At times, you would want to process transactions in the prior year in your Sage Cloud Accounting books. You may get an error message when doing so, which prohibits you from entering data in the prior year. If this happens it is likely that a lockdown date has been set blocking you from entering transactions.

You are able to remove the lockdown date set in Sage Cloud Accounting in order to process in the previous year. While it is very easy to remove a lockdown date, be careful when doing so as, as processing in the prior year will affect prior-year transactions and reports as well as the current year figures.

As a failproof, contact your accountant first, If you are unsure of whether you should remove the prior year lockdown date and start processing in the prior year. There may be a valid reason why this lockdown date has been set.

You can also prevent other users who are working for you from entering data in the wrong year by setting a lockdown date. This will protect the integrity of your books and remove the long tedious process of finding errors once an entry has been made in the wrong period.

It may be a bit tricky to find the right buttons to press to unlock your previous year and that is why I am here to help.

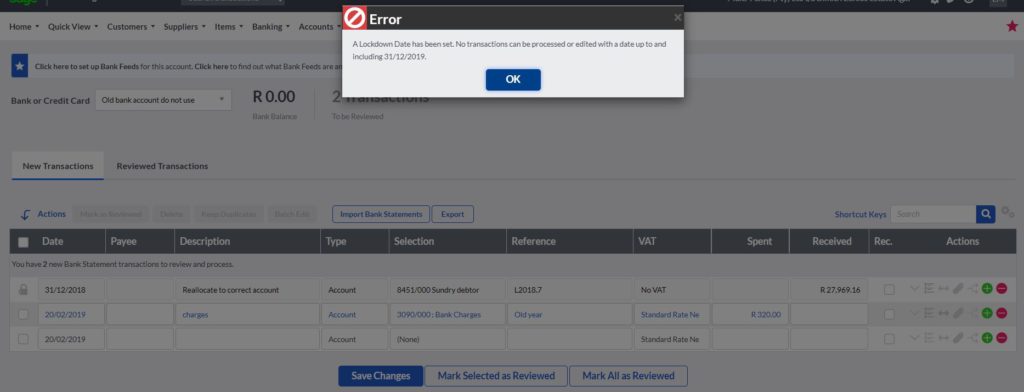

The lockdown error message

You will get an error message stating that no transaction can be processed before and inlcuding to a certain date. This date may not necessarily be your business’ financial year end date. It can be any day selected in Sage’s calendar.

Step1: Remove the error button to carry on

Step 2: Select company in the top bar and then click on “Change Company Setting”

Step 3: In the Company settings go to “General settings” and click on “Financial years”

Step 4: At this stage, you may consider the reason why the date has been set. Remove the tick next to “Lockdown Date” by clicking on it. Below the tick, you will see the Lockdown Date that has been set.

Step 5: Save and close

Good to go

You are good to go, and you can import the necessary transactions or perform the corrections that you need to do.

Tip: Follow the same procedure to set the lockdown date back on again to prevent unauthorised changes to your business’ books.