This is Part one of a two part series on a payroll taxes validation failure received from SARS when submitting The Annual Reconciliation Declaration (EMP501).

In part 1: I will be showing you:

- Through a case experienced by one of our TFA clients exactly how to find where an error occurred in your EMP501 declaration. This series originated because we experienced a validation failure and spent a lot of time researching online, holding for support and still coming up short. Eventually we found the solution ourselves and would like to share it with you as it can be of assistance to you saving you the hassles and time to search for a solution.

- The process started with communications received by SARS stating that a payroll taxes validation failure error occurred in your EMP501 submission. You will see what this letter looks like. the chances are that you in future will experience this problem or already have.

- Since your EMP501 submission was accepted by SARS. It is difficult to comprehend that an error actually occurred.

In the video below and this article you will learn how to access, view and read the Validation Failure using SARS E@syFile.

A common occurrence

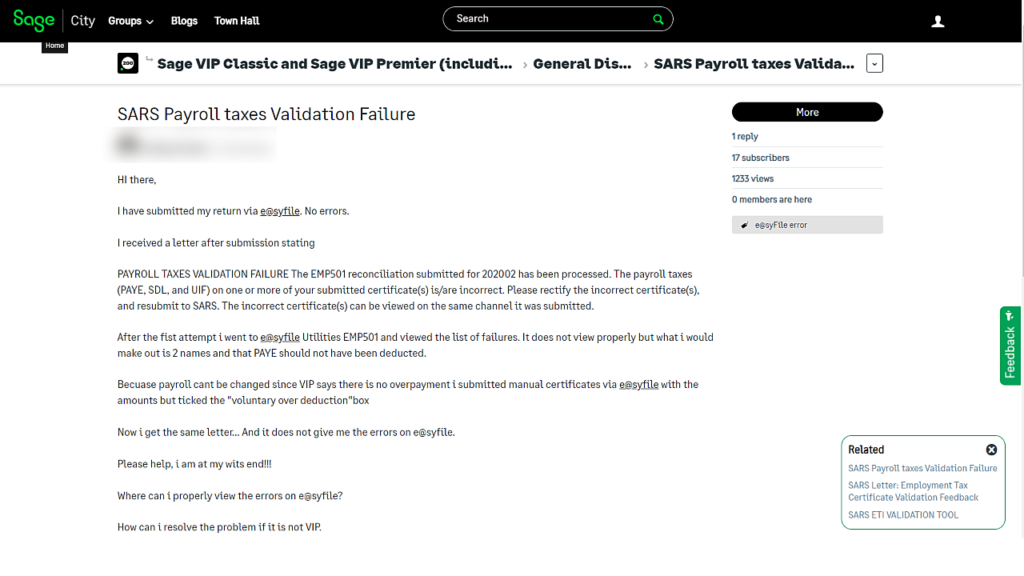

This is a common occurrence as further evident by this query posted on Sage City Community. The post reads:

Hi there,

I have submitted my return via e@syfile. No errors.

I received a letter after submission stating

PAYROLL TAXES VALIDATION FAILURE The EMP501 reconciliation submitted for 202002 has been processed. The payroll taxes (PAYE, SDL, and UIF) on one or more of your submitted certificate(s) is/are incorrect. Please rectify the incorrect certificate(s), and resubmit to SARS. The incorrect certificate(s) can be viewed on the same channel it was submitted.

After the first attempt I went to e@syfile Utilities EMP501 and viewed the list of failures. It does not view properly but what i would make out is 2 names and that PAYE should not have been deducted.

Because payroll cant be changed since VIP says there is no overpayment i submitted manual certificates via e@syfile with the amounts but ticked the “voluntary over deduction”box

Now I get the same letter… And it does not give me the errors on e@syfile.

Please help, I am at my wits end!!!

I’m sure we all felt that!

Where can I properly view the errors on E@syfile?

Don’t worry, I’ve got you, you’re about to learn how.

How can I resolve the problem if it is not from your payroll system.

These failures are rarely from your Sage Payroll software. Automatic calculations leave little opportunity for errors.

Notification from SARS

If a failure with your tax submissions has occurred you will be notified by SARS via email that SARS has issued correspondence which requires your attention. To view correspondence from SARS you are required to login to your SARS Efilling profile or use the SARS MobiApp.

Login to your SARS Efiling profile.

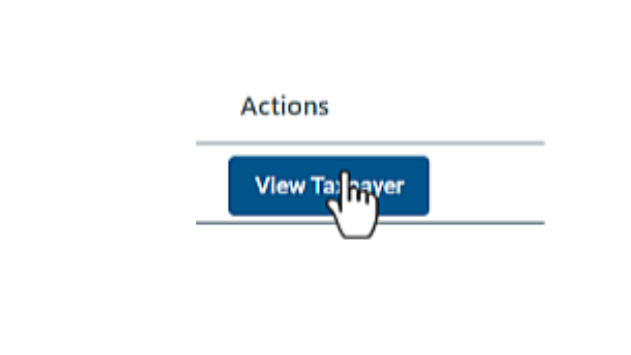

Search for your company or select your company by clicking on the blue “View Taxpayer” button.

SARS eFiling is a free, online tax system for the submission of returns and declarations by taxpayers in South Africa.

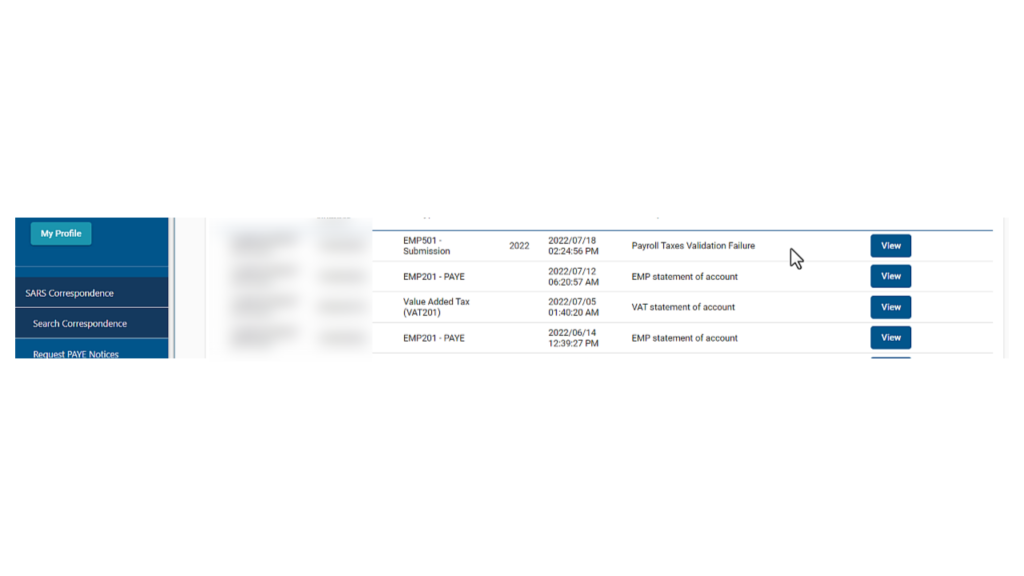

To the left of your screen is a blue sidebar menu. Select the first menu item SARS Correspondence and then select Search correspondence.

Click on the blue view button next to the applicable document. In this case we want to view the Payroll Taxes Validation Failure document. The document will open in a new window.

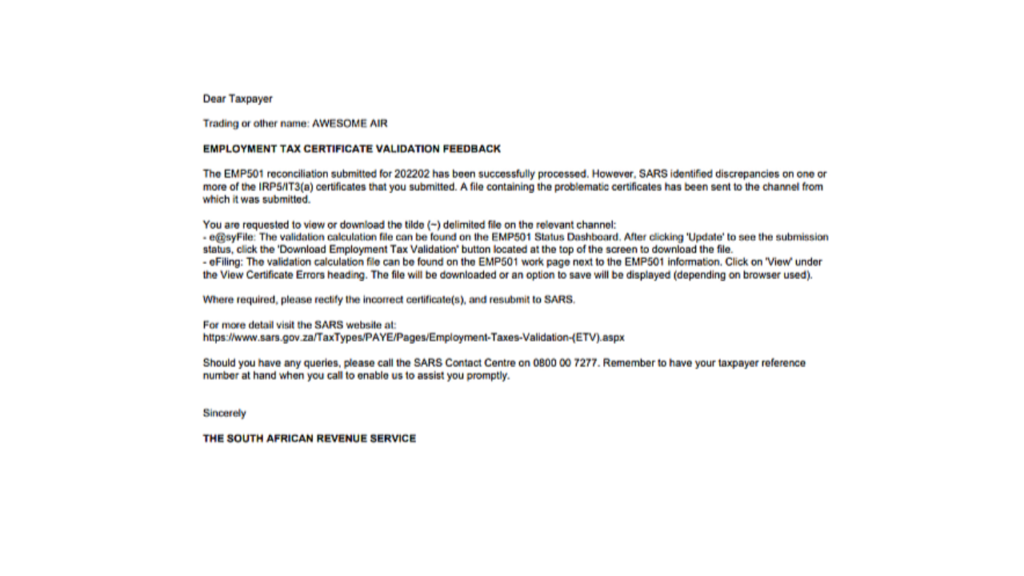

The feedback document instructs us to download a validation calculation file containing details of the failure. I am going to download the file from SARS E@syFile. Because that is the channel which was used to submit the Employer’s annual declaration.

Login to SARS E@syFile with your login details. Select your company and click the continue button to access the companies database.

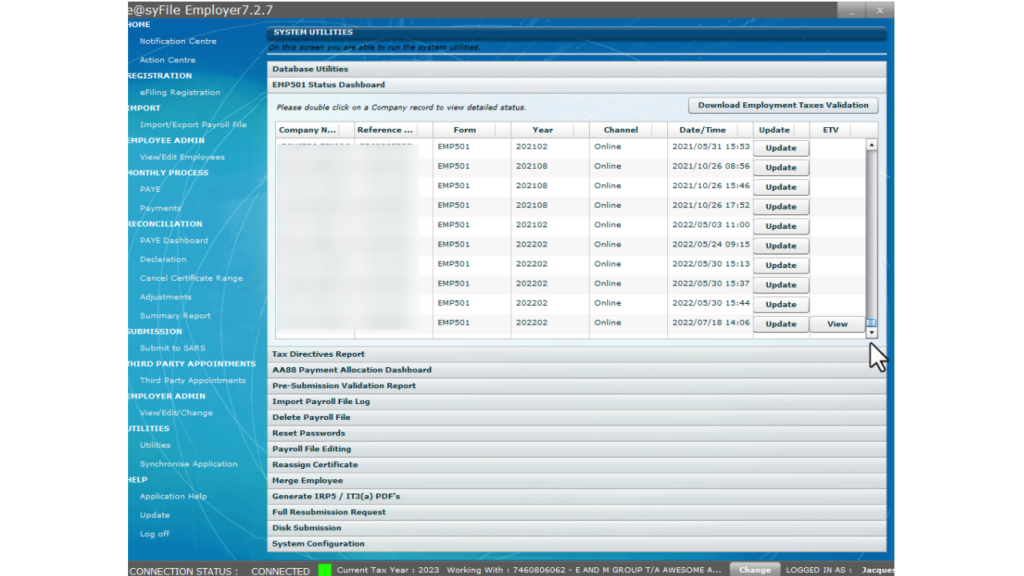

To the left of the screen is a sidebar menu. Select the menu item Utilities. In the system utilities select EMP501 Status Dashboard.

Highlight your company by clicking on it and then click the “Download Employment Taxes Validations”. You will be asked to enter your login details again.

Now a “View” button is available for your company. Select “View”.

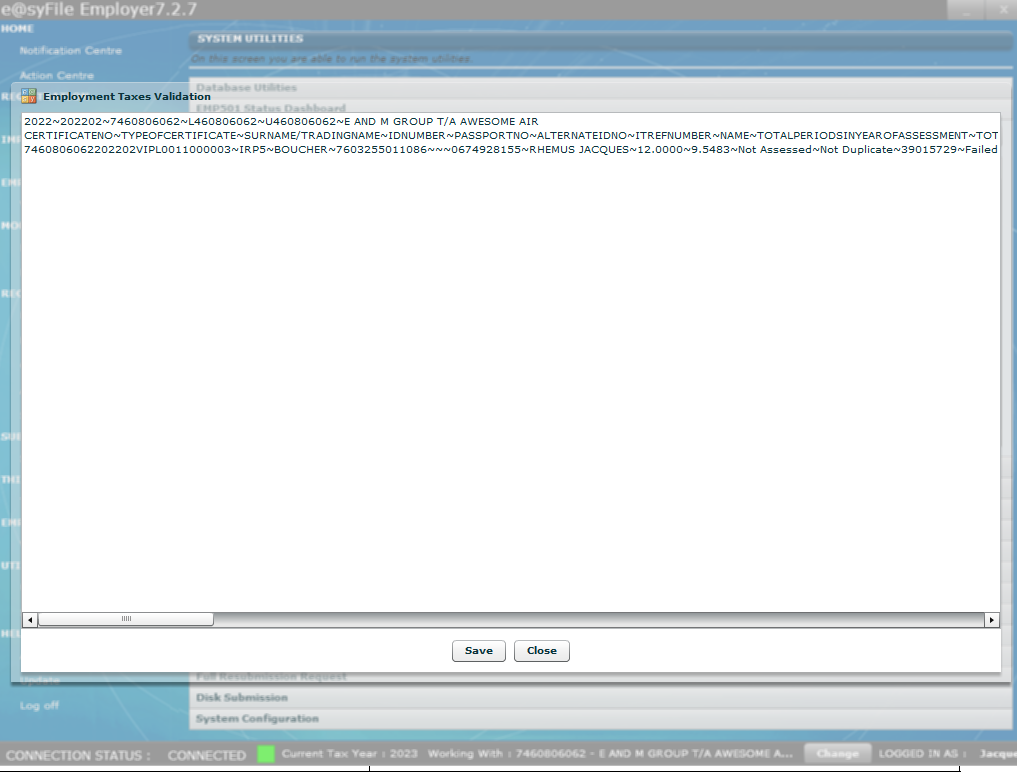

As you can see the file is not in a readable format. You will need to select the “save” button and download the validation calculation file.

The validation calculation file is a tilde (~) delimited file. This means we need to open the file using Excel.

A delimited text file is a text file used to store data, in which each line represents a single book.

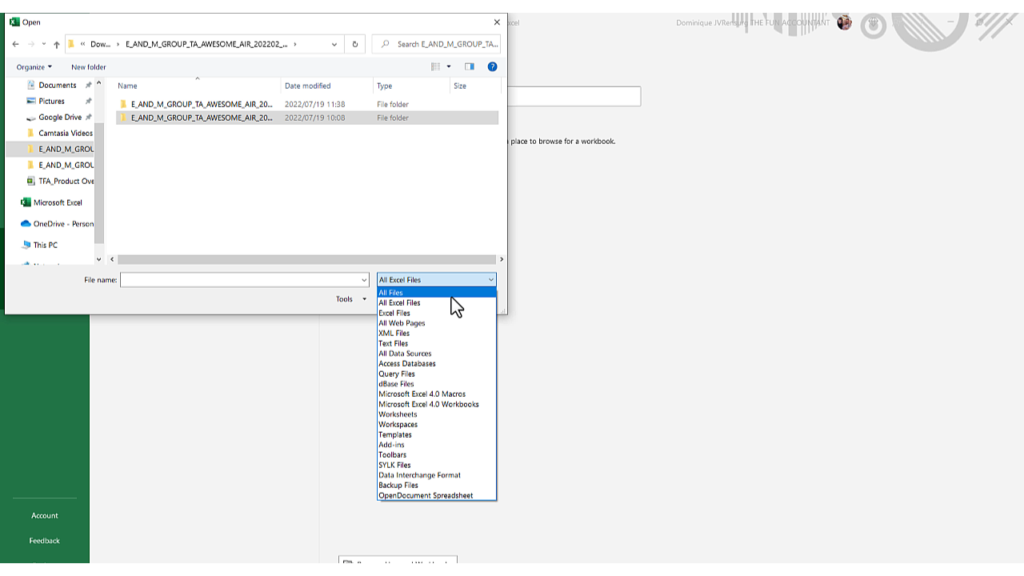

Open Excel. Select “open” to open the validation calculation file you have downloaded. At the bottom of the file browser window next to File Name is a dropdown where you need to select all files as the format of the file we want to open is not an .exe file.

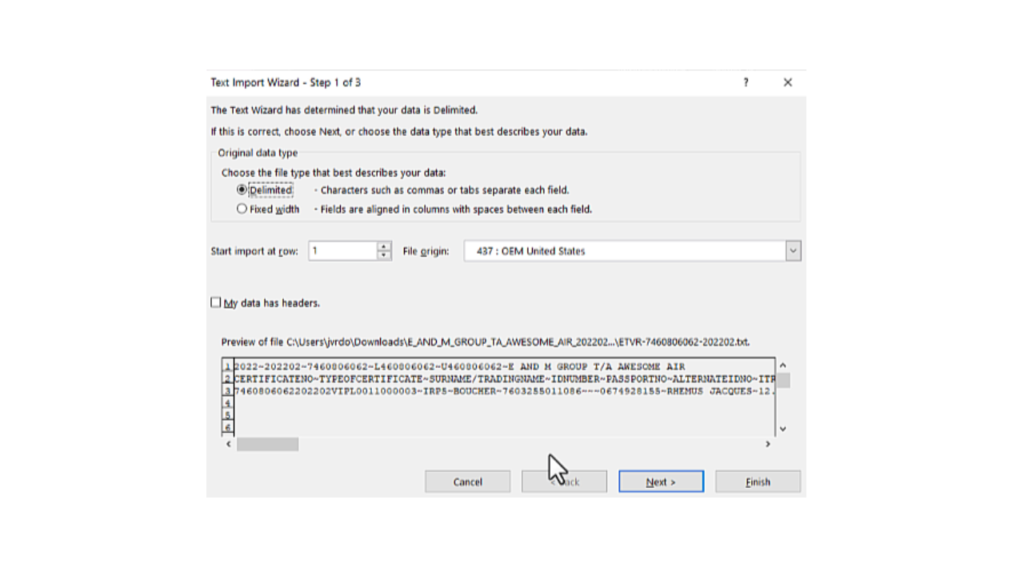

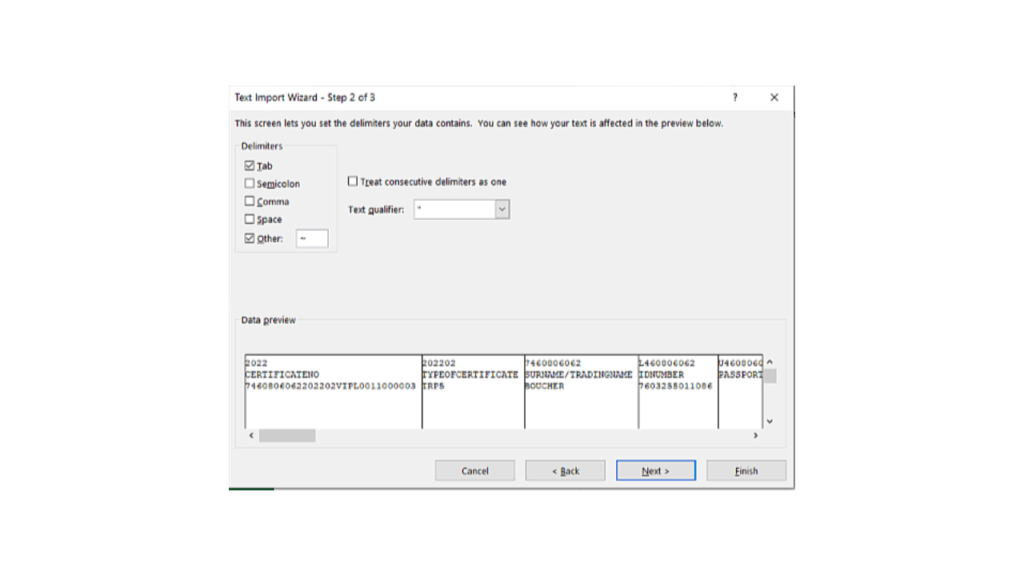

Select the file. Excel will open the text import wizard. The import wizard will detect the data format as Delimited. Select “Next”, now we need to set the delimiters in our data.

As you can see here and as stated earlier we have a tilde (~) delimited file, meaning our delimiters are the tilde (~) symbol. Select “other” and enter the tilde symbol found on your keyboard.

Select “Next” you may skip this step in the text import wizard and complete it. Select “Finish” and wait for the spreadsheet to open.

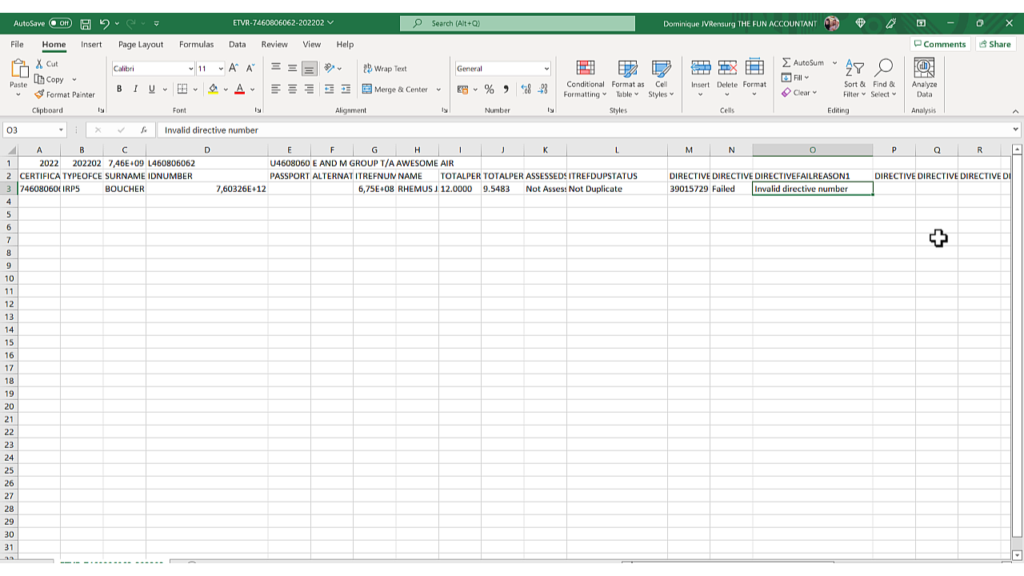

Now we can see which employee certificate has a validation failure and what failure has occurred.

Join us next for Part 2 in the series of payroll taxes validation failures where we show you how to fix the error by the resubmission of our EMP501 declaration.