Still managing payroll with a spreadsheet?

Then you know as a small business, the struggle of submitting your EMP501 without payroll software. This blog walks you step-by-step through the manual submission process using SARS EasyFile version 7 — perfect for the mid-year reconciliation up to 31 August. It’s not the easiest route… but if you’re doing it, let’s do it right.

? Watch the Full Tutorial Below:

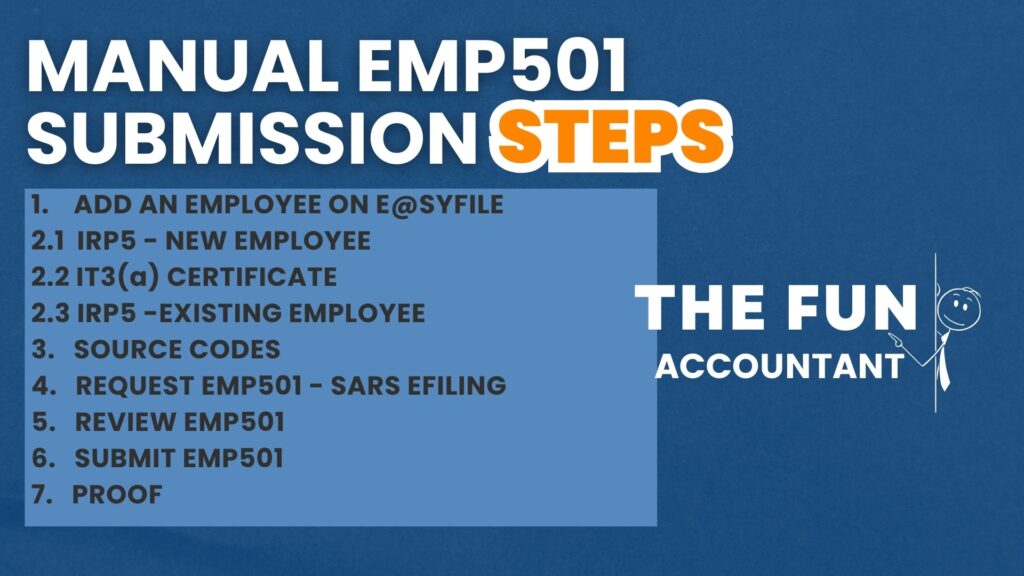

? Quick Look: Manual EMP501 Submission Steps

Before diving into the detailed walkthrough, here’s the full manual process at a glance. This visual pairs directly with the video and gives structure to each part of the blog.

Manual EMP501 Steps at a Glance:

- Add an Employee on EasyFile

- IRP5 – New Employee

- IT3(a) Certificate – Low-income employee

- IRP5 – Existing Employee

- Enter Source Codes

- Request EMP501 – SARS eFiling

- Review EMP501

- Submit EMP501

- Get Proof of Submission

? Each of these is explained step-by-step below with screenshots, tips, and common pitfalls to avoid.

Why Manual EMP501 Submissions Still Matter

Many small businesses in South Africa still run payroll using spreadsheets or basic methods. Whether it’s due to cost or habit, these employers need to submit their EMP501—without the help of fancy payroll software.

This guide is for them.

? Note: This tutorial specifically uses SARS EasyFile version 7.2.9 for a mid-year reconciliation (1 March – 31 August).

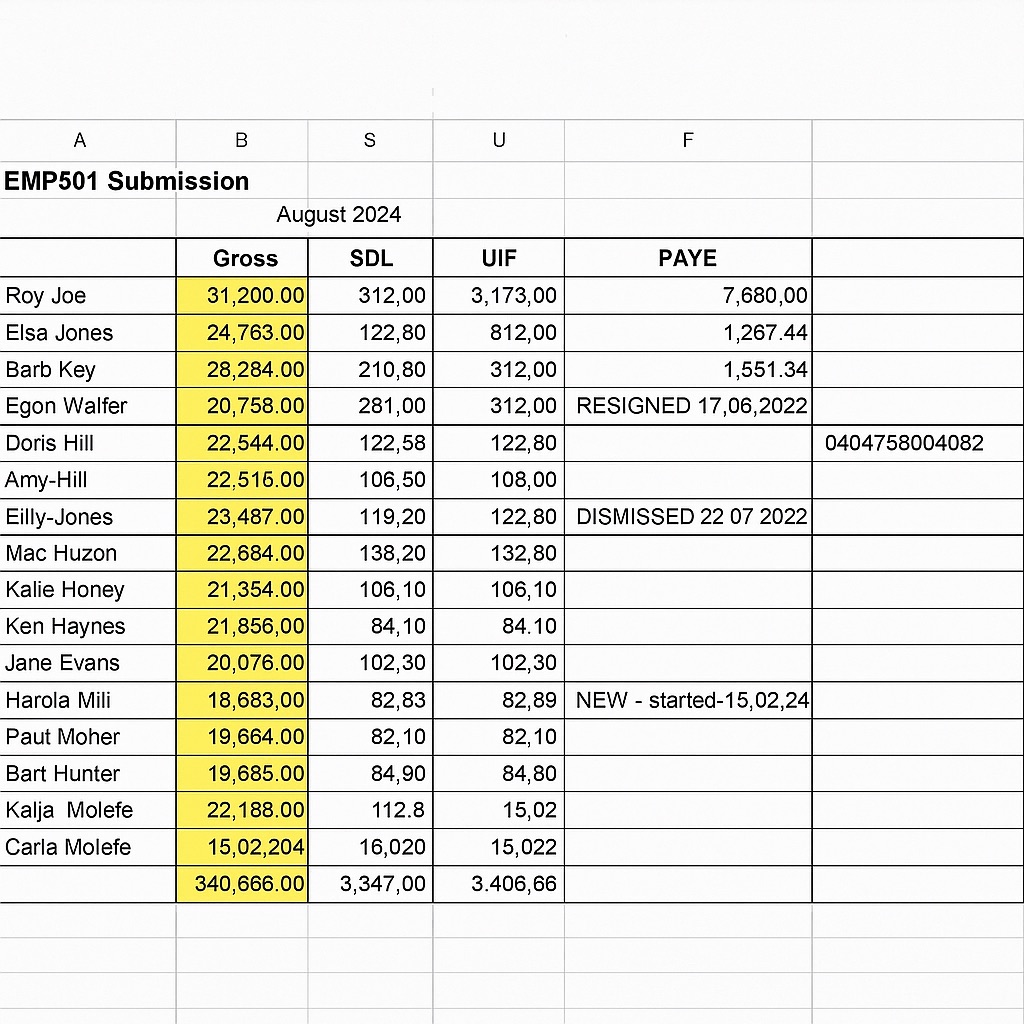

What Happens Before You Open EasyFile

Start with your spreadsheet.

✅ Add up all the PAYE, SDL, and UIF totals for your employees.

✅ Cross-check those totals against your SARS Statement of Account.

? TFA Tip:

“Reconcile before you touch EasyFile. Fixing things after submission is ten times harder.”

? Don’t skip this. If the totals don’t match, fix that first. This guide assumes your figures are accurate.

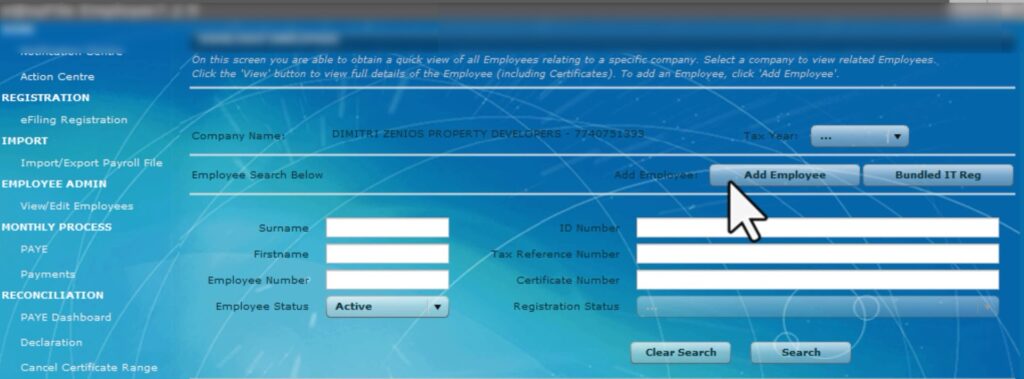

Add an Employee on EasyFile (Step 1)

Open EasyFile, log in, and select your employer.

Navigate to Employee Admin → View/Edit Employees → Add Employee.

Fill in all the required fields:

- Personal details (ID, names, date of birth, etc.)

- Contact and residential address

- Bank details

? Fields with a red asterisk are mandatory—skip them and your submission will fail.

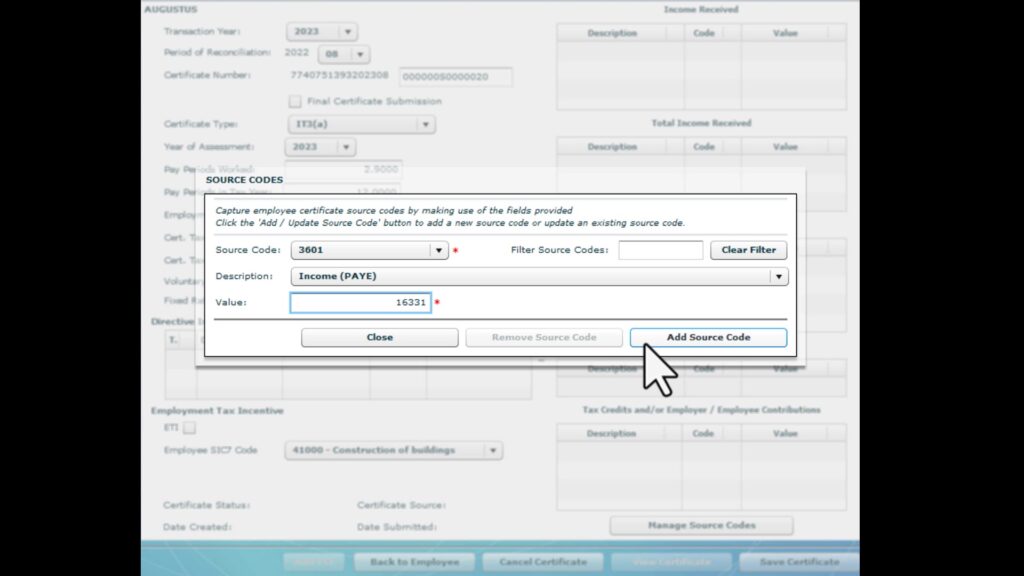

Capturing the IRP5 Certificate

Now that your employee is added, it’s time to capture their certificate.

- Select Add Certificate

- Choose Transaction Year, Period of Reconciliation (08 = August)

- Set Certificate Type = IRP5

- Add pay periods worked and SIC code

Click Manage Source Codes and enter:

- 3601 – Salary

- 4102 – PAYE deducted

- 4141 – UIF (employee + employer)

- 4142 – SDL

Once everything is entered, save the certificate.

Creating an IT3(a) for Low-Income Staff

This is for employees who earn below the tax threshold. They still need UIF and SDL submissions.

Steps are the same, except:

- Certificate Type = IT3(a)

- Source Codes:

- 3601 – Salary

- 4141 – UIF

- 4142 – SDL

- 4150 – No tax due

? Keep it simple.

Manual payrolls with pensions, medical aids, or fringe benefits are best handled by payroll software.

Updating IRP5 for Existing Employees

Want to issue another IRP5 for someone already in the system?

- Go to View/Edit Employees, select the name

- Click Add Certificate

- Repeat the same steps as above

- Confirm 3601, 4102, 4141, and 4142 are added correctly

? No need to re-enter personal details—EasyFile remembers them.

Reconciling the EMP501 Return

You’re almost there!

Head to Reconciliation → Declaration and click Request to pull in the EMP501 data from SARS eFiling.

Double-check:

- Total liabilities match certificate values

- PAYE, SDL, UIF totals = EMP201 declarations

- Difference fields = Zero

? EMP501 declaration screen showing no errors.

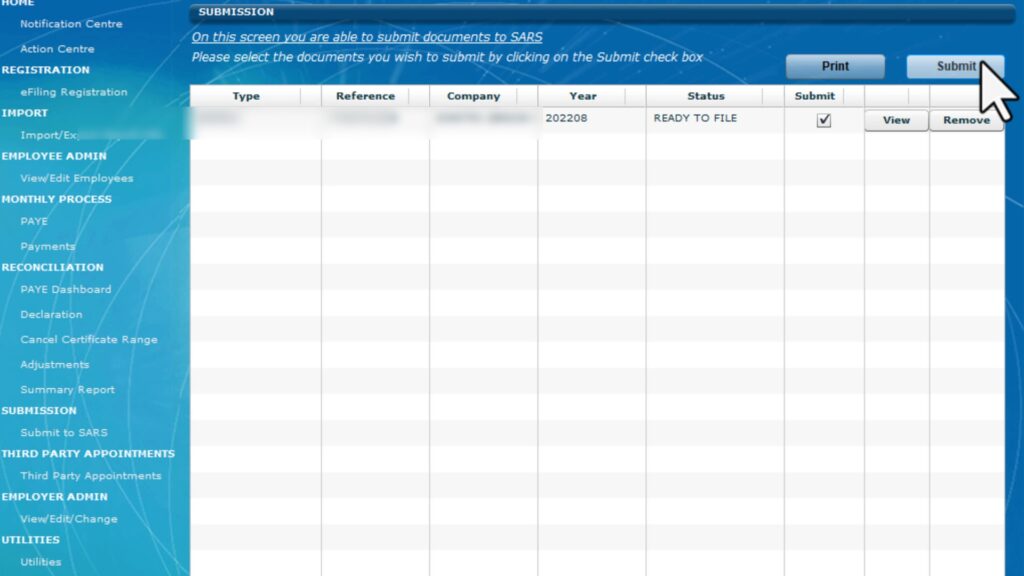

Submitting to SARS and Getting Proof

Submit the EMP501 by going to File → File and Close.

Then under Submission, click Submit to SARS.

Save the confirmation files when prompted.

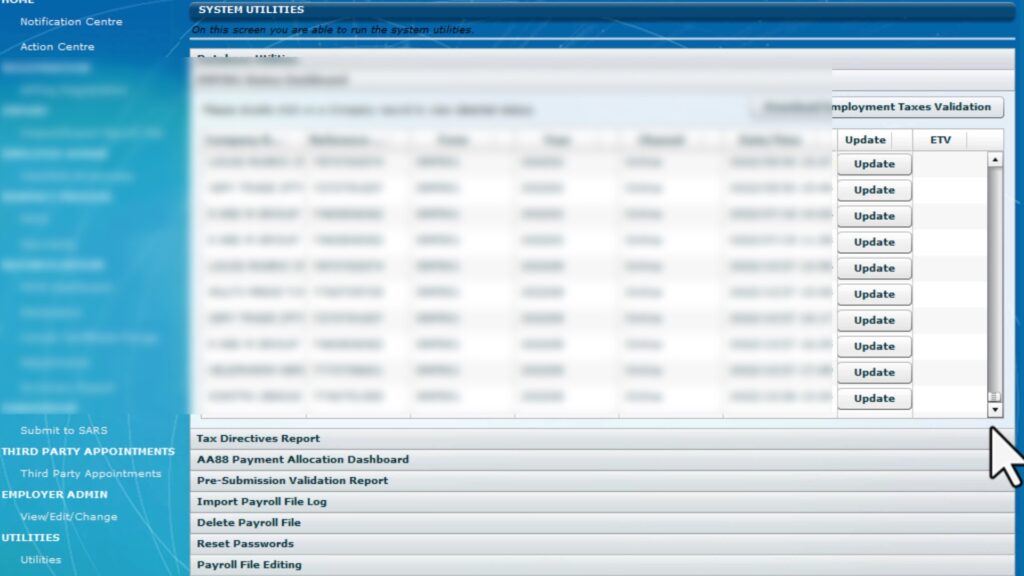

For proof:

- Go to Utilities → EMP501 Status Dashboard

- ✅ Check the ETV column—if it’s empty, there are no errors!

✅ Quick Recap Checklist:

- All certificates added

- EMP501 requested and matches

- Submitted and confirmed

- Status dashboard clear of errors

Manual Works, But Software Wins

And there you have it—your full manual EMP501 guide using SARS EasyFile 7.2.9. If this process felt long, that’s because it is.

? Want a faster, cleaner, and error-free option?

? Watch my video titled “EMP501 Submission Guide on New Easyfile Software” to see how payroll software can generate your certificates automatically and import them into EasyFile without the manual madness.

It changes everything.

?

Try it yourself:

? Want to See the Better Way?

This post shows how to survive the manual route. But the real win? Letting the software do the heavy lifting.

? If you found this helpful, subscribe to the TFA YouTube channel, and check out more content for small businesses reducing admin and streamlining their business.