Real employer help with regards to things such as Revenue Services submissions that are useful are hard to find. The information that can be found is either outdated or never addresses the issues facing employers in South Africa. Let’s face it: the resources created by SARS and made available to its taxpayers are shockingly poor. This coupled with their online software that is badly designed, not user-friendly and hardly working well make entrepreneurs’ life a nightmare, in terms of dealing with the nuances of Revenue Services. We decided to make a video combined with this article on how to perform and submit an EMP501 reconciliation from scratch in an attempt to guide small business owners to comply with the onerous requirements of the South African Revenue Services.

In the video below and this article you will learn how to do The Annual Reconciliation Declaration (EMP501) submission for a company using Sage Cloud Payroll and SARS E@syFile. By following this practical example and use it as a guide hopefully you can avoid the long queues or dreaded phone call to SARS.

What is an Employer Reconciliation?

An EMP501 reconciliation is a report of all a company’s employees’ earnings, which must be submitted to SARS.

Employers are required to perform a bi-annual reconciliation of the payroll taxes (PAYE, SDL and UIF) declared monthly on the Employer Declarations (EMP201) report.

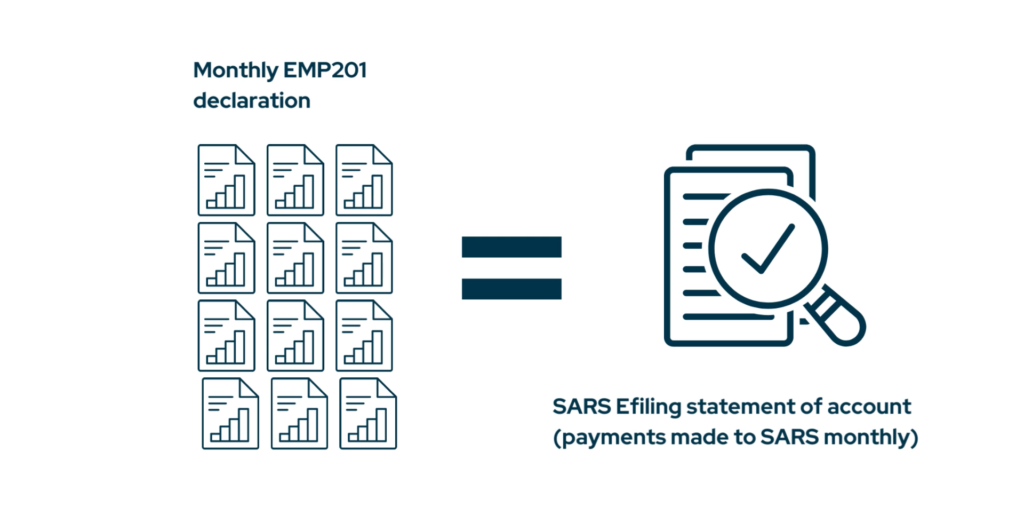

This reconciliation is between the EMP201 (monthly) returns and the information that SARS has in terms of payments made by the company.

It is the employer’s obligation to deduct and declare the correct amount of employees’ tax from each employee’s remuneration and pay this over to SARS on a monthly basis.

Why should I submit my EMP501?

The basic answer is it’s the law. However it’s important to understand exactly why you are doing something.

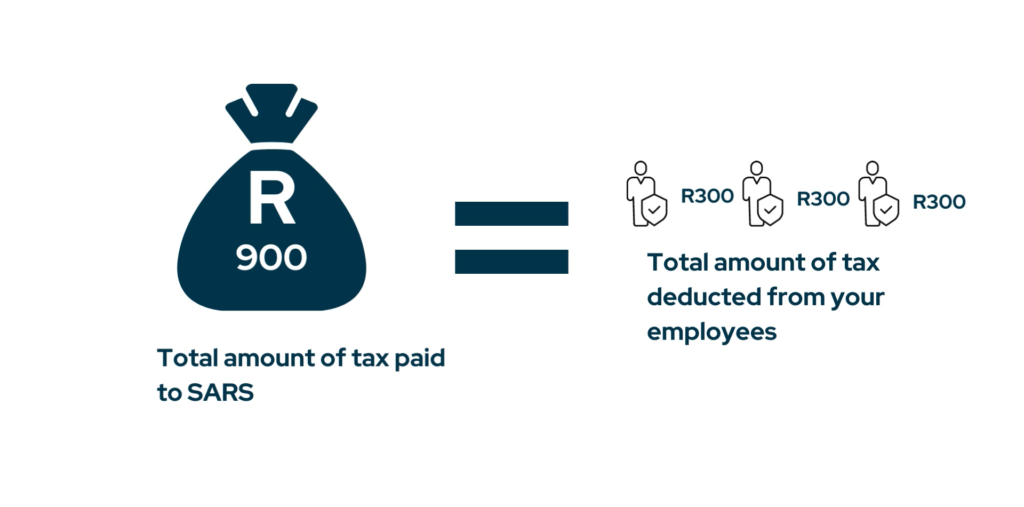

The amount of tax deducted from your employee’s remuneration is paid to SARS on a monthly basis in a lump sum. The purpose of the reconciliation is to ensure the total amount of tax paid to SARS agrees with the total amount of tax deducted from your employees.

The end result of the reconciliation is that each employee receives an IRP5 or IT3 certificate. An IRP5 or IT3 is a document that contains all the employees’ information regarding their remuneration, and other prescribed deductions that may affect their taxes and statutory contributions like UIF (unemployment insurance fund) . This certificate automatically updates the employee’s tax return (IT12) with the submission performed by an employer. After this process SARS has a full record of income and taxes paid for each person employed in a particular tax year.

How to submit your company’s EMP501

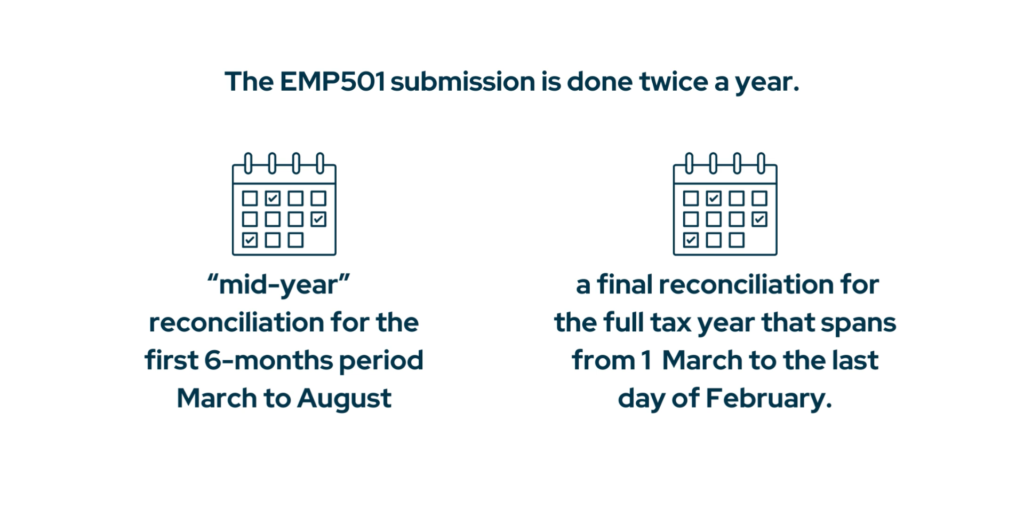

The EMP501 submission is done twice a year. There is a “mid-year” reconciliation for the first 6-months period March to August followed by a final reconciliation for the full tax year that spans from 1 March to the last day of February. Only the final reconciliation issues IRP5 certificates.

I will be using SARS E@syFile to show you how to submit your EMP501. This is the only option for companies with more than 50 employees while smaller companies may choose either E@syFile or SARS Efiling.

Let’s begin

Sign up up for a 30 day free trial here .

Sage Cloud Payroll is a reliable software solution with automatic tax calculations being applied by the software that are consistently and automatically updated as legislative changes take place.

I will be doing a year end tax submission from Sage Cloud Payroll.

Generate your Tax Year End submission file

Login to your payroll software using your login credentials.

Select the name and then cycle of the company you will be doing submissions for.

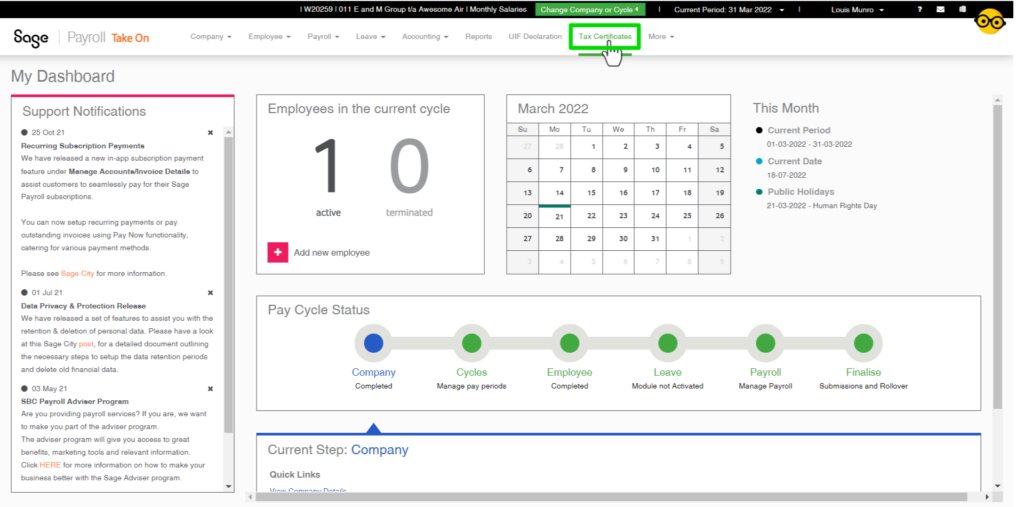

Have a look at the white menu adjacent to the Sage Payroll logo and select the Tax Certificate menu item. Generate your Tax Year End and Mid Year submission file to be imported into @Easyfile here.

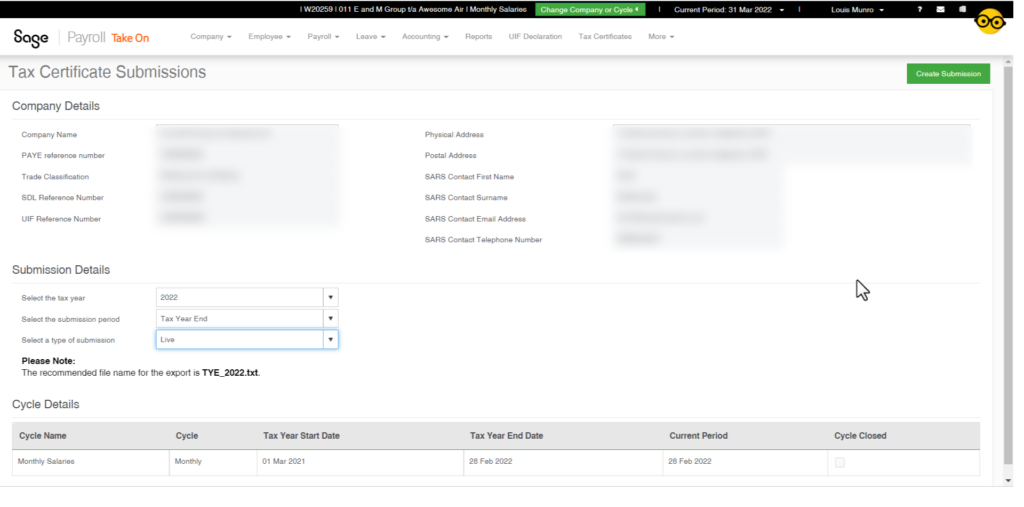

Your company details will be filled automatically provided the company was correctly set up.

You do however need to input the submission details. Select the Tax Year, Select the submission period: I am submitting the company’s year end tax. Next select the type of submission, I am doing a Live submission. If you need to do a resubmission for any reason you will choose resubmission.

The tax submission file will be downloaded in the following format:

TYE.2022.txt

This file will later be uploaded to SARS E@syfile. A pop will appear indicating that your file has been successfully exported. We will now go ahead and download our submission reports.

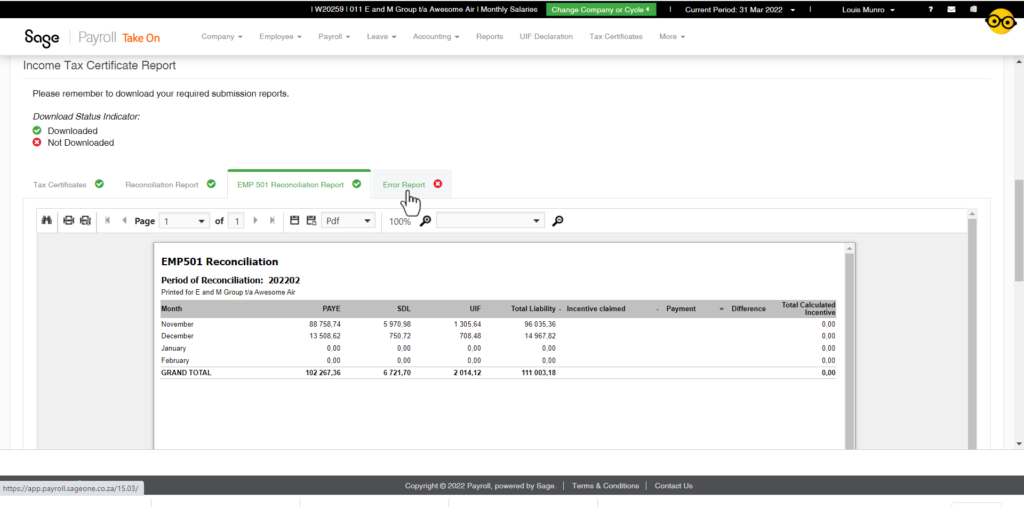

These reports are important for record keeping purposes and will be the reports you send to SARS to accompany your tax submission should SARS audit your company.

Go ahead and download all 4 reports namely; Tax Certificates, Reconciliation Report, EMP501 Reconciliation Report and an Error Report.

Now that we have successfully downloaded our tax submission file from our payroll software we need to login to SARS E@syfile to do the submission.

Add an Employer to SARS E@syfile

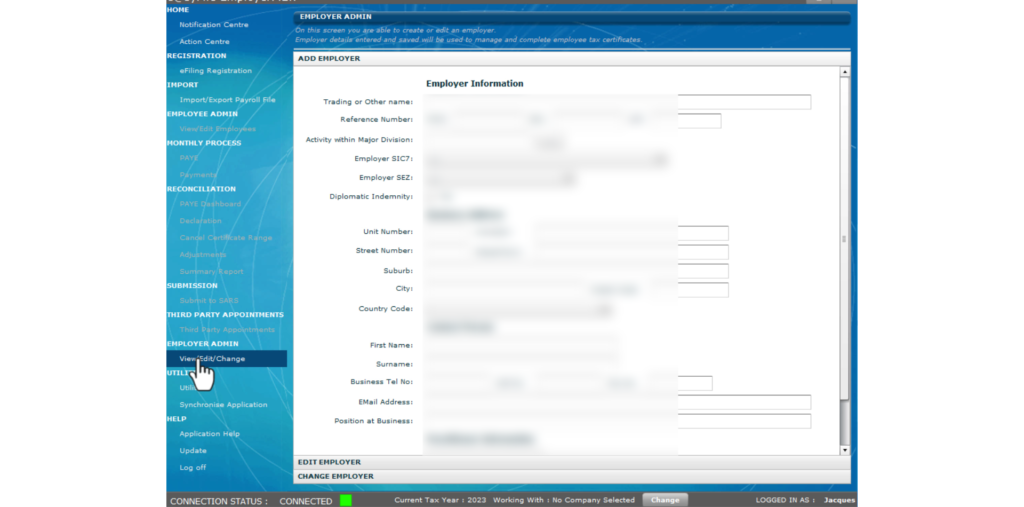

Login to SARS E@syfile. First we will add an employer together. With no company selected, navigate to the left of the screen to a sidebar menu, select the employer admin menu item and then select the view/edit/change item.

Add an employer by filling out all the particulars of your company here.

You should now be working within the company you added.

Import Payroll file

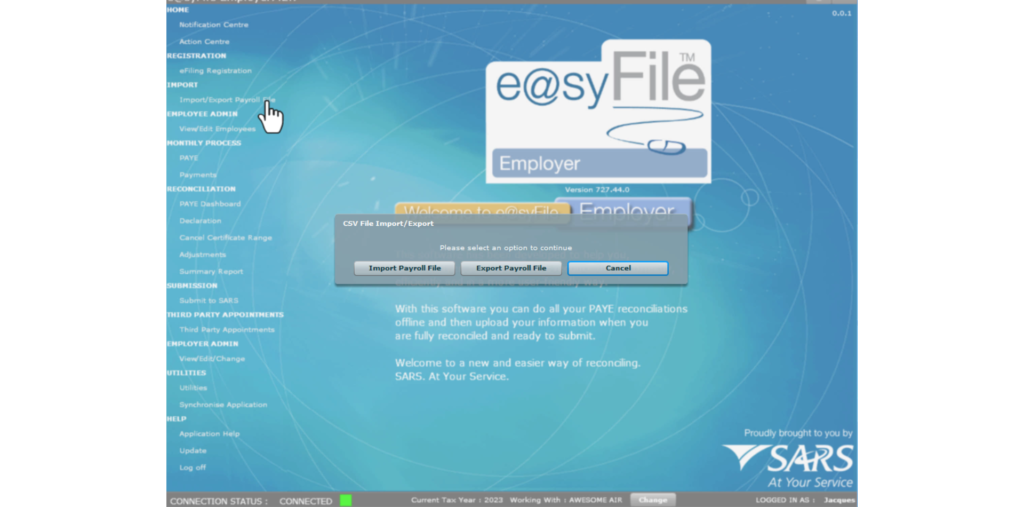

In the same sidebar menu navigate to the import item and select import/export payroll file. Import the TYE.2022.txt file downloaded from your payroll software.

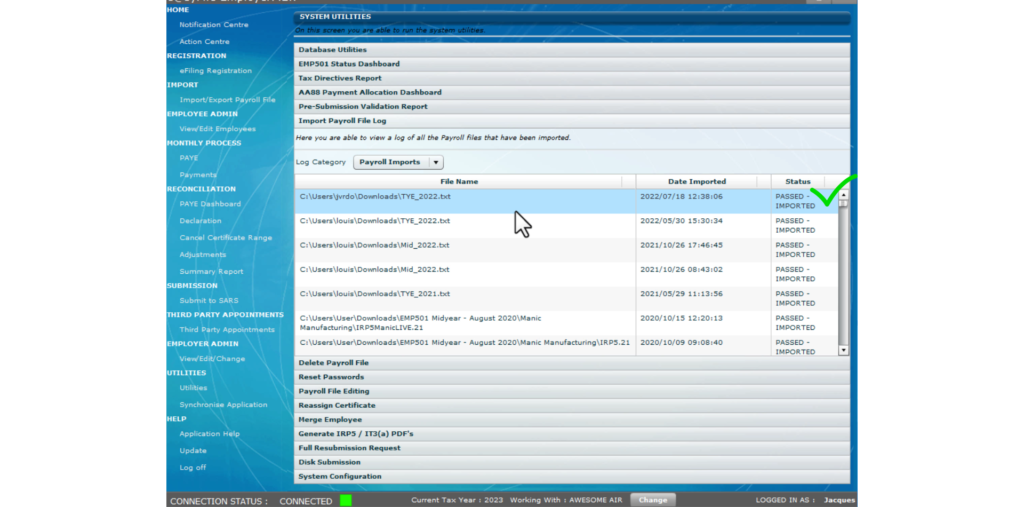

Navigate to and select the utilities item in the sidebar menu. Select Import payroll file log to check the status of the uploaded file. We want the status to be Passed and Imported.

Download E@syfile Form Viewer

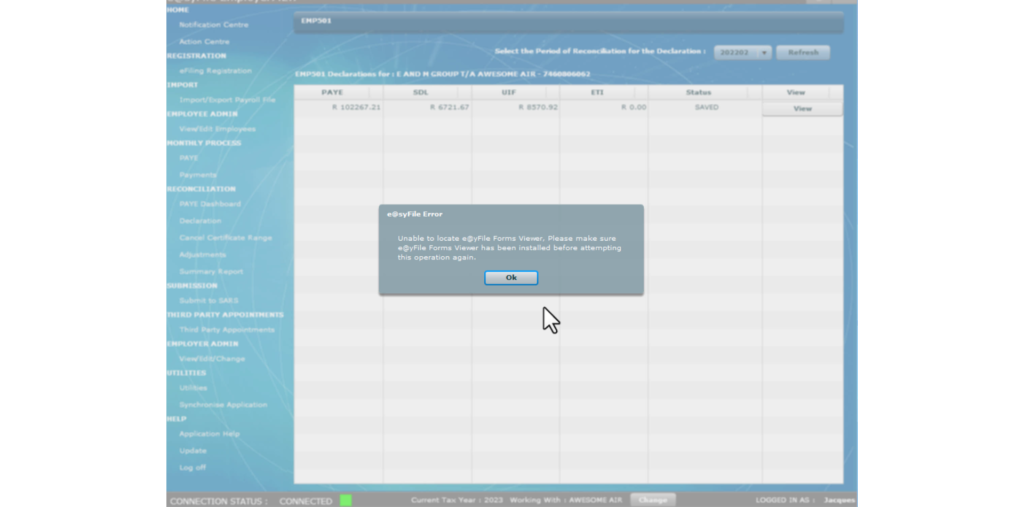

We now have everything we need to complete the EMP501. I confidently navigate to the Declaration item in the sidebar menu but I am ultimately met with a pop up indicating I need to download the E@syfile form viewer.

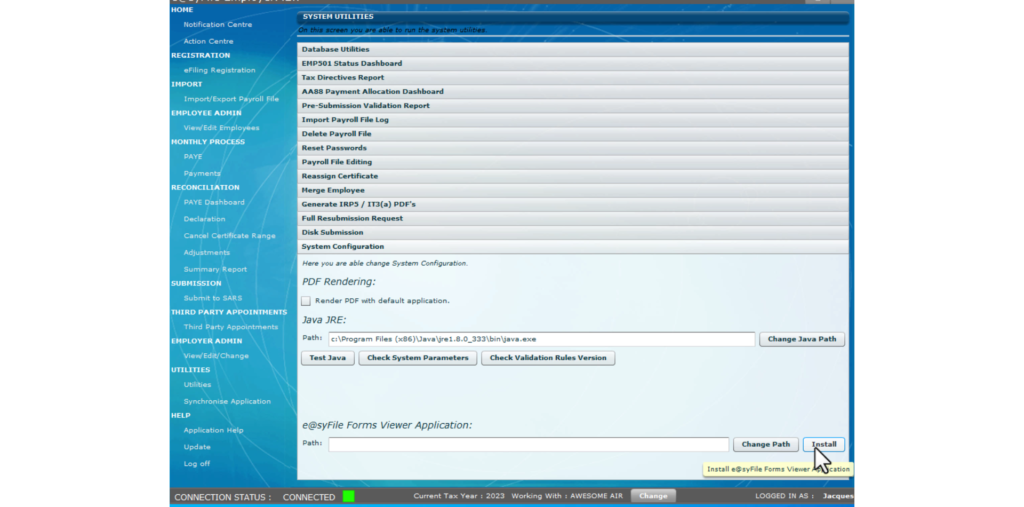

This can be done within E@syfile. Navigate to and select the utilities item again and locate the last drop down, system configuration. Here you can see the E@syfile Forms viewer application. Select the install button to install the app.

EMP501 Declaration

Navigate to the Declaration item in the sidebar menu once again.

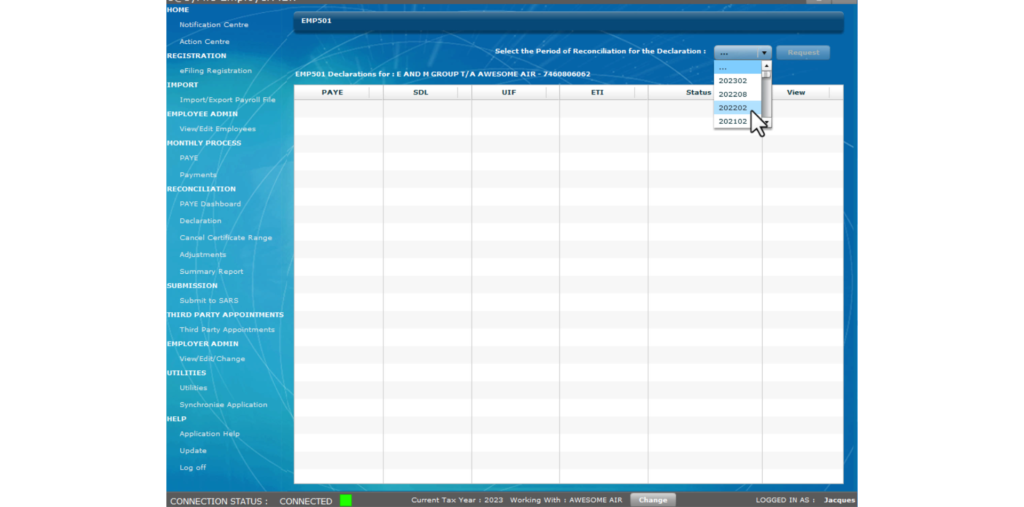

At the top of the EMP501 declaration window select the “period of reconciliation” and then select request.

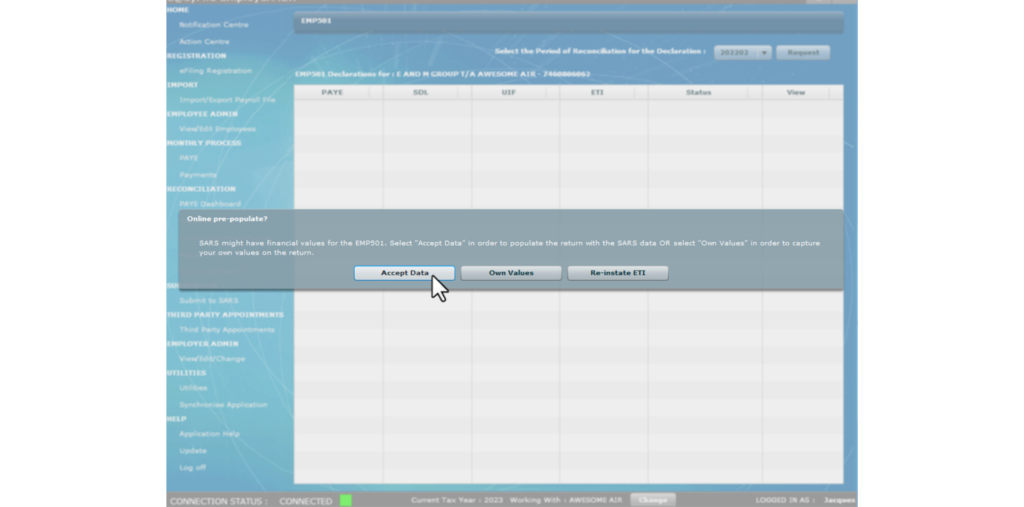

A pop up will appear asking you to choose how to input the financial data. I have imported my submission file from my payroll software so I go ahead and select accept data. You will be asked to enter your login details once more.

Select view so we can review the EMP501 declaration.

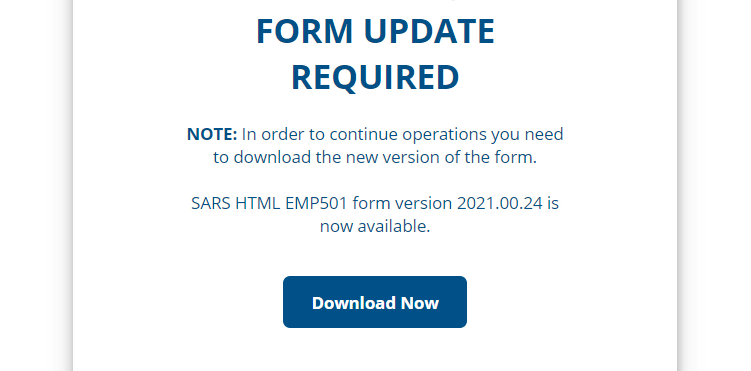

Before I am able to view the declaration SARS requires a form update to be downloaded. Select the download button. Your declaration may take a while to download.

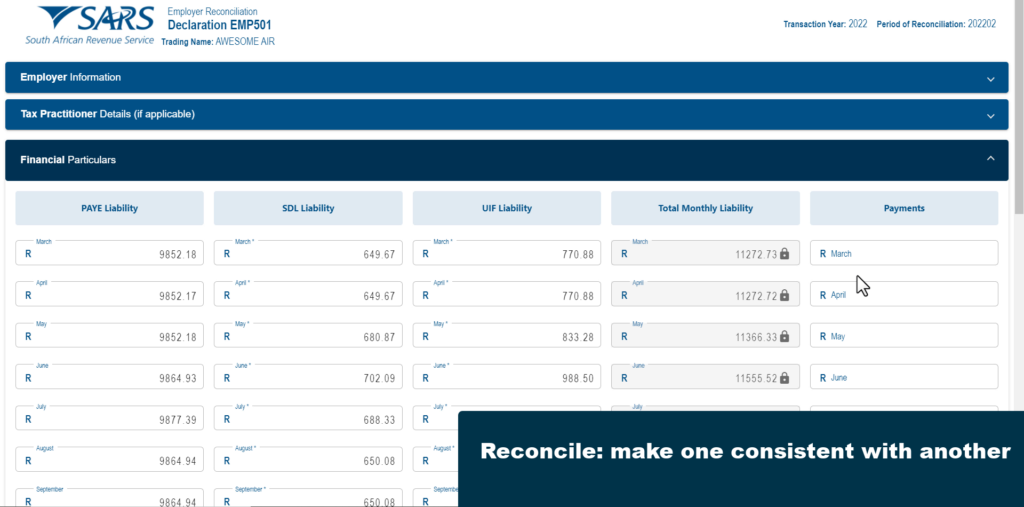

Reconcile your EMP501 Declaration

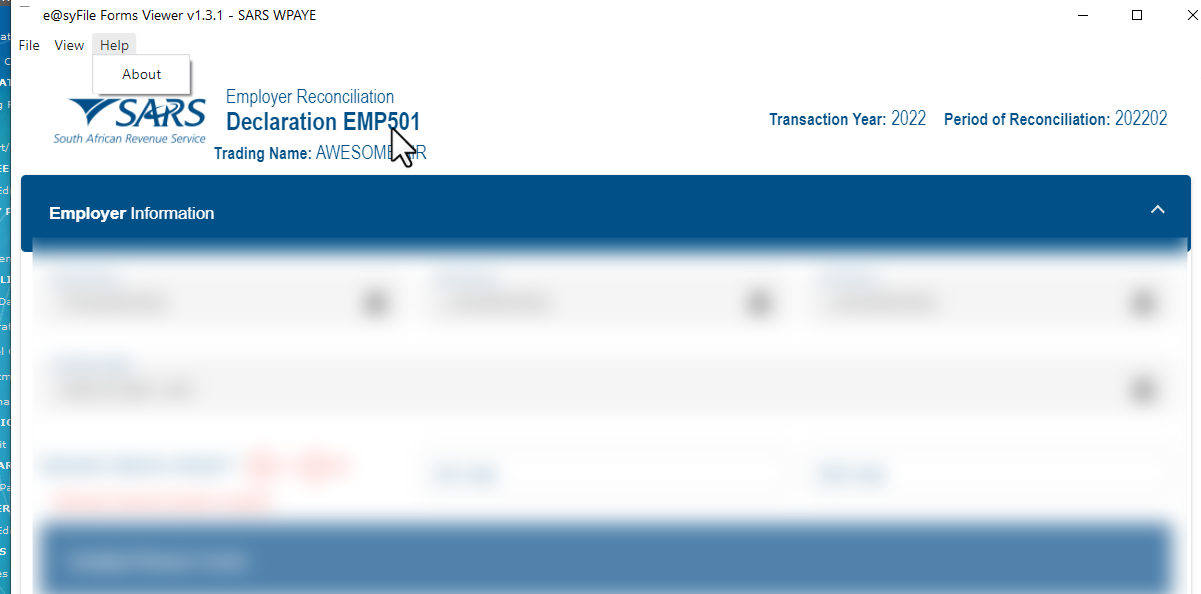

This is your EMP501 declaration. Sections highlighted in red require your attention however it is good practice to review all the information entered.

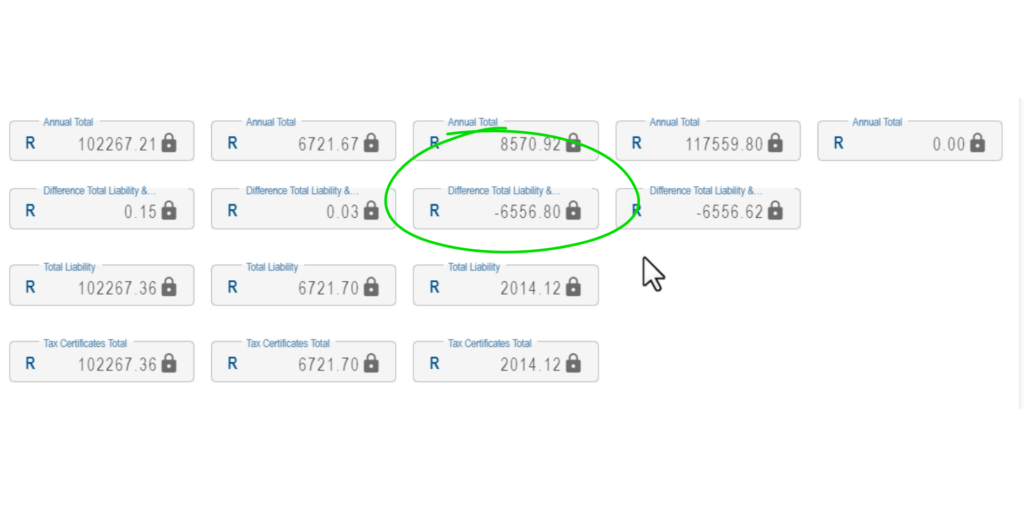

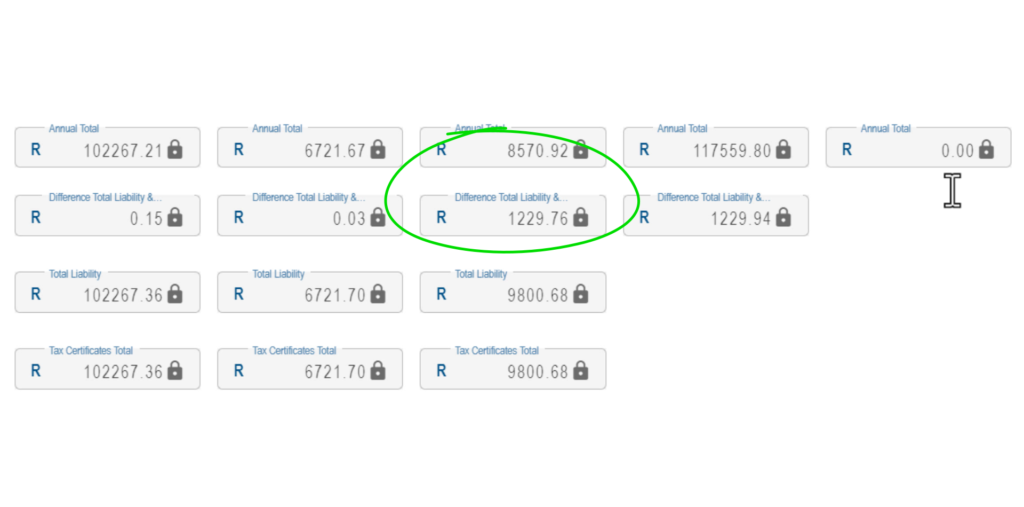

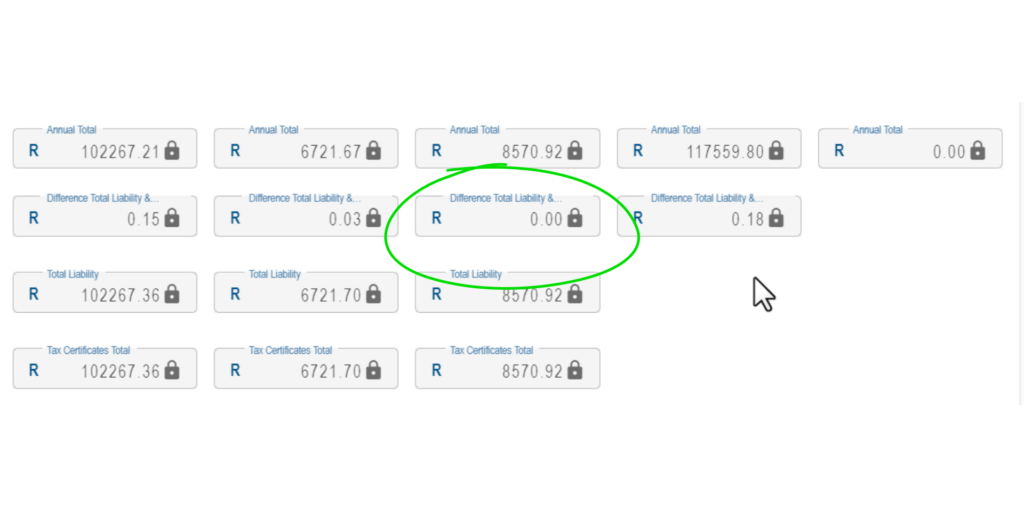

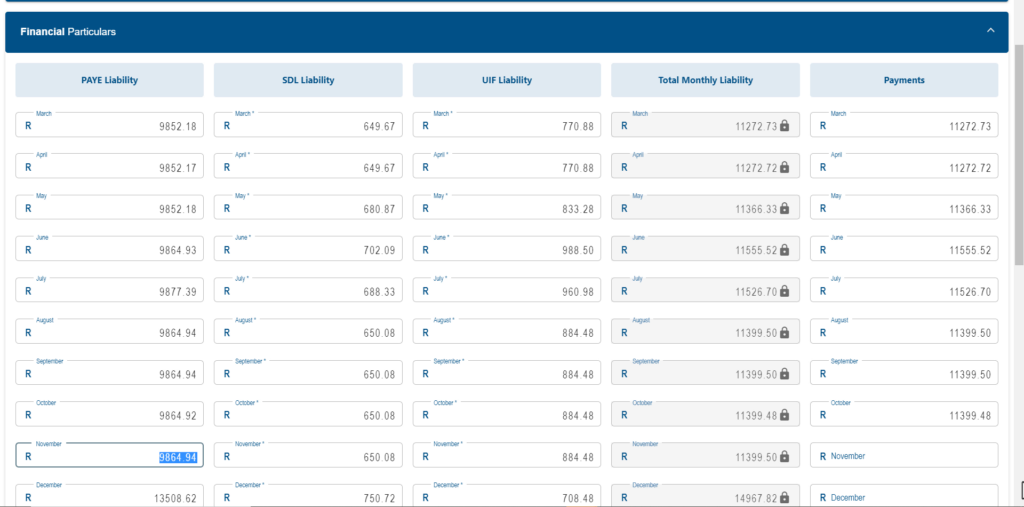

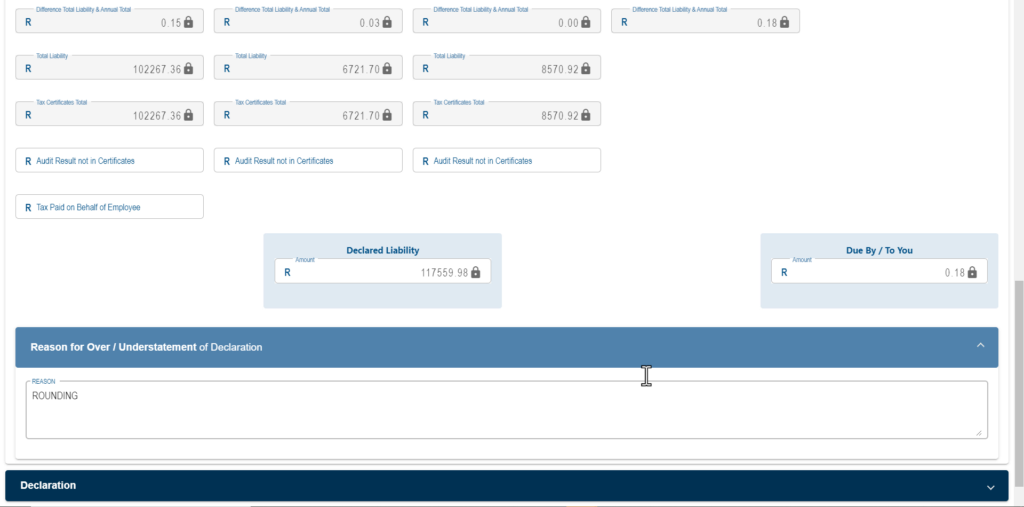

Reconcile the financial particulars section of the declaration by comparing the amounts paid from the PAYE statement of account downloaded from SARS Efiling to the amounts in the last column. At the bottom of the declaration form the differences should be zero or minimal, unless an underpayment or overpayment to the authorities has been made, this will result in an annual declaration liability.

In this reconciliation there are differences due to take on balances entered into the payroll software when the employer switched his software. Fortunately we were aware of issues pertaining to this company’s UIF calculations and therefore were able to reconcile the difference fairly quickly. We manually adjusted the UIF deduction and company contributions according to the statutory requirements. It takes a few attempts but eventually we balance the figures.

The reconciliation is almost complete. We now need to input the actual payments made to SARS on a monthly basis. Open your statement of account from SARS Efiling and input the transaction values for each month.

Small differences are indicated as being due to rounding in the Reason for over/understatement of deductions section.

Once all the information has balanced you have completed the reconciliation.

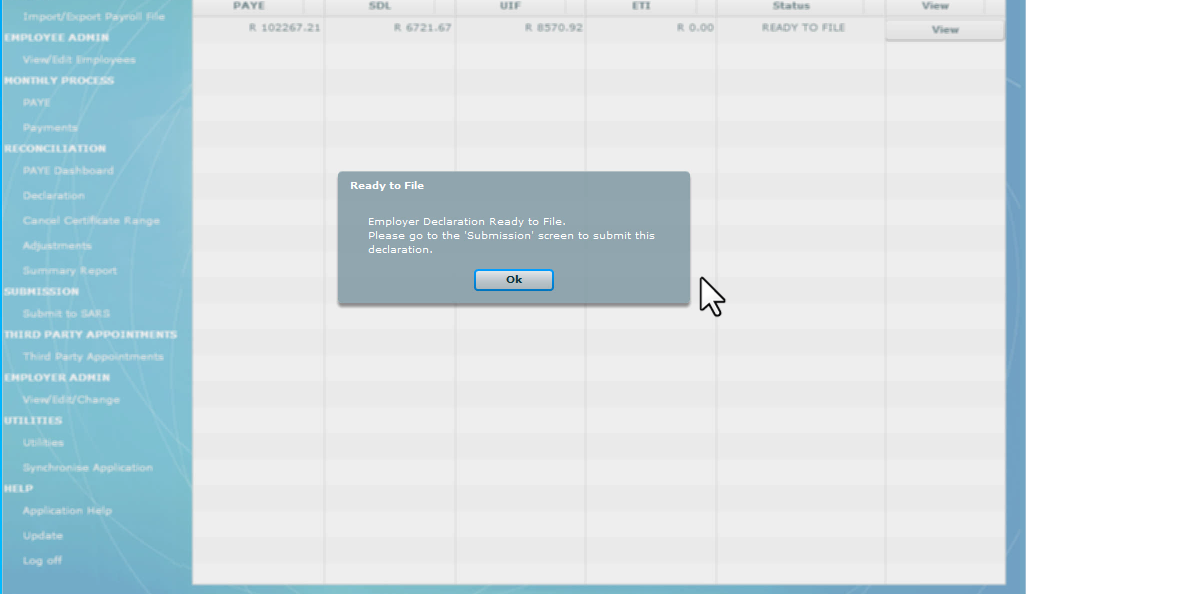

In the upper left hand corner select file and close from the File drop down. A pop up will appear indicating the declaration is ready to file.

Submit the EMP501 Declaration to SARS

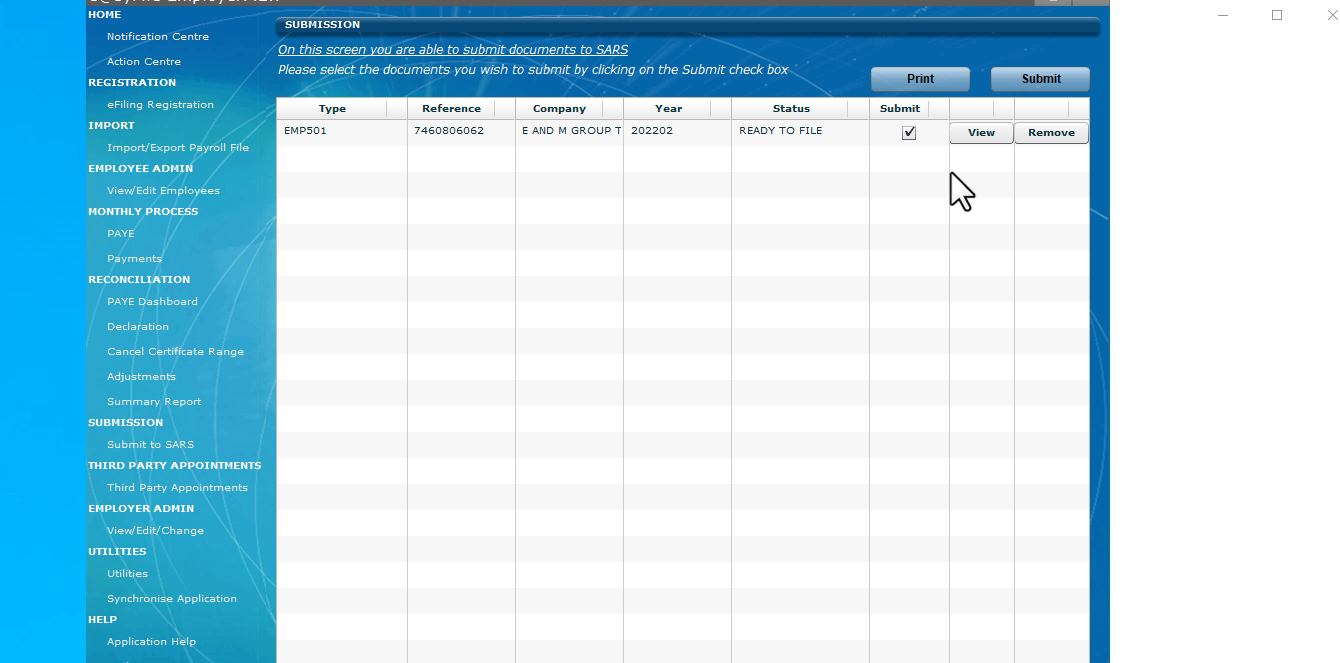

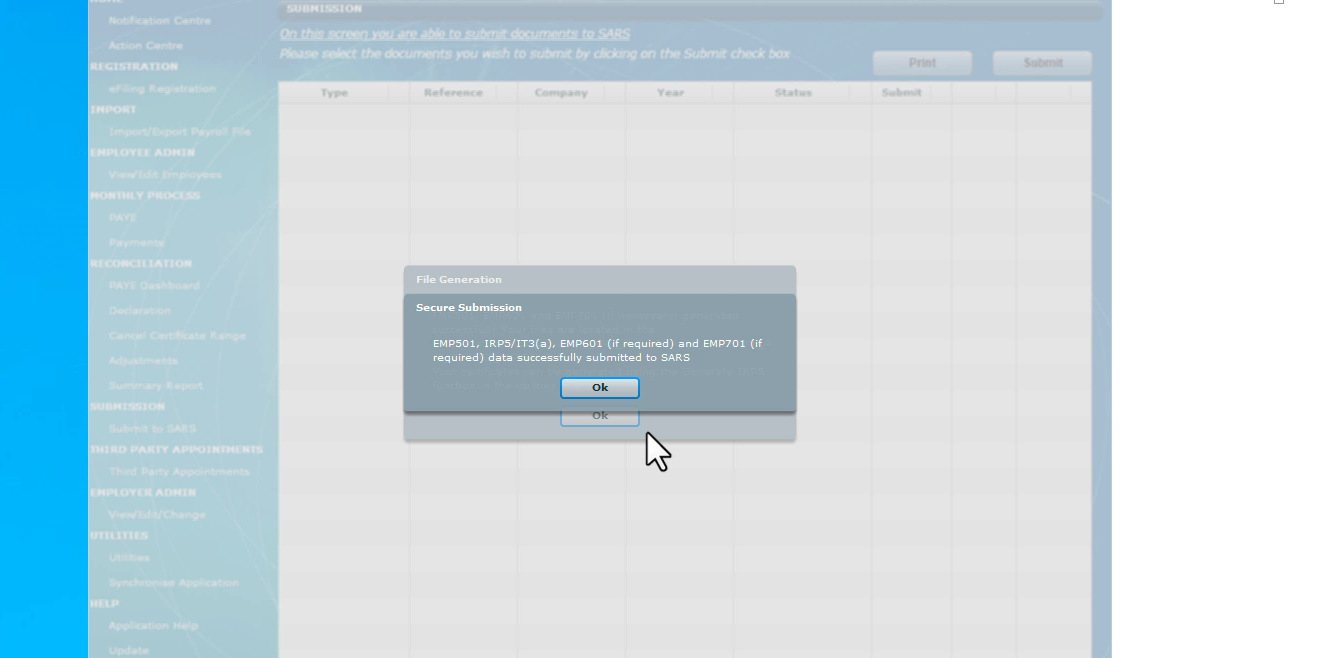

In the sidebar menu to the left of the screen under the item Submissions, select Submit to SARS. Your EMP501 will be listed with a ready to file status. Check the Submit checkbox and then select the “submit” button in the top left hand corner of the submission window. Select a folder to save the documents to, you will be asked to login once more.

A pop up will appear indicating that the EMP501 has been uploaded successfully. Your submission will be processed. A pop up will appear indicating that the submission to SARS is successful.

Generate your Employee Tax Certificates

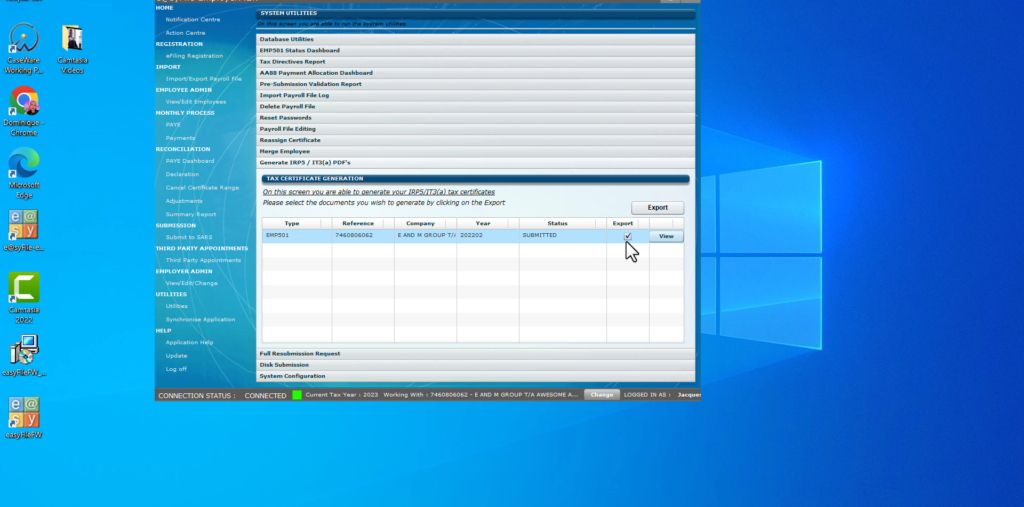

Now that we have submitted the EMP501 we can complete out Year End Tax submission by generating the employee tax certificates. Navigate to and select the utilities item again and locate the Generate IRP5/IT3(a) PDF’s drop down.

The EMP501 we submitted will be here with a submitted status. Check the export check box and then select the export button at the top right of the window.

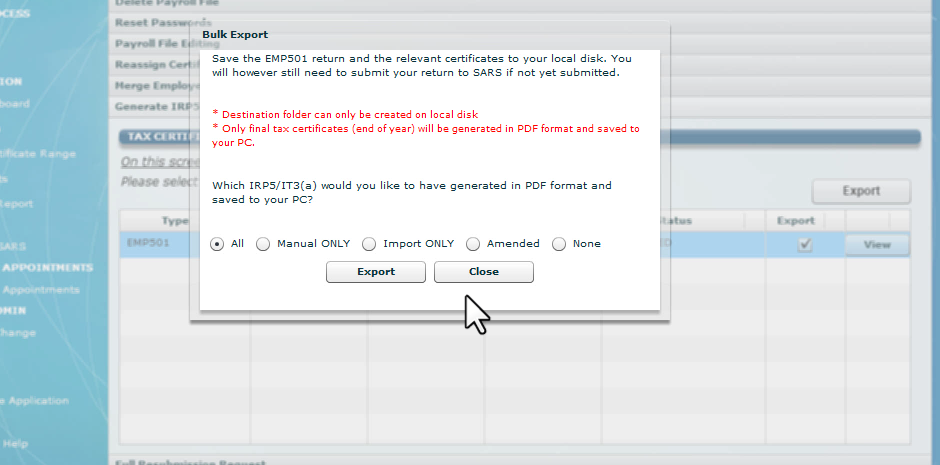

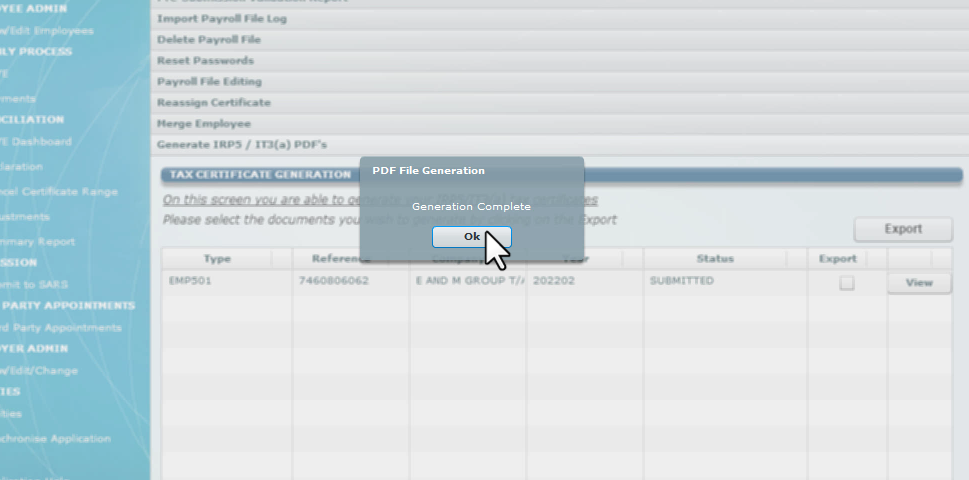

A pop up will appear, check all and then select the export button. Select a folder to save the documents to. A pop up will appear indicating that the certificates have been generated successfully.

If you have any more questions about year end tax submissions leave them in the comments below.