Xero is a cloud-based accounting software that is primarily used by small businesses. Xero is popular among many accountants and it is being used in over 180 different countries.

I have applied Xero in a business based on the fact that Xero is boasted as easy to use and “the best accounting and invoice generating software”. I was told that it is the preferred accounting software to be used with Unleashed Inventory system.

As a Chartered Accountant and specialist user of cloud accounting software, I was disappointed in certain functionalities of Xero up to a point that I was embarrassed by the results provided by Xero.

Xero definitely does have positive aspects and in future reviews, I will address those. The purpose of this post is to explain some of the reasons why I canceled my subscription to Xero and opted for Sage Accounting instead.

Let’s jump into it.

Top Header – Navigating the system

This may be personal preferences but why do Xero use 2 tabs in the top header naming “Business” and another “Accounting”?

I do not understand the rationale behind this because creating a customer age analyses is categorized under “Accounting”, is this not part of a business function? It took me a while to get used to navigating in Xero. Eventually, I simplified it by reasoning that if I wanted to perform a function like creating/authorizing an invoice I click on “Business” and when I wanted to get a report I clicked on “Accounting”.

I find it much easier to navigate in a system such as Sage Accounting which has more options in the top header without having to drill down to see what is displayed underneath. This saves a lot of time especially in the beginning stages of using cloud accounting software.

In Sage, if I want to create a new customer, or sales invoice or a customer ledger it’s simple I click on customers, everything related to your customer is all there.

Xero Customer Statements are inaccurate

You can imagine the devastating impact of inaccurate customer statements on the cash-flow of a business. Sending customer statements is a vital process that is required when managing the money owed to you.

Xero created an inaccurate reflection of a customer account that I needed to send. Let me explain:

Firstly, generating a customer statement was a mission. I head over to the Accounting tab and then inspected the Sales section. I could not find it there. Just in case I also looked in the accounting section, not there either.

I did a google search and found these steps to create a customer statement in Xero:

- In the Contacts menu, select Customers. You can also access statements from the Options menu within a customer’s contact record.

- Click Send statements.

- (Optional) Change the statement type or date and click Update.

- Select the customers you want to email statements to.

- Click Email.

- Enter or change the information in the Send Statement window.

- Click Send.

I looked at the customer balance and the balance appeared to be correct.

I clicked on Send statements

The customer amount due is now R23,074.75. Worst of all it says due to us and not the R30,360 that is actually due to the customer. After a lengthy investigation, I found that the R30,630 amount due to the customer is correct.

I double-checked this to the customer statement that I was about to send to the customer. Hoping for the correct amount to be reflected. The customer statements are incorrect (See below).

I knew that I had a major problem with my customer balances and that I could not create customer statements in bulk and sent it. The business as well as the customers were asking for accurate statements!. Sending customer statement reports is a simple function that could normally be perform blindfolded within seconds. In Xero, it became a nightmare of uncertainty, trial, and error.

My explanations to the customer as to why I could not give an accurate statement was met with disbelief and distrust, especially given that a refund was due to the customer. My reports were met with words like: “what kind of system are you using!?” Xero left me in a state of embarrassment and distrust in the system.

I then started my investigation as to exactly why and how these inaccuracies occurred.

Problems with Customer ledgers in Xero

All my years of training and experience taught me that the starting point of solving an entry in accounting records is to inspect the ledger. So I decided to look for a customer ledger in Xero to find all the entries recorded. I could not find a customer ledger and be directed by the questions and answers in Xero Central to create a “Contact transactions – Summary”

In order to expand and view the transactions, you have to click on the amount. The expanded version is below.

- In Xero, all the transactions are reflected in one column and not 2.

- The report does not make mention of any debit or credit.

- Compared with the Sage Accounting report below. The Sage Accounting report reads easier, balances can be explained and debits/credits provide clarity about the capturing of the accounting entries. More columns = more clarity.

Another problem with Contacts transactions summary

When a customer account has no amounts outstanding, you can’t create a customer transaction summary.

I observed a tendency by Xero to refrain from using debits or credits. Debits & Credits are the basis of accounting in my opinion.

Problems with advance receipts and payments

It is common in business to receive a deposit in advance before the product or services are delivered. You will also be required from time-to-time to make payments in advance for products or services to be delivered.

I am going to focus only on the customer cycle but the bills payable had the exact same issues.

In Xero, you cannot allocate a deposit receive in advance to a customer account. You can only allocate deposits received to a general ledger account these are treated a “prepayment”. Xero follows the logic that you must create an invoice and then only does Xero allows you to allocate a receipt to an invoice.

Why is this a big deal?

- The deposit received being allocated against a general ledger account creates an unnecessary transaction and additional processing steps that have to be taken. This is time-consuming.

- It complicates the books which are contradictory to the claims that Xero is simple, user-friendly and easy to use.

- By creating this additional “prepayment” general ledger account, another account was created that had to be reconciled and explained. At any given point of time, there will be a balance in this account which has to be explained and traceable to supporting documents. I had 443 line items at month-end in this account, which were generated within 1 month. It was time-consuming to analyze this and unnecessary. There are systems that allow you to allocate a deposit received directly to the customer account.

- Due to the fact that the customer deposit was not reflected on the customers’ account, I could not provide the customers with statements from Xero reflecting what was their deposit paid and the status of their account.

- Each customer account had to be manually reconciled and reported on by now using tools from outside of Xero. Our workload increased 10-folded. In a business with many customers and many deposits, this became a full-time job with additional costs.

- I was informed that the solution is to create an invoice upon a deposit. This is not in-line with accounting principles of recognizing income which must only happen when the service has been delivered or when the risk of ownership of goods has been passed over to the customer.

- By creating invoices upon deposits received without having delivered the goods or services open the business books up for manipulation of overstatement of income.

Xero Support

Their support options are:

- Get support on Xero Central – This type of support is done by searching through various articles, questions, and answers. Within Xero central, you can start a discussion by asking a question to the community.

- Contact Xero support – You raise a case with the Xero support team. When I used this avenue I had to wait for hours for feedback on my case.

- Aks your adviser – A question is sent directly to your accountant and you’ll receive a response via email.

Xero is falling short in the support department.

- My queries and issues could not be quickly resolved and the process to find solutions is painstaking.

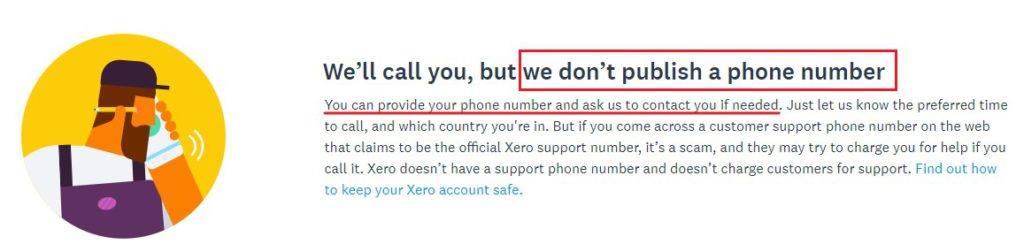

- Xero lacks telephonic support as they do not provide contact phone numbers. For accounting software on which business owners depend it may be problematic in emergency situations and in more complex cases.

- The lack of online chat. Xero’s competitors provide 24/7 online chat facilities.

Summary of the Xero cons

There may be a business scenario where there are more pro’s of Xero than cons.

In this post, I have given some reasons why I canceled my Xero subscription in a specific situation.

The summary of the reasons are:

- Navigating issues;

- Inaccurate customer statements;

- The layout of customer ledgers;

- Lack of full reporting in the contacts transaction summary;

- Allocating of deposits and advance payments and additional work to be performed;

- Time-consuming additional reconciliation of the prepayment general ledger account;

- Lack of timeous support.

The decision about which cloud accounting software to use for your business is an important one. This decision can result in hours of frustration or hours of pleasure. I hope that this post can assist you when making an informed decision about the best cloud accounting software for your business.