Presented here are tax tips for South African Estate Agents to help them navigate the treacherous tax landscape of South Africa.

These tips are basic tax considerations. This is not a graduate tax article and merely for informative purposes and does not constitute tax advice. For tax advice applicable to your needs, contact your registered tax practitioner.

Follow the link to the video below for those more visibly stimulated.

The outcomes of tax tips for South African estate agents are:

Independent Estate Agent vs. Employee Estate Agent

Estate Agents considering their tax options have to draw a clear distinction between an Independent Estate Agent vs. an Employee Estate Agent.

The reason for that is because the income of these 2 types of working arrangements are taxed differently.

An independent estate agent in essence operates as a stand-alone, independent business.

VS

An agent that works for commission in an employment relationship with a company.

Rules to determine independence

In the real estate industry the relationship between the individual estate agent and the Real Estate Company or Broker can be vague and it is not simple to pin it down.

The safest route to take is to be guided by the Revenue Service’s Guidelines, because they are the guys pivotal in determining the responsibility of an estate agent as to how to account for:

- Money received

- Expenses incurred

- Tax liability

- Manner of tax payments.

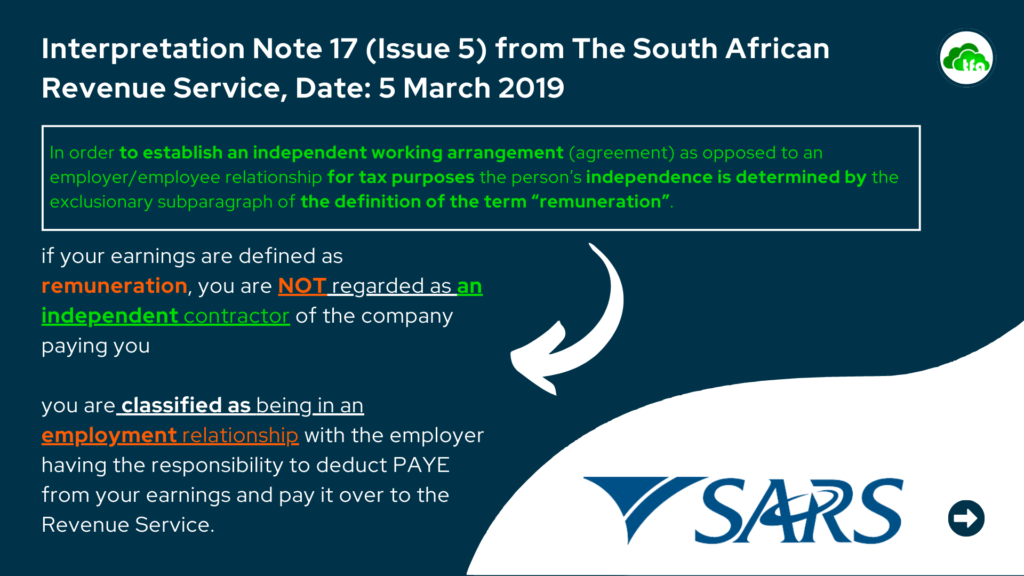

What now follows are extracts from and definitions laid down in Interpretation Note 17 (Issue 5) from The South African Revenue Service, Date: 5 March 2019.

In order to establish an independent working arrangement (agreement) as opposed to an employer/employee relationship for tax purposes the person’s independence is determined by the exclusionary subparagraph of the definition of the term “remuneration”.

Interpretation Note 17 (Issue 5)

This means that if your earnings are defined as remuneration, you are NOT regarded as an independent contractor of the company paying you.

Then you are classified as being in an employment relationship with the employer having the responsibility to deduct PAYE from your earnings and pay it over to the Revenue Service.

Independent Contractors’ Taxes Tests

To conclusively deem a person not to be an independent contractor for employees’ tax purposes 2 tests have to be passed.

A person shall not be deemed to carry on a trade independently if the services or duties are:

TEST 1

Required to be performed mainly at the premises of the client, and

the worker is subject to the control of any other person as to:

- the manner in which the worker’s duties are or will be performed,

- or as to the hours of work.

TEST 2

The worker is subject to the supervision of any other person as to the manner in which:

- the worker’s duties are or will be performed, or

- as to the hours of work.

Where either Test 1 or Test 2 apply positively, the worker is deemed NOT to be an independent contractor.

The amount received by the estate agent is, therefore, not excluded from remuneration (and tax must be deducted accordingly as Employees tax also known as PAYE from the income received).

In contrast NO TAX will be withheld by the company from the earnings of an independent estate agent.

In short an estate agent’s independence is determined by:

- Where duties are performed. (place of conducting business).

And / or - The control exercised over the agent in terms of how duties are performed (manner of work).

And/or - Control of when duties are performed.

Typical Clauses in Contracts reinforcing the Estate Agent’s Independence

It is best to turn to the contract between the 2-parties to establish the agent’s independence and hence how the money flow has to be treated.

We are now going to look at the terms of a typical agreement that clearly establish an independent relationship and not an employment contract.

No Supervision over Time and Manner of how duties are performed:

“The Estate Agent shall be free to devote to his or her real estate service business such

portion of his or her time, energy, effort and skill, as the Estate Agent sees fit and to

establish his or her own endeavours.”

“The Estate Agent shall not be required to keep definite office hours, attend sales meetings or adhere to sales quotas.”

“The Estate Agent shall not have mandatory duties except those specifically set out in this Agreement.”

“Nothing contained in this Agreement shall be regarded as creating any relationship (employer/employee, joint venture, partnership, shareholder) between the Parties, other than the independent contractor relationship as set forth herein.”

The Estate Agent may be:

- a natural person,

- a company or

- close corporation.

(Each entity is taxed differently)

Taxation Arrangements with Independent Estate Agent

Typically, an employee incurs no “business expenses” and is reimbursed or granted allowances for expenses on behalf of the employer, while an independent contractor incurs business expenses (advertising, entertaining, bookkeeping, wages, travel etc) and builds these into the fee or contract price.

Similarly, an employee might not have to register with the Department of Labour (as a labour broker or employer) or with SARS for Value-added tax (VAT) (as an enterprise) or for PAYE (as an employer), where an independent Estate Agent may have to depending on their circumstances.

The independent estate agent clause on tax responsibility also reads:

“The Estate Agent understands that he/she or it is entering into this Agreement as an

independent contracting estate agent and not as an employee.”

“The Estate Agent understands that it is the Estate Agent’s sole responsibility for paying all income taxes, withholding taxes, and other taxes and amounts required by law for the Estate Agent’s compensation and all other payments to the Estate Agent, if any.”

“Neither the Estate Agent nor any of his/her/its staff is an employee or agent of the Company for any purpose whatsoever.”

“The Company will not withhold and pay any income or other taxes on the Estate Agent’s compensation.”

“The Company will have no responsibility to provide any insurance, retirement or other employee benefits to the Estate Agent.”

“The Estate Agent will not be treated as an employee with respect to services rendered by the Estate Agent pursuant to this Agreement for tax purposes.”

In practice this means that no taxes will be withheld from the estate agent. It also places a responsibility on the estate agent to provide for his/her own taxes as a business and to provide or make provision for a tax bill as a provisional taxpayer normally three times during a tax year.

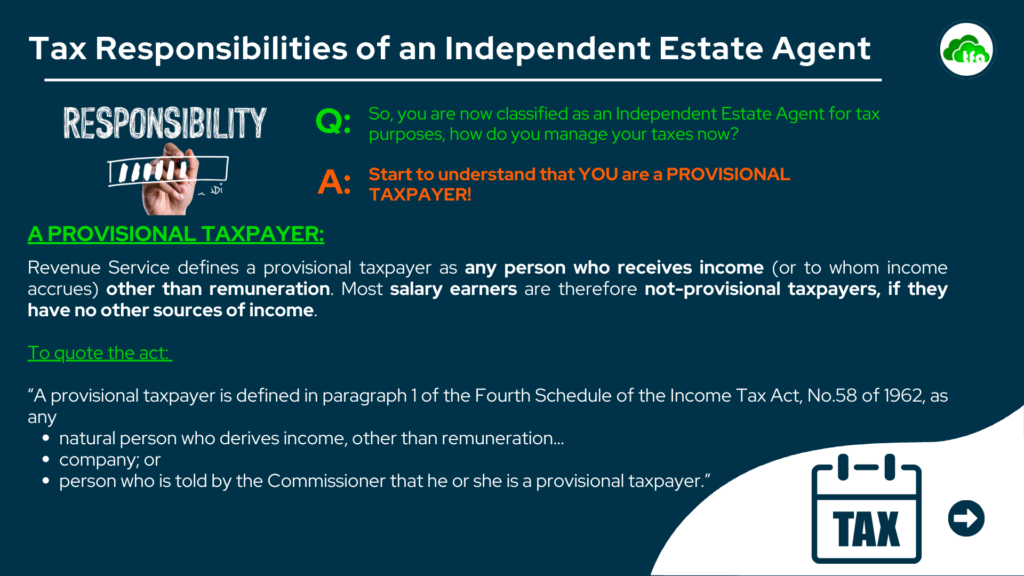

The Tax Responsibilities of an Independent Estate Agent

So, you are now classified as an Independent Estate Agent for tax purposes, how do you manage your taxes now?

Start to understand that YOU are a PROVISIONAL TAXPAYER!

There are instances where a person can receive income other than remuneration and be excluded from being a provisional taxpayer:

Exclusion Test 1:

Any natural person who does not earn any income from carrying on any business – provided that person’s taxable income will not be more than the tax threshold.

2023 tax year thresholds are:

for taxpayers below age of 65 – R91 250;

age 65 to below 75 – R141 250 and

age 75 and over – R157 900);

Or

Exclusion Test 2:

The taxable income of that person (earned from interest, foreign dividends, rental from letting of fixed property and remuneration from unregistered employer) will not be more than R30 000;

The practical implications of being a provisional taxpayer is that the “buck stops with YOU”.

- You will have to enforce self discipline to put money away to provide for the glooming tax guillotine above your head.

- Nobody is going to deduct tax from your income and

- no one is going to create a tax certificate for you.

- You need to create an income statement as laid out in the example to follow and

- You will probably need a professional accountant to assist you with your tax return.

- Most important of all, if you do not keep proper records of your expenses with the necessary knowledge of what is deductible from your income to derive at a net profit which is one of the markers needed in your tax computation. You will lose out and pay more tax than is lawfully required.

The final tax amount due

The final tax amount due by you is determined with real figures unlike provisional taxes which is based on an estimate. It will be helpful to think of your provisional tax payments as credits which will be deducted from your final tax amount to arrive at a tax liability or refund.

How is the income tax determined on an Estate Agency Business (In general)?

Commission Income

Less: Allowable Tax deductions / Expenses related to estate agent’s business

Equals: Business Profit

Add: Other Taxable income

Less: Exemptions e.g. Interest rebates

Less: Special Deductions e.g Donations to PBO, Retirement Annuity.

Equals: Taxable income

Calculate: Income Tax

Less: Section 6 “age” rebates

Less: Section 6A Medical Tax Credits (medical aid tax credit rebates) Less: Section 6B Additional Medical Tax Credits (additional tax expenses)

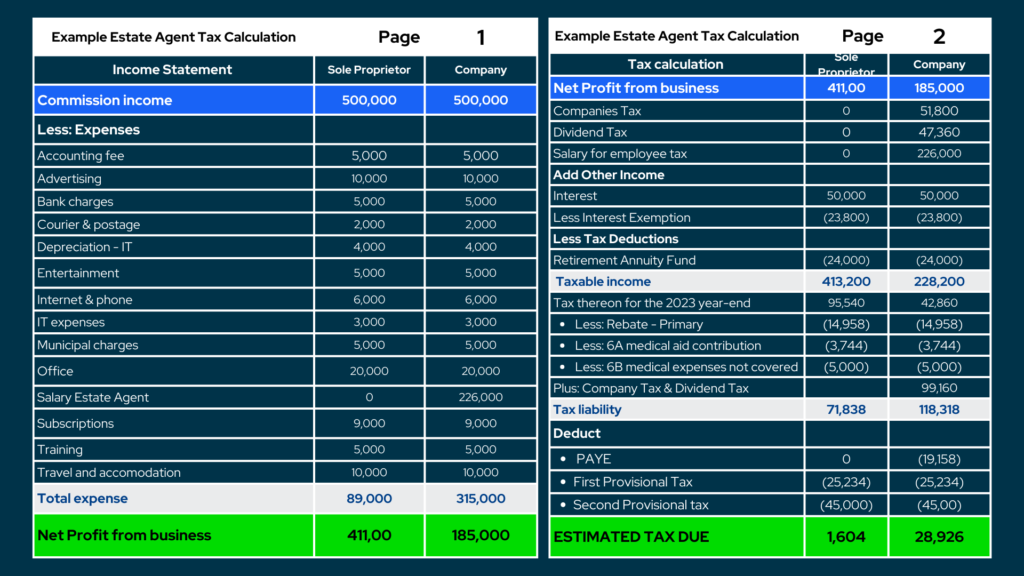

Let’s do a practical example of an Estate Estate Agent’s tax calculation:

We display two possible scenarios:

- The Estate Agent trades as a Sole Proprietor (individual) and

- The Estate Agent trades as a company. (Be careful of a company)

Both entities have exactly the same income and expenditure except for in the company the agent gets a salary of R226,000. The company has to deal with dividend tax, which is not required for a sole proprietorship.

It is clear that trading as a Company will not always ensure the lowest tax liability. Comprehensive planning is required with a company coupled with keeping company records and other obligations will result in escalation of costs.

The company’s tax can be minimised when it is classified as a Small Business Corporation as defined by the Tax Act. There are conditions that must be complied with in order to qualify as a Small Business Corporation.

Delving any deeper into this subject is beyond the scope of this presentation and I would advise you to seek professional tax advice if you consider trading as a company.

General Guidance as to when to consider to trade as a Company:

You have employees and have to register your business as an employer at the Department of labour, SARS and Unemployment Insurance Fund.

2. Turnover

Your turnover is in excess of R1m and you have to register for VAT.

3. Partners

Partners are joining you in the business. For continuity purposes issuing shares may be better than partnership agreements.

4. Small Business Corporation (SBC) for Tax purposes

You have three or more unrelated people, full time employed within the business. (Small Businesses Corporation requirement)

Course of action for an Independent Estate Agent

- Know your status:

Are you an employee or independent contractor as defined by Revenue Services. - Save money for tax!

Put 25% of your gross income away for taxes. - Submit Provisional Tax Returns:

Thereby avoiding penalties and interest. - Keep accurate records of ALL your expenses:

Taxpayers lose millions of Rands in excessive taxes by not keeping record of all their expenses. There are technologies like Dext that simplify the keeping of records and storing it to prove the claim later as an expense. - Remember the basic rule:

Expenses incurred in the production of income are deductible from income for tax purposes. - Stay up-to-date with your accounting records.

Using an online accounting system that is kept up-to-date so that you have minimum admin work and can be accessed from anywhere will be a great asset in your business. You will know your financial position at important times. Sage Accounting is my preferred Cloud Accounting system. - Claim your work space as a deduction from your income and keep a logbook of your travel kilometres.

- Get professional help early, before it is too late.

In the long run, having to deal with old records and tight deadlines instituted by SARS costs more than being up-to-date with your books and tax submissions.

Tools to help you succeed as an estate agent

Presented in the image above are the tools that many of my estate agent clients use. The DEXT product is brilliant for capturing slips and vouchers, storing them and extract them without effort and is perfect on its own for those agents that are working in an employment arena for commission and who is allowed to deduct expenditure relating to generating their commission income.

For the independent estate agents who needs a cloud accounting system as they would have to generate regular profit and loss reports for tax and other purposes my preferred product is Sage Cloud Accounting combined with Dext and those who have employees I recommend Sage Cloud Payroll.

For the estate agents who manage properties in addition to their selling efforts I would recommend adding Netcash to your arsenal of tools. All of these products will help you to do business easy, quick and precise.

Thanks for reading!