It is a mouthful to describe in short what this blog is all about. Let’s try: You are going to learn how to automate your supplier processing with the Dext and Sage Accounting system.

We are going to cover the process of recording your business expenses with the Dext:

- emailing system,

- syncing and

- sending all of that important information to Sage Accounting,

- solving the problem of capturing supplier invoices and keeping track of expenses and liabilities in an efficient yet accurate manner. Also:

- providing a solution to deal with the magnitude of supplier invoices landing in your email inbox and actually doing something useful with them. Not printing them and reducing the creation of unnecessary paper-work.

- I am going to forward a supplier invoice received in my inbox straight to Dext and

- test how the data extraction and syncing the information to Sage accounting works.

- Let’s see if this can reduce the paper burden of purchases and payments in our businesses and increase efficiency.

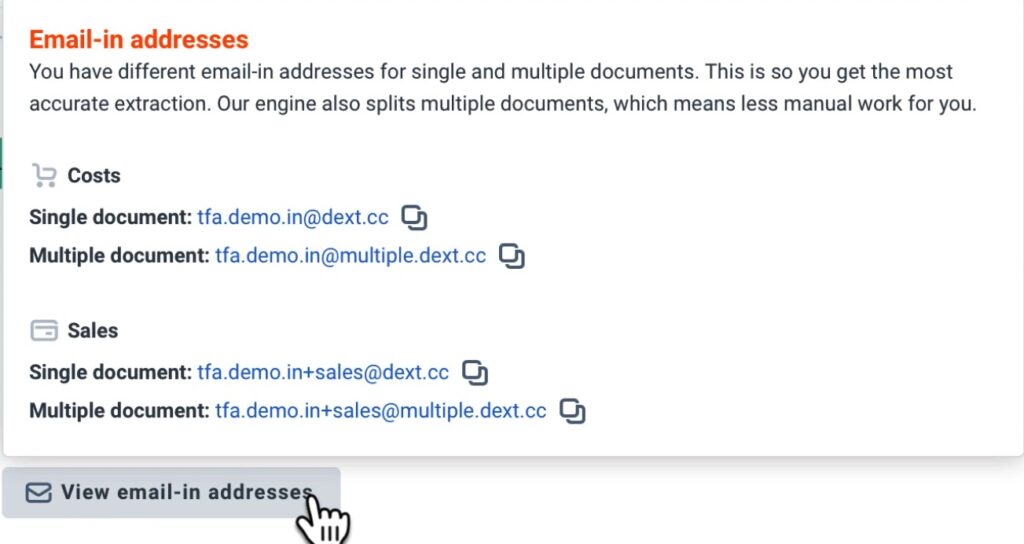

Email-in addresses

It is common for suppliers to send their invoices via Email. You must have your unique Dext, Costs Email-in Address, before you can do anything with it from your inbox.

From your Dext’s main menu, you will find your cost Email address in the

> left side bar menu

> under users

Each user that are added to Dext receives their own unique forwarding email address to which Costs Invoices are send to. This address’ details can be changed later if needed, provided that it has not been used by anyone else on the Dext system.

The Multiple Costs document splits a single file that contains more than one invoice into multiple invoice documents that are each processed separately on Dext. The Multiple Costs document function of Dext has helped me to save a lot of time doing my work.

I am going to copy the single document’s email address which I plan to use in my mail server. This address will be used for for forwarding files that contain only one document per file.

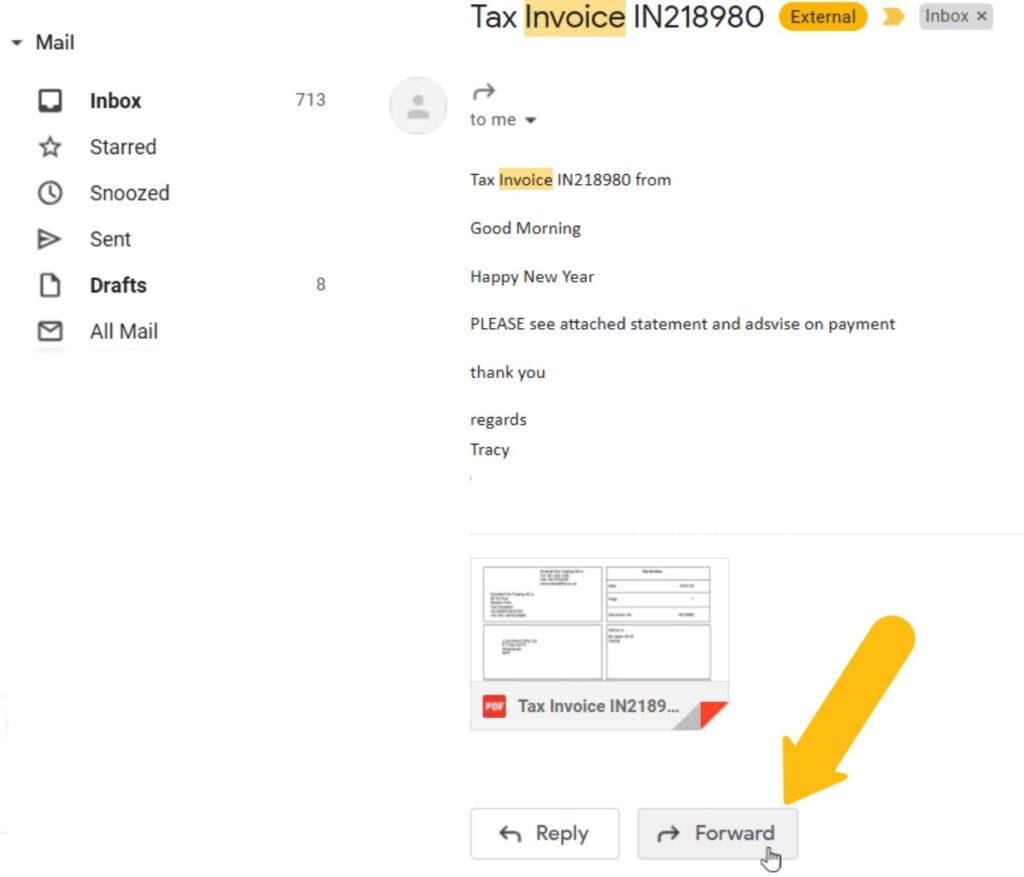

Forward the supplier invoice to Dext.

You open the email received from your supplier like any other Email and the invoice is normally attached to the mail with a message from the supplier and other details.

You merely forward the mail from your inbox to the newly found Dext, Email-in address.

The Dext automation process of the invoice emailed.

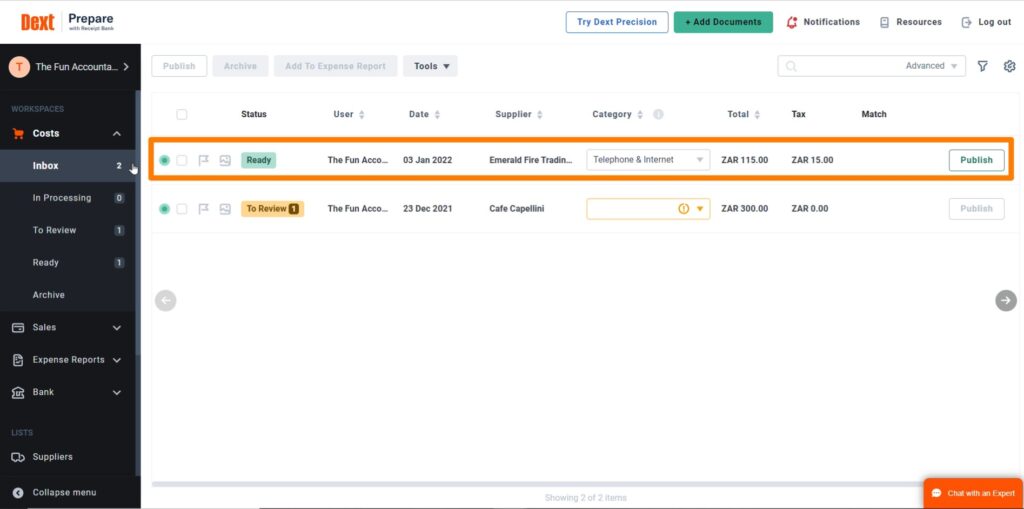

In Dext under the costs section in the left side menu bar you can see how Dext deals with the invoice.

Under “my inbox” you can see that:

- Dext has received the invoice,

- Dext has extracted information from the invoice and

- the status of this document is “Ready”.

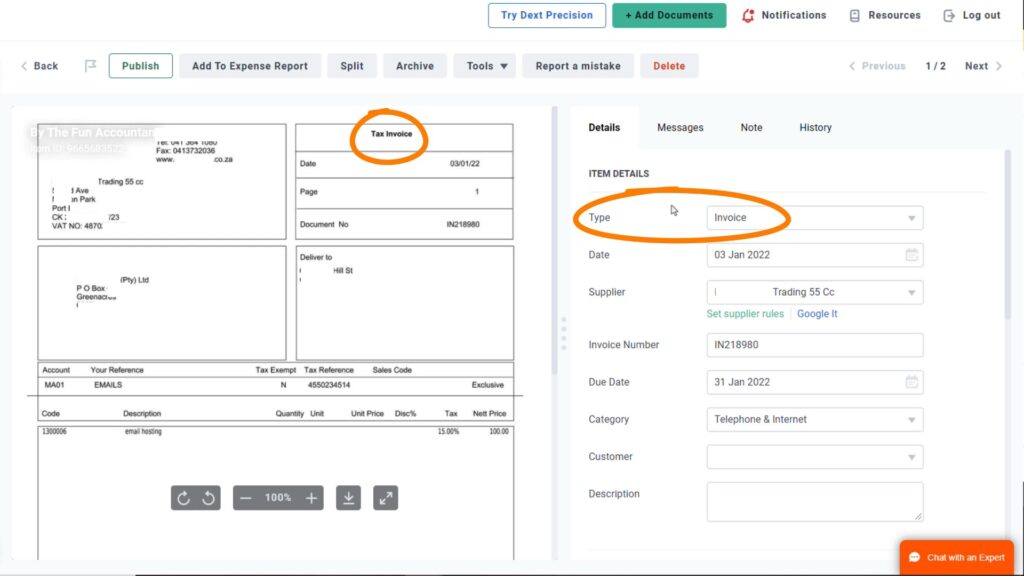

Click on the Ready button to see what all is happening in the Dext engine:

- Dext recognised the document type as an Invoice.

- The date has been correctly extracted from the invoice.

- The supplier name and invoice number have been extracted.

Dext will create the supplier if it not already exists in Sage.

From the Supplier List in Sage you can easily search for a supplier and confirm if the specific supplier already exists. If the supplier was not already created in the Sage system, Dext will create the supplier automatically for you, when you publish a document and you don’t have to be concerned for checking if suppliers have already being created.

Accounting data extracted by Dext from the supplier invoice.

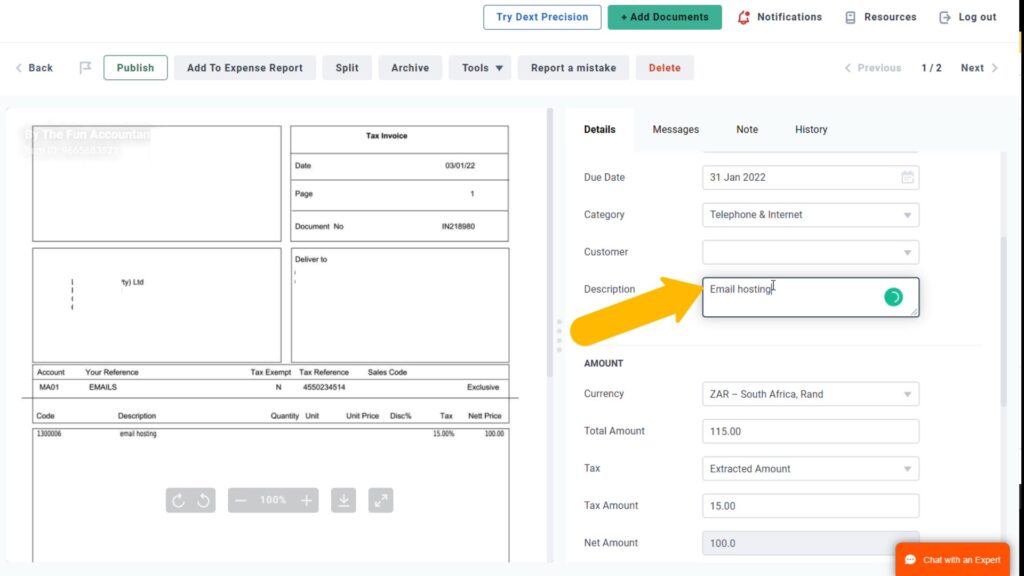

Let’s look at the accounting data extracted by Dext:

- Expense category: The expense category is automatically completed if you have previously set up a quick entry rule that is associated with this supplier. Otherwise the expense category can be chosen from the list of accounts that comes from Sage.

- Description: I am going to enter a description for this expense to provide useful information when a person looks at the details of the general ledger. The general ledger provides the details of entries in an expense category for a specific period.

- Total Amount: The total amount extracted agrees with the invoice.

- Tax: The tax amount originates from the invoice.

- Expense amount: This amount will posted to Sage as an expense excluding tax.

Publishing

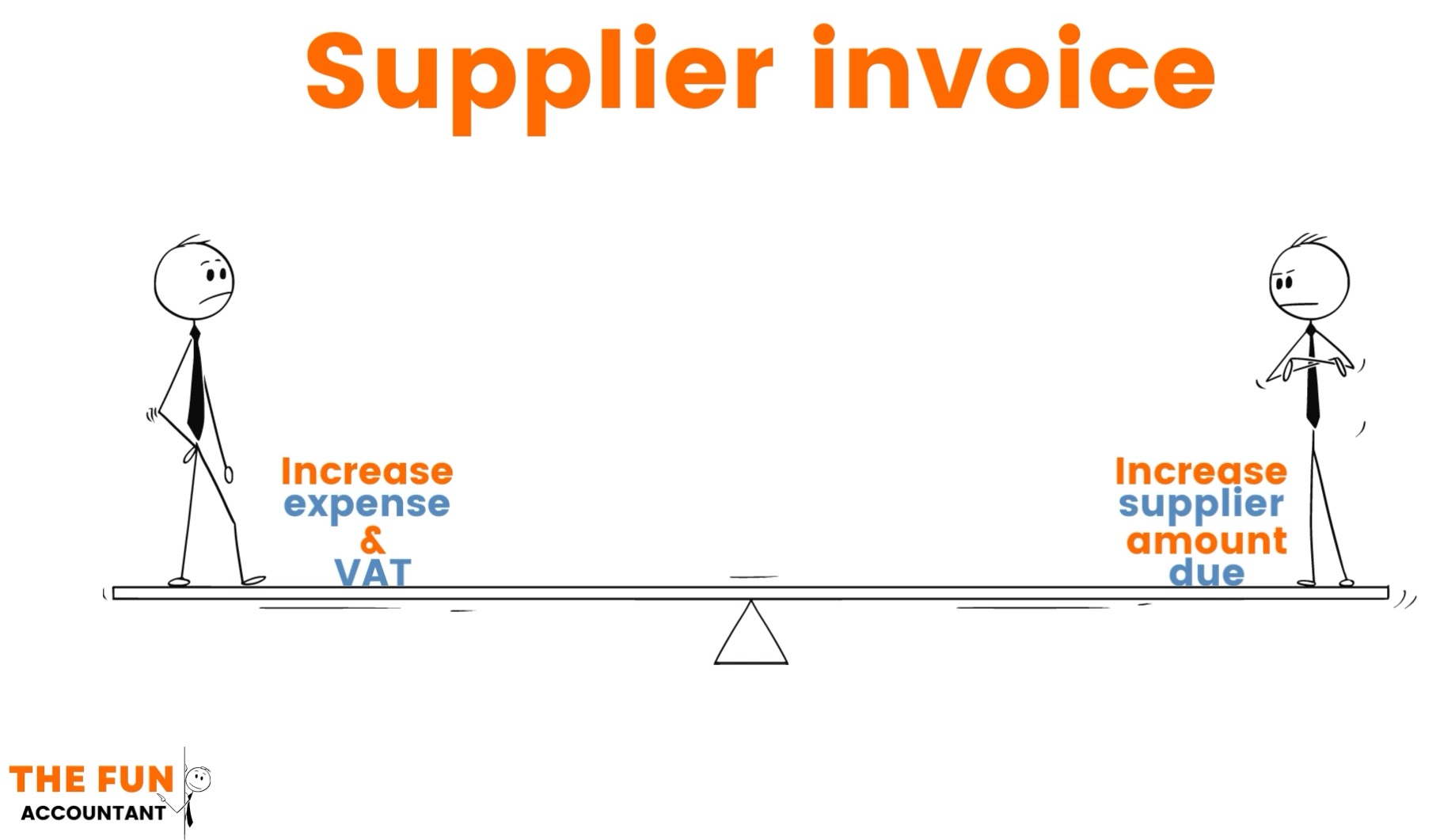

The invoice is published in Sage as a supplier invoice which means a transaction is recorded in the Sage Accounting system by:

- increasing the expense and

- the amount owed to this supplier as well as

- the VAT amount claimable which will be found in the VAT transaction report.

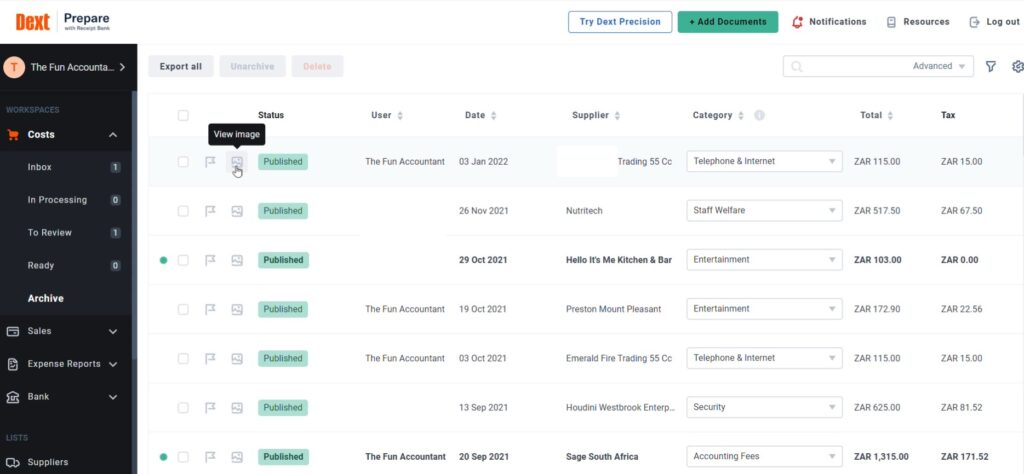

Archive

Once Dext and Sage complete the transaction sync process, the document is stored in the Archive section which can be found under: Costs in the left-side menu.

From the Archives you can:

- View the document whenever you need to as well as the,

- Information extracted and populated in its particular field and

- the details of how this transaction was processed.

Processed in Sage Accounting.

I’m now heading to Sage Accounting for the great reveal and follow how this transaction was recorded.

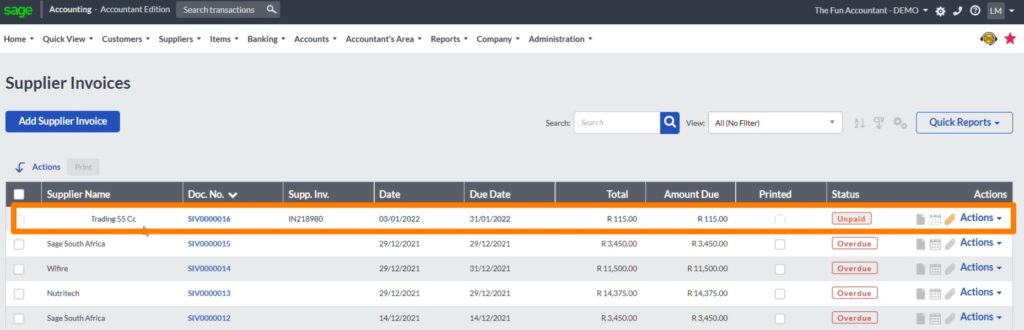

Supplier Invoices

We’re first going to inspect the Supplier Invoices. This is the area where supplier invoices are added to the accounting system. The Dext-Sage integration performs all the hard work for us.

On the first line is the newly recorded transaction of the supplier and at a quick glance the transaction summary already shows that details correspond with the information extracted by Dext from the document.

- The supplier name

- document number

- Invoice number

- Invoice date

- And the total amount

The paper clip at the end of the line is an orange colour as opposed to a light grey which tells you that there is a document attached to the transaction. When clicking on the paperclip to open the transaction document you will see that it is the actual invoice that was opened in Dext, originating from the email, in a neat and clear format. The source document attached like this to the transaction line assists with proving the validity, accuracy and completeness of this transaction.

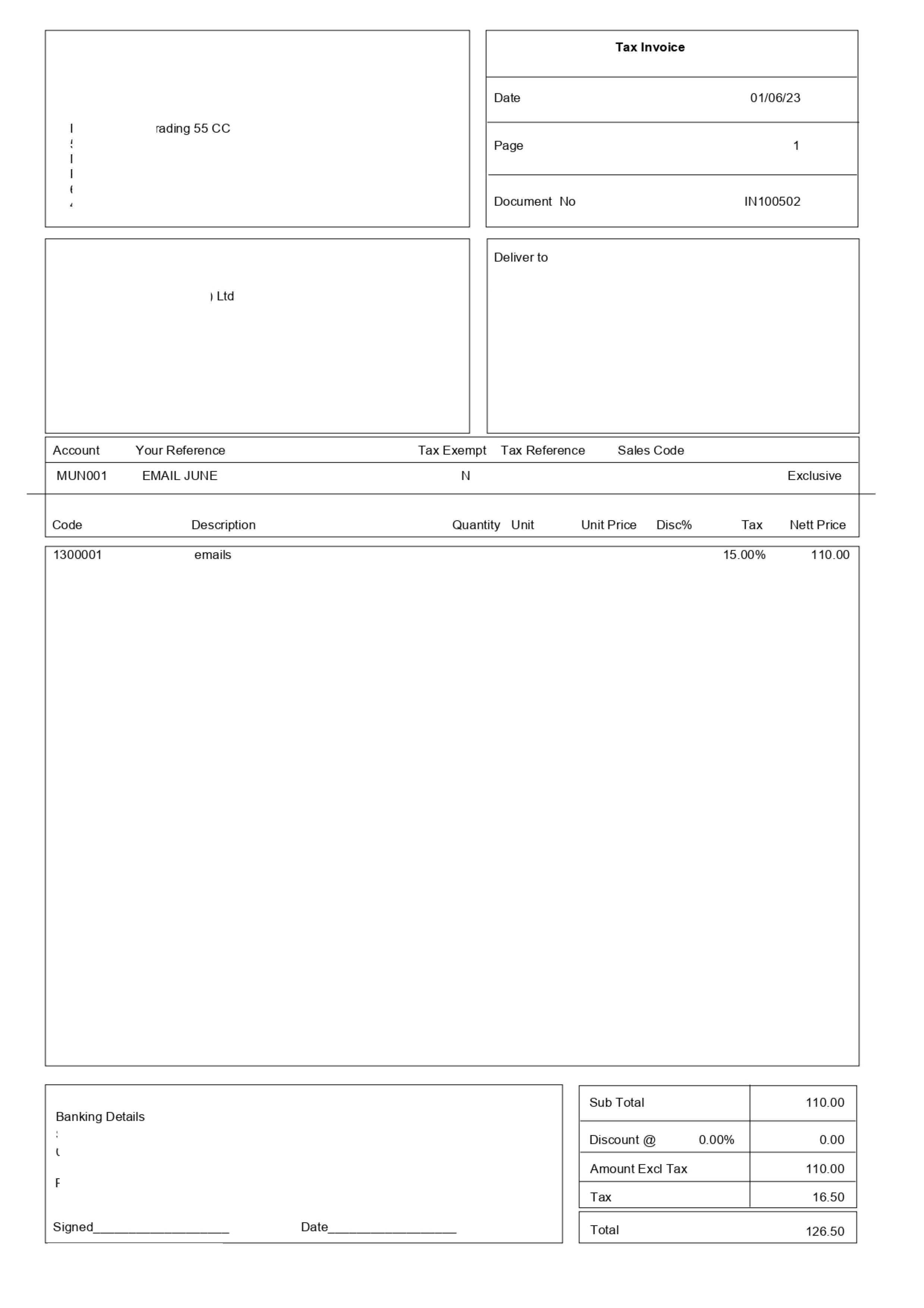

The Supplier Invoice Document.

When you click on the blue Document Number automatically assigned to a transaction, you are directed to the recording of the details of a supplier invoice. All the fields are populated from the Dext system including:

- the expense category,

- the description entered in Dext,

- the VAT type,

- the expense amount,

- the VAT amount and

- the total amount due.

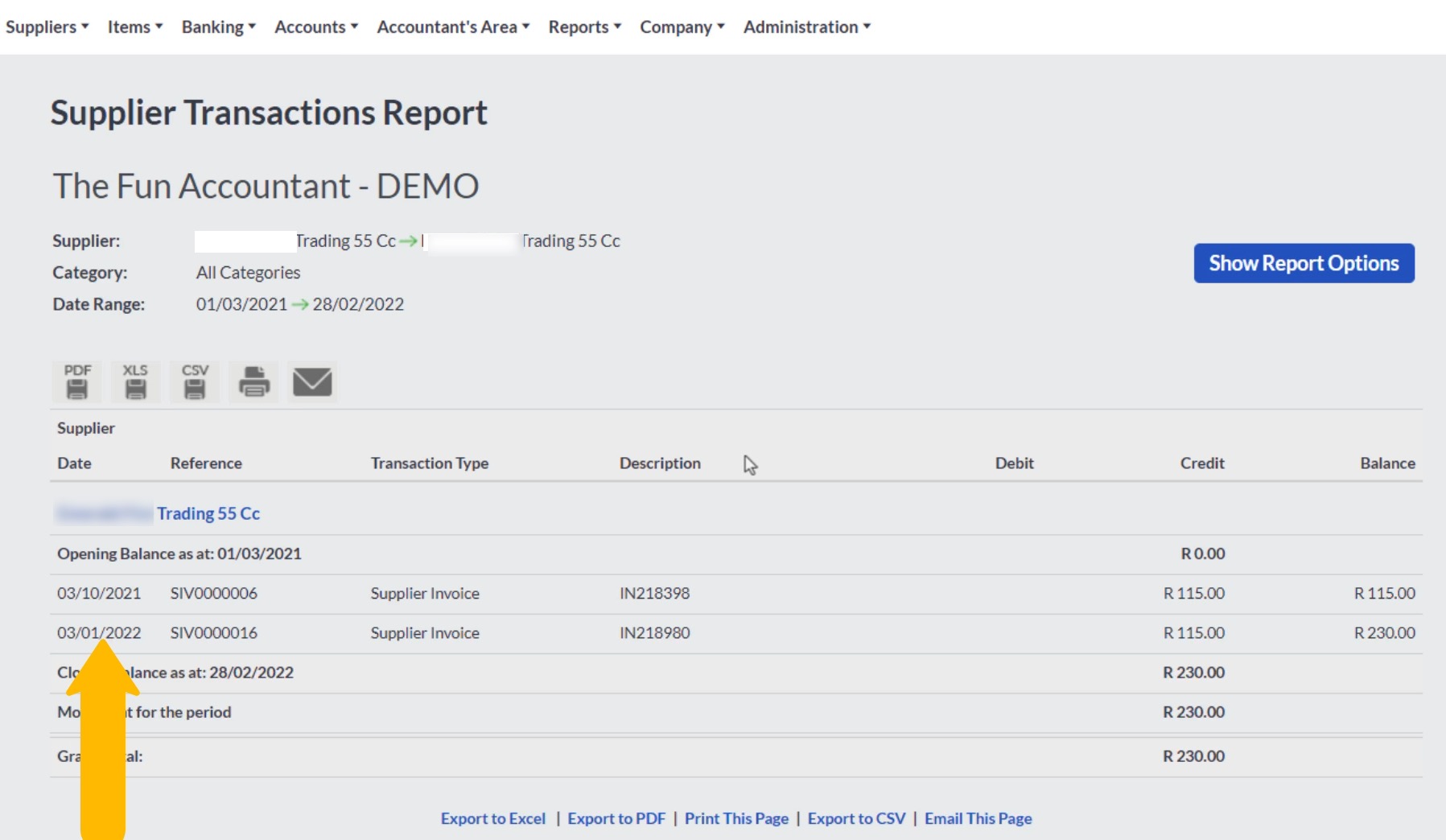

Testing the Supplier’s ledger account.

It will be interesting to scrutinise the supplier ledger and consider the recording of the transaction particularly the supplier’s account. You can do that by clicking on:

> suppliers in the top navigation menu

>scroll to reports and

>then to Supplier Transactions

>Set the Date Range to Yearly

>Select the supplier and

>View Report

And.. as expected the transaction is accurately recorded on the correct date with the correct description.

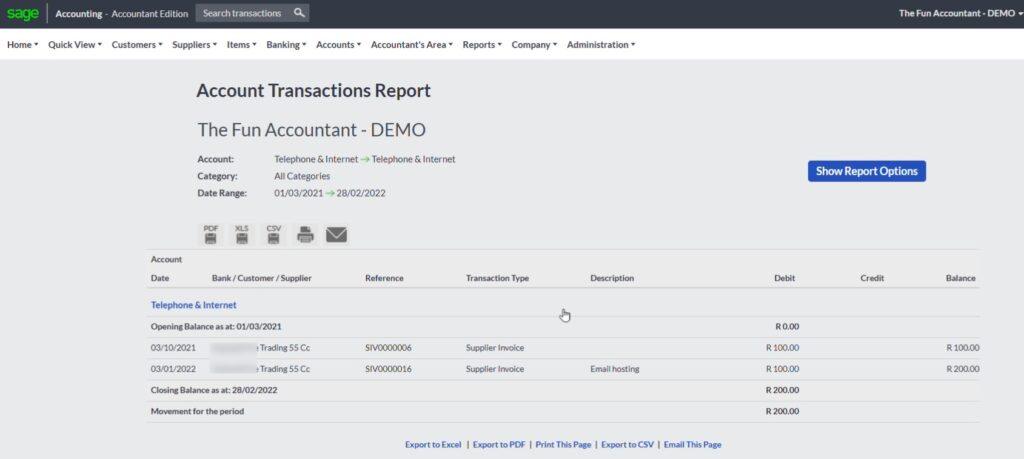

The expense side of the transaction.

In accordance with the double-sided-entry-system in Accounting terms which means that there are always two entries in accounting for a transaction, I will test the Debit entry or Expense entry in the Accounting System.

In this example the expense entry of the transactions, is clear and logical.

You can view the details of Expenses in the General Ledger in Sage from the Top Navigation Menu under:

- “Accounts”,

- scroll to “Reports” and

- then “Account Transactions”.

By following the same procedure as to view the Supplier’s transaction details:

- Specify the “Date Range”,

- Search and choose the “Expense Category” which was specified in Dext and

- “View Report”

The expense transaction is accurately disclosed under the “Telephone & internet” account with the amount excluding VAT and the other details also corresponding to the information extracted from Dext the:

- Date

- Supplier name

- Transaction Type and

- the Description.

The Supplier Age Analyses

The summary report in the Sage Accounting system of your total debt owed to all your suppliers on any specified date, the: Supplier Age Analysis.

Can be found from the top navigation menu under:

- “Suppliers”,

- “Reports” and

- click on: Supplier Balances-Days Outstanding.

- Do not select a specific supplier.

- View a “summary” and

- very important “exclude suppliers with Zero balances” as having them displayed would clutter the report with unwanted information.

- Click on “View report”, for the end result…

The report is generated by Sage and from here, you can see:

- who you need to pay from your business purchases,

- how old the debt is and

- the total outstanding amount.

More importantly for this example recorded you can see the R115 amount that has been recorded by the Dext and Sage Integration without the need for manually entering any amount. As a matter of fact you only had to enter a description for the transaction.

Conclusion

The Dext-Sage-System is one of my favourite methods to automate the capturing of business expenses by merely sending a supplier invoice via my emails to Dext. Where the most important information is extracted from the document, populated and “published” to Sage Accounting.

Video Recordings

Hopefully you find this method helpful in your working environment and if you want to watch the video recording of this subject click below:

Free Training

Visit our Free Training Video Page below: