I am going to show you how to refresh your ITR12 tax return on the SARS eFiling system, when this is needed and what the implications are of refreshing an ITR12 Income Tax Return.

Normally individual taxpayers would refresh their tax return on SARS eFiling after there have been changes to their:

- IRP5 data

- Medical Data

- Retirement Annuity Data

- Investment Income or

- Tax Free Investments.

This article integrates with the article how to do an Annual Reconciliation Declaration (EMP501) submission for a company using SARS E@syfile which is a requirement of the tax authority in South Africa.

Check out the video below accompanying this blog:

When do you need to refresh your ITR12 tax return?

- Best practice would be to always refresh your ITR12 tax return before you complete and finalise your annual tax return submission. Refreshing the return will ensure that any changes are updated, even a change that you might not be aware of.

- You as the taxpayer might have discovered an error on any of your certificates and requested your employer or the investment fund or bank to correct it. It is unlikely for banks to make these mistakes but employers sometimes do.

The taxpayer in this example’s tax return for 2022 was auto assessed by SARS and upon reviewing the tax assessment, the taxpayer discovered that not all the certificates have been included in his tax return. He then requested from his employer an updated IRP5 certificate. We then submitted the annual declaration on behalf of the employer and the new certificate was added and reflected on the taxpayer’s tax return. I am going to show you exactly how the individual’s tax return looked before and after the correction.

A word of advice is to always check the auto assessments performed by SARS or to get a professional tax practitioner to check it for you, because you might be on the bad end of the stick of overpaying tax, which is never a good experience. - In another scenario you could be informed by your employer or Investment Fund that there has been a change to your IRP5 certificate from their end which will require you to refresh your ITR12 return, and

- lastly SARS might inform you of an update of your information.

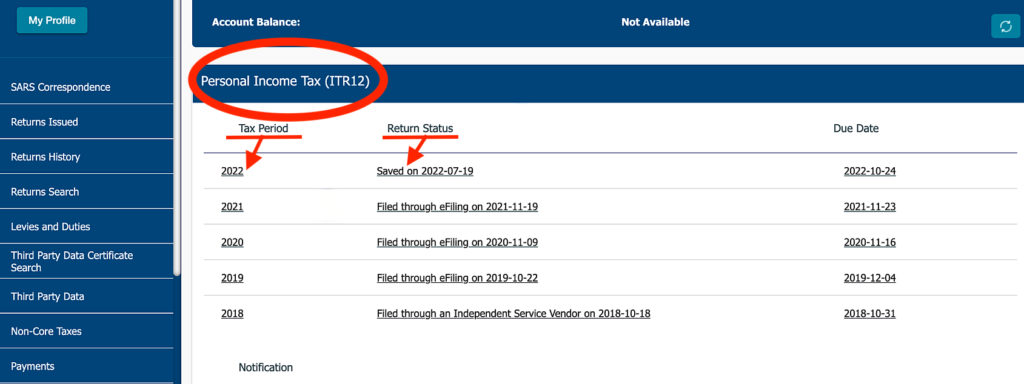

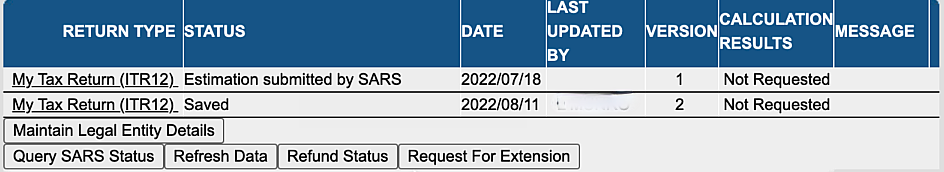

The e-filing tax return screen

Here I am logged in on the SARS eFiling system and I am on the tax submission screen where I can access any of the previous or the current years’ tax returns. The 2022 current years’ tax return Status is Saved with the date it was last accessed.

The 2022 date means: the period ending the last day of February 2022, which is the year-end date for individual South African taxpayers.

To access the tax return plus other forms like the assessments and communications pertaining to that year:

- Click on the 2022 button.

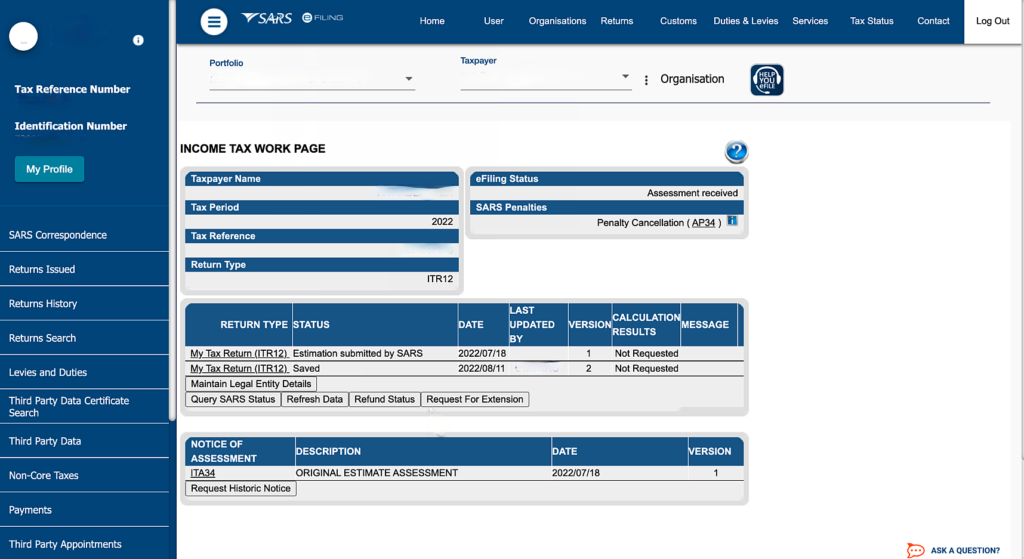

Income Tax Work Page

The Income Tax Work Page will open. You will be presented on this screen with 100% of the information that most people will need to complete their tax return for a specific tax year.

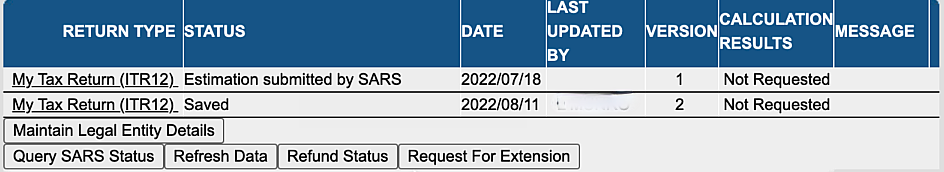

My Tax Return – Estimate submitted by SARS

I am going to focus on the Tax returns created as laid out below.

The first return was automatically updated and assessed by the tax authority. These auto assessments are a growing trend and the tax authority is blowing its horn for the growing number in which they are auto assessing taxpayers.

But do not trust and just accept the system as I am going to show you now that there was an error with this SARS assessment.

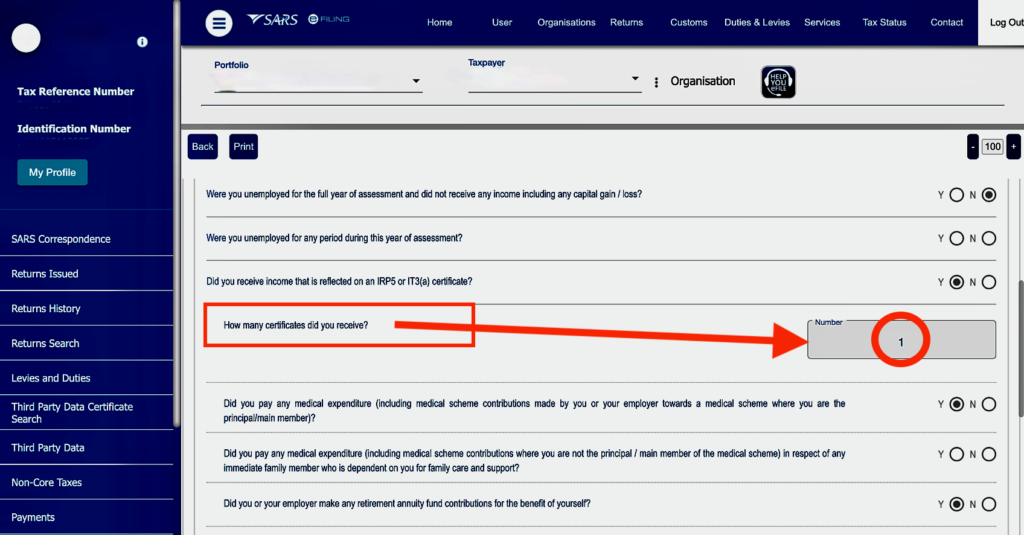

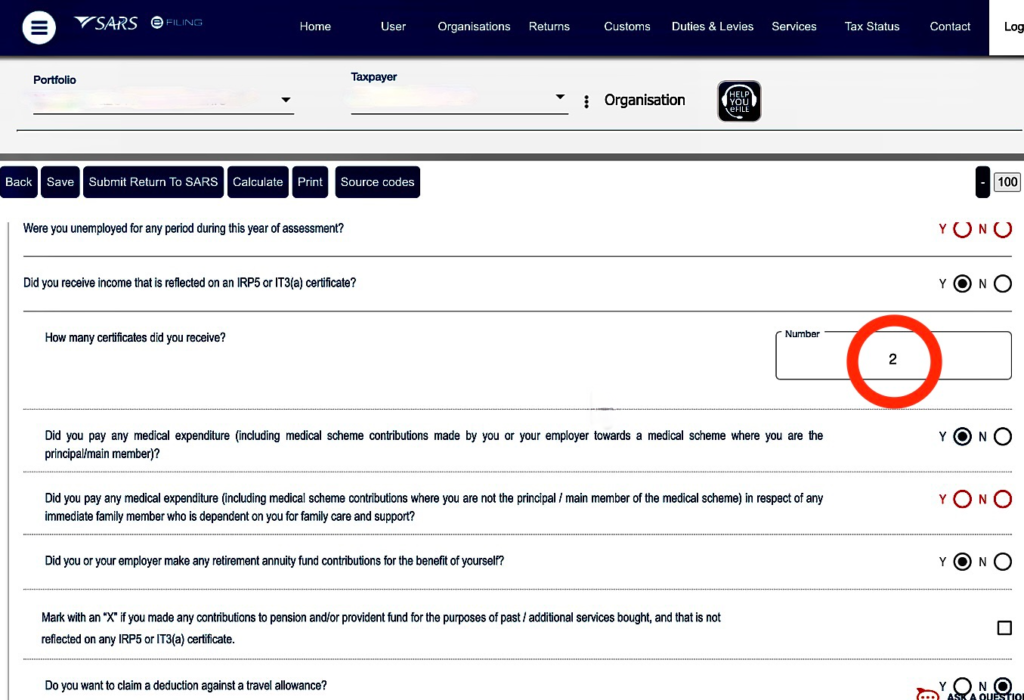

When I click on the return to open it and scrolling down to the area of concern in this case: the number of certificates issued. As you can see next to the question: How many certificates did you receive? The number is 1. Which was not correct as there is a certificate omitted from this tax return.

Click back to go to the Income Tax Work Page.

Request a Tax Correction

On the Income Tax Work page you can see that there is another saved ITR12 tax return. I have requested a correction of the SARS estimation and they have issued another return which is saved as a second return. This request of correction I performed is unfortunately not included with this blog. But I think it is clear enough of what I did to get to this point.

We have looked at the “Before shot” lets Refresh the data on this return and see what happens.

E-filing: Refresh Data

Below the tax return you will see the Refresh Data button next to the Query SARS Status. You can’t miss it. When you hover over it you will see a clear message explaining what Refresh Data does.

It reads: “This will refresh your IRP5/medical/Retirement Annuity data and address data to the latest data available.”

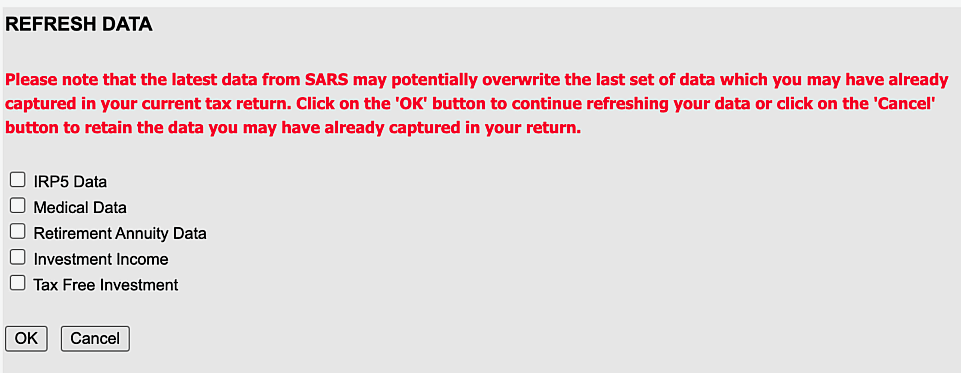

Refresh Data Warning

If you click the Refresh Data button you are presented with a red warning message explaining that the information you have already captured will be overwritten.

ITR12 refresh data checkbox

You are also presented with a checkbox of items that you would like to update. The options are:

- IRP5 data

- Medical data

- Retirement annuity data

- Investment income

- Tax free investments

Select IRP5

In this example I am going to refresh the IRP5 Data of the employer which is what I select and click on OK.

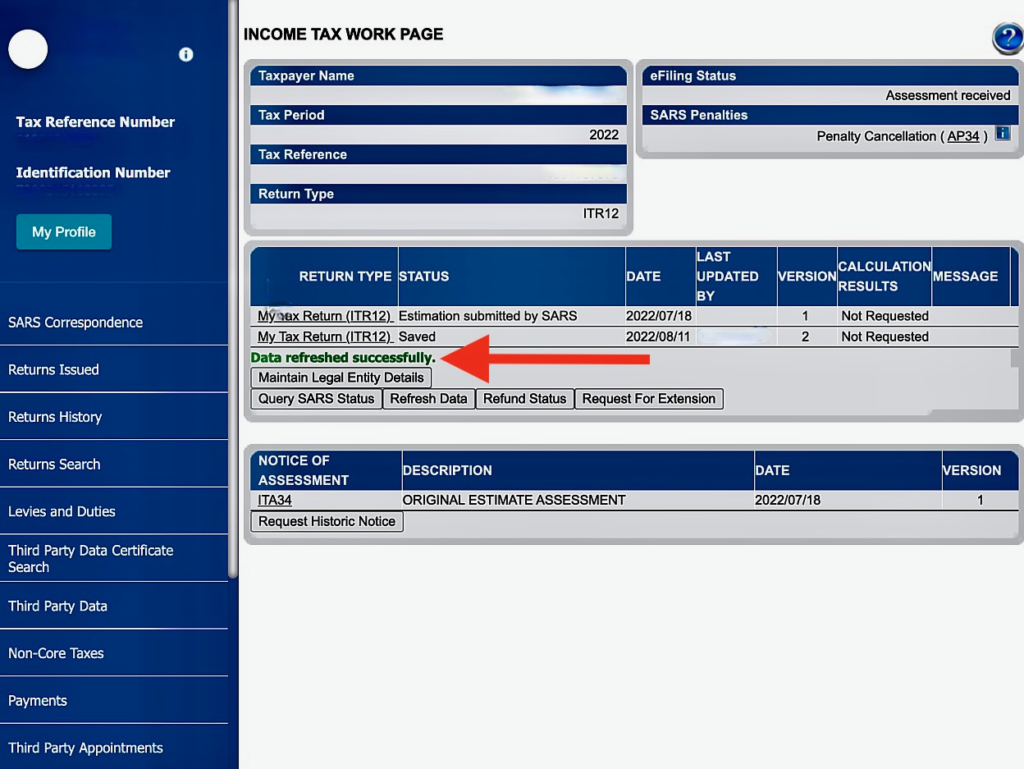

“Data refreshed successfully”

You will get a green notification that the Data refreshed successfully right underneath the tax returns.

Testing and viewing the effect of refreshing tax data of an ITR12 tax return

Lets click on the saved Tax return to see the effect that the refreshing of the data had on our information and whether the process installed by the tax authority actually works.

After the tax return has opened, I scroll to the IRP5 section. I can now see that there are two(2) IRP5 certificates.

Checking your IRP5/IT3(a) certificate’s detail on your tax return

Your employer or investment fund or bank should give you an IRP5 or IT3(a) certificate (in the case where no tax was paid on behalf of the employee). The taxpayer should not add this certificate to their tax return when completing it on efiling, because the IRP5 or IT3(a) data are populated and updated to each person’s individual tax return via the annual EMP501 declarations.

The certificate is useful to check that the information given to you agrees with the information that are populated on your tax return.

Employee Tax Certificate Information [IRP5/IT3(a)]

In order to do this I am going to scroll down to the “Employee Tax Certificate Information [IRP5/IT3(a)]” sections of the tax return and click on the dropdown button upon which the first IRP5 will opens that I compare with the certificate on hand.

![SARS eFiling ITR12 Employee Tax Certificate Information [IRP5/IT3(a)]](https://thefunaccountant.com/wp-content/uploads/2022/08/Employee-Tax-Certificate-Information-IRP5IT3a-1024x564.png)

The second IRP5 certificate is numbered as a heading and you click on the dropdown button to view the details of the certificate.

![SARS eFiling Employee Tax Certificate [IRP5/IT3(a)]](https://thefunaccountant.com/wp-content/uploads/2022/08/SARS-eFiling-ITR12-Employee-Tax-Certificate-Information-IRP5IT3a-1024x597.png)

By comparing this data with the certificate from the employer on hand I can see that all the information agrees and I am happy to proceed with checking and completing the tax return.

After you have saved the return and gone back to the income Tax Work page, you can see that the Green Data Refreshed notice has disappeared.

Conclusion

We have reached the end of this blog, where I essentially wanted to test and show you whether changes made by employers on an individual’s tax certificate after the tax season has opened actually does flow through and update that person’s tax return on their end.

It was good to see that I was successful with the Refreshing Data option on the individual’s ITR12 Income Tax Work Page and that the system proposed by the Tax Authority does work.

I know that not many people have the chance of seeing a real live example being tested on someone else’s tax return, but I believe by seeing it and coming back to this blog it might just help you with your own tax stuff.

Thank you for reading.