Congratulations you are a small business owner, you’ve just hired your first employees, and now it’s time to pay them. If you’re unsure where to start, you’re in the right place.

You might think spreadsheets will do, but payroll involves much more: fair pay, legal compliance (think Basic Conditions of Employment), managing leave, and handling tax reporting. Not to mention, actually paying salaries.

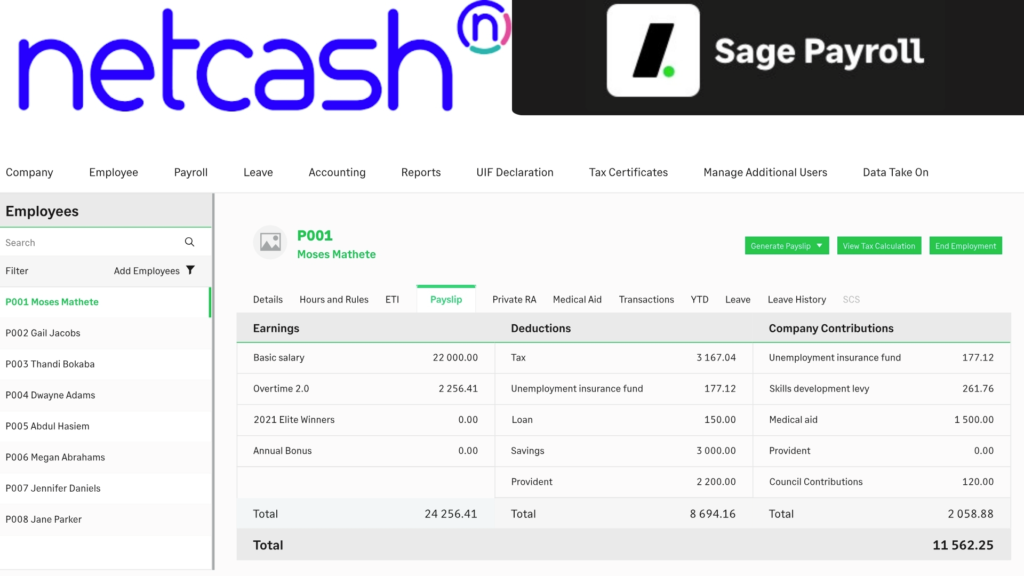

That’s why you need a reliable payroll system, but not only that! You must also consider a safe, reliable payment mechanism that is in-line with your dream of reducing admin to the bare minimum and making paying your employees Easy, Quick, Accurate and Fun. – Hello Sage Business Cloud Payroll and Netcash!

This guide focuses on how small businesses can use Netcash as an integrated way to pay salaries.

For an in-depth walkthrough, check out my YouTube video: “Best Way to Pay Employees in a Small Business.” It’ll show you exactly how to put these concepts into action.?????????

Why Sage Business Cloud Payroll?

I’ve explored many payroll solutions, and for me SBCP (Sage Business Cloud Payroll )stands out among the many payroll solutions for small businesses.

It packs all the essential features without breaking your budget. Whether you’ve got two employees or a hundred, you’ll only pay for what you actually need. But it is not perfect and have it challenges thinking: Payroll Imports to name one aspect that comes to mind.

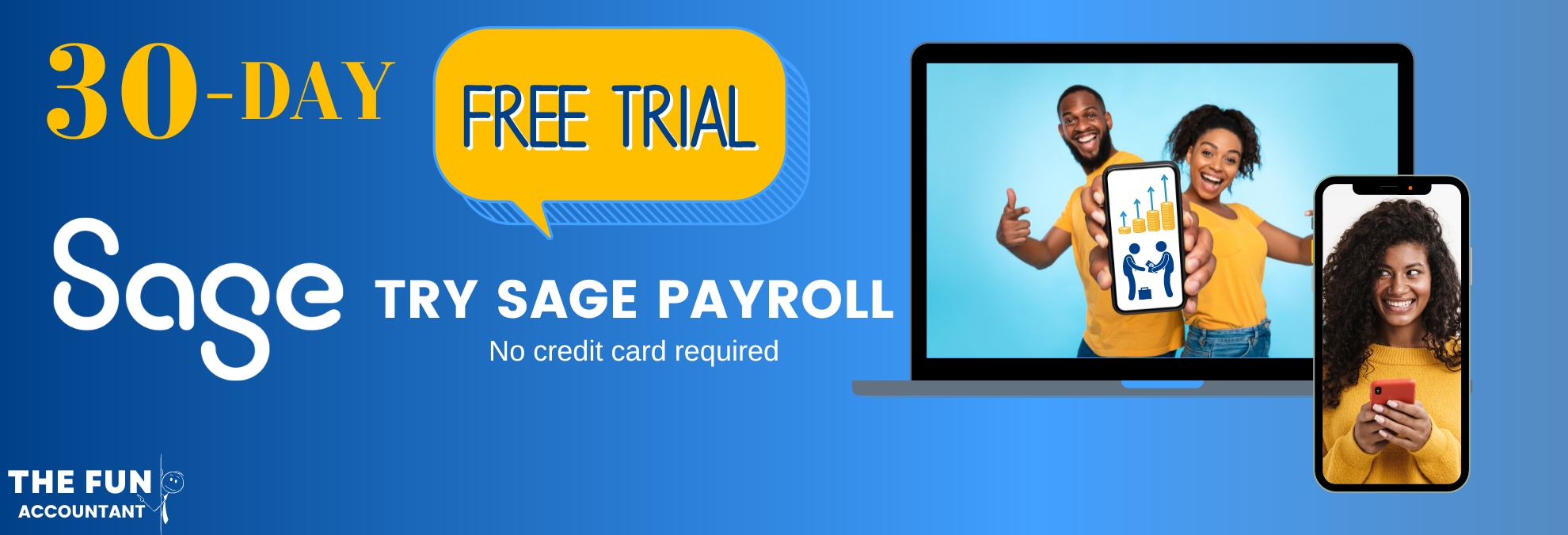

Employee Payment Options

When paying your employees from a Payroll Run, you have a few options. Here are some common salary payment options being used by small businesses:

Cash Payments

The standard option is cash, which seems simple—you figure out the net pay, give the employee the cash in an envelope, and hopefully get a signature. However, cash payments have safety risks, making them less than ideal for many small businesses.

Cash is also difficult to trace in Accounting and actually results in more paperwork and headaches than what is necessary.

Cheque Payments

Practically obsolete in South Africa.

Electronic Transfers

With this method, you enter the employee’s banking details on your internet banking platform and manually enter each employee’s net pay from your Sage Net Pay List Report before authorizing the transfer.

ACB (Automated Clearing Bureau)

ACB (Automated Clearing Bureau) takes payroll integration a step further. Sage Payroll creates a salary payment file with all your employees’ net pay amounts, and you upload this file to your internet banking.

This lowers the risk of fraud and typing errors because the amounts can’t be changed during the transfer.

This payment method is the most expensive, resulting in additional bank charges. See ABSA Business Integrator.

Netcash

One of the Netcash solutions, is the “Salary Payments“.

Netcash offers full integration from SBCP (Sage Business Cloud Payroll) to paying all your employees at once. It provides the highest level of integration between your payroll and the payment process, greatly reducing the risk of errors or fraud, especially if someone else handles the payments.

Steps to pay salaries directly from Sage Business Cloud Payroll using Netcash.

Integration is the name of the game when embarking on the path of efficiency and reducing admin. This is where the Sage and Netcash eco-system come in. But first you have to…

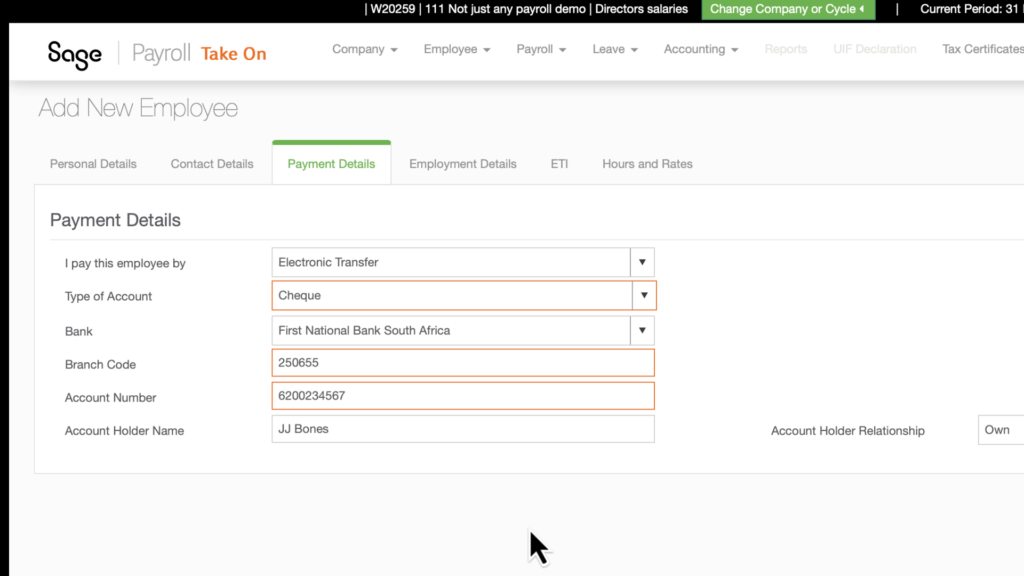

Step 1: Setting Up Employee Banking Details

To ensure smooth payments, you need to enter the employee’s banking details in the setup screen. This is very important because it makes sure the correct bank details are used for salary payments, connecting the net pay calculated in SBCP(Sage Business Cloud Payroll) directly to the actual payment through Netcash.

Step 2: Running Your Payroll in Sage Payroll

Process your payroll as you normally would within SBC-Payroll. This includes entering working hours, earnings, deductions, and bonuses. SBC-Payroll handles the calculations, including taxes and UIF contributions, and generates payslips.

Step 3: Creating the Payment Batch in Sage Payroll

After finishing running the SBC-Payroll simplifies the payment process. You can generate a payment file (often in CSV format) containing the necessary payment information but not needed with the direct link between SBC-Payroll and Netcash.

Step 4: Seamless Payments with Netcash

Looking for the magic, this is where it all happens! The payment file generated by SBC-Payroll sync directly into Netcash.

Netcash uses this information to process all employee salaries electronically. This integration eliminates the need for manual data entry, reduces the risk of errors, and streamlines the entire payment workflow.

Key Benefits of the Integrated System

- Efficiency: Automates the payment process, saving you time and effort.

- Accuracy: Reduces the risk of errors associated with manual data entry.

- Security: Provides a secure way to transfer funds, minimizing the risk of fraud.

- Timeliness: Helps ensure that employees are paid on time, every time.

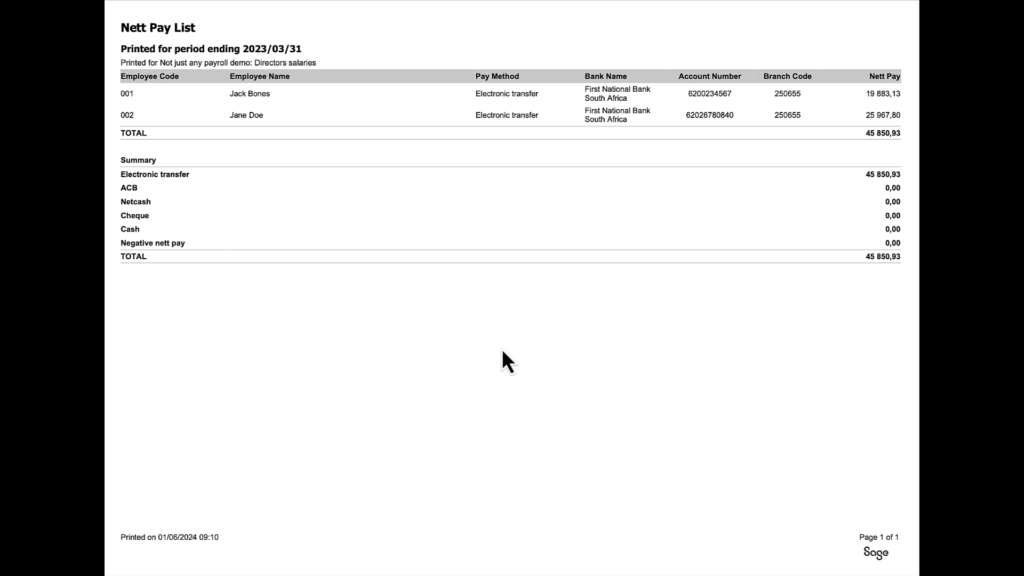

Net Pay List: Your Essential Report from SBC-Payroll

For salary payments, the most important report generated within SBCP (Sage Business Cloud Payroll) is the Net Pay List. This report provides a detailed overview of each employee’s payment method, bank details, and net pay for the relevant period.

Netcash and Sage Payroll Integration

Netcash and its salary payments service works seamlessly with SBCP (Sage Business Cloud Payroll), allowing you to upload payment files directly from your payroll.

The process is simple, secure, and easy, and you don’t have to enter amounts again in your bank account. No matter the bank or how many payments there are, you can be sure that everyone will be paid on time.

The Netcash workflow

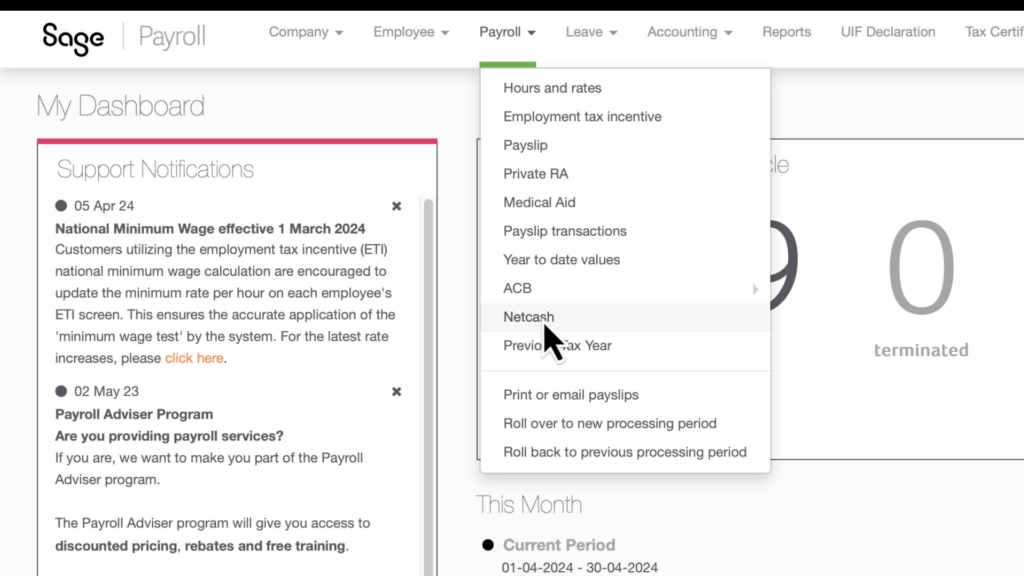

1. To access Netcash from SBCP (Sage Business Cloud Payroll):

- go to the top navigation menu,

- click ‘Payroll,’ and then

- go to ‘Netcash.’ This will take you to the Setup screen. The information from here on will only show if you have a Netcash account set up.

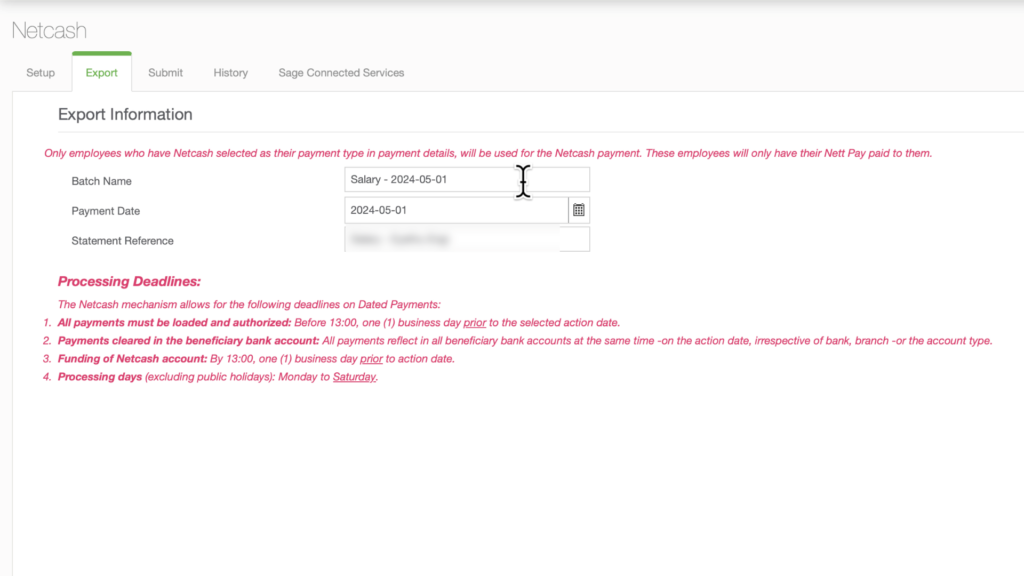

2. A salary batch will be created for employees whose payment method is set to Netcash.

Three fields will be shown:

- The batch Name,

- The payment Date, and

- The statement Reference for the salary payments from your bank account.

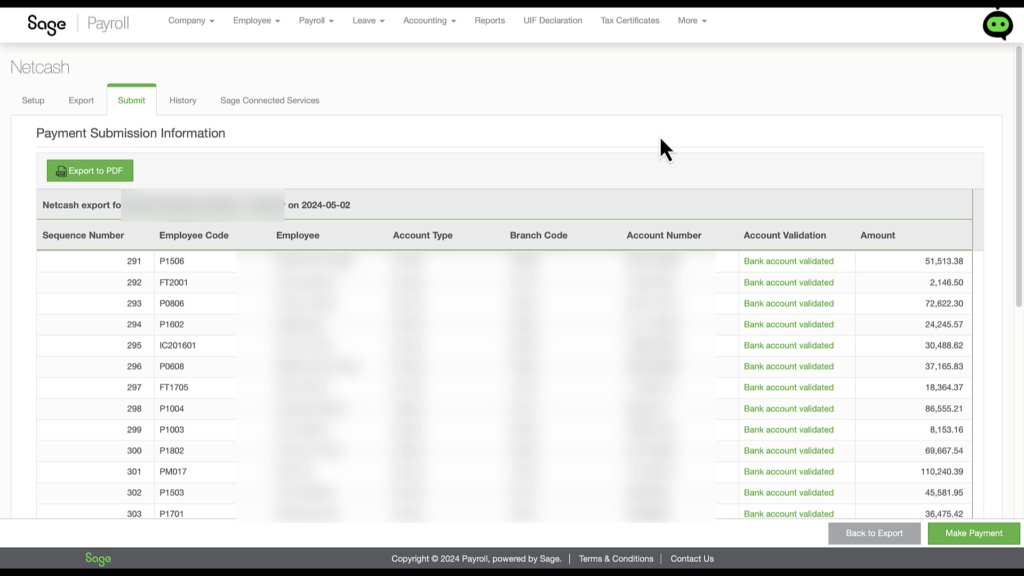

3.When you click ‘Next,’ Netcash gets the payment information for each employee and validates the bank account details.

4. You’ll receive an email confirming that the data in the file has been validated.

5. Back in Sage Payroll, click the ‘Make Payment’ button. A message will pop up saying that the “payment file has been submitted.”

6. Press ‘OK’ to continue and go to Sage Connected Services, where you’ll enter your Netcash login details.

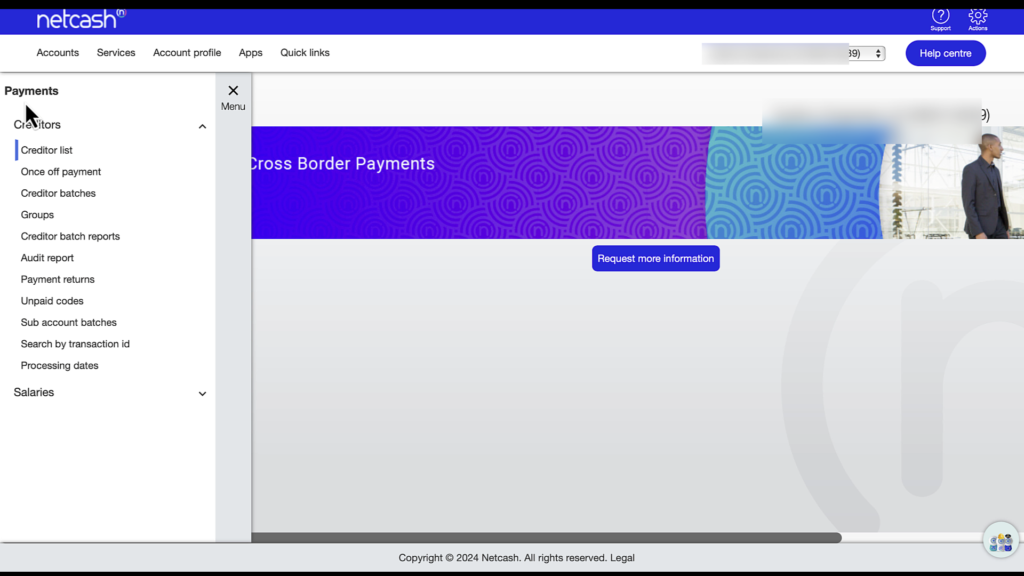

7. You’ll then be directed to your Netcash account. Under ‘Services’ in the top navigation menu, select ‘Payments.’

8. Then, in the left corner, click on ‘Menu,’ which will expand to show more options.

- Press ‘Salaries,’ and under

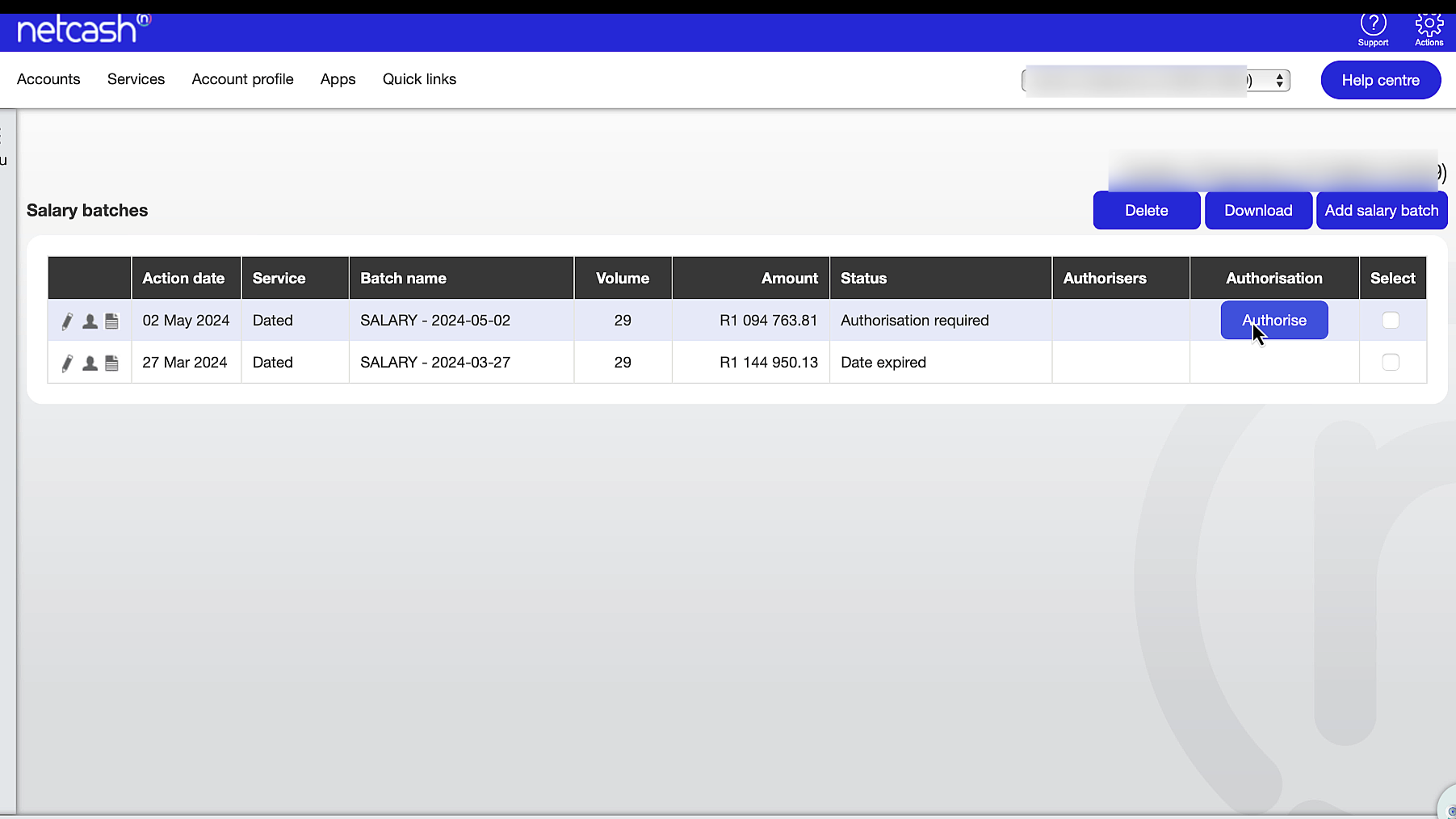

- The ‘Salaries’ menu, select ‘Salary Batches. You’ll see that the total that needs authorization matches the total amount from Sage.

- Click ‘Authorize,’ and on the next screen,

- Confirm the batch authorization.

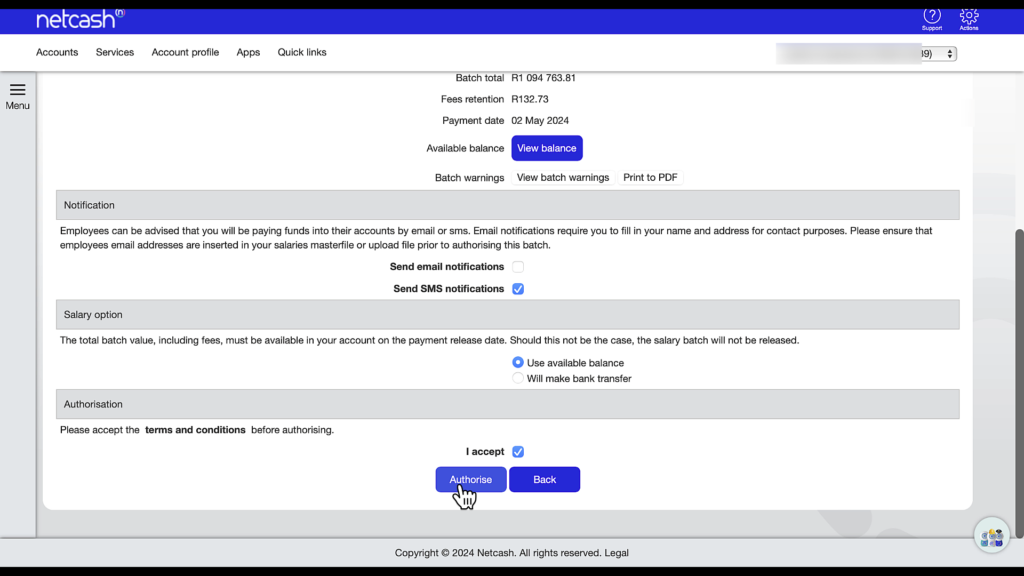

Bonus: Employee notifications

You can also choose to notify employees by email or SMS that their funds will be paid into their accounts.

“Show me the money”

The total batch amount, including fees, must be available in your Netcash account on the payment release date. You can use the available balance or make a bank transfer for the salary batch to be released.

9. Finally, accept the terms and conditions and press ‘Authorize.’

10. You’ll then receive a One-Time Pin on your phone, which you enter to release the batch. You’ll get a confirmation email that the salary batch has been authorized, with a report attached. By opening the PDF report, you’ll see that the batch value matches our Sage Net Pay value.

Netcash History Reports

To view history reports in Netcash, under ‘Services,’ select:

‘Payments.’ Then click the left ‘Menu’ button and choose ‘Salary Batch Reports.

All the past salary batches will be displayed, with the latest salary payments batch we released directly from Sage Business Cloud Payroll at the top.

You can also view:

- a batch summary report and

- a salary batch detail report, where you can see the net salary payment amount per employee.

These reports can be saved if you need to share or store them with your payroll file.

Conclusion: A Streamlined Payroll Experience

The integration of Sage Business Cloud Payroll and Netcash offers a powerful solution for small businesses seeking to optimize their payroll processes:

- SBC-Payroll simplifies the complexities of payroll calculations and reporting,

- while Netcash provides a secure and efficient way to execute employee payments.

By combining these two systems into a cohesive payroll eco-system, you can achieve a streamlined, accurate, and reliable payroll workflow.