Sage Business Cloud Accounting is a comprehensive business solution. A quick overview will never be enough to give you all the information about Sage. However, if you are in a hurry and want to know what Sage Business Cloud Accounting is all about this article is perfect for you.

I have done a 10-minute video that accompanies this article and I show you everything that I discuss below in a demo business. The video will give you a very good idea of what Sage actually looks like in real life.

Check out my 10-minute video below

Items and inventory

You can add an unlimited quantity of items to Sage. With the Item section of Sage, you can control your stock levels and get reports on your most profitable selling items.

The item database is used to pull information into other documents in Sage like purchase orders, quotes and sales invoices.

Sales

For most businesses, the most important aspect is their ability to create sales. You can create a quote, and send it to your customer.

Quotes

Sage gives you the ability to create online quotes on the go. This will help your business to look professional and to keep track of your quotes in an orderly manner. It will also save you time by storing all your customer details in a masterfile from where the quote details are completed.

Sales Orders

After your customer has accepted your quote you can create a sales order to let your team members know that the quote has been accepted by the customer.

Invoice

The sales order can then be executed or picked and turned into an invoice.

Delivery Note

When you do an invoice you have the option of also printing a delivery note that can be accompanied with the goods and retained as proof of delivery.

Credit Note

Incorrect invoicing or returned goods can be corrected and documented back into stock with a credit note. Once the credit note is linked to the invoice the details of the invoice is automatically brought into your credit note document.

Custom Layout Designer

There are multiple ways in which you can display your invoices in Sage and if their layouts are not satisfactory you can customize your invoices or any document that you want with the invoice layout designer which can be obtained from Sage without an additional cost.

Purchases cycle

I recommend using the Supplier section of Sage for purchases of goods and purchases. By using the supplier section you will create supplier invoices also known as bills.

These bills are stored in your system forever, which is a great tool to retrieve transaction detail. It also gives you the ability to get reports about the amount bought from certain suppliers. This information can give you the edge to understand your business and to negotiate discounts from suppliers.

Purchase Orders

You can begin your process of purchasing by creating a Purchase Order. Your internal Purchase Order can be sent to your supplier via email or other means where your order can be placed.

Supplier Invoices

As mentioned above bills are recorded as supplier invoices. Sage’s supplier invoices help you to keep track of the outstanding money you owe.

Once the goods have been received by you and you get your supplier invoice form your supplier you can capture the supplier’s document by changing the status of your purchase order to invoice and then completing the transaction by saving it.

Receipts and Payments

I do not recommend manually capturing receipts from customers and manually capturing expenses and payments to your suppliers into your bank account. But it can be done if you would like some manual controls in your business.

Bank transactions

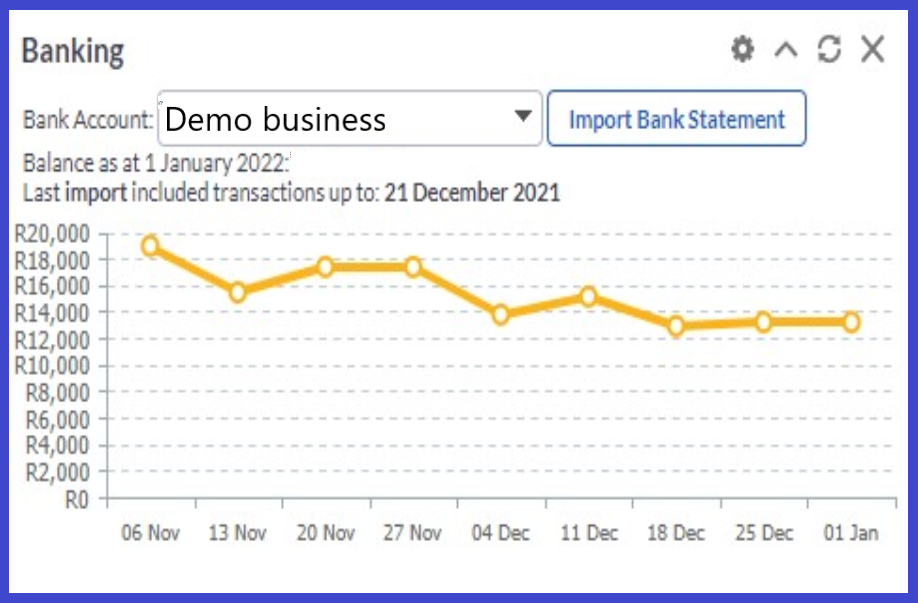

Import Bank Statements or Bank Feeds

The best way to deal with bank transactions in Sage is to import those transactions from your bank or to link Sage to your bank account where the bank transactions are loaded to Sage on a daily basis. Once the transactions are displayed in your banking area of Sage they can then be categorised as expenses, matched to supplier accounts and receipts can be allocated to your customers’ accounts.

The Import Bank statements button takes you to your bank transactions section where you can have multiple bank accounts. If you click on import bank statements, the bank transactions can be imported into Sage or the transactions will be pre-loaded to Sage if you have linked your business bank accounts to Sage. This is known as “Bank Feeds”

The bank payments that are displayed can be allocated to expense accounts which is how we categorise expenses that we do not buy on credit through our supplier system, or we can match payments to supplier invoices.

VAT

Sage assists us in a great way to keep track of our tax liability by the ability to choose the tax type with each transaction. With supplier transactions, the tax has already been accounted for when we capture the supplier invoice.

Customer Receipts

When we choose the customer under the “type” field we are able to allocate receipts and match the receipt to the customer invoice. We select the customer from whom the funds were received in our bank. We can then match this receipt with the invoice that was given to the customer for our goods or services.

Split payments or receipts

We can also split payments or receipts where more than one category has been paid or received with a single transaction. For example, we can pay one supplier for website design and for email hosting but we may like to split it into “Advertising” and “IT expenses”.

Attach Documents

We can attach documents to a bank transaction line as an explanation of the transaction for later use.

Rules

We can set up Rules in Sage to help our efficiency in the future. With the creation of Rules, Sage built a database of Rules to automatically match bank transactions later to specific expenses, income, suppliers, or customers. The Rule functionality in Sage can save us a ton of time by reducing data capturing. The Rules is a very important function which all of the Cloud Accounting packages must-have.

Bank Reconicliations

A very important function for accountants is that we can reconcile bank accounts on the go. This helps to ensure the accuracy of our records.

Reporting

The reporting aspect of Sage Cloud accounting is arguably one of its biggest strengths. You are able to create reports on every aspect of your business.

VAT Reports

The VAT reports are detailed and easy to obtain with the click of a button. The VAT report dates are set in the company settings and from this setting, the VAT is broken down into your VAT periods as determined by your tax jurisdiction.

Users

Under the Administration tab, you can add an unlimited number of users. With the standard package, you get 2 user access which enables you to give simultaneous access to your entire system to another user, irrespective of where they are located.

You can add more users and control their access in the permissions section under “Control user access”.

Sage in a nutshell

That is Sage Business Cloud Accounting in a nutshell. Hopefully, this is enough to give you more information and an overview of this absolutely great software. and if you would like to sign up for Sage Business Cloud Accounting in Africa or the Middle East please use the link below.