete are:

- The first field is the PAYE amount,

- followed by the Skills Development Levy,

- and finally the UIF.

It’s important to check that these amounts match the Payroll Liability in the Sage report. Once the fields are reviewed, the return will be submitted to SARS by pressing the ‘File Return’ button.

The declaration must be accepted by clicking ‘Confirm,’ after which a result page will confirm that the return has been successfully submitted.

Press ‘Continue,’ and a pop-up message will again confirm the submission.

Afterward, clicking ‘Close’ will lead to the payment process.

- The ‘Pay Now’ button is selected,

- followed by clicking ‘OK’ to proceed with the payment. Even though ‘Pay Now’ is selected, the actual payment can be scheduled through the bank. The next step will explain how this is done.

Finalizing and Authorizing the Payment on SARS eFiling

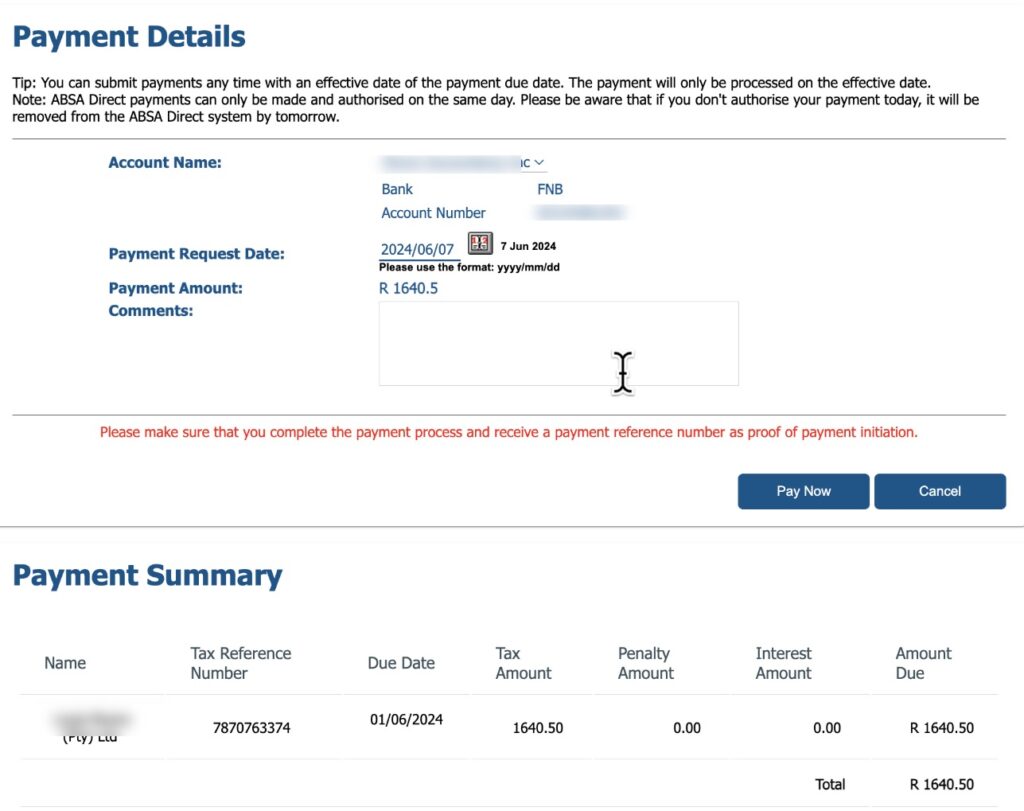

- On the Payment Details screen, select the bank account that’s already set up in SARS eFiling.

- Next, choose the payment date by clicking the calendar button.

- The latest payment date is the 7th, unless the 7th falls on a Weekend or Public Holiday in which case it must be submitted on the Friday before the 7th day of the month.

- Press the ‘Pay Now’ button, and a message will appear informing you that the payment must be authorised by the bank account owner.

- Click ‘OK’ and then ‘Confirm.’

A final message will appear, giving one last chance to modify the payment. Once ‘OK’ is clicked, the payment instruction will be submitted to the bank.

The confirmation message indicating that the payment was successfully submitted to the bank should appear.

It’s highly recommended to save the confirmation at this point, as this is the only opportunity to print or obtain proof of the payment made on SARS eFiling

Authorising the Payroll Tax Payment on Your Bank’s Platform

Before proceeding, it’s important to note that the payment hasn’t been finalised yet. It still needs to be approved on the bank’s side, so let’s handle that quickly:

- Log in to your online banking platform and navigate to the Payments section. Most banks, including FNB, Standard Bank, and others, have an eFiling link or a similar option under Payments.

- Click on the eFiling link to view the transaction details.

- Open the menu options, then select ‘Submit eFiling Payment’ (the exact wording may vary depending on the bank).

- Check the box next to the transaction and

- press ‘Continue’ or ‘Proceed.’

Finally, the transaction needs to be authorized to complete the EMP201 payment. Once authorized, press ‘Finish’ (or your bank’s equivalent).

And that’s it! The EMP201 amounts have been filled in on eFiling, the payment has been submitted on eFiling, and the bank transaction is now fully authorised. You’re all set!

Submitting UIF Directly from Sage Business Cloud Payroll

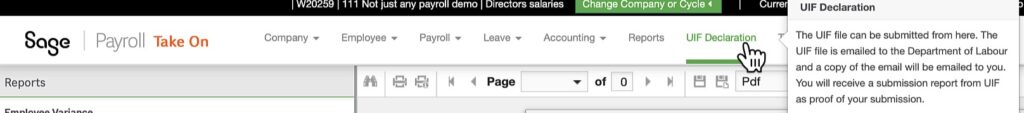

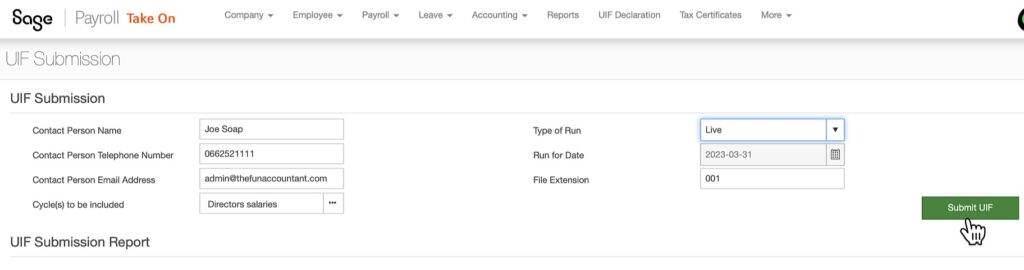

It’s time to move on to the UIF declaration. In the top navigation bar of Sage Business Cloud Payroll, you’ll find a link for UIF submission. This feature allows users to email their UIF information directly to the Department of Labour, and in return, you’ll receive a submission report as proof of compliance.

Thanks to all the information captured during the initial company setup, the required UIF fields are pre-populated. The only task left is to select the type of run (we’ll choose the Live option) and click the green ‘Submit UIF’ button.

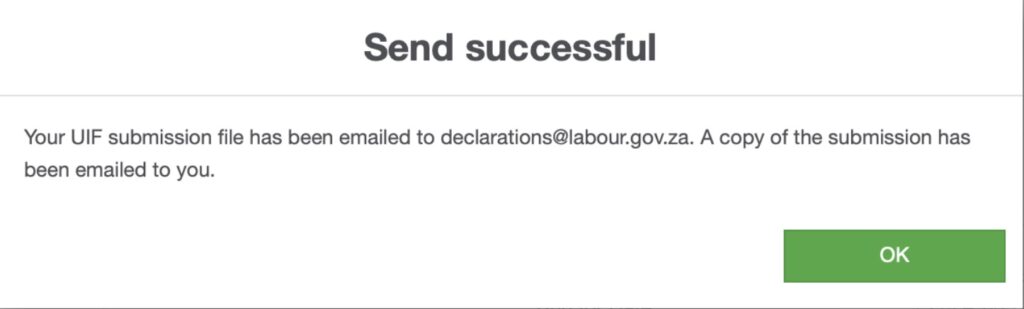

A pop-up message titled ‘Send Successful’ will confirm that your UIF submission has been emailed to the department, and a copy has been sent to you.

An immediate acknowledgment email from the Department of Labour titled ‘Declarations’ will follow. While the email’s content might seem minimal, its attachment contains the confirmation of the declaration received.

In Sage Payroll, clicking ‘OK’ will generate a UIF submission report. This report is important to retain in case of a UIF audit, as it allows you to trace the amounts back to their original source. Most importantly, if any errors occur, a UIF Error Report will display.

Once the Department of Labour processes the UIF return, you should receive a confirmation email acknowledging that the file was processed without errors. Be sure to keep these emails as proof of compliance.

This shows just how quick and easy UIF submissions are with Sage Business Cloud Payroll. By using this streamlined process, you’ll ensure your submissions are accurate and compliant, stress fee and saving time.

Getting compliant feels good

And there you have it, folks! We’ve tackled the beast that is payroll taxes and made it a whole lot easier.

Remember, the hardest part is setting everything up correctly. Once you’ve got that down, the rest is smooth sailing—or at least as smooth as payroll taxes can be.

Who knew getting compliant could feel this good?